We Bought Ahead of Earnings Report

Before the release of its second-quarter earnings report tomorrow, we are making a substantial investment in CarMax (NYSE:KMX) shares as we see several catalysts ahead. We believe the used car dealership industry will see continued tailwinds, as the UAW strike has persisted. The strike has led to lower new car inventory, which could drive more consumers to the used car market and benefit Carmax. While earnings results are uncertain, we see upside potential in Carmax based on broader industry trends.

UAW Strike is Likely to Persist

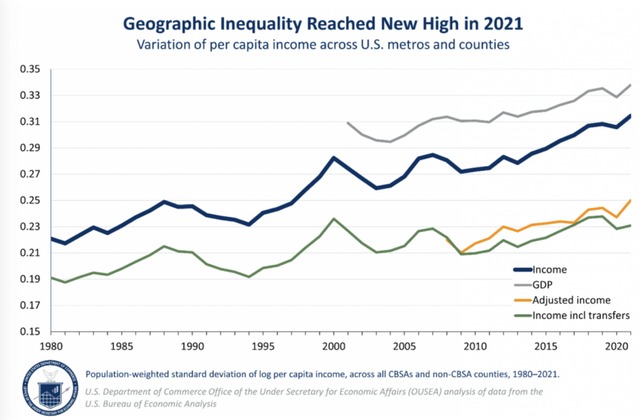

With Biden publicly supporting auto workers on the picket line on September 26th, we believe the UAW strike could persist longer than expected as it takes on greater political significance ahead of the 2024 presidential election. Despite the 40% proposed wage increase seeming high to investors, support for workers may grow given the widening geographic income inequality in the US, which was exacerbated by high inflation in 2022.

US department of commerce

While the Fed’s aggressive rate hikes aim to curb inflation going forward, they do not address legacy inflationary impacts, in our opinion. Automakers likely have the balance sheet capacity to meet some wage demands despite their slim margins, but prolonging negotiations may be their strategy to avoid fully capitulating. With both sides dug in, an extended strike seems likely. Overall, political and economic dynamics suggest this labor dispute could drag on.

Impact on Used Car Dealerships

The ongoing UAW strike could create positive catalysts for used car dealerships as new car inventory remains constrained. As we’ve previously discussed, the used car industry has benefited from tight supply amid the pandemic’s impact on production. While rising interest rates are broadly dampening auto demand, supply shortages are helping offset any cooling on the demand side. So despite some headwinds, used car dealers continue benefiting from inventory shortages in the new car market. The strike prolonging these tight conditions could sustain tailwinds for used car sellers like Carmax.

Used Car Price Trends

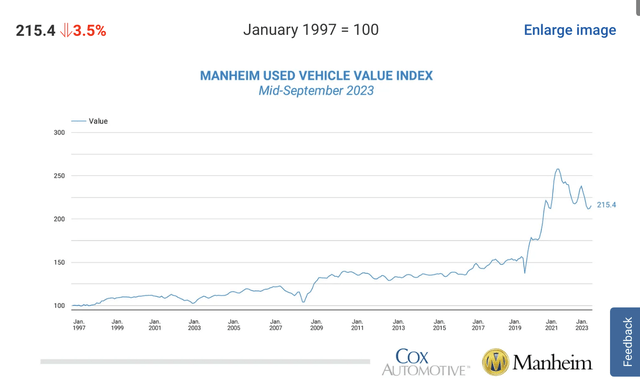

The latest Manheim Used Vehicle Value Index showed a 1.5% sequential increase in September, but a 3.5% decrease versus a year ago. This suggests that used car affordability has improved from 2021 levels as prices moderate, but values appear to be stabilizing on a monthly basis. The index indicates the rapid used car price appreciation of last year has slowed, with more modest monthly changes. While used car prices remain elevated, the slowing rate of increase and recent stabilization are welcome signs for car shoppers’ affordability.

Manheim

Profitability Dynamics for Used Car Dealerships

It’s important to note used car dealerships like Carmax are not automakers – they profit from trading inventory. With typical 30-to 60-day turnover rates, used car dealers can remain profitable as long as prices don’t swing dramatically within those periods. The current environment of steadily declining used car prices may be ideal for these dealers. They benefit from improving affordability as prices moderate, while facing minimal margin compression thanks to the gradual price drops versus sharp declines. The stable pricing trend sustains their profitability. So while lower used car prices reduce gross profit per unit, the steady downward trajectory preserves margins within dealers’ inventory churn periods.

Carmax’s Digital Shift in the Used Car Market

Carmax is the current leader in the used car dealership industry, though it only commands around 2% market share in a highly fragmented space. Recently, Carmax has introduced an online sales platform to match the price transparency model pioneered by Carvana (NYSE:CVNA). This online shift could be a paradigm change for the industry, as traditional dealers rely on negotiable pricing and in-person test drives, providing little transparency. Online marketplaces allow customers to purchase at the listed price, benefiting from total transparency. This model better suits a transactional business like used car sales, where customer relationships are difficult to build and comparison shopping is common. Though service can build loyalty, most customers shop around for the best deal when purchasing. Carmax’s online pivot combined with its popular vehicle history reports helps build trust and scale in this fragmented industry.

