The spot Bitcoin (BTC-USD) ETFs, since their launch on January 10 have so far recorded very impressive inflows. The ETFs have also seen some “bad” weeks with negative net flows. Typically when Bitcoin sees a retrace, the ETFs see more outflows. The spot Bitcoin ETFs have provided a proxy for gaining exposure to Bitcoin without needing to worry about intricacies like custody of Bitcoin and Bitcoin network fees. Among the approved spot Bitcoin ETFs, the Fidelity Wise Origin Bitcoin Fund (BATS:FBTC) is one of my favorite spot Bitcoin ETFs. Reasons include the fund’s experience in launching crypto-focused products (being active in crypto since 2014), its self-custody (unlike other ETFs that opt for a third-party asset custodian), its attractive 0.25% expense ratio, and the six-month initial expense ratio waiver. Fidelity’s all-around infrastructure surrounding Bitcoin and other crypto-assets makes FBTC a potential institutional pick and shovel for Bitcoin investing.

Fidelity’s robust range of investment, trading, retirement, and wealth management platforms and packages, which includes Fidelity Crypto and Individual Retirement Account (“IRA”) packages, positions the issuer to become a go-to platform for offerings such as including Bitcoin in IRAs, now that a traditional vehicle to access crypto has been approved. While some detractors believe digital assets won’t be included in IRAs, I, however, believe that at this stage, it would be ill-advised to bet against BTC. Bitcoin has come a long way as an asset class, from an emerging technology just over a decade ago to becoming mainstream today.

Excerpt from my January FBTC article.

As FBTC closely tracks Bitcoin’s spot price, the success of FBTC is mostly linked to Bitcoin’s success. This begs the question, where is Bitcoin (and its spot ETFs) likely headed, following the recent volatility?

Bitcoin FUD: ETFs Face Volatility

Volatility is inherent to the crypto market. Being an open 24/7 market with ubiquitous access and no market open or close times, the crypto market reacts to news on the go (in real-time). Instances like the September 2017 China crypto trade ban, saw BTC drop by around 40% from its monthly $5,000 high. The FUD soon blew over and BTC went on to hit an all-time high price of around $19,000 in December 2017 – just three months after the China ban FUD had driven the price down. Similar FUDs have followed, for which a “Bitcoin obituary” was prematurely declared; Bitcoin, however, has consistently bounced back, breaking a new all-time high price.

