The iShares High Yield Systematic Bond ETF (BATS:HYDB) focuses on high-yield corporate bonds with comparatively higher quality and wider spreads. HYDB’s strategy seems to be working, with the fund sporting a slightly above-average 7.0% dividend yield and outperforming since inception. HYDB’s strong strategy, above-average dividends and returns, make the fund a buy.

HYDB – Overview and Analysis

Strategy and Holdings

HYDB is an index ETF focusing on high-yield corporate bonds with comparatively higher quality and wider spreads. HYDB’s underlying index first selects all applicable bonds meeting a basic set of inclusion criteria. These are then screened for credit quality, considering seniority, balance sheet data, and market prices, amongst other factors. Finally, the index overweighs bonds with above-average spreads for their credit quality, while keeping overall credit quality the same. Think of HYDB as investing in the highest-yielding bonds rated BB, then the highest-yielding bonds rated B, and so on. This isn’t quite right, but close enough.

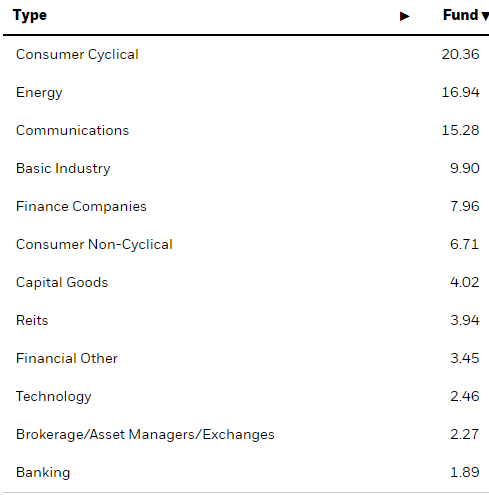

HYDB is a reasonably well-diversified fund, with investments in over 260 bonds from most relevant sectors. It is much less diversified than the broadest bond ETFs, including the Vanguard Total Bond Market Index Fund ETF (BND), as these invest in several bond sub-asset classes, unlike HYDB.

HYDB

Credit Quality

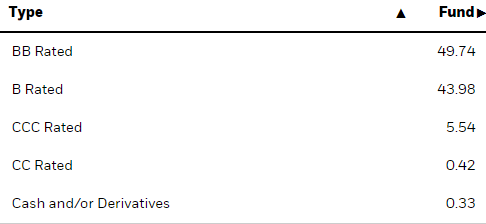

HYDB exclusively invests in non-investment grade bonds, almost evenly divided between BBB and BB holdings, with smaller allocations to CCC and CC.

HYDB

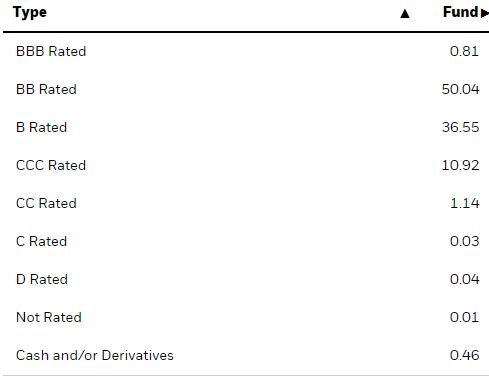

HYDB’s index should ensure a similar credit quality profile to that of its (broader) benchmark. As most high-yield bond benchmarks are similar, this should result in similar credit quality to most of the larger high-yield bond index ETFs too. HYDB’s credit quality is slightly higher than that of the iShares Broad USD High Yield Corporate Bond ETF (USHY), the largest index ETF in this space. Results are slightly better than expectations, although the differences here are not significant.

