Investors are pricing-in a very aggressive set of Federal Reserve rate cuts in the coming years. In my opinion, expectations are too hawkish, as economic conditions do not support significant rate cuts right now. Specifically, inflation remains above target at around 3.0%, and unemployment at 3.5% is at historical lows. As such, and in my opinion, interest rates are likely to remain higher for longer.

Under these conditions, short-term and variable rate bonds and loans should outperform, due to their comparatively strong dividends and low duration / interest rate risk.

Higher For Longer – Economic Context

Some context first.

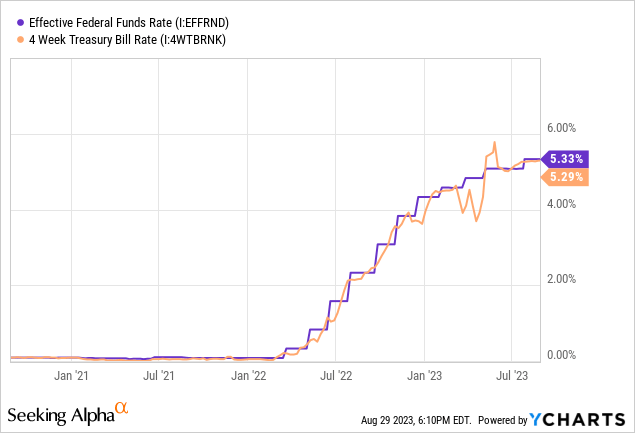

The Federal Reserve sets the federal funds rate. This is technically an overnight interbank lending rate but, for our purposes, is equivalent to the short-term, risk-free rate in the economy. T-bills are short-term investments with effectively no risk, and so T-bill rates tend to track fed rates quite closely (spreads earlier in the year were due to data collection issues, as I recall).

Data by YCharts

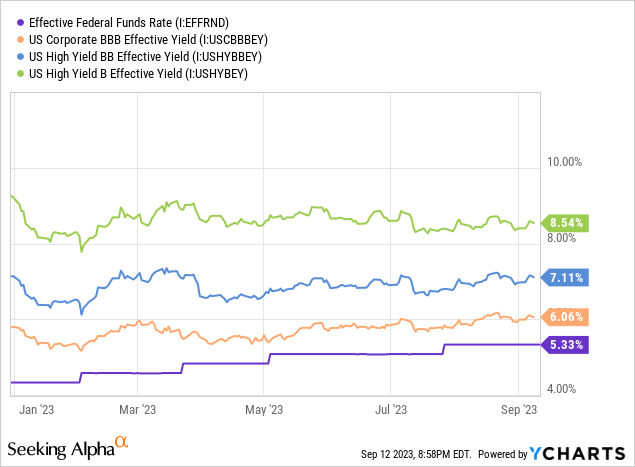

Interest rates for bonds and other fixed-income securities tend to be strongly dependent on Fed rates, but are influenced by other factors too.

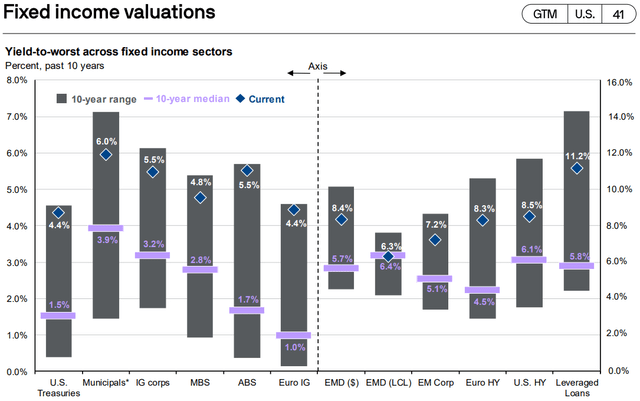

In the vast majority of cases, bonds with higher credit risk trade with higher rates / at spreads to fed rates, as compensation for the added risk. As an example, BBB-rated bonds trade with an average yield of 6.0%, or 0.7% higher than current fed rates. Bonds with weaker credit ratings trade with even higher yields too, as expected.