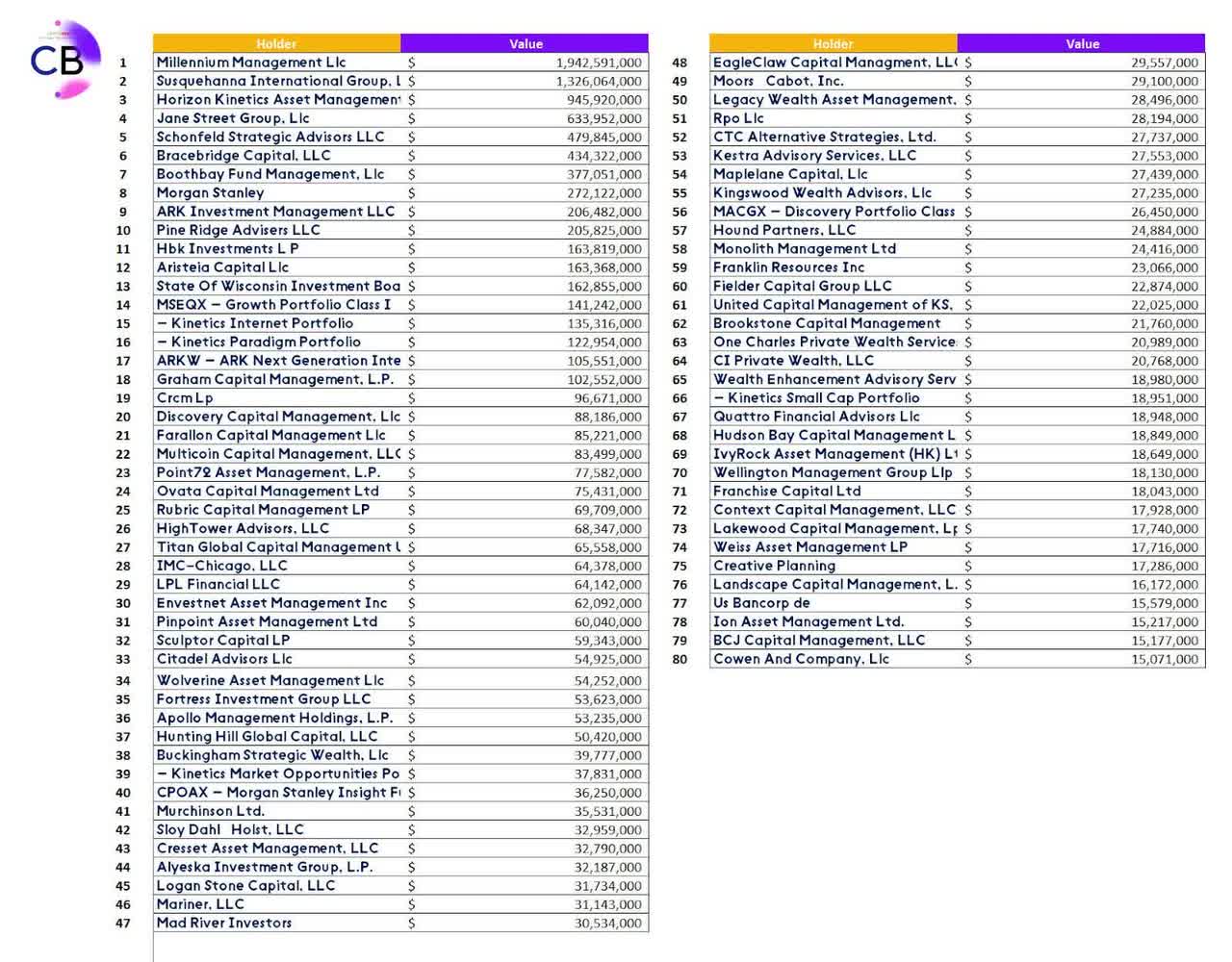

The top 80 holders of spot ETFs are institutions, according to SEC filings (Bitcoin Magazine)

The difference between the past Bitcoin era (like the 2017 scenario I previously described) and the current era is that there is more organic demand for Bitcoin from institutional investors via the spot Bitcoin ETFs. Data show the top 80 holders of the Bitcoin ETFs are institutional investors. Despite the recent FUD fueled by the sale of BTC by the German government (the FUD seems to have waned further since the start of this week), I believe that the post-halving bullish case (new supply reduction) for Bitcoin is still in play. This is evident in the $1.04 billion inflows the spot ETFs recorded last week, which followed the swift rebound Bitcoin witnessed from the over 15% dip and now trading strongly above the $60,000 psychological level.

Now that the German government is out of BTC to sell, (according to on-chain data), Bitcoin investors are speculating a similar selling pressure from the Mt. Gox repayment. For readers who are not familiar with the Mt. Gox story, Mt. Gox, an initialism for “Magic: The Gathering Online eXchange.” was a Japan-based crypto exchange and the largest crypto exchange in its prime (2011 to 2014). The crypto market was a nascent and fledgling industry at that time, and Mt. Gox faced several security breaches, with one of the most prominent cases of such breach in 2011 when 25,000 BTC were stolen from Mt. Gox users’ accounts. The biggest breach took place in February 2014 during which 850,000 BTC were stolen from the exchange. Forcing the exchange to shut down and file for bankruptcy. 200,000 BTC of Mt. Gox funds were later found in one of the exchange’s old wallets, and that propelled the repayment hopes.

A decade later, Mt. Gox is finally set to commence repayments to creditors after a lengthy process between the creditors and the Mt. Gox trustee. Mt. Gox will reimburse 140,000 BTC, currently valued at around $9 billion, to its creditors.

Mt. Gox moved 44,526.95 BTC worth about $2.8 billion to a cold wallet on Tuesday (seen in on-chain data), after initially sending over what appears to be a 0.02 BTC test transaction into the same cold wallet – a precursor to the payouts. The payouts to creditors will be facilitated through major crypto exchanges, including Bitstamp and Kraken.