HYDB

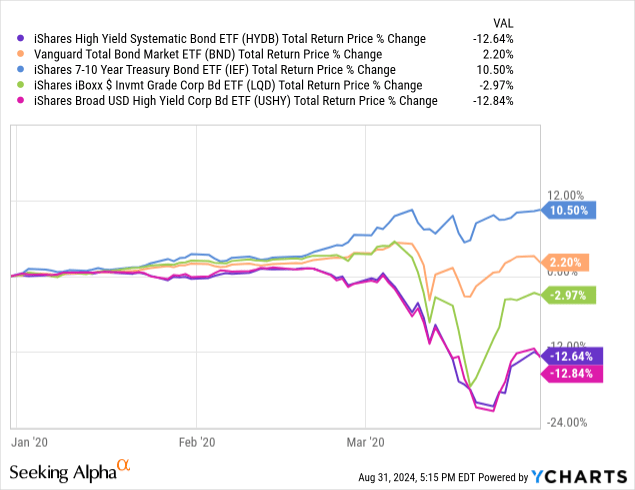

HYDB’s weak credit quality should result in significant, above-average losses during downturns and recessions. Losses could be a bit lower than those of broader high-yield bond ETFs because of the differences in credit quality, but these are very small differences and could be easily swamped by other factors or volatility.

HYDB suffered double-digit losses during early 2020, the onset of the coronavirus pandemic, in-line with the above. Losses were marginally lower than those of its benchmark, but the differences here are tiny and almost certainly nose.

Data by YCharts

Dividend Yield

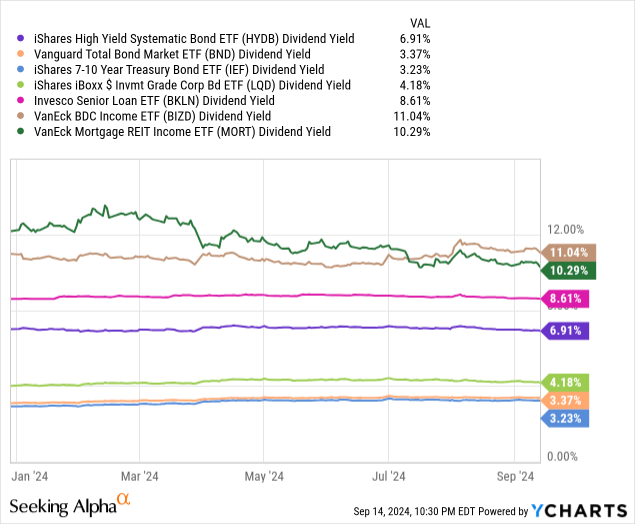

Riskier bonds tend to carry higher yields, and HYDB’s bonds are no exception. The fund itself yields 6.9%, quite a bit higher than most bonds and bond sub-asset classes. Of the larger of these only senior loans have higher yields. Some of the more niche income assets have materially higher yields than HYDB though, including mREITs and BDCs.

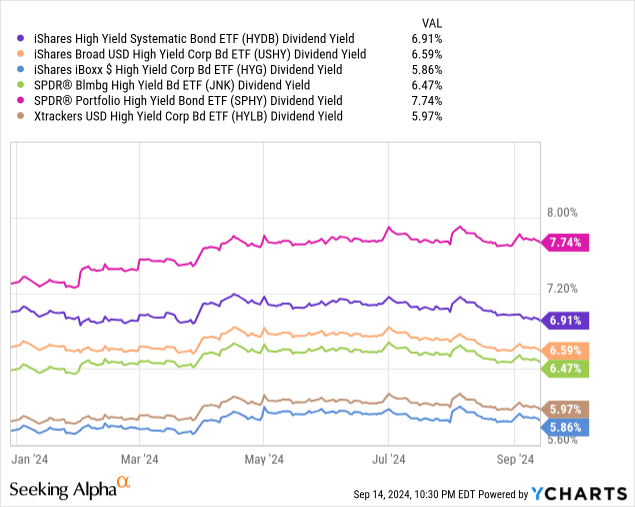

HYBD’s index should result in a higher yield than most of the fund’s high-yield bond peers, which is indeed the case. Of the larger ETFs in this space, only the SPDR Portfolio High Yield Bond ETF (SPHY) has a higher yield.

HYDB’s strong, above-average 6.9% dividend yield benefits the fund and its shareholders. It is a particularly important benefit considering that both HYBD’s dividend and credit quality is higher than that of its high-yield bond peers. High-yield, low-risk investments are rare, but HYDB seems to (marginally) be one.

