Introduction

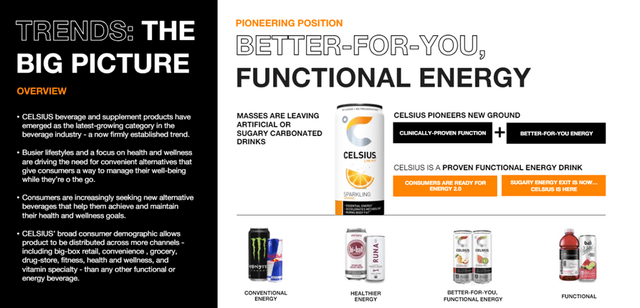

Celsius Holdings (NASDAQ:CELH) is an energy drink manufacturer and distributor that has seen a rapid rise in popularity in recent years. The company’s drinks are particularly popular with the younger generation as evidenced by the 17% favorable response rate in Piper Sandler’s 47th semi-annual Taking Stock With Teens survey. The company has beaten out larger brands such as Red Bull and Monster with this important demographic as its “Better For You Functional Energy” message resonates well with this audience. Its stock has risen rapidly to reflect this and this article analyzes whether it is a worthwhile investment.

Investor Presentation (Celsius Holdings)

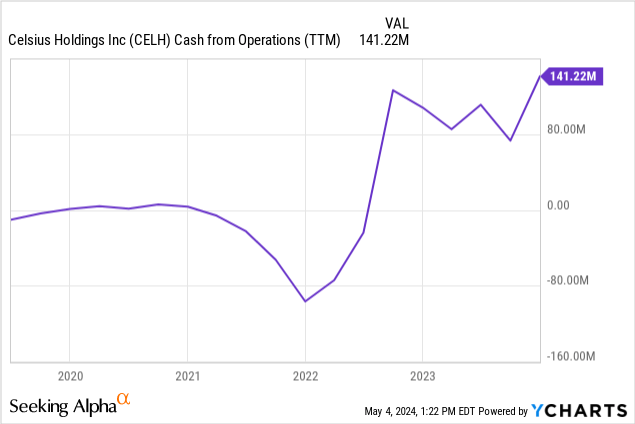

Celsius Financials Are Strong

In the past Celsius Holdings had been struggling to generate any meaningful cash from its operations. However, that changed in 2022. Currently, 2023 marks the 2nd year of the company generating above $100 million in cash flow from its operations. In 2023, Celsius’s cash flow from operations was $141.2 million which is around a 30.5% increase compared to $108.2 million a year before.

The year 2023 also marks the first time the company registered any meaningful operating income at $266.4 million. Throughout most of the company’s existence, it had been operating at a loss. So this is the start of the company achieving its plans to properly scale.

From the looks of the financial statements, Celsius requires very little in terms of capital expenditures to fund its growth. Therefore, it has a large amount of free cash flow, i.e. discretionary cash that’s available to be used or distributed. In 2023 the company had capital expenditures of $17 million. Therefore calculating the company’s free cash flow gives us a figure of $249.4 million.

Having sufficient FCF is important when risk sentiment in the market sours as what could be starting. As the US recently reported bad economic data, many analysts will start to scrutinize growth stocks like CELH. Having cash flow is vital for the company at this time. Furthermore, Celsius has no long-term debt and only $1.1 million in Capital leases.

Celsius Holdings has total liabilities of $447.9 million against total assets of $1.54 billion. Of these total assets, the vast majority or $1.2 billion are current assets. The company has total cash and marketable securities of $756 million as of the end of 2023. With virtually no debt and a lot of cash, Celsius Holding has a “rock solid” balance sheet. This is vital as it means that i) the company has the necessary capital and cash flow to fund its expansion, ii) the company is protected from any “cash crunch” during a downturn, and iii) when comparing “growth stocks” CELH can stand out as having positive FCF is looked upon favorably by analysts.

