International Business Machines Corporation (NYSE:IBM) is an information technology giant that most people are familiar with. The New York-based information technology consulting company yields 3.8% and appears ready to make its next move higher in this bull market. This article will outline my reasoning for being optimistic about IBM advancing in price. My technical analysis approach uses price action, momentum, volume, and relative strength to outline my investment thesis. I will also identify a stop loss and an initial price target.

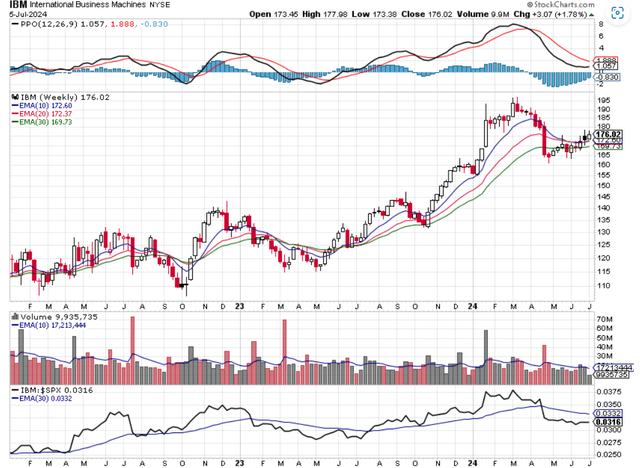

Chart 1 – IBM weekly with moving averages, momentum, volume, and relative strength

www.stockcharts.com

When I analyze a stock, I use the weekly time frame and I like to use moving averages to determine the substance from the noise, so to speak. Prices fluctuate as we know and moving averages can help us distinguish between random price fluctuations and the real trend. In Chart 1 we see price and three moving averages. The 10-week exponential moving average [EMA], along with the 20-week EMA, and the 30-week EMA. Big gains in the market are often preceded by price being above all three moving averages and all three moving averages are trending higher. Notice IBM from June 2023, to March 2024. Over this time, IBM gained over 40% and price never closed below all three moving averages. Those are the type of market moves I aim to capture using my market analysis.

Since the top at $197.22 in March 2024, IBM has declined. It pulled back to $161.02 in April 2024 and closed below all three moving averages. The moving averages themselves rolled over and the 10-week EMA and 20-week EMA started to decline, and then the 10-week EMA crossed below the 20-week EMA in April, indicating the potential for a further downside move in IBM. Instead of further declining, IBM just consolidated in the $160 to $170 price range and now IBM has moved higher. I see two bullish price action indications on Chart 1. The first is that price is now above all three moving averages again. The second bullish price action indication I see is that the 10-week EMA is above the 20-week EMA, which is above the 30-week EMA. The moving averages are in what I call bullish alignment. This set up often precedes a large price advance and was present in the June 2023 to March 2024 price advance. I am bullish about the current price action set up.

Another consideration I use when analyzing a stock to buy is momentum. I want to buy stocks that have bullish momentum. To determine this, I use the Percentage Price Oscillator (PPO) shown in pane 1 of Chart 1. The PPO is easy to understand. When the black PPO line is above the red signal line then short-term momentum is bullish. When the black PPO line is below the red signal line then short-term momentum is bearish. That is the condition today, short-term bearish. Long-term bullish momentum is measured by the location of the black PPO line in the chart. If the black PPO line is above zero or the centerline of the chart, then long-term momentum is bullish. This is the condition we have today. I say long term, because looking at PPO, you can see that the black PPO line does not often go above or below zero or the centerline of the chart. The black PPO line usually stays above or below for months on end. Right now, we have bearish short-term momentum combined with bullish long-term momentum. On the plus side, you can also see that the black PPO line is starting to curl upwards, meaning that a short-term momentum change may take place soon to the bullish side. Momentum leans bullish to me when I analyze the PPO.

I like to see strong volume to the upside for stocks that I want to buy. Strong volume numbers on weeks when the stock rises indicate institutional investors are buying the stock. Retail investors don’t have enough money to buy enough shares to move the price up or down. However, institutional investors do, and they leave footprints, which are shown by the big volume bars in the third pane of Chart 1. Three weeks ago, when IBM closed back above all three moving averages, it did so on higher-than-average volume, which is an indication of institutional money buying shares in IBM. They will only do that if they think that IBM is undervalued and should be trading at a higher price. The volume picture leans bullish to me.

Relative strength is a consideration for me when I buy shares of stock. I want to own stocks that are outperforming the SP 500 index. The relative strength indicator in the bottom pane of Chart 1 allows me to analyze how IBM is performing compared to the SP 500 index. The black line is a ratio of the price of IBM to the price of the SP 500 index. When the black line is rising then IBM is outperforming the SP 500 index. You notice that IBM outperformed the general market during the June 2023 to March 2024 advance. When the black line is falling, that shows that IBM is underperforming the general market. You can see that clearly from the March 2024 high to present day. Analyzing the current condition, it looks like relative strength has flattened out over the last several weeks, meaning that IBM has performed about the same as the general market. The relative strength of IBM to the general market is still bullish from the June 2023 low to present day, as the relative strength line is higher today than it was back in June 2023. Now, the relative strength line is at best neutral when I analyze IBM.

If I take a position in IBM, I like to consider where I will place my stop loss in case my analysis proves incorrect. I would rather take a small loss and move on to another opportunity, than sit with a stock and suffer a major loss. My first stop loss point would be a close below the 30-week EMA at the $169 level. Looking at Chart 1, you can see that when the price closes below the three moving averages that can mean further losses ahead. Notice February 2022 and January 2023. In those two months, price closed below the three moving averages and then declined from there. It doesn’t always work out that way, as the recent area of price consolidation shows, but I’d rather be safe than sorry. Now that I have a stop loss identified, where might price go from here? Since October 2022, IBM has moved higher and made a series of higher highs and higher lows. Each pullback has led to a new high. My technical analysis suggests that this could happen again. Price could therefore exceed the previous high of $197 made in March 2024. If so, that is a gain of 21 points or almost 12% from the current price. With a stop loss of $169 or 7 points from the current price, this opportunity sports a 1:3 risk to reward ratio, which I see as a good opportunity.

In summary, price is now above all three moving averages and all three moving averages are in bullish alignment. Long-term momentum is bullish, and the black PPO line is curling upwards, indicating that short-term momentum may soon become bullish. Volume shows recent bullish activity. Relative strength is not much better than neutral. This trade opportunity offers a reasonable 1:3 risk to reward ratio.

Read the full article here