Having called this rally in Gold (XAUUSD:CUR) at the end of November here, I think it’s time for an update.

In essence I wrote that a breakout to a new high was highly likely to spark a major rally.

https://seekingalpha.com/article/4655198-golds-meteoric-rise-will-2600-be-the-new-normal

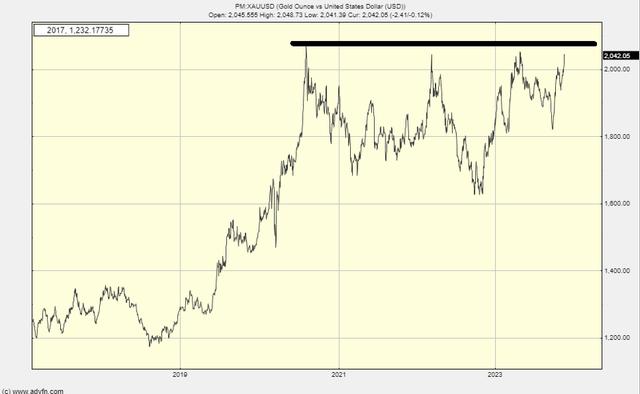

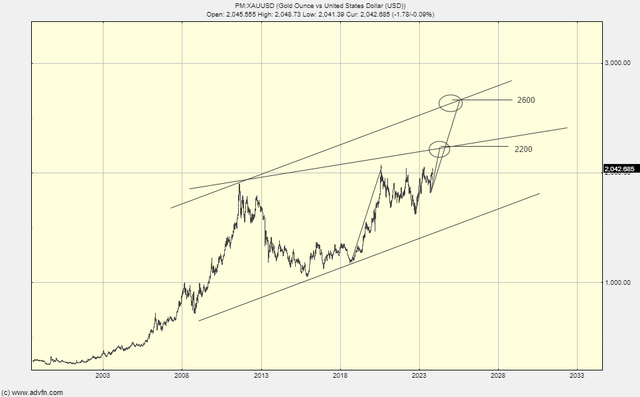

Here are two charts from that article, which sum up the idea:

.

ADVFN

As you know it broke that level. Here was the predicted consequence.

ADVFN

This $2600 level is now only $200 away.

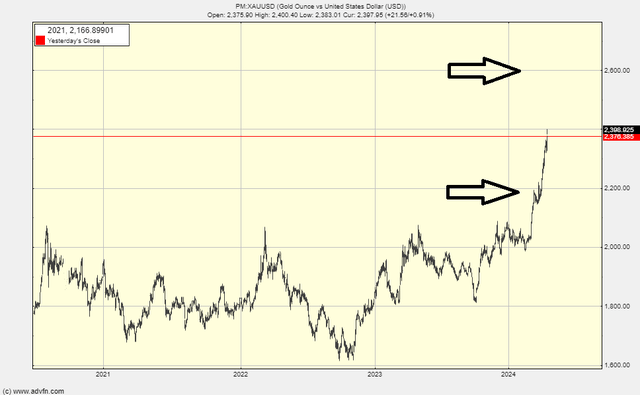

Here is the state of play with a pause at $2200 a most flattering hesitation.

ADVFN

So, it seems that $2600 is on the cards, which would be another nice pop.

But what then?

There is both good and bad news. The bad news first. I cannot make my charting toolbox spit out a high probability rise above $2600. I have tried several times. When I start looking at $2700 or $2800 levels, it gets sketchy and if you want to look for $3000 it is years out. That’s the bad news.

The good news is that there is a small chance of a ridiculously big move, and a gold holder can have it for free.

Gold is not going to fall back and if the low probability vertical occurs it will be within this year, so there is little to lose by just sitting tight and watching to see if gold will motor.

Charts are brilliant at predicting the past. This is a favourite joke of mine, but it does have an application as the past is quite good at indicating when something has suddenly changed. To me, there is potentially a big game changer for the gold market and that is Bitcoin USD (BTC-USD). Bitcoin has historically been a drag on gold, but now it may be that it will be the opposite. Without a doubt, institutions that provide services, for example market making, Futures, Options, and ETFs get paid for that and effectively that drains money from that market. Hopefully, that is counterbalanced by added value from those services. However, market participants aren’t famous for adding value and are notorious for predation. Gold has been a particularly mistreated market where the big players have – for years – pushed the market around for their own profit. It just might be that those predators now look to Bitcoin as a potentially more profitable farm for their activities, as it is a naive, money-gorged market to play instead of a slow ossified one like gold. Those enterprises do not have infinite capital and simply cannot play both gold and Bitcoin because, at least for now, they have a fixed allocation of capital and expertise to work with in this modern reality of regulatory capital. As such their boot is off the neck of gold now there is a Bitcoin ETF completing the derivative chain that connects the physical to the futures to the options. Instead, their boot is on the neck of Bitcoin giving gold the opportunity to reprice. The Bitcoin ETF in effect sets the dogs on Bitcoin and, at least for now, pulls them off gold. It’s just a theory but it will be easy to observe whether it plays out.

In any event, in the coming weeks we should get a continued rise to $2600 at which point we should reach a new equilibrium.

If my Bitcoin gold conjecture pans out, gold can run much further, but a gold sticker need only hang tight to see if we are in an old school vertical or not. That’s a nice situation for gold holders to enjoy and for those attracted to equities, elevated price levels for the physicals should finally feed through to mining stocks in all their convoluted glory.

Read the full article here