As I’ve noted in prior writings, I’m bullish on the energy sector broadly. There’s broad underinvestment that will take years to right, and fossil fuel demand won’t go away, no matter how much policymakers try to push a green agenda. Many agree with me, and there are a lot of ways to take advantage of what I suspect could be years of tailwinds. So how do you play it? Perhaps with a “smarter” approach. To that end, let’s look at the First Trust Nasdaq Oil & Gas ETF (NASDAQ:FTXN), which tracks the Nasdaq US Smart Oil & Gas Index, to determine if it’s a smart as the name makes it out to be for energy bulls.

FTXN is an exchange-traded fund that attempts to track the performance of the Nasdaq US Smart Oil & Gas Index, which is a custom index consisting of US companies involved in the oil and gas industry. The ETF started trading in September 2016 and has a little over $217 million in assets. The fund is entirely passive. Nasdaq’s index methodology uses a multi-factor approach to stock selection and weighting. Certainly sounds smart.

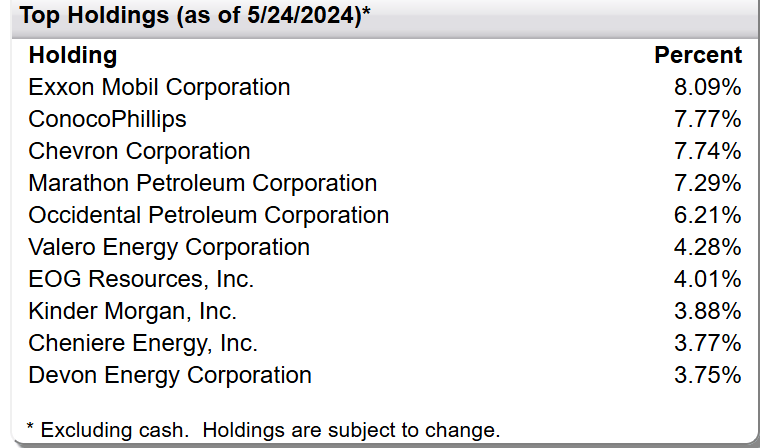

A Look At The Holdings

FTXN currently holds 42 securities with market capitalizations that range between $2.8 billion to $466.22 billion. When we look at the top holdings, we see overlap with many of the other energy sector ETFs out there. Exxon Mobil ranks at the top. And while the position sizing looks fairly top heavy in terms of the top 5 positions, it actually looks a bit less concentrated than other energy funds I’ve seen out there.

ftportfolios

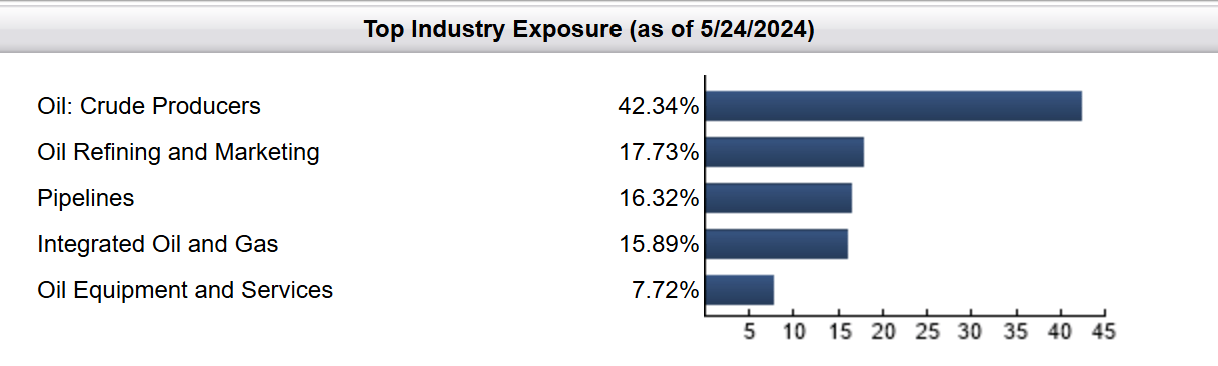

Sector Composition

The bulk of the holdings can be characterized as crude producers, with that making up 42% of the fund. Refining and marketing come next, followed by Pipelines. This is a comprehensive allocation overall, and what you’d expect to see broadly.

ftportfolios.com

This exposure ensures that the fund is not overly overweighted in any one piece of the pie, reducing concentration risk, as well as leveraging the respective best attributes of both upstream and downstream production. By remaining both upstream and downstream, FTXN encourages exposure to the full value chain of the oil and gas industry that could add even more value, and stability, to the bottom line.

