Introduction

Ever since the post-pandemic economic reopening caused inflation to fly, the monthly consumer price index numbers have been among the most important data releases.

After all, lower inflation means a path to lower Fed rates. Stubborn inflation means elevated rates and increasing pressure on financial health. That’s the short version.

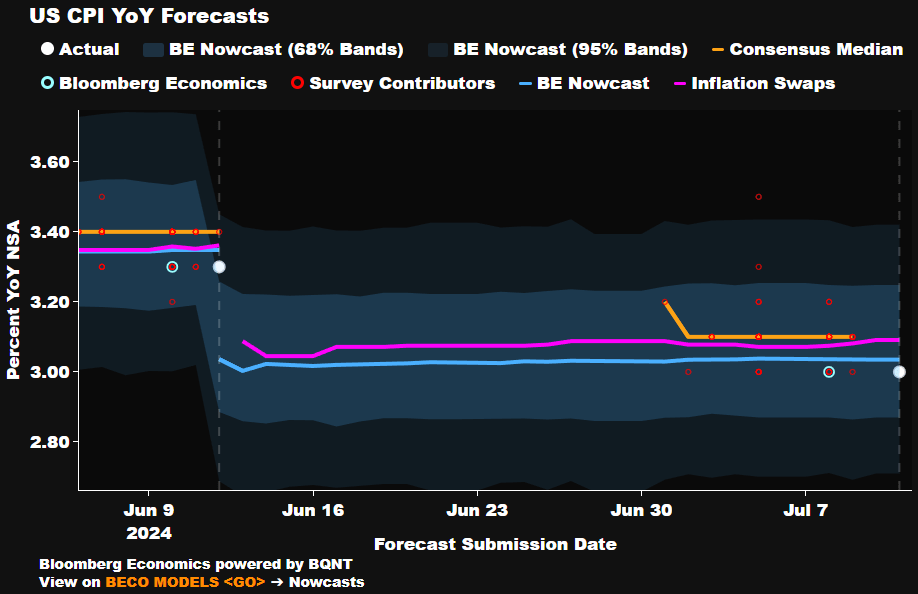

With that said, the most recent report provided great news for the Federal Reserve:

- Core prices (excluding food and energy) rose by 0.1% in June (compared to May). This was less than 67 out of 71 economists expected.

- All-item (headline) CPI declined by 0.1%, pressured by lower gasoline and energy costs.

- On an annual basis, CPI rose by 3.3%, less than expected, with the lowest growth rate since April 2021.

Bloomberg

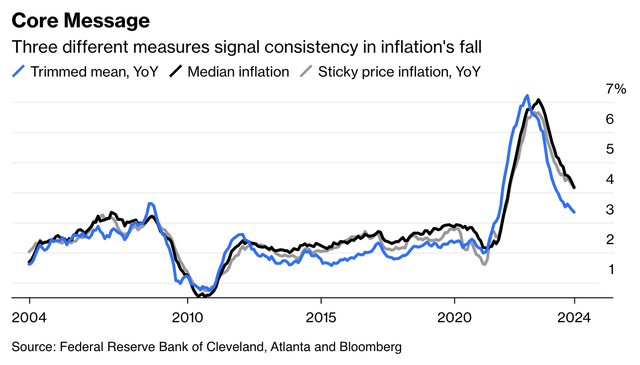

Moreover, while the decline in prices is very slow, we are seeing promising declines in inflation indicators adjusted for outliers. This includes trimmed-mean inflation, median inflation, and sticky price inflation, as measured by the Federal Reserve Banks of Cleveland and Atlanta.

Bloomberg

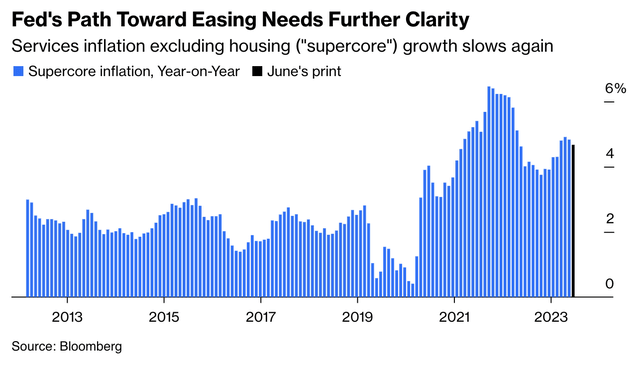

The same goes for the super-core inflation index, which is core services minus housing.

While one may make the case that it’s silly to strip out so many factors (I would agree), it’s an index watched by the Fed.

This index just saw its second-consecutive monthly decline, albeit at uncomfortably elevated levels.

Bloomberg

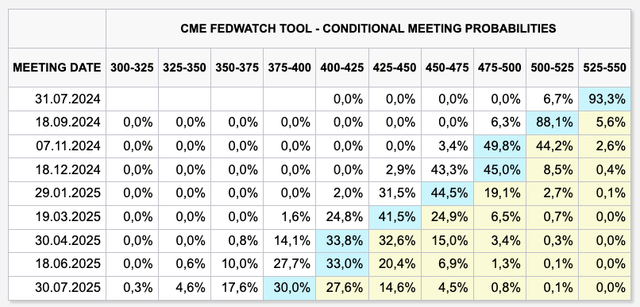

As a result, the market now expects the Fed to cut rates six times over the next 12 months, from the current 5.25-5.50% range to 3.75-4.00% at its July 2025 meeting.

