Valero Energy (NYSE:VLO) is a leading U.S. oil refining company. VLO’s shares have not just rallied but are nearly five and one-half times higher since the March 2020 low and were trading at a record high in early April 2024.

Oil refining is a capital-intensive business, with profitability hinging on the price differential between crude oil and oil products.

West Texas Intermediate crude oil and Brent North Sea crude oil, the two global petroleum benchmarks, trade in the futures market on the CME’s NYMEX division and the Intercontinental Exchange, respectively. Elevated crack spreads have boosted VLO shares, and a continuation of high processing margins could send the shares even higher.

Crack spreads are real-time indicators of petroleum demand and refining earnings

VLO and oil refineries that crack petroleum into oil products take advantage of the product’s premiums to raw crude oil. Crack spreads measure the price differentials between crude oil and products. Refinery profits rise and fall with crack spread levels, making the spreads a real-time indicator for two reasons. First, increasing demand for crude oil products translates to higher demand for the critical input – petroleum. Rising crack spreads often lead to higher oil prices. Second, higher crack spreads increase refineries’ profit margins, usually increasing their share prices.

The gasoline crack spread is seasonal and has been trending higher, benefiting VLO

Gasoline is the most ubiquitous oil product as automobiles rely on the fuel worldwide. Since drivers tend to put fewer clicks on their car’s odometers when the weather is poor, gasoline prices and crack spreads tend to reach seasonal lows during winter.

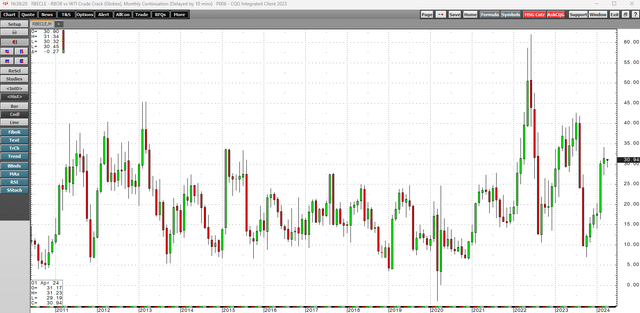

Monthly Chart of the NYMEX RBOB Gasoline Crack Spread (CQG)

The monthly chart of the NYMEX RBOB gasoline crack spread highlights seasonal lows in November 2011, September 2013, January 2015, February 2017, January 2019, March 2020, December 2020, September 2022, and October 2023. Lows tend to occur as winter approaches or during the coldest months, and prices often recover during spring. The outlier on the chart was the March 2020 low, when the pandemic gripped markets across all asset classes and sent NYMEX crude oil prices below zero for the first time in April 2020. Seasonal highs tend to occur during the spring and summer months during the vacation season when gasoline demand peaks.

Since October 2023, the gasoline refining spread has rallied from $7.04 to $34.08 per barrel and was at the $30.94 level on April 3.

Distillate cracks have gone the other way but remain elevated

Heating oil is a distillate oil product, so the NYMEX heating oil futures contract and heating oil crack spread is a proxy for other distillates, including diesel and jet fuels.

While heating oil implies seasonal strength during the coldest months, distillates are more year-round fuels, displaying somewhat less seasonality than gasoline.

Monthly Chart of the NYMEX Heating Oil Crack Spread (CQG)

The monthly chart shows that while distillate cracks have declined from over $53 per barrel in August 2023 to $29.03 on April 3, the long-term trend since the September 2020 $6.44 per barrel low has been primarily bullish, with the distillate crack making higher lows. Critical technical support stands at the May 2023 $22.67 low.

VLO is a leading U.S. oil refiner

Valero benefits from rising crack spreads as it purchases petroleum, refines the oil into products, and sells gasoline and other oil products through its marketing operations. VLO’s company profile states:

VLO Company Profile (Seeking Alpha)

In late January 2024, VLO reported Q4 EPS at $3.55 per share, which beat consensus forecasts by 60 cents per share. Q4 2023 revenues at $35.41 billion beat by just under $865 million. At over $180 per share on April 3, VLO had a $58.39 billion market cap. VLO is a highly liquid energy stock that trades an average of around 3.6 million shares daily. The company’s $4.28 dividend translates to a 2.4% yield.

VLO will report Q1 2024 quarterly earnings on April 25, 2024. The current consensus estimate is for EPS of $3.12 per share and revenues at the $31.46 level. Since VLO’s gasoline refining reaches a seasonal low in winter, Q1 earnings and revenues can be lower than other quarters. Crack spread levels could lead to another earnings surprise on the upside for VLO.

A volatile stock trading at all-time highs – crack spreads are critical for the path of VLO shares

Meanwhile, with the 2024 peak driving season on the horizon, the prospects for VLO’s future earnings and a prolonged period of elevated crack spreads have caused the shares to rise to a record high.

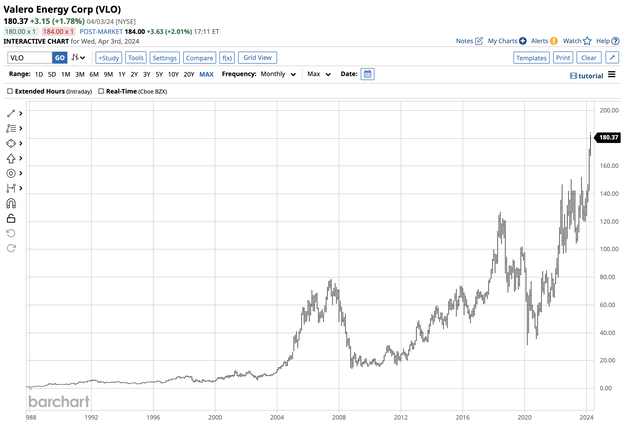

Long-Term Chart of VLO Shares (Barchart)

The long-term chart dating back to 1987 shows VLO’s ascent. More recently, the 2020 pandemic caused oil and refining spread prices to plunge, sending VLO to an eight-year low of $31 per share. Since then, VLO has made higher lows and higher highs, reaching a record high of over $127 per share in May 2022. More recently, VLO moved to $183.79 on April 4, 2024, and was sitting near the high above the $180 level on April 4.

Sustaining VLO’s upward trajectory depends on crack spreads over the coming weeks and months. As the spreads are a real-time indicator of refinery profits, rising gasoline and distillate crack spreads could push VLO shares to higher highs. However, the risk of a correction increases with the refiner’s stock price. VLO is in a bullish trend in early April 2024, with the peak gasoline demand season on the horizon. VLO has had plenty of time to hedge its refining margin exposure, which means earnings should be strong for the coming months. Market trends are always your best friend, and gasoline and VLO’s trends remain higher in early Q2 2024. I expect higher highs in VLO shares, but investors should keep an eye on crack spreads for the long term because of their position as real-time earnings indicators.

Read the full article here