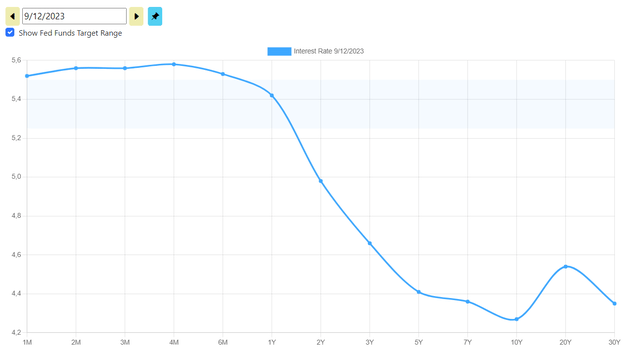

In most cases, bonds with higher maturities yield more too, to compensate investors for the added rate risk, and for tying investor capital for longer. Importantly, this is not the case right now, with most longer-term bonds yielding less than shorter-term securities. As an example, we have the U.S. treasury yield curve.

U.S. Treasury Yield Curve

Longer-term bonds yield less than shorter-term securities right now, because investors expect significant rate cuts in the coming months, and are pricing bonds accordingly. 20Y treasuries at 4.5% might not look all that compelling compared to T-bills yielding 5.5% right now, but the yield on those longer-term treasuries would look quite strong if the Fed were to cut, say, 3.0% or more. Markets expect significant rate cuts in the next two years, hence the inverted yield curve.

Due to the above, higher for longer might not necessarily literally require higher rates for longer. A slower, more methodical pace of rate cuts would have a similar impact. As an example, if the Fed were to slowly cut to 5.0% in the coming years 20Y treasury rates should increase, as these only yield 4.5%. Demand would decrease as investors realize T-bills will outyield 20Y treasuries for years, causing prices to go down, and yields to go up.

Considering the above, I wouldn’t take ‘higher for longer’ that literally. Less high at a slower pace might work too, but doesn’t roll of the tongue as easily.

Higher For Longer – Federal Reserve Policy

The Federal Reserve is, in its own words, firmly committed to fulfilling its statutory mandate from the Congress of promoting maximum employment, stable prices, and moderate long-term interest rates. Neither of these three metrics points towards the significant rate cuts that markets expect.

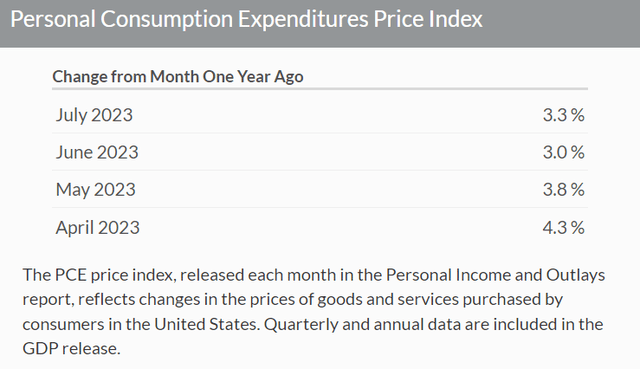

Inflation

Right now inflation is key, and most relevant inflation metrics are above the Federal Reserve’s 2.0% target. The PCE price index, the Fed’s key long-term inflation metric, stood at 3.3% this past July. The index does show inflation moderating, but it remains above target.

BEA

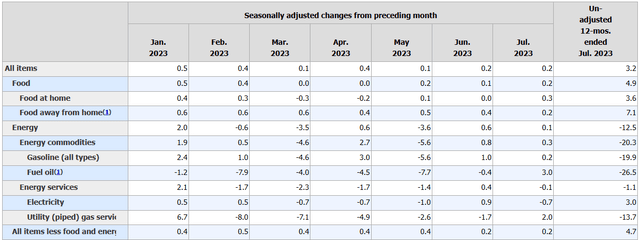

The better-known CPI is up 3.2% these past twelve months, 0.20% this past July. Monthly inflation seems stuck at these levels, but monthly figures are very volatile. Core CPI, which excludes volatile food and energy, is even higher at 4.7%. Monthly figures are also higher, in some prior months.

BLS

From the above, it seems clear that inflation is currently running above target.

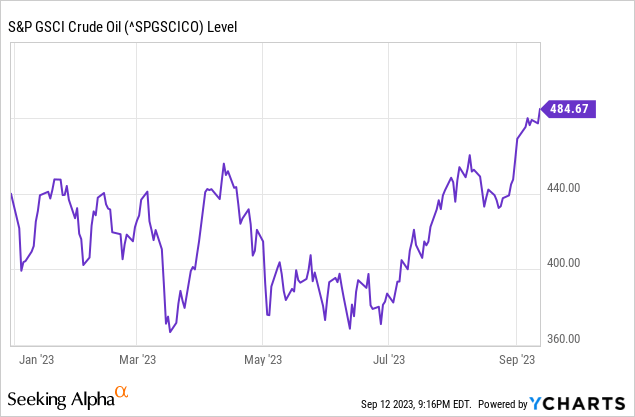

Oil prices have increased YTD, but have been flat for most of the year. Although prices can always trend down from here on out, I see no tailwinds here.

