C3.ai (NYSE:AI) stock is down 38% from its all-time high, and I believe it represents a good value investment based on the current valuation.

When a fast-growing customer base is not a growth stock

C3.ai stock is up 21% over the last three months, following a mid-April low. With a background of surging artificial intelligence stocks, I feel that the company’s prospects are being underappreciated.

The company has seen its client base growing at a fast pace in 2024 with 19 different industries signing up for its Enterprise AI software. In fiscal 2024, 88% of bookings were for AI application sales and 12% were driven by the AI platform.

As a result, the company saw its subscription revenue rising to $79.9 million. That segment marked 92% of revenue, up 41% year-on-year. Total revenue for the fiscal year came in at $310.6 million, up 16% over the same period.

That is not a large number compared to the AI market leaders, but investors are piling into chipmakers to chase big techs generative AI plans. However, the day will ultimately come when enterprise AI is in more demand. That is already happening for the company as industries embrace the new AI cycle.

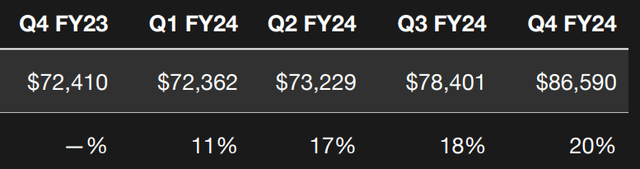

C3.aI Revenue Growth (C3.aI)

C3.ai has signed 191 agreements in the recent quarter with many big players showing interest. Exxon Mobil (XOM), A.P. Moller-Maersk, and General Mills were among those firms. Defense companies make up 49.5% of bookings, including the U.S. Navy, and the U.S. Intelligence Community signing agreements.

Agreements signed included 123 pilots, which means there is potential for a subscriber revenue boost as each quarter passes.

Another growth driver for the company is its partner program. In FY24, C3 AI closed 115 partner agreements with companies such as Google and Amazon, leading to a 62% increase year-over-year. That drove 76% growth in partner-supported bookings.

C3.ai looks like a growth stock and acts like a growth stock, but is not seeing the same valuations as some of its peers.

Margins may have bottomed for the company

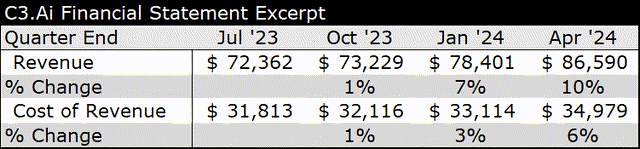

In its latest earnings, C3.ai reported a non-GAAP margin of 69%. Falling margins were hurting the company but we must start the outlook from the start of the latest AI adoption cycle. Revenue growth is outpacing cost of revenue by a factor of around 2:1.

C3.aI Financials (C3.aI, author)

What is also typical of growth stocks is a rise in sales and marketing costs to bring on new customers. That has risen from $43.9 million to $63.2 million over the same period. Research and development costs are also a factor when chasing growth and they have averaged from $49.48 million to $50.86 million. Rising revenue will also start to see R&D costs become a smaller factor.

In the latest quarter, the company posted a net loss of $72.9 million, but 70% of that figure came from R&D costs.

Total long-term liabilities are around $165 million but the company has $750 of cash reserves.

Current valuation and outlook

C3.ai currently has no profit but we can use the price/sales metric which is currently at 9.30 on a forward basis, according to Seeking Alpha data. As a comparison, Microsoft (MSFT) trades at 14X, while Nvidia (NVDA) trades at 26x. Those companies are not exactly peers but shows how investors are evaluating the current AI market.

Customers may not be ready to adopt C3.ai solutions as they are still experimenting or studying the potential. “Today, many companies are dabbling in trivial AI projects or relying on outside integrators to try to cobble together something that works,” which become “large and expensive experiments.”

One area that could create growth for the company is in industry’s use of AI in predictive maintenance. Dow (DOW) is one of the world’s largest chemical companies and is using C3.ai for that purpose, which has now been rolled out to further sites and assets, the company said.

The world’s largest oil have also moved to AI for predictive maintenance in recent years. A Global Data report highlighted the importance of using predictive maintenance to preserve the life of company assets.

As noted at the start of this article, the stock price is currently down 38% from the all-time high and there are underlying reasons why investors are undermining the growth prospect. If margins start to catch again and revenues grow from previous pilots leading to bookings, I believe the share price can create value for investors.

Another upside potential for the stock is a large bearish position in the company’s stock with a short float of 27.63%. That could lead to a short squeeze if there is a future earnings surprise.

The downside to the investment thesis

The obvious downside to the investment thesis is the potential for customers to take up many pilot programs that do not lead to recurring revenue. That would mean the current price-to-sales valuation is overdone.

Conclusion

Despite the current valuation, the balance sheet of the company is stable and revenue is currently growing, which could provide a margin of safety. As noted, margins should improve as they are outpacing the cost of revenue, while the company has been spending on growth with additional plant, property, and equipment. The company’s CEO may also be right that after enterprises have tested and deliberated over AI tools for their business, they could gravitate to C3.ai. The company’s success with its partner program offers a runway for recommendations, while its ability to attract big-name corporations is another. I also believe that the company may be at the start of its growth journey, while others have a larger potential valuation shock.

Read the full article here