CME Group

While all of these numbers are subject to change (at the beginning of this year, the market expected six cuts in 2024), one very interesting thing happened.

After the good inflation numbers, the market sold off!

In general, lower inflation is bullish — especially for growth stocks. Lower inflation makes it more attractive to discount future growth, which usually benefits “growth” stocks more than “value” stocks.

Here’s how Bloomberg’s John Authers put it (I added emphasis):

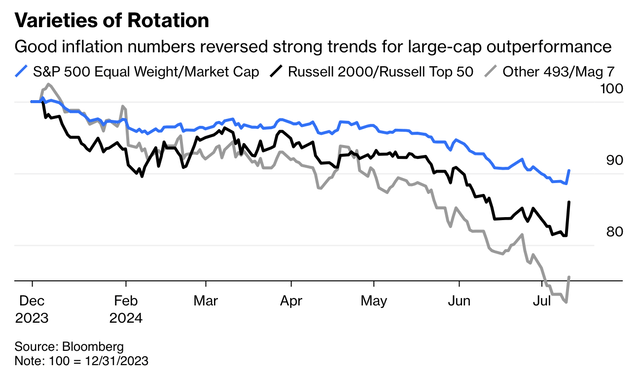

The snap back after the inflation numbers was dramatic, but only followed a protracted and dramatic narrowing of the market that had seen the biggest companies grow ever more dominant. It’s too soon to say that trend is over, but the shift suggested that the excitement around big tech stocks may have been primarily defensive; they were seen as a hedge against a slowdown:

Bloomberg

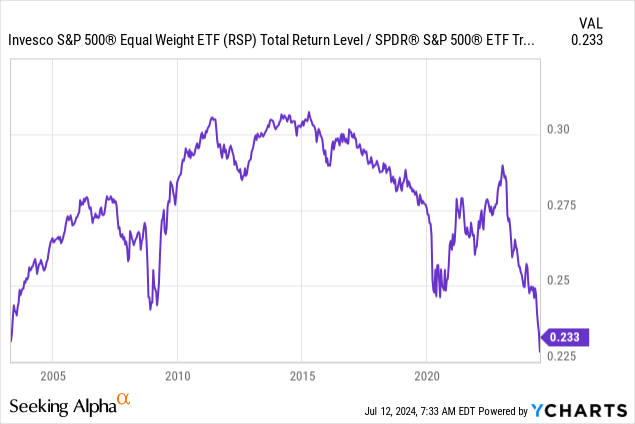

As some readers may know, the relationship between the equal-weight S&P 500 and the “normal” market-weighted S&P 500 has been a topic in many of my articles.

To paraphrase the quote from Mr. Authers above, we have seen a dramatic narrowing in the market.

In fact, the underperformance of the equal-weight S&P 500 (see below) has been nothing short of mind-blowing, as a handful of stocks consistently pushed the S&P 500 to new all-time highs.