In addition, we believe Carmax faces minimal competition from Carvana currently given the duo’s tiny combined market share. With Carmax matching Carvana’s price transparency while maintaining its leadership position, we foresee a promising long-term perspective as consumers increasingly begin their car search online.

Inventory Sourcing in the E-commerce Era

Further, online used car dealerships like Carmax also benefit from the ability to directly source inventory from customers, without reliance on OEM trade-in programs. Traditional dealerships partnered with automakers, receiving inventory support and trade-ins. This gave them an advantage in customer acquisition over independent used car dealers like Carmax. However, online marketplaces are changing consumer behavior – customers now research resale values prior to visiting lots. With pricing transparency, Carmax sourced 94% of inventory directly from consumers trading in versus new car purchases. As online commerce grows, the OEM advantage of captive trade-ins shrinks. Dealerships such as Carmax can leverage their online platforms to source inventory, lessening reliance on in-person trade-ins. The rise of e-commerce levels the playing field for sourcing used car inventory.

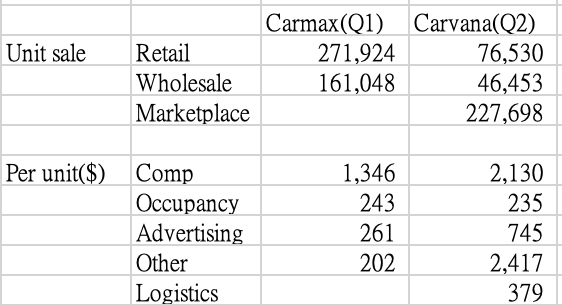

Cost Structure: Carmax vs. Carvana

In theory, Carvana’s online-only model provides cost advantages over Carmax’s nationwide dealership footprint, with lower occupancy and sales costs. However, given Carmax’s much higher sales volume – nearly 4x that of Carvana – it currently benefits from lower operating costs per unit sold. Carmax’s scale provides efficiency despite its extensive physical locations. For now, Carmax’s leading market share translates to a lower cost structure compared to newer digital entrants like Carvana, though the online model may eventually provide savings as e-commerce scales. But Carmax’s vast existing infrastructure keeps per unit costs lower than the still-emerging online disruptor model.

KMX, CVNA, LEL

Omni-channel Approach: The Future of Car Sales

An omnichannel model combining online and physical locations may be ideal long-term, as test drives and service at retail locations provide convenience. Carvana recently converted former ADESA sites to customer hubs and limited free shipping to local inventory, migrating toward an omnichannel approach. So while a purely digital model seems advantageous in theory, the integration of online and offline capabilities appears to be the optimal strategy. As long as Carmax can maintain its sizable scale edge, an omnichannel setup leveraging its national footprint could sustain lower costs than the emerging digital disruptors. Carmax’s leading market share gives it an opportunity to evolve into an omnichannel leader, integrating the convenience of physical locations with the transparency and acquisition benefits of e-commerce platforms.

Valuation Analysis

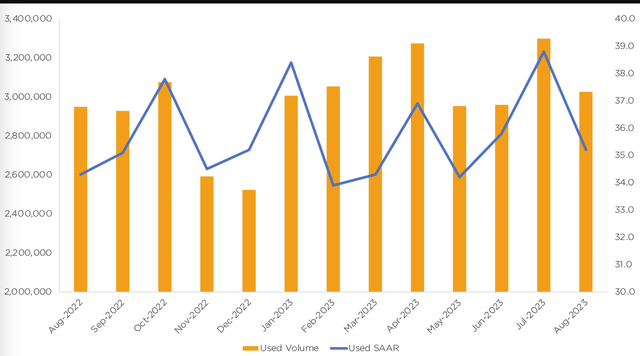

Carmax’s used unit sales declined 9.6% in Q1 2024, an improvement from the 12.6% drop in Q4 2023. However, industry data from Cox Automotive shows total retail used car sales up 4.5% over the first eight months of 2023 versus last year. Along with stabilizing used car prices, the broader industry trends appear favorable for Carmax. This potential inflection in sales trajectory, coupled with stabilizing used car prices, could catalyze a revaluation of Carmax shares from a value to a growth stock. If Q2 results affirm this recovery in the industry and Carmax returns to sales growth, shares may see multiple expansions. We view the current momentum in the used market as a positive catalyst that could fuel improved investor sentiment and change the valuation rationale around Carmax stock.

