Stock market investing is sometimes referred to as a giant casino, in which day to day price movements are hard to predict, due to the multitude of variables and external events that can influence prices.

Unlike the casino, however, the market is not a zero-sum game, unless if you’re trading options because so long as you’re willing to play the long game, your win doesn’t have to equate to someone else’s loss, and vice versa.

That’s why I’d much rather put capital to work and risk it in the market rather than the casino or any online sports betting platform like DraftKings (DKNG) or FanDuel (DUEL), considering my inclination for passive income from dividends and putting money toward my core competency of evaluating stocks.

This brings me to Bristol Myers Squibb (NYSE:BMY), which is so beaten down in price that at the current valuation, odds seem to be stacked in favor of value and income investors with a long-term horizon.

I last covered BMY in February, highlighting its steady revenue, pipeline opportunities, and undervalued stock price. It appears the market hasn’t agreed as of yet, as the stock price has declined by 17% since then, while the S&P 500 (SPY) rose by 14% over the same timeframe.

In this article, I revisit BMY with updates since my last piece and discuss why it’s a high conviction buy at the current price

Why BMY?

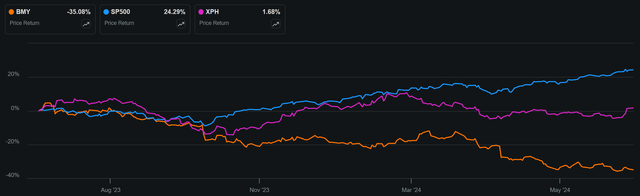

Bristol Myers Squibb has largely underperformed that of the S&P 500 and the SPDR S&P Pharmaceuticals ETF (XPH) over the past 12 months. As shown below, it’s 35% decline over this time frame represents a wide gap between the 24% and 2% rise in SPY and XPH.

BMY 1-Yr Price Return (Seeking Alpha)

Moreover, BMY hasn’t caught a bid thus far in July, as income stocks have seen capital flows after inflation cooled in June. Despite negativity around the stock, I believe the market is overlooking simply how cheap BMY is, especially considering its decent operating fundamentals.

This includes 6% YoY revenue growth on an FX-neutral basis during Q1 2024, with strong performance from newer drugs Eliquis, Reblozyl and Opdualag more than offsetting declines in Opdivo and Revlimid.

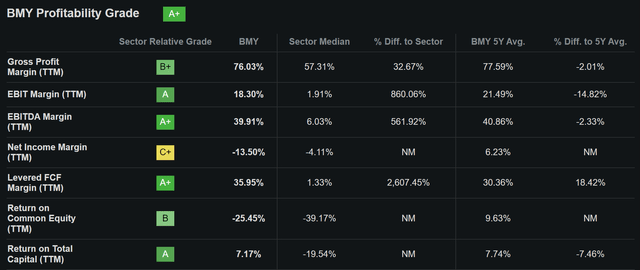

BMY also maintains strong profitability with an A+ grade and sector leading EBITDA margin of 40%, as shown below. It’s worth noting that net income margin is negatively impacted by a one-time non-tax-deductible IPRD (in-process research and development) charge from the Karuna therapeutics acquisition.

Seeking Alpha

Importantly, BMY has a strong pipeline of drugs that include Breyanzi and Camzyos, which treats the diseases of Lymphoma and Cardiomyopathy, respectively. Plus, BMY has catalysts stemming from its recent acquisition of KarXT, which fuels BMY’s Alzheimer’s clinical program.

While the market is currently fixated on GLP-1 weight-loss drugs from Eli Lilly (LLY) and Novo Nordisk (NVO), catapulting those names to nosebleed valuations, it seems to be ignoring the market opportunity for BMY in the Alzheimer’s arena. This is a disease that afflicts 55 million individuals globally, and is expected to by 2x that number every 2 decades, reaching 78 million by 2030.

Management noted this as being a high unmet need during the recent Bank of America (BAC) global healthcare conference:

The caregivers that are supporting Alzheimer’s patients, both psychosis and agitation, recognize the huge unmet need for those patients. So having something out there that addresses this where there is nothing is going to have a big impact on the health care system overall and improve people’s quality of lives but as well as the caretakers’.