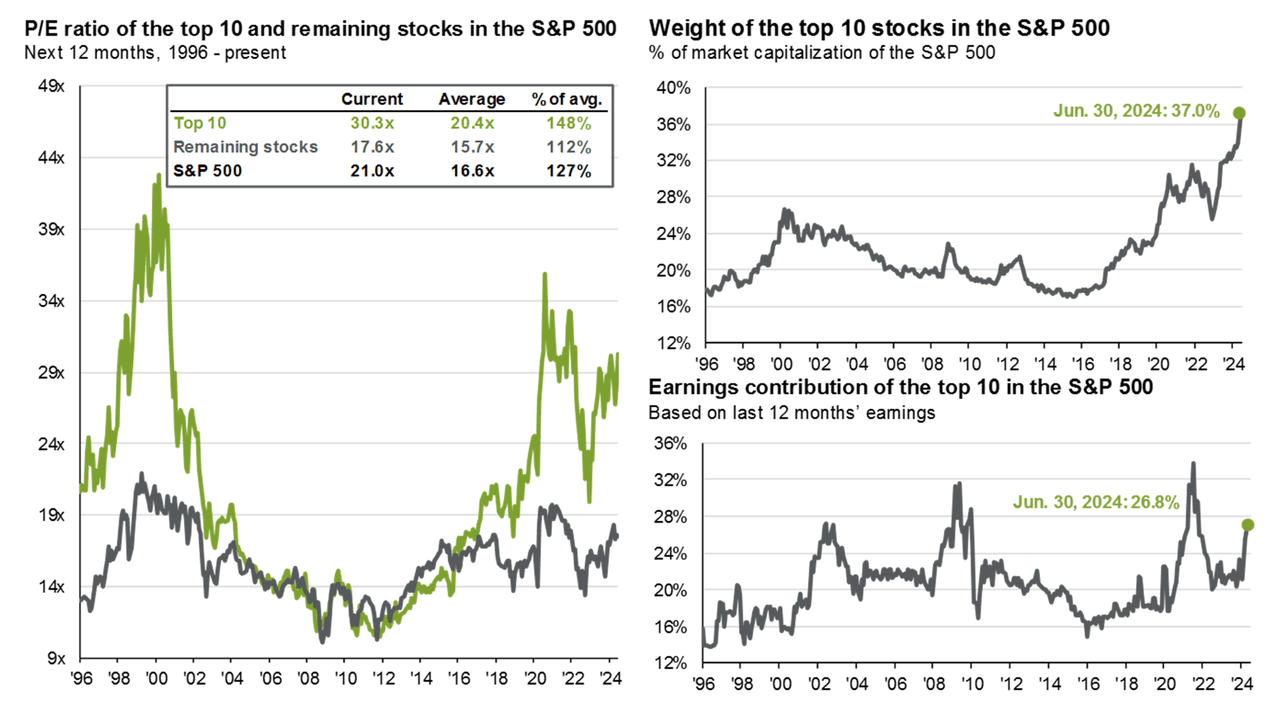

Things have gotten so much out of hand that the biggest ten stocks of the S&P 500 accounted for 37% of its value going into this month.

Even during the Dot-com bubble, that number was below 28%.

JPMorgan

While the ten biggest companies are all high-quality companies that have grown for a good reason, it created massive concentration risks as the market essentially became an AI play.

I’m painting with a broad brush, but I think you get the point.

While I could be wrong — it’s all just speculation — I believe this was a great example of “selling the good news.” With the market pricing in roughly six rate cuts, I believe the average investor knows inflation will have to come down a lot more to justify more cuts.

The risk/reward for disinflation trades isn’t good anymore.

Hence, money is flowing into areas that have lagged when “everyone” was betting on lower inflation.

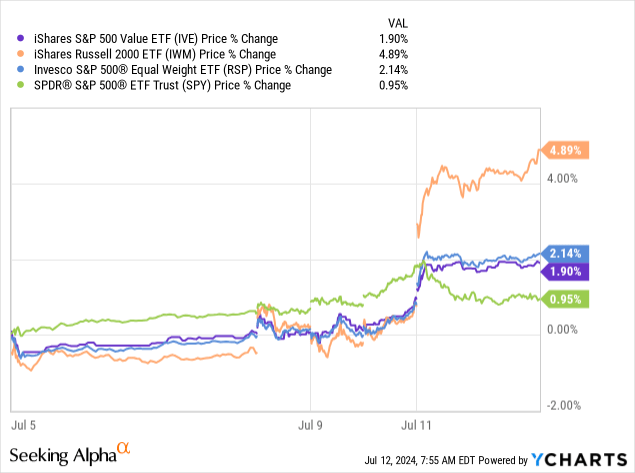

That’s why the equal-weight S&P 500 is bouncing back, supported by the S&P 500 Value ETF, the Russell 2000, and others.

Having said all of this, I’m not bearish.

While the market is far from cheap, my point is not that investors should dump their shares. My thesis is a broadening of strength, as I expect the equal-weight S&P 500 to outperform the market-weighted S&P 500.

A big reason for this is the sentiment shift we just discussed and the expected broadening in earnings growth.

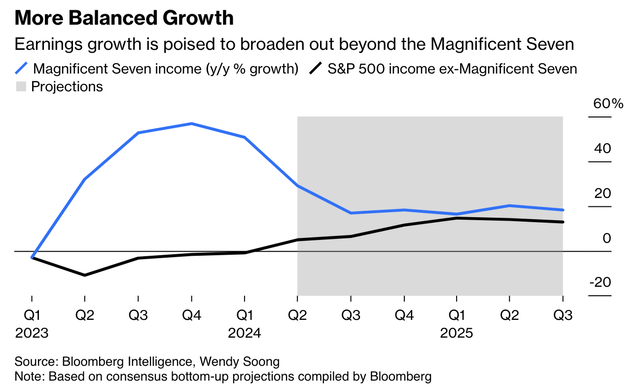

To quote Jonathan Levin (emphasis added):

What we’re starting to see now, though, is a broadening of earnings growth to such areas as ground transportation and energy, which could help broaden the stock market’s performance as well. The Magnificent Seven are estimated to report earnings gains of around 29% from a year earlier (still fast, but a bit slower for them), while other stocks in the index are forecast to start growing profits again. Sounds like a balanced and reasonable earnings mix to me.

Bloomberg

Unless the economy falls off a cliff, I believe this is a great opportunity to assess the value of some of the stocks that were left behind when AI dominated the market.

Hence, in the second part of this article, I’ll present three dividend growth companies that I expect to offer great long-term value.

Home Depot (HD) — A Great Housing/Consumer Play

Home Depot was one of the first dividend growth stocks I bought for my portfolio. Initially, I used it as a proxy to get access to the American consumer.

However, over the past few years, I have started to view the company as much more than that, as it’s one of the most aggressive growers in the housing market.