While fears of a sell-off and another price crash linger, one key difference I have noticed between the recent BTC sell-off by the German government and the Mt. Gox payouts is that the former was sudden and occurred without prior public knowledge, while that of Mt. Gox is already anticipated with the market bracing for impact. The market may have absorbed some of the FUD already. Also, the exchanges that will distribute the repayments or creditors have up to 60 to 90 days to plan and distribute the payments. Hence, the repayments would likely not be a case of funds distributed simultaneously and dumped on the market abruptly. However, I’m not ruling out some volatility once the payouts roll out fully. This volatility could spill over to FBTC and other spot Bitcoin ETFs.

Risks

Volatility risk remains one of the main risks associated with BTC and ETFs like FBTC. I’m, however, confident that the current dust created by the German sell-off and Mt. Gox repayments will settle very quickly. I take this stance mainly because of increased demands for the spot ETFs which have outpaced new BTC creation. Based on the 3.125 BTC block reward since the fourth halving in April and an average block time of 10 minutes, about 450 BTC are created daily on the Bitcoin network. At the current market price of around $65,000, the 450 daily produced BTC is around $29 million. On weeks with healthy inflows, the spot Bitcoin ETFs average over $100 million of daily inflows. This is the main basis for my confidence in Bitcoin beating the FUD and maintaining momentum moving forward.

Direct custody of Bitcoin exposes investors to asset loss risks for which the investor will be fully liable. An ETF like FBTC provides some cushion and mitigates this risk by handling asset custody within the fund. This, however, doesn’t completely rule out the risk of hacking or theft of the fund’s cold wallets. Such an occurrence will adversely affect the ETF’s net asset value.

Investor Takeaway

Many a Bitcoin maxi still downplays the importance or usefulness of the spot ETFs in the Bitcoin ecosystem. They tout the direct ownership and self-custody of Bitcoin as the only viable option. Just like some investors prefer gold ETFs over directly owning physical gold bars or gold mining stocks due to simplicity and liquidity, those interested in Bitcoin may opt for ETFs instead of worrying about the intricacies of cryptocurrency wallets and exchanges. Not every investor is interested in the intricacies and the techy aspects of Bitcoin, so some may prefer ETFs instead. Among the ETFs, Fidelity’s Wise Origin Bitcoin Fund ETF possesses the stand-out features, in my view, comprising experience in managing crypto-focused products, competitive expense ratio, and healthy inflows and trade volumes.

