AI will revolutionize the world, but apparently only matters for a select number of stocks. I’m very skeptical of what’s going on now in markets with this artificial intelligence narrative. Yes – a lot of money has been made, but extremely unevenly and in an inconsistent-with-logic way. Having said that, there is no denying that it could be a game-changing dynamic for society. If you believe more gains are out there, you may want to consider the Invesco AI and Next Gen Software ETF (NYSEARCA:IGPT). Unless, of course, you realize it’s just a tech fund with a heavy weighting in Nvidia.

Launched in 2005 as the Invesco Dynamic Software ETF (PSJ), the fund underwent a rebranding in August 2023 with a sharper eye to the AI and next-gen software sectors. It also changed its ticker to IGPT. The fund, tracking the STOXX World AC NexGen Software Development Index, seeks to invest at least 90 percent of its net assets in securities of issuers that have a high proportion of revenues generated through technologies or products that are designed to accelerate the future of software development.

The construction of the index follows strict rules: it breaks down eligible companies in the subsectors of semiconductors, software, interactive media and services, electronic equipment and instruments, healthcare equipment and supplies, and technology hardware. The 100 companies with the largest free-float market capitalization are listed. This way, it offers broad-based exposure to the most promising players in the field of AI and next-generation software.

Or does it?

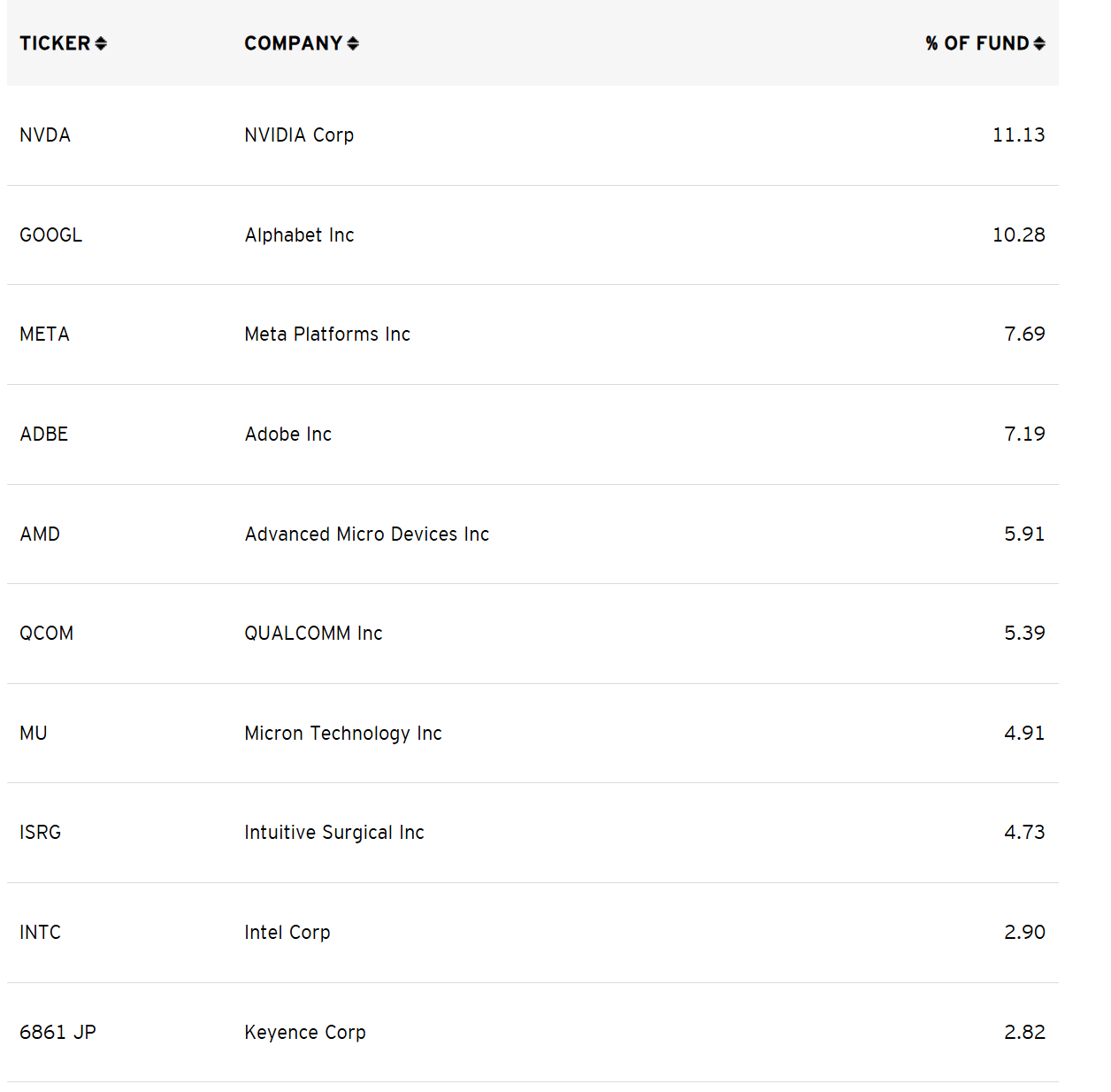

A Look At The Holdings

You can probably already tell I’m skeptical. The portfolio includes 98 names. On the surface, you’d think that’s great. You can’t choose winners and losers when it comes to AI stocks, so good exposure overall here, right?

The thing is, most of these stocks when you actually look at their performance haven’t anywhere near tracked the hype of the performance of Nvidia, Alphabet and Meta, which collectively make up about 30% of the fund.

invesco.com

Maybe this is expected given how dominating Nvidia has been. But my point remains the same. This is an AI name with nearly 100 names, but only 3-4 names are benefiting from the AI craze overall. So why not just own those stocks outright instead of a fund like this?

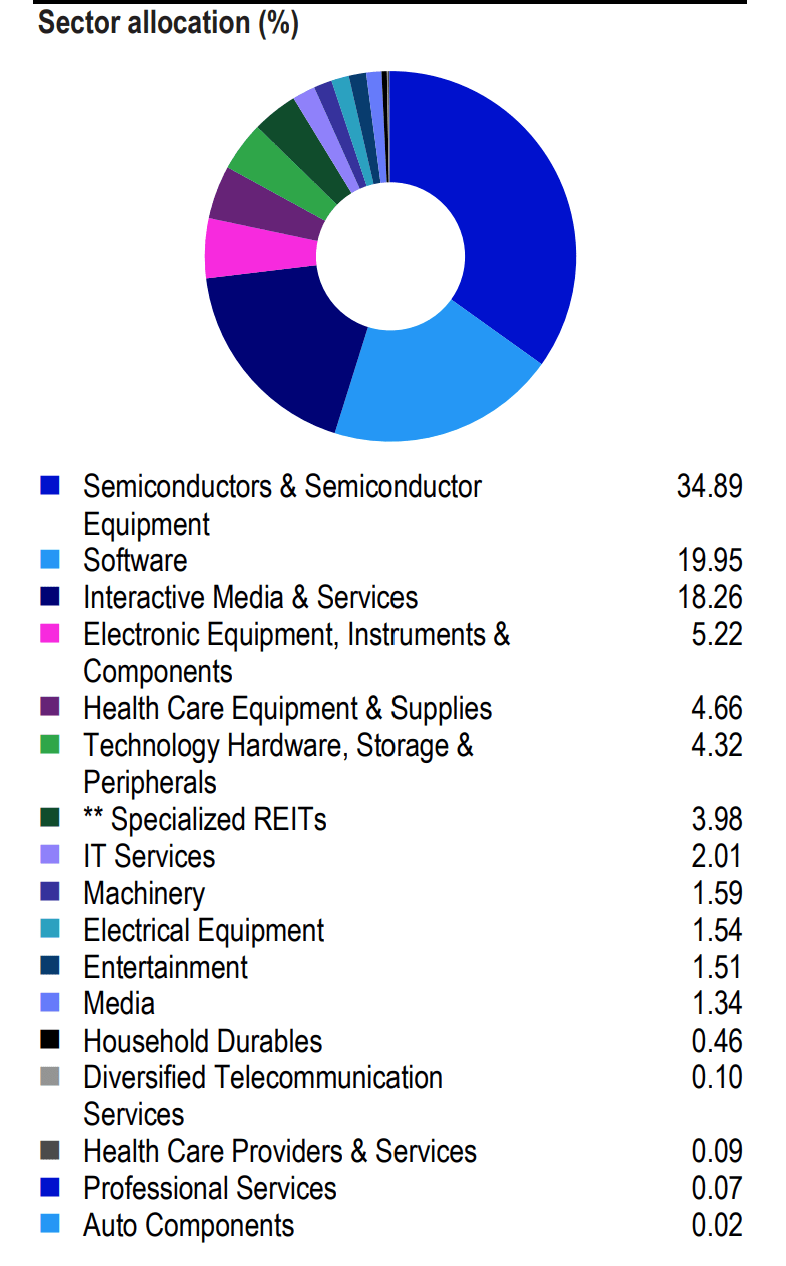

Sector Composition

As you’d expect, this is a tech fund. Nearly 35% is in the semiconductor industry, with software (which is what real AI is about) is at 20%. Diversified portfolio from an industry perspective? Sure. But again, this looks more just like any other tech fund that has heavy exposure to Nvidia, than a true pure play on Nvidia.