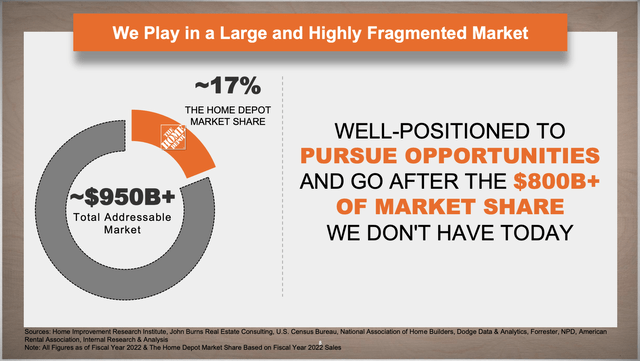

Currently, it has a market share of roughly 17% in what it estimates to be a total addressable market of almost $1 trillion, large enough to provide plenty of organic growth opportunities.

The Home Depot

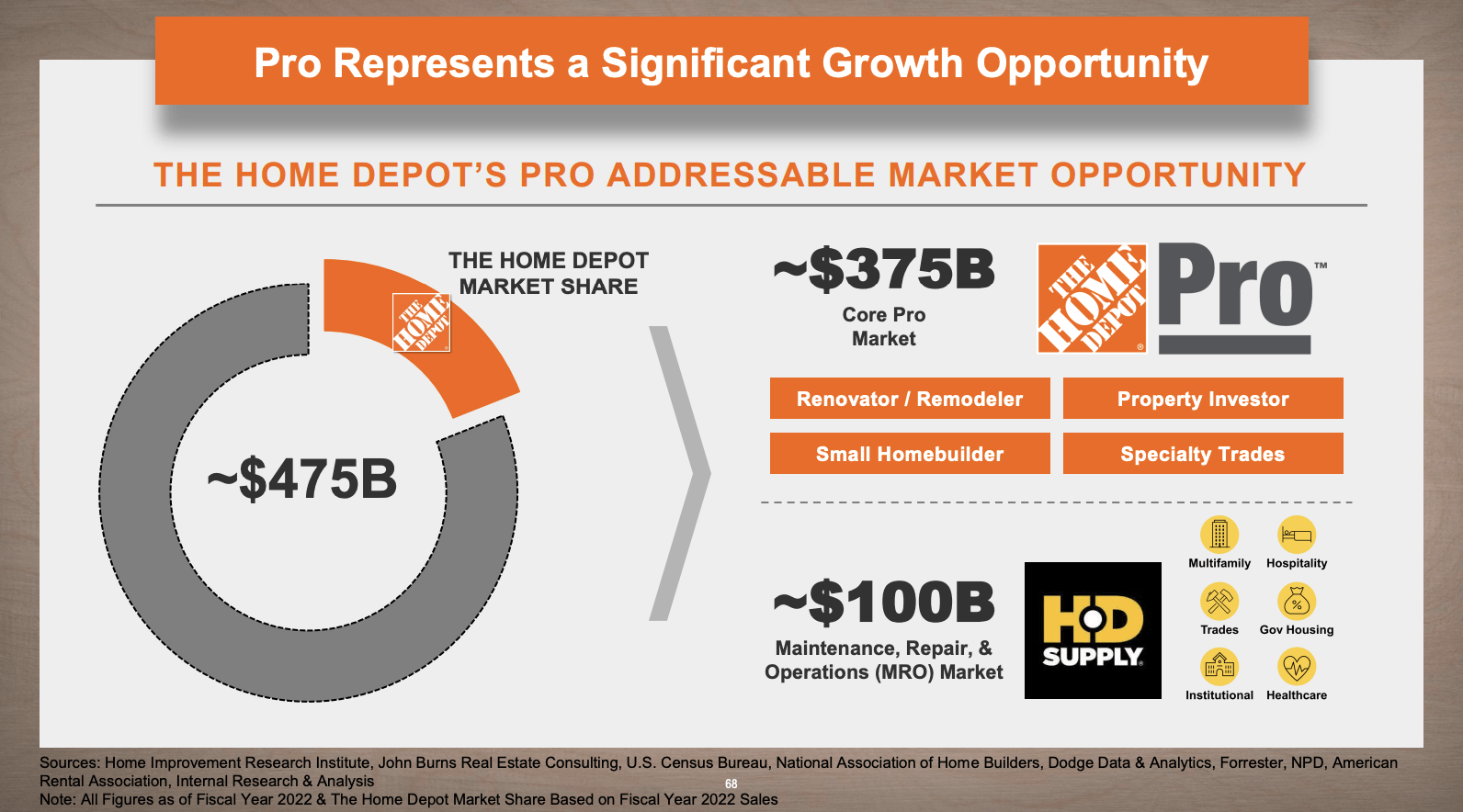

Moreover, the company has identified a $475 billion total addressable market, specifically within the residential pro-contractor segment, where it currently holds a relatively small market share (see below).

Through organic growth and acquisitions of major companies like SRS Distribution, Home Depot aims to become a major player in a market that benefits from an elevated average age of both residential and commercial buildings in the United States.

The Home Depot

At the end of 2022, the average U.S. commercial building was 53 years old!

The average commercial building is designed to last 50 to 60 years, meaning we are about to witness the golden age of building maintenance.

It is also increasingly using technology to improve its stores, including the development of advanced pro intelligence tools integrated into its CRM (customer relationship management) platform.