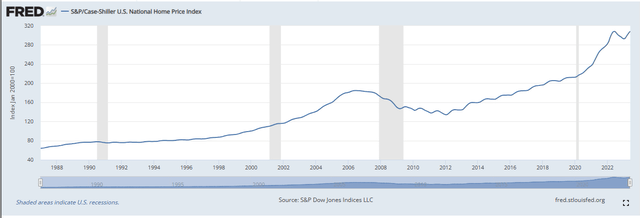

Housing prices are starting to increase too, which should result in higher rents. There is a lot of lag and volatility here, however.

U.S. Federal Reserve Bank of St. Louis

Right now, inflation calls for further rate hikes, not cuts.

Employment

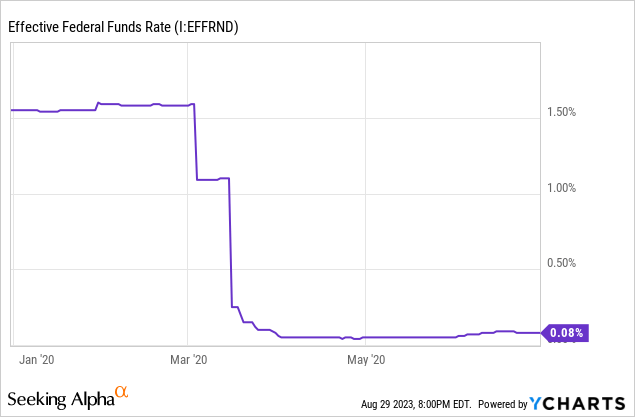

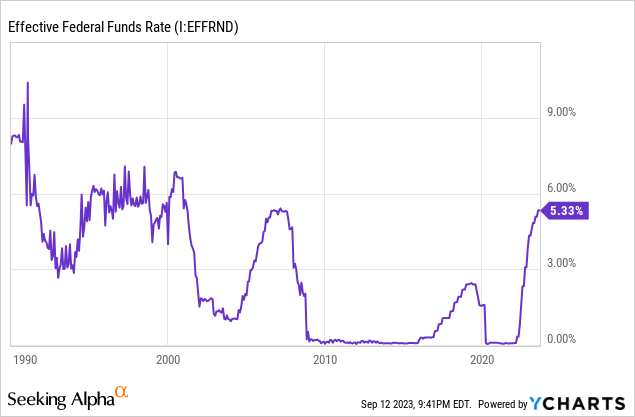

The Federal Reserve tends to cut rates during a recession, as economic stimulus to combat the recession. As an example, the Fed cut rates from 1.6% to effectively 0.0% in early 2020, to combat the recession caused by the onset of the coronavirus pandemic.

Data by YCharts

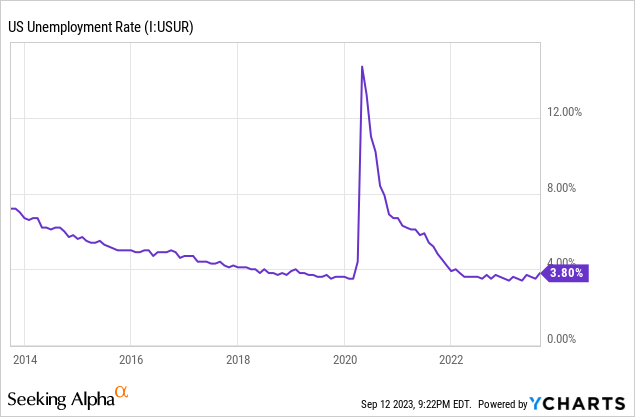

The Federal Reserve takes into consideration many metrics when gauging the current and future state of the economy. Key among these, as per statutory requirements, is employment, with the Fed cutting rates when unemployment is too high. How high is too high is a very complicated question, but the situation right now is very clear. Unemployment stands at 3.8%, much lower than average, and close to decades-low.

As unemployment is low, the Fed does not need to cut rates. At the same time, low unemployment gives the Fed cover for further hikes. The Fed might hesitate to hike if the economy were weak and unemployment higher, but that seems unlikely under current conditions.