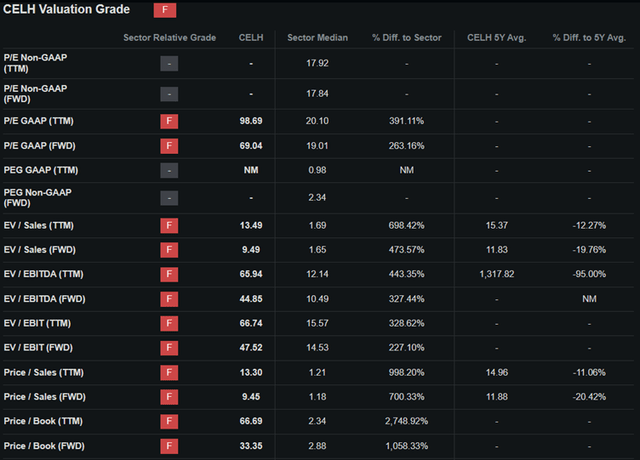

Valuation

In terms of valuation, the company scores poorly on a lot of the current metrics. This is not surprising given the run-up of the company’s stock price. Celsius Holdings’ stock is currently trading at a P/E ratio of 98x on a TTM basis and 69x on a forward basis. This is much higher than the 20x and 19x P/E ratio of the sector median. On a forward P/E basis the company is 263% more expensive than the sector median.

Celsius Holdings is a rapidly growing company within an established category. On a P/E basis, it is understandable that the company’s valuation is a bit expensive. Looking at its Price-to-sales ratio, the company’s stock is also pretty expensive at a valuation of 13x TTM Sales and 9.45x Forward sales respectively.

Relative Valuation (Seeking Alpha)

Despite the pricey current valuation, the company is growing at a rapid rate therefore it could grow into its valuations assuming everything goes well and it can maintain its growth trajectory. Using current analysts’ estimated earnings, assuming the same stock price as of today, by 2027 Celsius Holdings would be trading at 32x earnings. In order for that to happen revenue would have to grow 42.9% in 2024, 41.19% in 2025, 32.01% in 2026, and 16.39% in 2027.

Forecast Earnings (Seeking Alpha)

Distribution Increase to Fuel Further Growth

A lot of these tailwinds can come from Celsius Holdings’ distribution deal with PepsiCo (PEP). This deal was recently modified. The change centers on an incentive program to incentivize and compensate Pepsi for sales of Celsius products. In my view, this change is a win-win for both parties. The change will push and motivate Pepsi and align the interests of both parties. While the average margin per product sold could be lower this can be compensated by the increase in sales.

Investment firm Cowen has an Outperform rating on CELH and a price target of $95. It’s analyst Robert Moskow has stated that ;

“When CELH initially signed its distribution agreement with PEP in August 2022, the company had a ~3% share of the energy drink category. Now, as a clear #3 player with a 10%+ share, it makes sense to us that Celsius warrants priority within the portfolio. Incremental placements in Pepsi coolers and expanded distribution at independent convenience stores and food service should offer continued tailwinds to CELH’s growth and market share trajectory.”

Celsius Holding is also pushing an expansion into Internationally particularly UK, Ireland, France, Canada, and Australia / New Zealand. Expanding into other markets could have the potential to further accelerate sales growth as the company’s energy drink gets exposed to new audiences. Like its distribution partnership with Pepsi in the US markets, Celsius has partnered with Suntory Oceania. According to Pierre Decroix, CEO of Suntory Beverage & Food Europe;

“We are delighted to be partnering with CELSIUS in France, building on the partnership announced in the UK and Irish markets in January, and to break new ground with a totally different consumer experience in the energy drinks segment. Thanks to the ongoing performance of our brands, we are a solid and established partner to support the development of CELSIUS in the French market. We are looking forward to a broad launch as early as 2025, which will follow initial targeted actions at the end of this year. This is a great growth opportunity for all retail partners, as well as a unique opportunity to strengthen our portfolio.”

We saw how rapidly Celsius was able to grow post-Pepsi partnership. It is my hope that they will be able to replicate that success internationally as well. Celsius has a great product line that appeals to the younger demographic. By expanding its product reach via international expansion and improved distribution/promotion, it is my view that the company can continue on its growth trajectory.

Closing Thoughts

From March to current day, CELH stock experienced a steep decline from a high of $99 to its current price of roughly $76 a decrease of 23%. Possibly in overreaction to the news of the change in the distribution agreement with Pepsi. In my mind though the sell-off was triggered by the news headline but mainly due to a correction in the stock’s price. Between February to March, the stock nearly doubled from $55 to $99. Celsius Holdings’ energy drink has only increased in importance in Pepsi’s overall portfolio. The deal is unlikely to be detrimental to Celsius as they now have more bargaining power. Therefore this correction is healthy in my view and a chance for investors to accumulate shares.

Read the full article here