This includes identifying optimal pro targets and high-value cross-selling opportunities.

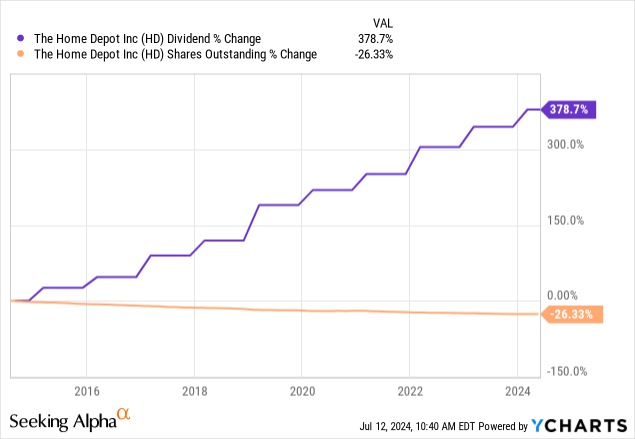

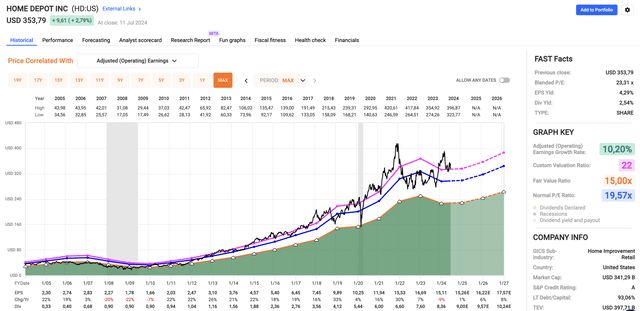

Regarding its dividend, HD currently yields 2.5%. This dividend comes with a 58% payout ratio and a five-year CAGR of 12.7%.

Moreover, over the past ten years, HD has bought back 26% of its shares.

Although Home Depot is not as cheap as I would like it to be, I believe it will be one of the biggest winners in an environment where the Fed can cut rates.

The moment the market sees a sustainable path to lower rates, I expect a lot of capital to rush into building projects, including private DIY.

FAST Graphs

As such, I would give the stock a Buy rating.

The next stock has a Strong Buy rating.

Canadian National Railway (CNI) — A Top-Tier Dividend Grower

Canadian National is one of the companies I would own if I didn’t have the goal of keeping a rather concentrated portfolio (I own three railroads).

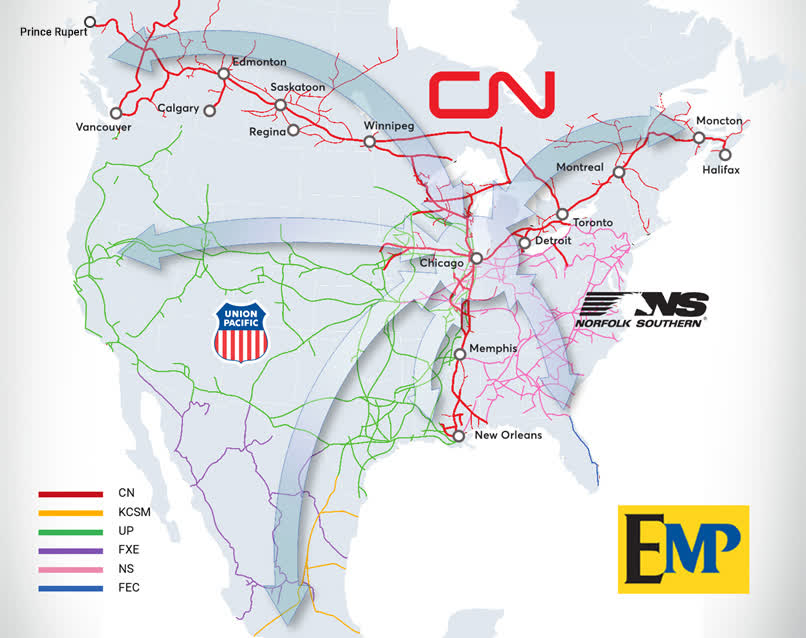

This Canadian giant is the competitor of my investment in Canadian Pacific Kansas City (CP) and the largest railroad north of the U.S. border.

In an environment where the market broadens, I believe high-quality wide-moat railroads are great investments — especially if lower rates translate to higher economic growth expectations.

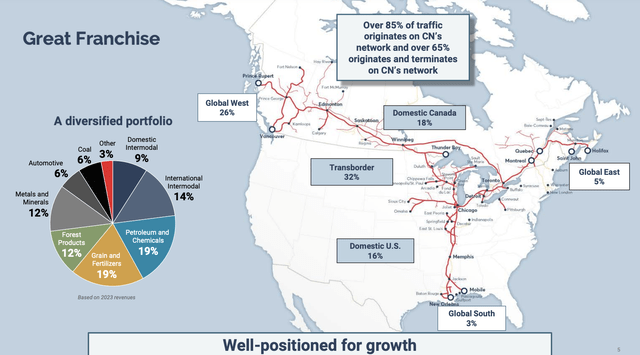

The company, which is listed both in Toronto and New York, has a massive network, spanning the West and East Coast of Canada, the U.S. Midwest, and the Gulf Coast.