COX

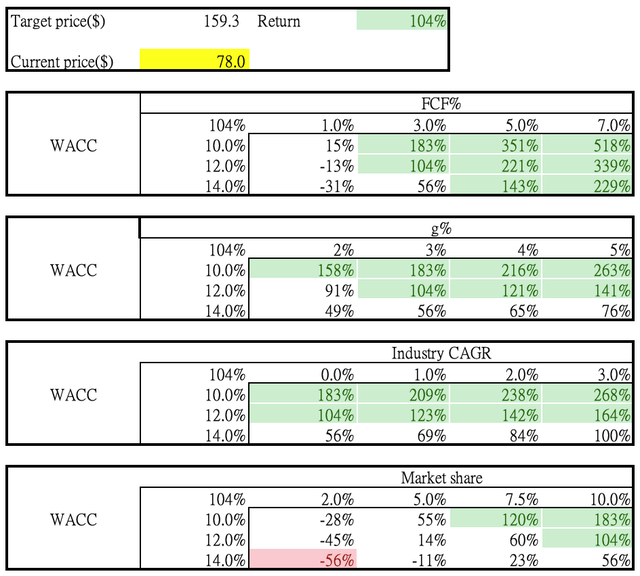

Under a 10-year growth model, we assume Carmax can expand its market share from 2% currently to 10% over the next decade before settling into 3% annual growth thereafter. Applying a 3% long-term free cash flow margin and 12% WACC, our valuation generates a price target of $159, representing a 104% upside from the current price.

LEL

Even halving the market share assumption to just 5% still yields a 14% upside scenario. Further upside could stem from industry growth reacceleration or Carmax sustaining free cash flow margins above 3%.

Overall, our base case points to the significant potential upside based on what we view as reasonable assumptions around Carmax’s ability to gain a share in the used car market through its omnichannel strategy. More bullish industry or profitability scenarios provide further valuation upside from current levels.

Risk

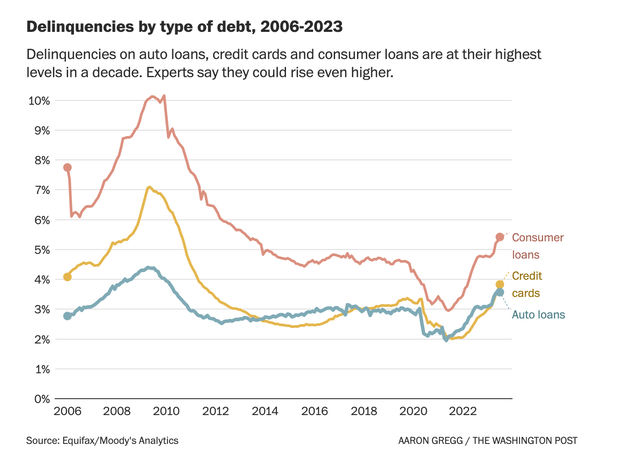

One risk worth monitoring is rising auto loan delinquencies, as default rates have climbed back above pre-pandemic levels, though still below the 2008 peak. With more underwater loans where the debt exceeds the car’s value, there is a greater incentive for consumers to default. This auto finance deterioration could lead to higher repossession rates, flooding the used car market with discounted inventory as lenders unload vehicles. While not yet a dire trend, the uptick in delinquencies bears watching as it could eventually spill over to the used market if it continues, driving down resale values. For now, used car supply remains tight, but growing auto credit troubles could change the supply-demand balance over time if defaults accelerate further.

Equifax/Moody’s

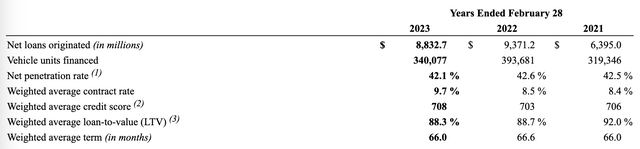

Unlike Carvana, Carmax retains auto loans on its balance sheet, so rising delinquencies impact its finance operations. In Q1, Carmax’s CAF income fell 32% due to lower interest margins and higher loan loss provisions. Recent bankruptcies of subprime auto lenders like Off Lease Only and U.S. Auto Sale Inc. underscore this risk. However, Carmax’s average borrower credit score is 708 with 88% loan-to-value, so its loans seem healthier overall than troubled subprime lenders.

KMX

The CAF income decline appears driven by Carmax taking a more conservative posture on losses. As the used car market leader, Carmax may actually stand to gain share from smaller dealer bankruptcies stemming from higher defaults. Still, investors should monitor credit trends as a potential headwind. Though Carmax’s prudent balance sheet approach and market position may insulate it relative to distressed subprime lenders, a deterioration in auto finance would impact earnings.

Conclusion

While macroeconomic risks exist, we believe Carmax is well-positioned to gain a share in the fragmented used car market through its omnichannel strategy and pricing transparency. The company’s dominant position and online pivot provide upside potential that likely outweighs near-term risks. Carmax also stands to benefit from industry consolidation and inventory constraints caused by the UAW strike. Given the long-term growth trajectory, current valuation discount, and potential industry tailwinds, we rate Carmax stock as a Strong Buy. The leader in used car sales appears poised to accelerate its market penetration through an effective omnichannel approach. While monitoring macro factors, we see an attractive risk/reward setup for Carmax shares.

Read the full article here