Moderate Long-Term Interest Rates

The Fed aims for moderate long-term interest rates. Exact figures on what constitutes moderate are not given, but I imagine moderate precludes ZIRP, as do the sky-high interest rates of the 70s and 80s. Looking at the 90s onwards, current Fed rates look higher than average, but not significantly so, and in-line with pre-ZIRP rates.

As per my calculations, based on market prices and surveys, the market is pricing-in around 2.5% – 3.0% in rate cuts for the next few years. That would leave rates higher than during the ZIRP era, but lower than during the 90s and mid-2000s.

In my opinion, the Fed’s goal of moderate long-term interest rates calls for some rate cuts, but lower than those expected by the market. The result is equivalent to higher for longer (less low at a slower pace).

On a more general note, looking at the data, I simply see no indication that significant rate cuts are likely. Inflation is above target, unemployment is low, the Fed simply has no reason to cut, besides a general impetus for normalization. Although economic conditions might evolve in ways that necessitate rate cuts, the opposite is true as well.

Higher For Longer – Implications for Investors

Shorter-Term Bonds and Loans

If rates remain higher for longer shorter-term bonds and loans should outperform, for two reasons.

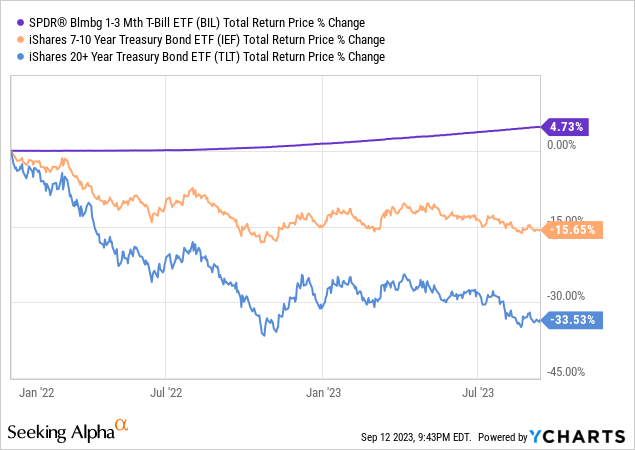

First, higher for longer literally means investors can benefit from higher short-term rates for longer. As an example, higher for longer would allow investors to benefit from 5.5% T-bill yields for longer, a straightforward benefit.

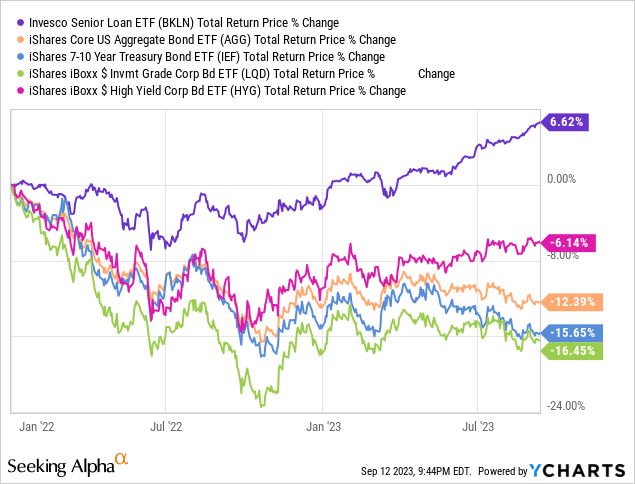

Second, higher for longer would likely lead to lower prices for longer-term bonds, leading to shorter-term bond outperformance. This has been the case for most short-term bonds, including T-bills, since the Fed started to hike, as expected.

Variable Rate Bonds and Loans

If rates remain higher for longer variable rate bonds and loans should outperform, for two reasons.

First, as most variable rate bonds and loans have very attractive yields right now, higher for longer would allow investors to benefit from said strong yields for longer. As an example, senior loans are currently the highest-yielding bond or fixed-income security, with a 11.2% yield.

JPMorgan Guide to the Markets

Investors benefit from those juicy dividends right now, but the dividends would decrease if the Fed were to cut rates. The longer rates remain high, the longer investors can benefit from these strong dividends, a straight-forward benefit for investors.

Second reason why higher for longer benefits variable rate bonds, is that these have very low duration / interest rate risk, and so would see minimal losses, leading to outperformance. Variable rate bonds and loans, including senior loans, have outperformed since the Fed started to hike, as expected.

Conclusion

Current economic conditions, including slightly above target inflation and decades-low unemployment, point towards interest rates that will remain higher for longer. Under these conditions, short-term and variable rate bonds and loans should outperform.

Read the full article here