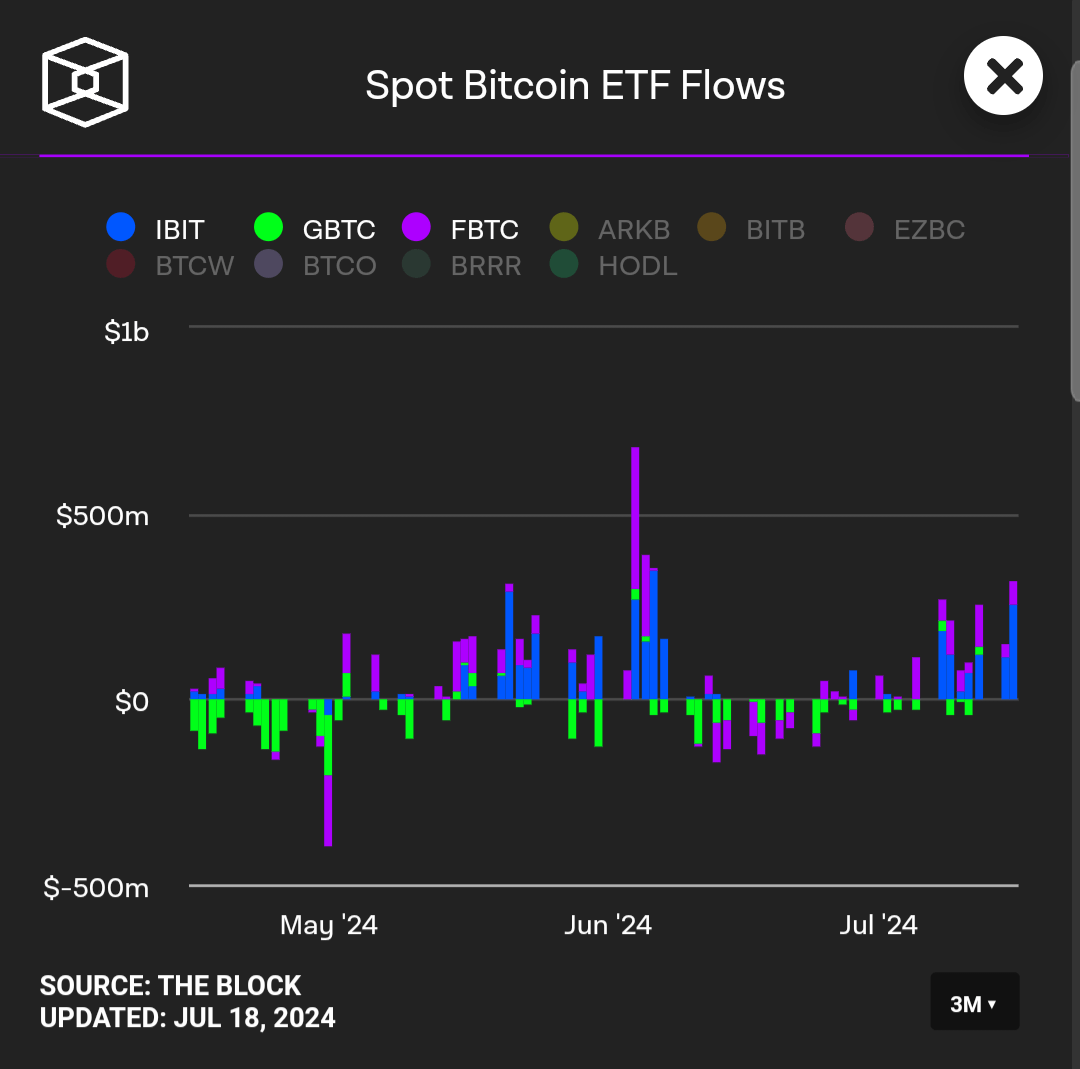

theblock.co

At the inception of the ETFs, BlackRock’s iShares Bitcoin Trust ETF (IBIT) led the inflows. FBTC has since played serious catch-up with IBIT and now leads inflows more often. Grayscale Bitcoin Trust ETF (GBTC) continues to see outflows and a decline in its AuM due to its high 1.5% fee.

FBTC’s fee, after the initial fee waiver until August 1, remains competitive at 25 bps. This isn’t the lowest fee among the spot ETFs – Franklin Templeton Digital Holdings Trust (EZBC) has a 0.19% fee, Bitwise Bitcoin ETF (BITB) and VanEck Bitcoin Trust (HODL) fees are 0.2%, and Ark 21Shares Bitcoin ETF (ARKB) has a 0.21% fee. However, FBTC’s combination of decent and consistent volume and inflows has made it a top pick among the ETFs. GBTC still commands the highest volume but has been plagued by consistent outflows due to its 1.5%. IBIT also commands significant volume.