Canadian National Railway

It also has fantastic diversification, including high-margin products like petroleum/chemicals, grains/fertilizer, and forest products.

Moreover, to combat Canadian Pacific Kansas City, which has the only network spanning all three North American nations, the company has a partnership with Union Pacific (UNP) and Norfolk Southern (NSC) to increase the combined footprint in North America, including Mexico.

Canadian National Railway

In general, CNI is in a great spot to benefit from several secular tailwinds:

- Increasing agriculture exposure/production.

- Canada’s role in global fertilizers.

- The fact that one freight train can replace more than 300 long-haul trucks (sustainability).

- Strong growth in oil production.

- Economic re-shoring to North America.

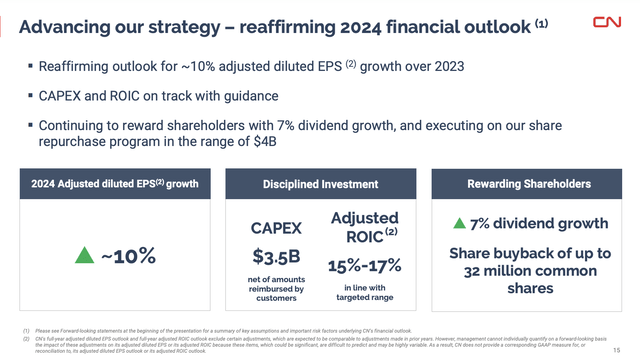

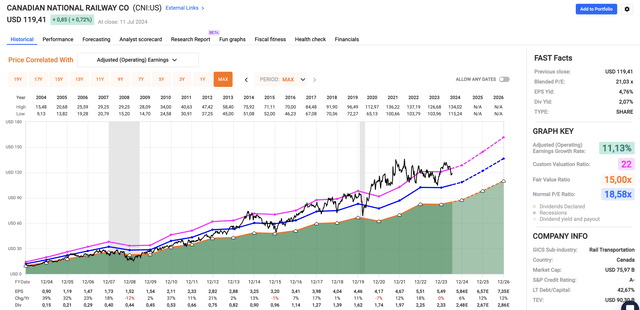

Additionally, despite economic challenges, the company guided for 10% EPS growth.

Canadian National Railway

It supported this outlook by hiking its dividend by 7%.

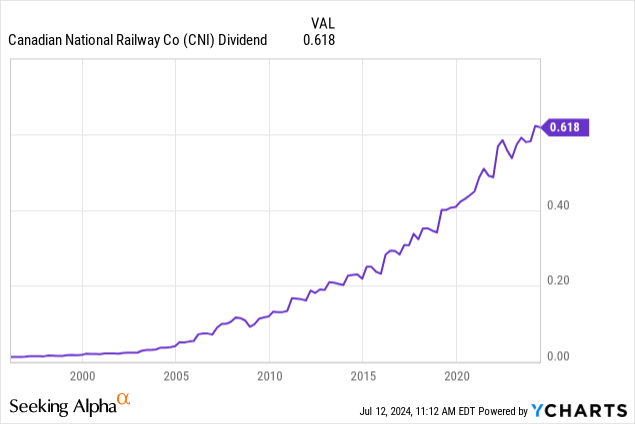

Currently, CNI yields 2.1%. This dividend has a subdued payout ratio of just 33% and a five-year CAGR of 10.4%.

The dividend is also protected by a stellar balance sheet with an A- rating.

The dividend has been hiked for 27 consecutive years. The only reason why it looks volatile is that Canadian National pays its dividends in Canadian dollars. Foreign investors will encounter some currency volatility.

Using the FactSet data in the chart below, analysts are looking for 12% EPS growth in both 2025 and 2026. If the company maintains a 22x multiple (its five-year average), we would see a path to $160 (in New York).

FAST Graphs

Although a lot depends on the trajectory of cyclical growth in North America, I believe the moment we see a bottom in indicators like the ISM Manufacturing Index, CNI will be difficult to stop.

Deere & Company (DE) — It’s Too Cheap To Ignore

I have spent the past few days discussing Deere & Company with countless people on social media. There’s one major reason for that: some people have lost respect for the company.

- The company is making headlines with “woke” policies.

- It is laying off people in the U.S. while moving production to Mexico.

Here’s a headline from the Daily Mail:

Daily Mail

Essentially, this is why people are upset:

The cherished tractor firm John Deere has become the latest target of activists, who say it’s strayed from its conservative base by backing LGBTQ+ events and embracing diversity-hiring targets.

The $61 billion-a-year company has been slammed for sponsoring a Pride event for kids as young as three, and encouraging staff to use ‘preferred pronouns’ as it tries to become more ‘inclusive.’

All the while, critics say, the 185-year-old firm has sacked American workers, with the axing this week of 345 more production employees from its plant at Waterloo, Iowa, as it shifts production to Mexico. – Daily Mail.

Don’t get me wrong, I won’t suddenly become political in my articles. I’m also by no means against people in the LGBT community.