invesco.com

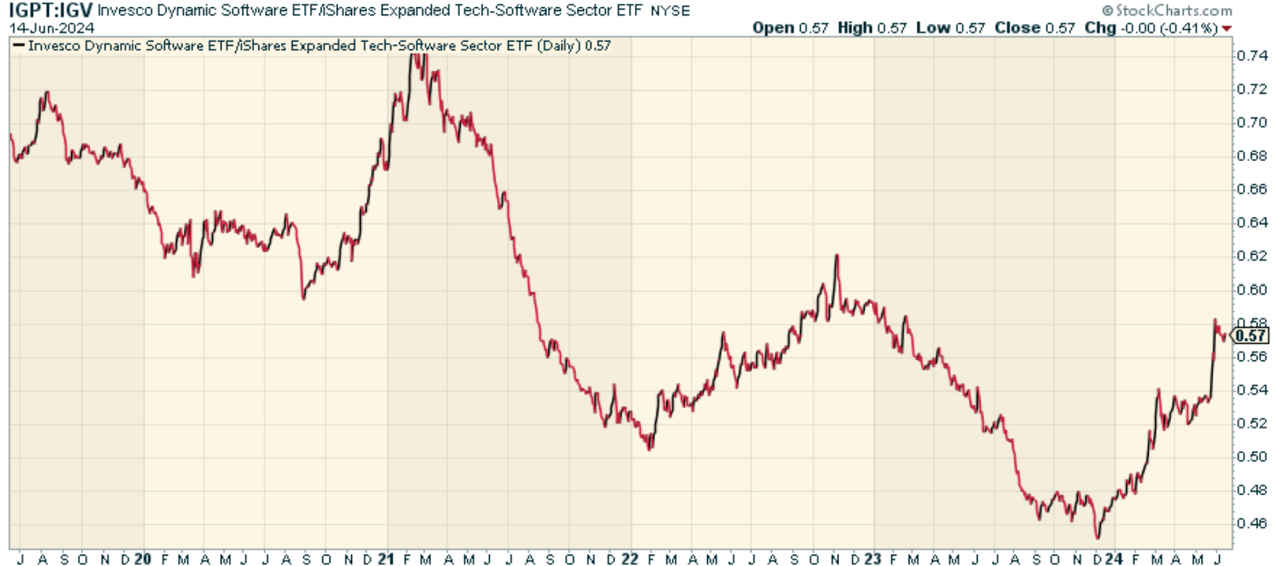

Peer Comparison

One fund worth comparing this against is the iShares Expanded Tech-Software Sector ETF (IGV). Why? Because AI is about software, and IGV does NOT have Nvidia in the portfolio while having a lot of overlap in terms of the stocks. I’d actually consider IGV more of a pure play than IGPT on the theme. When we look at the price ratio of IGPT relative to IGV, we find that IGPT has been outperforming recently (because of the Nvidia momentum) but overall, IGV has been a better returning mix of tech stocks.

stockcharts.com

Pros and Cons

On the plus side, IGPT (supposedly) gives investors concentrated exposure to the firms so far at the inception of this AI and next-gen software revolution, a space where disruption promises to continue for many years. And it’s a diversified portfolio of industry leaders, giving you that “safe” bet that investing in any individual stock might not.

But the pitfalls of IGPT investment should not be ignored, either. Due to its nature as a concentrated fund, it is particularly vulnerable to ups and downs in the fortunes of the technology sectors in which it invests – and these markets are notoriously volatile. The fund’s emphasis on high-tech industries also adds risk, since there is no guarantee that the firms it invests in will enjoy complete success with their very leading-edge products and processes. Furthermore, given the disruptive nature of much of today’s high tech, it’s only too possible that some of these new innovations will come and go as yesterday’s news.

Conclusion

I don’t know about this one. This seems like a fund with a name that is like every other software tech fund out there, but just with Nvidia as the semiconductor play that’s driving the real momentum. I’m skeptical in general of AI, and of portfolios that aren’t evenly distributed in terms of the drivers. This is a pass for me.

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here