Investment Thesis

As a publicly traded investment manager, Artisan Partners (NYSE:APAM) has shown a solid track record of providing value for their clients. Their culture and track record demonstrates their ability to navigate volatile markets and still generate solid return that can add value for clients. I believe this company demonstrates that active investment strategies can still work in today’s markets. Furthermore, the company has generously paid dividends to shareholders, demonstrating their commitment to creating shareholder value. However, at 11x FWD earnings, I believe the stock is now fairly pricing in all these positives, so investors should continue to hold the stock.

Company Overview

Artisan Partners is “an investment management firm focused on providing high-value added, active investment strategies in asset classes for sophisticated clients around the world”. They provide mutual funds, private funds, investment trusts, and separately managed accounts for their clients. Many of their clients include institutional investors like endowment funds, public retirement plans, and individual investors.

Their investment strategies revolve around creating an environment where people can act autonomously and focus on the long term. To me, this means they are allowed to take calculated risks that may underperform in the short-term but outperform in the long term. This culture has been critical to their success in my view because they can potentially take different positions than the market and focus on outperformance instead of hugging the benchmarks.

According to the annual report, “As of March 31, 2024, approximately 75% of our assets under management were managed for clients and investors domiciled in the U.S. and 25% of our assets under management were managed for clients and investors domiciled outside of the U.S.”. So, investors can see they are mainly a US-based asset manager, with most of their money managed domestically.

As an asset manager, they “derive nearly all of our revenues from investment management fees, most of which are based on a specified percentage of clients’ average assets under management” according to their annual report. As of May 31st, 2024, assets under management were $158.6 billion, which demonstrates a large amount of trust placed under Artisan in my view.

The company looks very strong with consistent investment performance across most of their investment strategies. I believe their process, business, and culture is very transparent as management has shown to be willing to differ from the crowd in their investment approach. Therefore, I continue to expect good fundamental investment performance, which will likely attract and retain Artisan’s clients.

Outperformance Stems From Unique Culture

In the active investment world, I believe that any sustained outperformance must generally come from a willingness to be different, and Artisan Partners has shown to really lean into this culture to support their investment strategies. Therefore, while everyone else may be bogged down by bureaucracy and portfolios that hug the benchmark, it looks to me that Artisan’s unique culture allows it to outperform their benchmarks.

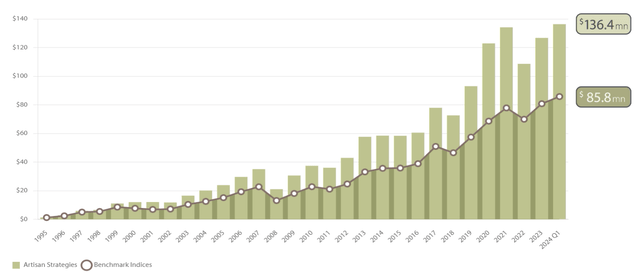

According to their website, Artisan Partners “have added significant long-term value, after fees”. In their 2023 annual report, they show this graph that illustrates their value-add investment strategies,

2023 Annual Report

Their culture rests on autonomy, which is essential for their “investments first” focus. I believe there can be no other reason for this outperformance other than a true dedication to clients, by focusing on investments and not fees. Their distraction-free, autonomous investment teams enable them to take positions that prioritize absolute returns over relative performance to the benchmark.

So, although it’s a competitive world in investment management, it seems to me that Artisan’s success mainly stems from their people, process, and philosophy. Active management can still be done properly, but in order for it to be done right it must be long-term, differentiated, and client focused in my opinion. Artisan Partners has demonstrated to me that they are willing to build a unique culture that sustainably creates value for clients, shareholders, and their employees.

Alternative Strategies Are Attractive

I believe going forward, management is correctly prioritizing new funds, investment strategies that play to their strengths. Many alternative investment strategies such as credit, debt, high-income, emerging markets, and developing world demonstrate management’s flexibility in developing new products for clients to pick from.

In particular, credit seems the most interesting to me because of the relatively stable returns at comparatively lower risk compared to equities. According to the earnings transcript,

From its inception, the Artisan High-Income Fund ranks number two in net flows out of 138 funds in the Morningstar High Yield category. Critically, though, Brian and the credit team have expanded beyond high income. They’ve been building out an array of capabilities, strategies, and vectors for future growth.