However, I am not a fan of “forced” inclusion, which has been a problem for many companies in the past, including Bud Light and Tractor Supply Company (TSCO). TSCO even had to abolish all of its DEI plans after customers got upset.

While I think that certain brands are immune to these policies (some brands cater to a very “liberal” crowd), a company like Deere has rather conservative customers. The same goes for Bud Light and Tractor Supply Company.

It also doesn’t help that these headlines pop up at the same time the company is cutting its workforce, as it is struggling with weak demand.

Nonetheless, I am not selling. In fact, I’m still very bullish on the future of Deere, assuming they get their current PR issue under control.

One reason for me to sell Deere would be the loss of customer trust. The tractor industry is competitive. While it will take a lot of a farmer to switch (most have strong connections through dealerships, etc.), none of these headlines help the company.

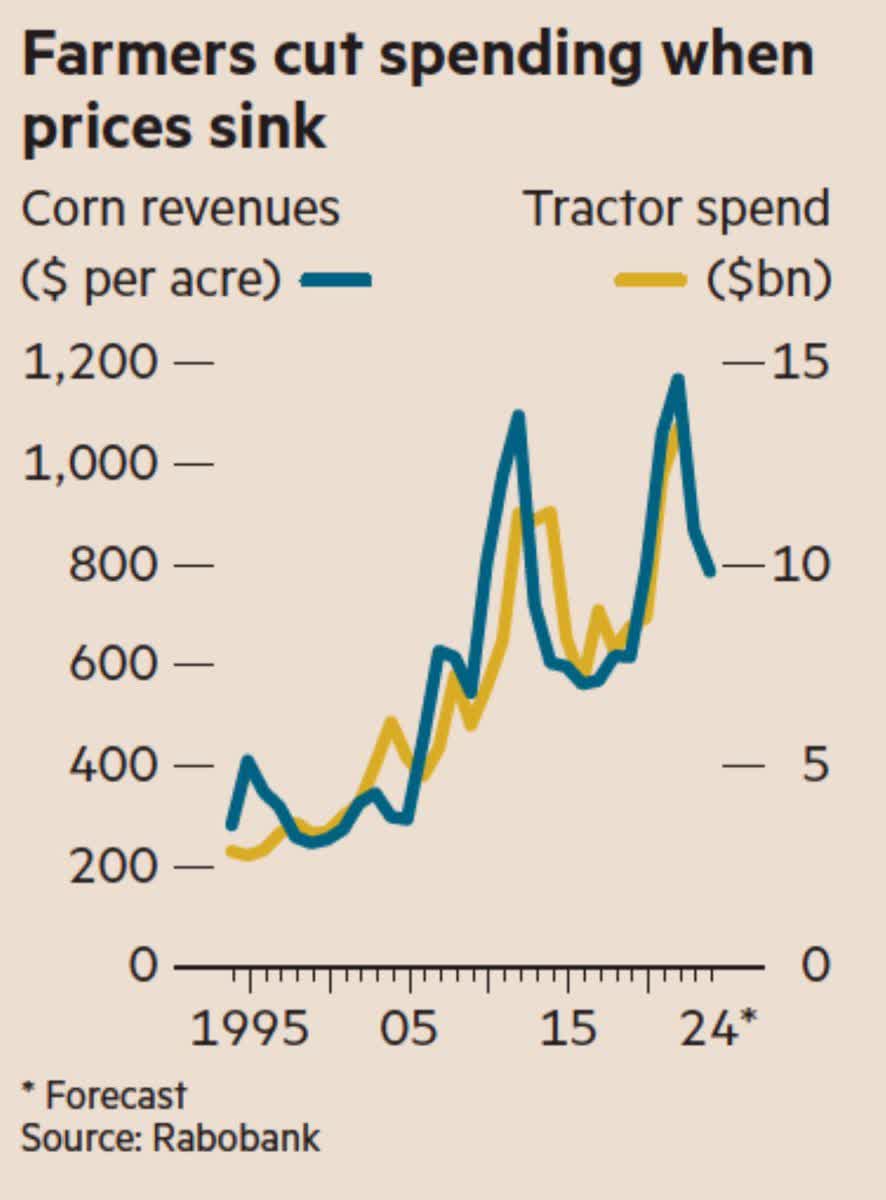

Anyway, the good news is that a lot of weakness has been priced in. With corn prices hovering close to $4 per bushel, the market knows we should expect tractor sales to decline.

Financial Times

This also explains why its sales in the second quarter declined by 12%, pressured by a 16% contraction in its Production and Precision Agriculture segment and a 23% contraction in Small Agriculture and Turf.

The company also lowered its full-year guidance, expecting between $7.0 billion and $7.25 billion in full-year operating free cash flow. Given the company’s price performance, I would not bet against another guidance cut when it reports 3Q24 earnings.

