BRP (NASDAQ:DOOO), the Canadian powersports vehicle and marine product manufacturer, is expecting to show soft financials in FY2025. The company already reported softer-than-normal growth in FY2024 as the company’s demand showed weakness in the second half of the fiscal year.

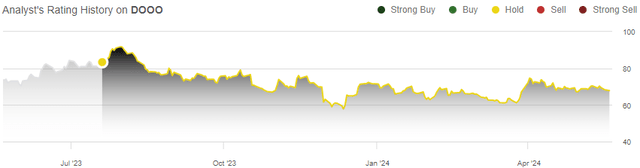

I previously wrote an article on the stock published on the 20th of July in 2023. In the article, titled “BRP Is A Risktaker’s Pick”, I initiated BRP at hold as the company seemed fairly valued when considering the company’s financials’ high correlation with potential macroeconomic turbulence. Since, the stock has had a negative return of -19% compared to an S&P 500 return of 17% as BRP’s financial outlook has decreased.

My Rating History on DOOO (Seeking Alpha)

Unexpected Softness Started in FY2024

At the time of my previous analysis, BRP guided for a revenue growth of 9% to 12% for FY2024, expecting good momentum to continue especially in year-round products and marine products. Since, the guidance has been brought down, and BRP ended up reporting a growth of only 3.3% in the fiscal year. Net income ended at 744.5 million CAD compared to a guidance of 940 million CAD to 980 million CAD in June.

The weakness in BRP’s financials started in Q3, where the company reported a year-over-year decline in revenues of -8.9%. As can be expected, the company related the weakness to macroeconomic factors in the quarter, but also to a slowdown at the US-Mexico border. Further in Q4, BRP explained continued weakness with unfavourable winter conditions. I still believe that macroeconomic challenges and retailers inventory management are the main cause of the weak financials reported in H2.

FY2025 Guidance Expects Further Financial Turbulence

With the Q4 financial report, BRP provided a guidance for FY2025 financials. The company expects revenues of 9.1 billion CAD to 9.5 billion CAD, down -10.3% year-over-year with the middle point of the given guidance. Seasonal products are expected to take the largest hit with revenues in the segment guided down by -18% to -22%. Normalized EPS is guided at 7.25-8.25 CAD compared to 11.11 in FY2024.

I believe that high caution is currently needed with the stock. BRP had to lower the FY2024 guidance significantly within the year, and the FY2025 guidance could well have the same fate. For example, BRP guides for flat marine revenues with the guidance’s middle point, whereas competitors in the industry such as Malibu Boats (MBUU), Marine Products (MPX), and MasterCraft (MCFT) continue to post high double-digit percentage revenue declines. The first quarter is expected to be very weak and seems to make the guidance expect sequential improvements in later quarters in FY2025.

Still, I don’t believe that the expected FY2025 weakness is necessarily any cause for large concern. The industry seems to be struggling, and BRP has communicated to have increased its market share in the North American powersports retail sales in FY2024. Comparison figures especially in FY2023 have been strong, and the revenue decreases are partly from a normalizing of the industry, too. BRP continues to expect healthy overall margins in FY2025, making the P/E 12.0 with the middle point of BRP’s FY2025 EPS guidance.

Upcoming Q1 Financial Report: Eyeing the Financial Outlook

BRP is going to report its Q1 financials on the 31st of May prior to the market opening. Analysts currently expect revenues of 2.01 billion CAD and a normalized EPS of 0.94 CAD, down by -17.2% and -60.6% year-over-year respectively – after a weak H2, the Q1 is expected to be even weaker.

BRP communicated inventory management to affect Q1 financials negatively and expects adjusted EBITDA to be down -35% in the quarter from the previous Q1. With the outlook given with majority of Q1 already behind on the 28th of March, I don’t think that there is potential for a very wide earnings beat or miss in the quarter. Mostly, I suggest to look forward to BRP’s given outlook in the report, as analysts seem to expect sequential improvement in year-over-year performance for Q2. The FY2025 guidance could also already see downward pressure if weak demand has persisted.

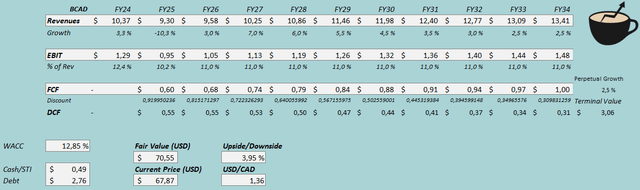

Updated DCF Valuation

Since my previous analysis, BRP’s financials have taken a turn downwards, making adjustments to my previous discounted cash flow model necessary. For FY2025, I now estimate an EBIT of 950 million CAD instead of 1630 million CAD in my previous DCF model. Afterwards, I estimate mostly a similar growth trajectory, although I expect some softness in growth to continue into FY2026 ending the revenues at a lower level than I previously anticipated. I have also adjusted EBIT margin estimates down in upcoming years into a sustained level of 11.0%. I don’t expect the margin recovery to be as wide as could be expected with FY2022 and FY2023 financials.

With the mentioned estimates, the DCF model estimates BRP’s fair value at $70.55, around 4% above the stock price at the time of writing. The estimate is down from my previous estimate of $84.55 due to the weaker-than-expected financial performance. The market seems to again be valuing the stock fairly with my financial estimates, making the stock a speculative buy if a stronger recovery is anticipated. For the time being, I don’t believe that very optimistic estimates are a rational basis for valuing the stock as macroeconomic pressures continue.

DCF Model (Author’s Calculation)

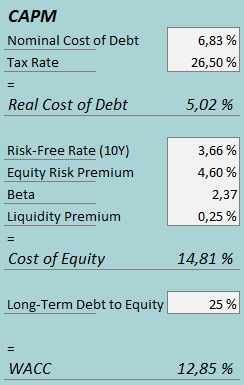

A weighted average cost of capital of 12.85% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q4, BRP had around 47 million CAD in interest expenses. With the company’s current amount of interest-bearing debt, BRP’s annualized interest rate comes up to 6.83%. The company continues to leverage quite a good amount of debt despite operating on a cyclical industry, and I estimate a long-term debt-to-equity of 25%. For the risk-free rate on the cost of equity side, I use Canada’s 10-year bond yield of 3.66%. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for Canada, updated on the 5th of January. Yahoo Finance estimates BRP’s beta at a figure of 2.37. Finally, I add a small liquidity premium of 0.25%, creating a cost of equity of 14.81% and a WACC of 12.85%. The WACC is down slightly from a previous estimate of 13.16% mostly due to a lower cost of equity.

Takeaway

After my previous analysis on the stock, BRP’s financial performance has turned downwards. The company has lost earnings due to a weaker-than-expected macroeconomic situation as well as some one-off items affecting H2/FY2024. The weakness is expected to continue in FY2025 too, as shown by BRP’s guidance for the fiscal year, and the upcoming Q1 results are expected to show the most weakness. I suggest high caution regarding even the current FY2025 guidance, and with my more conservative DCF model expectations, the stock seems to be fairly valued. As such, I keep my rating at hold.

Read the full article here