Shares of Brixmor Property Group (NYSE:BRX) have essentially tread water over the past year. While this has lagged the broader market, it has held in better than many other interest rate-sensitive stocks. BRX’s business has recovered strongly from the COVID pandemic, and its management team has a history of accretive portfolio management actions. While 2024 is likely to be a slow growth year, shares are attractive for long-term dividend growth investment.

Seeking Alpha

In the company’s third quarter, Brixmor generated $0.50 in funds from operations (FFO), in line with consensus as revenue rose by 1% to $307 million. Alongside these results, it boosted its same-store NOI expectation to 3.5-4% from 2.5-3.5%, meaning FFO will be towards the top end of guidance at $2.02-$2.04 from $1.99-$2.04. Same-store net operating income (NOI) rose by a sturdy 4.8% as base rents rose strongly due to higher new leases.

Over the past eight years, management has reduced its property count by nearly 30%, doing $2.6 billion of dispositions and $1 billion of acquisitions. Thanks to this reshaping of its portfolio, it has moved into higher-end markets with 14% greater population density and average household incomes rising by 33% to $106k. As such, its grocer sales per square foot are now 26% higher at $700.

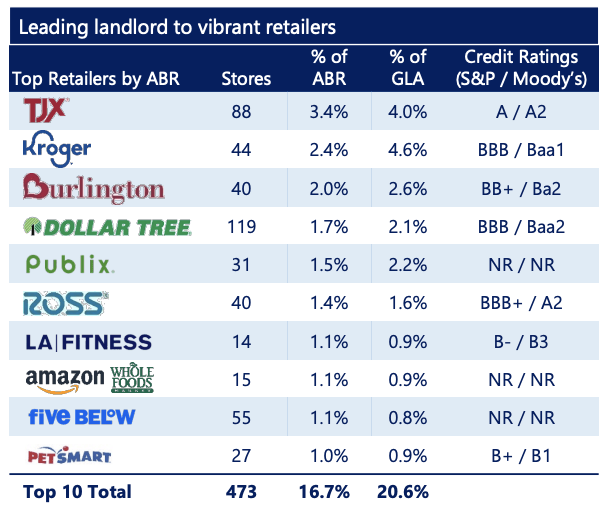

With net disposition proceeds, BXR has also invested $919 million into its properties, earning an 11% yield via higher property operating income on these investments. BXR now has 364 open-air shopping centers in higher-earning suburban markets. 74% of these are grocery-anchored. As you can see below, the company now has a strong roster of anchor tenants.

Brixmor

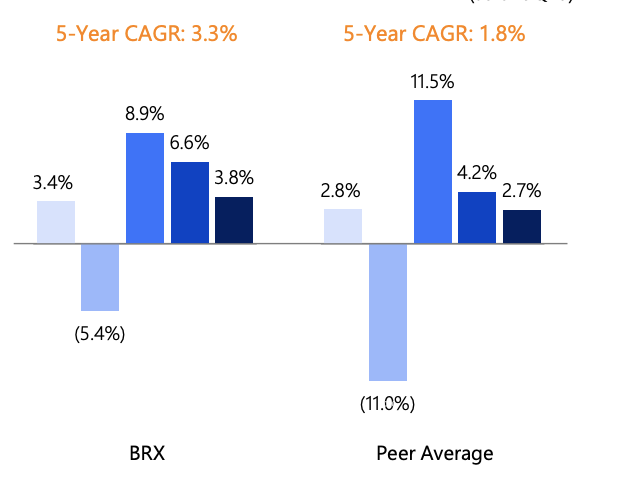

This transformation has seen the company enjoy better operating income performance than its peers. Over the past five years, it has grown twice as quickly as its peers on a same-store basis. In four of the five years, it has grown more quickly, with 2021 the lone exception, primarily because it only fell half as hard during COVID, creating less scope for a bounce back.

Brixmor

There is a lot of concern in retail real estate in general of how increased online shopping will hurt occupancy and property value over time. This is a reason I like grocery centers over malls, all else equal. While some grocery shopping is done online, for many fresh foods in particular, people like to pick them themselves. All else equal, online penetration should be lower in grocery than elsewhere. This provides a stable anchor with constant foot traffic to then support small stores. BRX’s small stores are also fairly e-commerce immune. 37% of its small shops are restaurants, 27% services, and 7% fitness, all by definition are in-person not e-commerce activities. Just 15% are general merchandise and apparel. This is crucial because small shops will pay 2-3x as much rent as anchors, meaning that stable and high occupancy here is quite critical for the bottom line.

Indeed, we are seeing Brixmor make progress on this as it has reshaped its portfolio. In Q3, occupancy was 93.9% with anchor space at 95.7% and a record 89.8% occupancy in small shop spaces. While that was a record for the company, its small shop occupancy is 140bp below the peer average. Even as it has been rising twice as quickly, there is still more ground to close, creating a potential NOI upside.

Now in the quarter, occupancy was down 20bp sequentially, primarily due to a 70bp drag from Bed Bath and Beyond, and other smaller bankruptcies. Management was able to replace about 70% of those leases intra-quarter, and the rest should be occurring either this quarter or next. While this has caused a temporary blip in occupancy, this will be accretive for shareholders in time because the spread on the re-leasing activity has been 76%. That will drive significant incremental cash flow. Additionally, by replacing struggling stores that drove little foot traffic with better operators, like TJX (TJX), foot traffic should improve, providing benefits to the entire shopping center.