Alternative investment strategies such as credit pose an opportunity for Artisan, as they can create new funds and strategies for future growth here. Their track record of innovating allows them to increase their AUM, reputation, and investment returns for their clients in my view. So, going forward, I think management will continue to perform well in pockets of the market that are less saturated, which gives them an edge in outperforming for their clients.

Aligned Executive Compensation Is Favorable

The proxy statement shows that executive compensation is another factor that contributes to the culture and the resulting outperformance of Artisan Partners. According to their proxy statement,

For 2023, 92% of our Chief Executive Officer’s compensation was based on performance. For our other named executive officers, performance-based compensation ranged from 86% to 94%.

CEO Eric Colson has demonstrated to be an effective leader in bringing on the right people to his company, and his compensation is directly tied to the overall performance of the business. He doesn’t have excessive stock options that incentivize him to drive the share price up, but instead his compensation is tied to the success of Artisan’s clients.

Performance-based compensation is tied to the actual business in terms of financials, client inflows and outflows, and overall investment performance of their funds. Furthermore, I am surprised to see that employees of Artisan own a significant amount of stock, at around “10.3% of our outstanding common stock as of the record date”.

Investors can see that overall the executive compensation looks fair, with $6 million going to the CEO not being excessive in my view. Their emphasis on tying the performance of the business and clients to compensation is another reason why their culture has uniquely outperformed their benchmarks. As a result, I believe their compensation philosophy is favorable for long-term shareholders.

Valuation – $45 Fair Value

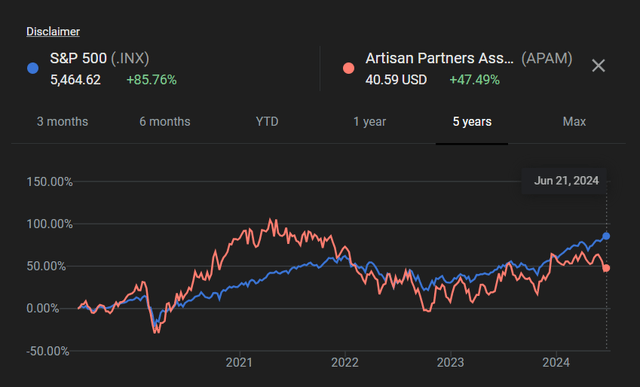

The stock seems fairly valued, and despite the outperformance they have for their clients, the stock hasn’t really outperformed the SP 500 over the past five years. In the past 5 years, Artisan Partners went up 47%, compared to the SP 500 returns of 85%.

Google Finance

Artisan Partners isn’t super cheap at 11x FWD earnings, compared to the sector median of 10x. Assuming revenues grow at around 5% annually, Artisan Partners should have sales of $1.15 billion by 2027. Apply a net margin of 23%, which is their 5-year average, gets me earnings of $264.5 million. Divide by shares outstanding of 64 million gets me EPS of $4, rounded down. Apply a 11x FWD earnings multiple gets me around $45 fair value, rounded up.

So, investors can see the stock is likely fairly valued, and I don’t expect it to outperform the SP 500 from here. At this point, Artisan Partners can be relied on for its dividend, but its share price is unlikely to add significant value for shareholders.

While the company spots a very high net income per employee of $400,000, which is much above the sector median of $83,000, I believe the company is as efficient as possible. Therefore, their margins and profitability metrics are as high as they can go in my view, which further reinforces my view that shares present limited upside in comparison with the SP 500.

Risks

Market downturns, recessions, and economic headwinds can negatively impact investment performance, which in turn lowers the fees Artisan earns on assets under management. Management must be careful to navigate economic uncertainties in their portfolio and stay diversified to weather any potential storm.

Investment managers operate in a competitive field with many funds competing on fees, returns, and strategies. I expect the industry to get more competitive as more money flows into alternative investment strategies, potentially putting Artisan’s competitive position at risk.

Key personnel can leave, which may put the culture at risk of deteriorating, and the unique autonomous environment may be at risk of changing, which may negatively impact investment performance. Passive investing could continue to be competitive, as its low-fees may cause more money to flow into index funds rather than Artisan’s actively managed funds.

Hold Artisan Partners

Investors should do reasonably well if they hold here, but I don’t expect the stock to outperform the SP 500. At around fair value of $45, AUMs aren’t increasing fast enough to justify any outperformance in the shares. I like management, the culture they’ve built, but it seems the market already recognizes these strengths. So, I expect the stock to trade sideways at around $45 a share for the next year.

Read the full article here