We’ll see how other competition comes out there, but we feel really strong. We got to see the data play out. But as we said before, this is a really big opportunity for us. We see multiple indications that will be multibillion dollar. And we even see bipolar as an opportunity for KarXT as well.

Importantly, in this still high interest rate environment, BMY maintains a strong balance sheet and an ‘A’ credit rating from S&P. It carries $10 billion in cash on the balance sheet and has a safe net debt-to-EBITDA ratio of 1.6x, sitting well below the 3.0x mark generally considered safe by ratings agencies for C Corporations.

This gives BMY plenty of liquid capital for bolt-on acquisitions to strengthen its drug pipeline, and that appears to not be appropriately priced into the stock. Morgan Stanley (MS) in a report published this month, highlighted potential for M&A in the biopharma space, naming BMY, Merck (MRK) and Amgen (AMGN) as being on a list of potential acquirers.

This includes potential for acquiring names like Legend Biotech (LEGN) or 2seventy bio (TSVT), both of which markets CAR-T cell therapies. LEGN with Johnson & Johnson (JNJ) in this regard, while TSVT partners with BMY.

BMY could also use its free cash flow, which amounted to $16.4 billion over the trailing, to further deleverage the balance sheet and buy back its own stock.

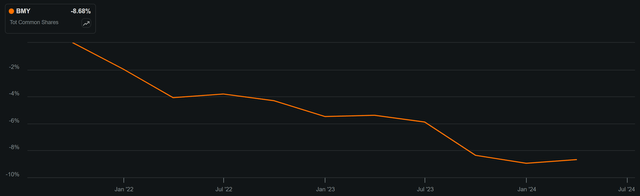

Over the past 2 years, BMY has repaid $10 billion in debt, including $3 billion during the first quarter of this year. Share repurchases at the current dirt cheap price would also be highly accretive to shareholders. As shown below, BMY has reduced its share count by 8.7% over the past 3 years alone.

BMY Shares Outstanding (Seeking Alpha)

BMY currently yields an attractive 6.0%. The dividend comes with a 7.8% 5-year CAGR and 7 years of consecutive growth. The payout ratio is also safe at 33%, based on adjusted EPS guidance of $7.25 for 2024.

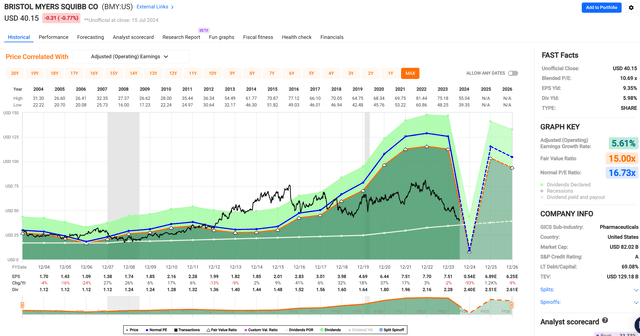

At the current price of just $40.15, BMY carries what I would consider to be a rock-bottom PE of just 5.8x based on 2025 EPS estimates by sell side analysts who follow the company. While forward earnings are expected to be lumpy, analysts typically don’t bake in potential for future acquisitions, as that’s not assumed in a business’s run-rate.

With a 5.8x forward PE that sits far below the normal PE of 16.7, I believe the market is simply too bearish around the stock, while ignoring potential catalysts around its pipeline including KarXT, and potential for future acquisitions down the road with the backing of its strong balance sheet.

FAST Graphs

Investor Takeaway

Bristol Myers Squibb presents a highly discounted investment opportunity for value and income investors, given its significantly undervalued stock price, underappreciated development opportunities, and robust operating fundamentals.

Despite its underperformance relative to the S&P 500 and SPDR S&P Pharmaceuticals ETF, BMY has demonstrated steady revenue growth, a well above average EBITDA margin, and a solid balance sheet with substantial cash reserves.

The market appears to be overlooking BMY’s potential in the Alzheimer’s arena and its capacity for strategic acquisitions, which could drive future growth. Coupled with a high dividend yield and a rock-bottom PE ratio, BMY stands out as a high-conviction buy for those with a long-term investment horizon.

Read the full article here