Performance Track-Record

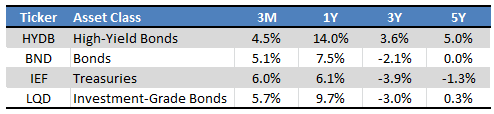

HYDB’s performance track-record is quite strong, with the fund outperforming most bonds and bond sub-asset classes since inception, and for most relevant time periods. Outperformance was due to a combination of a higher yield, and lower duration

Seeking Alpha – Table by Author

As is the case for most bond ETFs, HYDB’s 3y returns are particularly weak, as these coincide with a period of rising rates / lower bond prices. Returns these past twelve months have been incredibly strong, as rates have softened but remain at elevated levels. Long-term returns in the 5.0% – 6.0% range seem reasonable, although strongly dependent on future Fed policy.

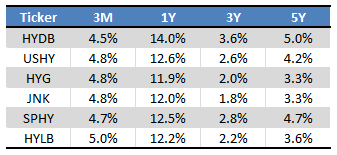

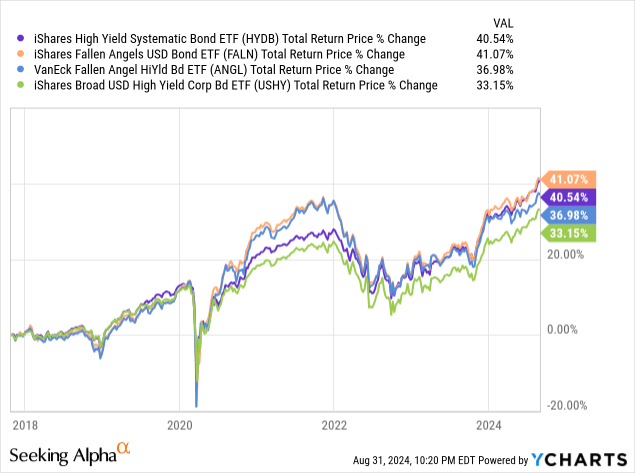

More importantly, HYDB has outperformed most of its peers since inception, and reasonably consistently so. It has underperformed these past three months, but only slightly so, and results could have simply been due to volatility.

Seeking Alpha – Table by Author

In my opinion, HYDB’s outperformance was due to the fund’s above-average yield and broadly successful strategy. Focusing on comparatively higher-yielding bonds, while keeping credit quality constant, should result in higher returns, as does seem to be the case.

Small inefficiencies like these are common in fixed-income markets, with fallen angels, bonds recently downgraded from investment-grade to non-investment grade, being a particularly salient example. HYDB likely invests heavily in these, and the fund has broadly matched their performance since inception.

Data by YCharts

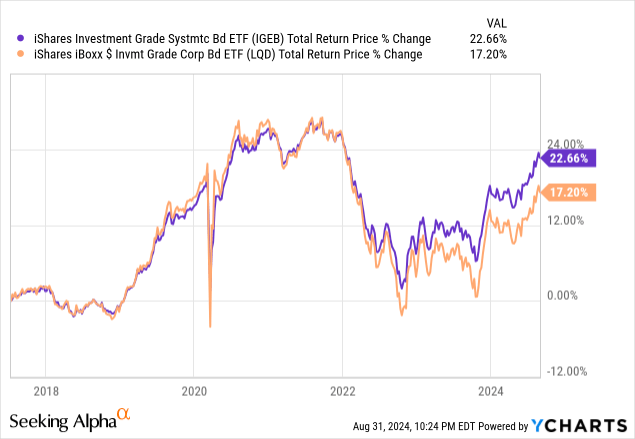

Blackrock has a similar ETF focusing on investment-grade bonds. Said ETF has also outperformed since inception, further evidence for the effectiveness of these strategies.

Data by YCharts

Overall, I believe that HYDB’s strategy works. It makes sense in theory. It does result in slightly higher yields and credit quality. Performance has been quite good since inception, with few exceptions. A similar fund has outperformed too.

Conclusion

HYDB focuses on high-yield corporate bonds with comparatively higher quality and wider spreads. HYDB’s strategy works in theory and has worked in practice, resulting in higher yields and outperformance since inception.

Read the full article here