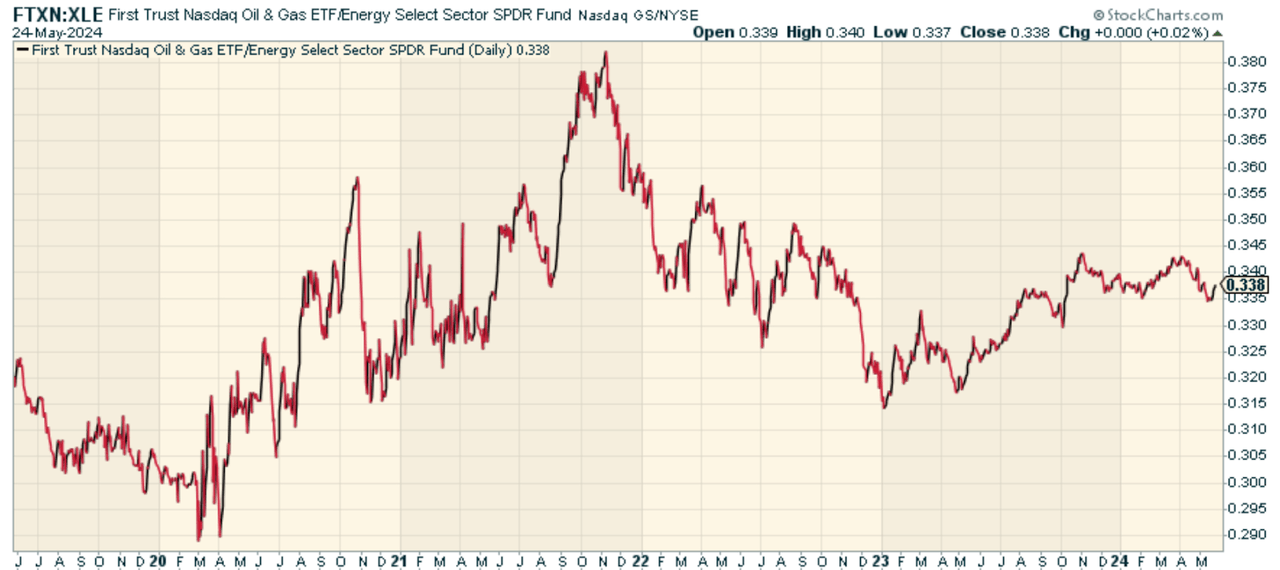

Peer Comparison

FTXN is not the only ETF that’s fishing for investors’ dollars in the energy space. The Energy Select Sector SPDR ETF (XLE) is the big player here. XLE is designed to track the Energy Select Sector Index. When we look at the price ratio of FTXN to XLE, we see that overall, there doesn’t seem to be any consistent outperformance. Overall, I’d say the two roughly perform the same.

StockCharts.com

Pros and Cons

On the plus side, the fund offers exposure to an industry that is the bedrock for all global economic growth and development. Routine energy demand is inextricably linked to the development potential associated with oil and gas, which benefits from the fact that much of the world’s population is still below the poverty line. Emerging economies continue to industrialize and urbanize. Moreover, the way the fund constructs its portfolio, using a multi-factor index, could provide further protection against idiosyncratic risk by focusing on companies that exhibit the strongest combination of risk factors. On the negative side, a recession could hurt the sector hard if one were to hit globally, and there will be fits and starts of momentum depending on political pushbacks.

To Invest or Not to Invest?

For investors looking for diversified exposure to the energy sector with a heavy US component, the FTXN is well worth a closer look. But it doesn’t seem to add much outperformance relative to broad-based energy ETFs, which are larger. It seems possible that the multi-factor approach ends up outperforming in the long-run, but this may be more due to mid and small-cap exposure getting favored over passive market-cap weighted averages. Not a bad fund at all, just don’t know if it’s as smart as the name makes it out to be. It’s really more a function of preference versus something like XLE in my view.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here