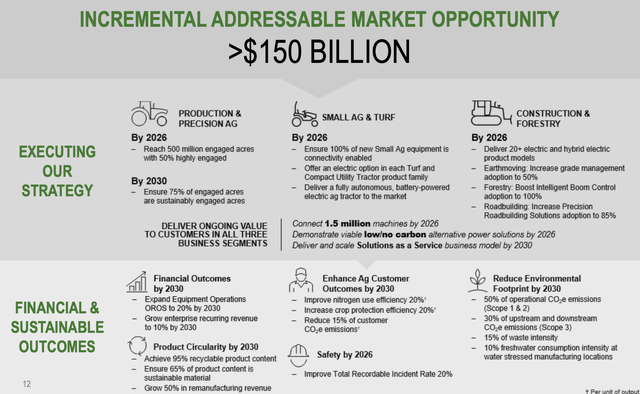

However, all long-term secular tailwinds are still valid:

- Deere is a leader in farm automation, optimization, and AI implementation. The company believes it is dealing with a total addressable market of more than $150 billion.

Deere & Company

- It benefits from a major replacement cycle, as farmers have been slow to buy new equipment after the Great Financial Crisis. After 2021, the replacement cycle started to heat up. However, elevated interest rates have made it hard for farmers to buy equipment that costs up to a million dollars.

Given the need for farmers to innovate, I expect a decline in interest rates to be a major driver of equipment demand, likely resulting in much higher analysts’ expectations down the road.

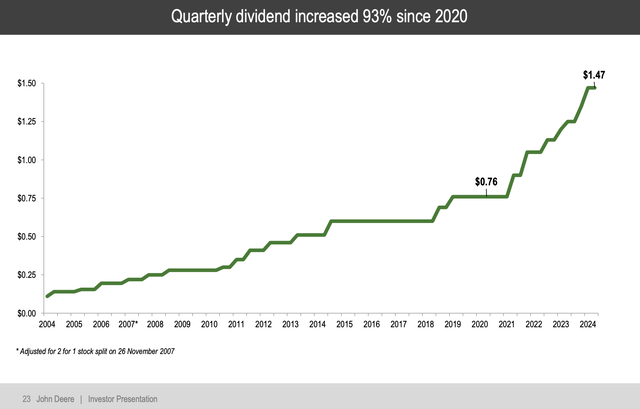

It also has a focus on shareholders. Since 2020, it has almost doubled its dividend.

Deere & Company

Currently yielding 1.6%, the dividend has a payout ratio of less than 18%, a five-year CAGR of 14%, and protection from an A-rated balance sheet.

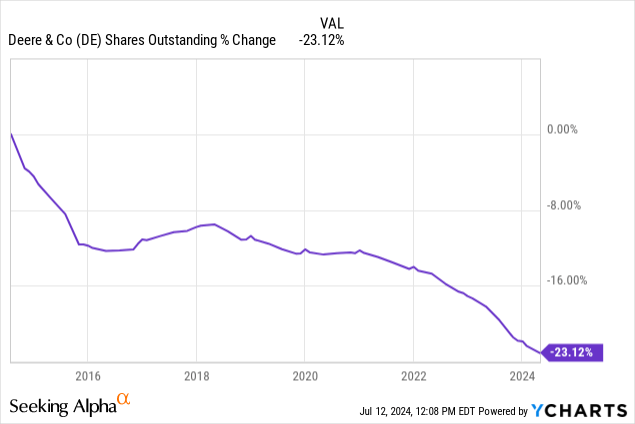

Additionally, over the past ten years, it has bought back almost a quarter of its shares.

Since 2003, DE shares have returned 13.4% per year. A big part of this return was supported by buybacks.

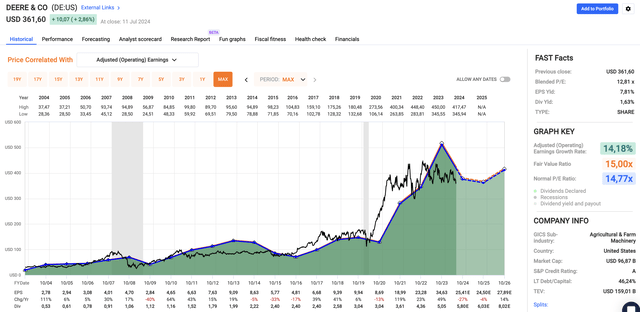

After its recent dip, DE trades at a blended P/E ratio of 12.8x, which is a few points below its normalized P/E ratio of 14.8x.

Although current EPS expectations hint at a 10-15% upside, I expect lower rates and a potential bottom in economic growth to lead to significant upside revisions in 2025 and beyond.

FAST Graphs

While this year is undeniably tough, I am adding to Deere’s weakness, as I believe it’s one of the best cyclical dividend growth stocks in the market.

Takeaway

The recent inflation report brings hopeful news for the economy, signaling a potential shift in market dynamics.

With core prices rising minimally and a drop in headline CPI, the market now expects significant Fed rate cuts over the next 12 months.

However, the market’s reaction to good inflation news was a sell-off, which suggests that investors are cautious and potentially aware that substantial disinflation is needed to justify more cuts.

As a result, money is flowing into lagging sectors, driving a rally in the equal-weight S&P 500.

I believe this shift indicates a broadening of market strength, presenting opportunities in undervalued stocks like Home Depot, Canadian National Railway, and Deere & Company, which are poised to benefit from these market and economic developments.

That said, if I’m right, this is great news for many other stocks as well. Hence, going forward, I’ll present many more opportunities, including updates on “big picture” developments in the economy.

Read the full article here