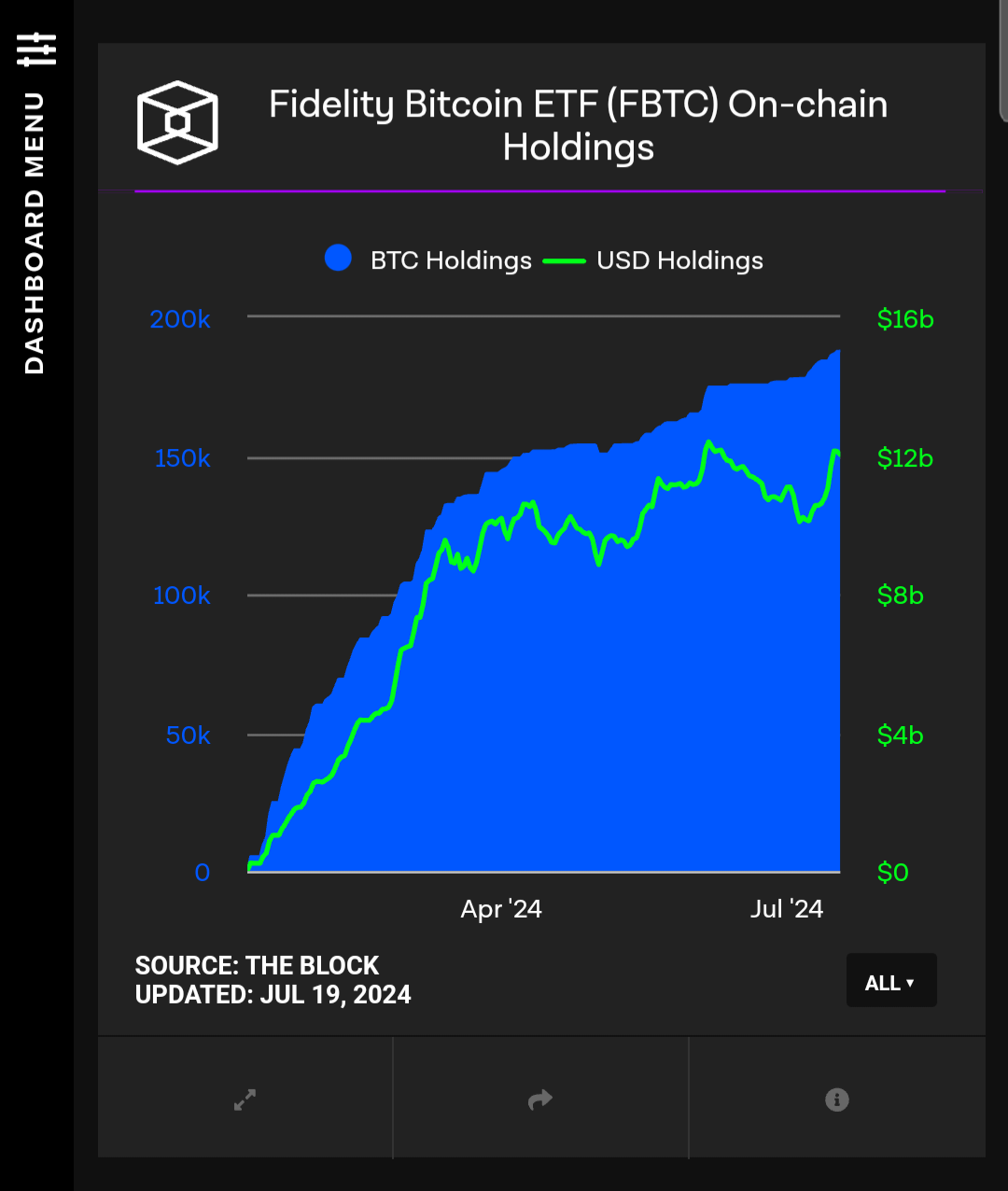

theblock.co

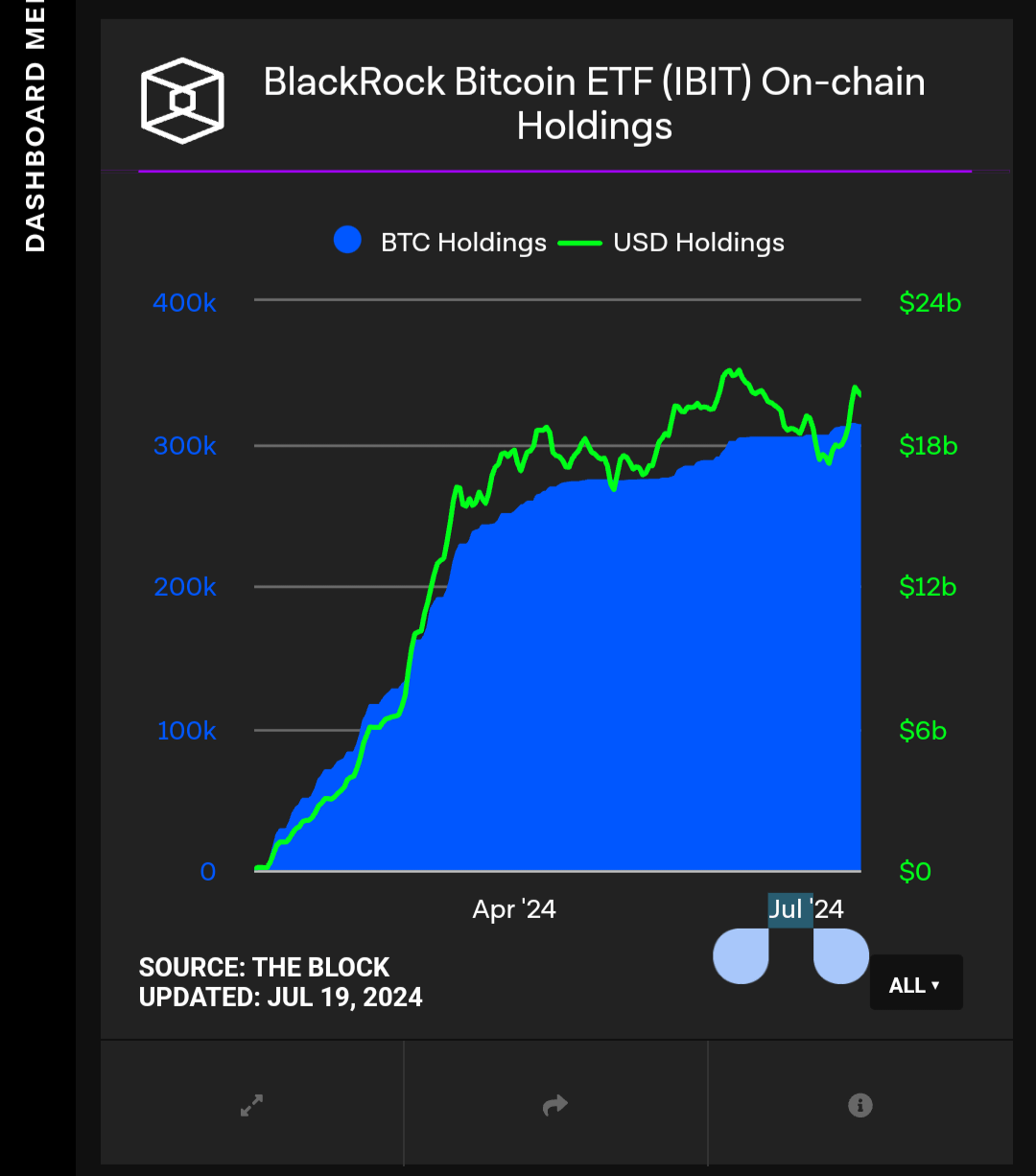

theblock.co

Where FBTC stands out the most has been in its on-chain BTC holding. Since the launch of the spot ETFs, FBTC’s on-chain Bitcoin holding has consistently surpassed its cash holding. Thus FBTC provides the best direct exposure to Bitcoin among the spot ETFs, in my view, evident in its proportionally higher allocation to BTC. The post-halving bullish case for Bitcoin is still in play and demand for BTC is catalyzed by the strong demand for the spot ETFs. Bitcoin is entering a bull market and FBTC’s higher exposure to Bitcoin means that it is in a good position to potentially trade at a higher premium to NAV in a full-blown Bitcoin bull market, among the spot Bitcoin ETFs. FBTC currently trades at a 0.21% premium to NAV, which is 25 basis points lower than IBIT’s 0.46% premium.

As a long-term crypto investor, Bitcoin is an asset I won’t bet against at this point. Bitcoin has become one of the campaign points of the coming U.S. elections, with the Republican Candidate set to give a keynote speech at the upcoming edition of the Bitcoin Conference dubbed Bitcoin 2024. Bitcoin is now mainstream!

I have a stronger case to recommend a “buy” for FBTC. I anticipated some “sell the news” sentiment after the ETF creation, coupled with the post-halving volatility; hence, I recommended a “hold” in my previous coverage in January. FBTC is up about 54% since that coverage. There is a strong bullish case for Bitcoin at this point and more upside for FBTC. Long FBTC!

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Growth Idea investment competition, which runs through August 9. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Read the full article here