This re-leasing premium is particularly large, but across the portfolio, BRX is seeing strong gains. BRX earned a blended new and renewal spread of 22.3%. New lease spreads were 53% at $22.74. Due to these increases, base rent rose by 5% from last year to $16.77/sqft, a new high.

BRX also has ample releasing opportunities over the next two years. It has 3.2 million square feet of anchor space maturing at an average rent of $8.91/sqft. By comparison, there has been a realized rate of $14.97 on anchor leases signed over the past year. Just by gradually bringing rents to market levels as leases mature, BRX will continue to drive meaningful cash flow growth. There is a further $49 million tailwind next year from occupied spaces beginning to pay leases.

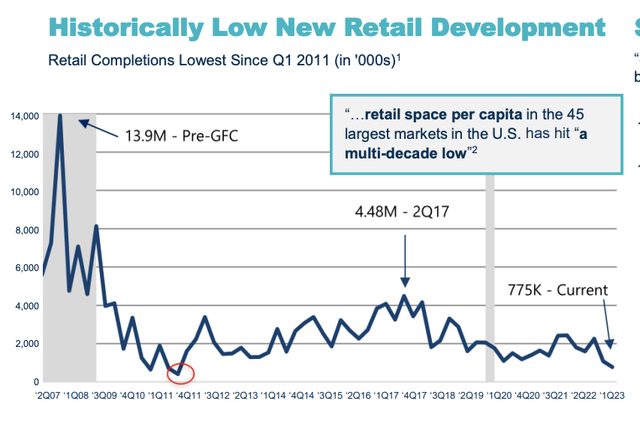

Given all of the negativity around retail, these strong re-leasing rates may be surprising. It is important to emphasize that pricing is set by levels of supply and demand. There has been so much pessimism around retail that there has been very little supply. In fact, retail construction is down over 80% since 2017. If you are a retailer who wants to add stores, there is little new supply to lease; rather you need to pay up for existing space. Particularly as an anchor, there are few locations available in attractive markets, which is why Brixmor has been able to so quickly re-lease its Bed Bath & Beyond locations at such attractive premiums. With interest rates so high and the long-term nature of construction, tight supply is likely to be a persistent feature in non-mall retail space.

Kimco

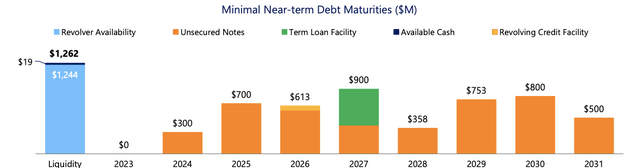

Subsequent to the quarter, S&P upgraded BRX’s credit rating to BBB from BBB-. This moves the company up from the lowest rung of investment grade. Given REITs are debt-heavy capital structures, maintaining investment grade ratings is critical to keeping funding costs lower. Debt is one modest negative I see for Brixmor. While it does not have significant maturities next year, its debt only has a 4.3-year average maturity. Its term loan also has a fixed rate swap that has temporarily reduced its interest rate, but which expires next year. If rates stay persistently high, refinancing maturities will be a drag on FFO. Given next year’s refinancing and swap expiration, interest is likely to be a $0.02-$0.05 headwind for the company.

Brixmor

This is about a 1.5% haircut to FFO growth, and barring a significant further increase in rates, 2024 should be the worst year for interest rate’s drag on growth, but this is likely to stay a modest headwind. Additionally, 2023’s uncollectable rent is expected to be just 40-60bp vs the long-run norm of 75-110bp. Now, 2024 may not be a normal year either, but the risk is that we see a rise in uncollectable rent, which will directly reduce net operating income. This could be a 0.4-5% drag next year.

As a consequence, FFO starts with a 2% headwind from these factors, which is why I stated in the beginning that BRX has a slow growth profile in the near term. Now given strong re-leasing spreads and the replacement of Bed Bath and Beyond, I do think BRX should be able to generate similar NOI growth as is in 2023, of about 4%. With these headwinds though, FFO growth is likely to be just 2-4%, or $2.06-$2.11.

Beyond 2024, with a more normalized baseline for interest expense and bad debt, I do think growth can accelerate somewhat given the tight supply and management’s history of accretive portfolio management. Brixmor also has a $900 million development pipeline to upgrade locations, which it aims to complete over five years and should support incremental NOI. Because it has over 1.8x dividend coverage, BRX can fund this out of retained cash, limiting its need for high-cost financing, and gradually strengthening the balance sheet further.

Still, alongside Q3 results, Brixmor increased its dividend by 4.8% to $0.2725. its dividend does remain below the $0.285 pre-COVID level. This is even as FFO is 10% higher than the 2019 level of $1.91 as management retains more cash. Due to this, I would expect dividend growth to exceed FFO growth next year and be about 5% once again.

Shares are trading with a forward FFO yield of 9.6%. While 2024 FFO growth will be modest, its strong coverage provides scope for ongoing dividend growth. Beyond 2024, its solid portfolio and strong leasing activity should propel 3-5% growth. I view the primary risk to shares being a significant further increase in interest rates, which likely would be a headwind for most real-estate and dividend-oriented stocks. Nonetheless, with shares yielding 5% now and dividend growth likely to be about 5% over the medium term, this provides a 10% annual return opportunity, making shares attractive for income-oriented investors.

Read the full article here