A thesis can be constructed that the WisdomTree International Quality Dividend Growth Fund (BATS:IQDG) is a solid bet for USD pessimists. This might look like an oversimplification, but let us look at the facts.

Truly, investing in a basket of top-quality non-U.S. stocks traded in Zurich, London, Paris, Frankfurt, etc. is a sophisticated way to benefit from the Fed finally returning to a more accommodative policy in the near term when the inflation scare is finally suppressed, especially since the August unemployment data point to the fact the regulator might consider pausing rate hikes, possibly with a first cut in spring 2024 already as the capital shortage era lasting for too long will have detrimental effects for the economy.

Additionally, as valuations across the globe differ, at times drastically, buying into a portfolio with inherently lower multiples than those U.S. investors have become accustomed to should secure capital appreciation over the longer term. Besides, the tests IQDG holdings must pass, including on ROE and ROA, should ensure excellent quality. So, it seems all the necessary ingredients are in place.

But there are a few problems with this way of reasoning. First, this strategy has never yielded sufficient returns, precisely like most of the international ETFs I have discussed to date. By saying so, I mean that achieving an annualized total return close to that of the iShares Core S&P 500 ETF (IVV) was a nearly impossible task for this vehicle over its comparatively long history, with its FX exposure being one of the principal detractors as we will discuss below. More specifically, IQDG beat IVV only in 2017, with other years being far from pretty, including 2021, when the fund underperformed racy U.S. bellwethers by 16.5%. Next, there is a CHF risk as it seems the catalysts that supercharged the Swiss currency’s rally earlier this year are no longer in place. And finally, valuation is not as comfortable as it supposed to be, with an earnings yield just marginally above the one offered by IVV. So, I do not see a bullish case here.

A Deeper Dive Into Strategy

Incepted in April 2016, IQDG tracks the fundamentally-weighted WisdomTree International Quality Dividend Growth Index. According to the index website, the goal is to aggregate 300 developed-world stocks (excluding the U.S. and Canada) taken from the WisdomTree International Equity Index that successfully passed the dividend, growth, and quality tests. WisdomTree provides the following description of these factors:

The growth factor ranking is based on long-term earnings growth expectations, while the quality factor ranking is based on three year historical averages for return on equity and return on assets.

In the index methodology, it is also said that to become eligible, a company must have “an earnings yield greater than the dividend yield.” A constituent’s weight depends “on annual cash dividends paid.”

A Closer Look At The Portfolio

As of September 1, IQDG had a portfolio of 248 stocks, with the principal ten accounting for the lion’s share of it, 39.2%. This group is shown below, with the essential financial data added.

| Company | Country | Original Ticker | Adjusted Ticker | Weight | Market Cap ($ billion) | Valuation Grade | Profitability Grade | EY | DY | ROA | ROE | EPS Fwd |

| LVMH Moet Hennessy Louis Vuitton SE | France | MC FP | (OTCPK:LVMUY) | 5.7% | 417.36 | D- | A+ | 4.1% | 1.6% | 11.5% | 29.8% | – |

| Novartis | Switzerland | NOVN SW | (NVS) | 4.4% | 208.58 | C- | A+ | 3.6% | 3.5% | 6.9% | 13.3% | -21.3% |

| Unilever | UK | ULVR LN | (UL) | 4.4% | 127.53 | C | A+ | 7.0% | 3.6% | 10.6% | 39.9% | 1.2% |

| Industria de Diseno Textil | Spain | ITX SM | (OTCPK:IDEXY) | 4.4% | 117.32 | C- | A+ | 4.3% | 3.0% | 14.4% | 28.9% | – |

| Nestle | Switzerland | NESN SW | (OTCPK:NSRGY) | 3.9% | 317.60 | D | A+ | 3.4% | 2.8% | 7.3% | 24.3% | 9.1% |

| GSK | UK | GSK LN | (GSK) | 3.8% | 70.76 | A- | A+ | 9.5% | 4.0% | 25.9% | 33.2% | 4.4% |

| Novo Nordisk | Denmark | NOVOB DC | (NVO) | 3.8% | 421.01 | F | A+ | 2.4% | 1.1% | 23.9% | 81.5% | 20.8% |

| SAP | Germany | SAP GY | (SAP) | 3.2% | 161.25 | D | A+ | 1.1% | 1.6% | 7.4% | 2.8% | -3.4% |

| L’Oreal | France | OR FP | (OTCPK:LRLCY) | 2.9% | 233.95 | F | A | 2.7% | 1.5% | 11.4% | 21.7% | 65.1% |

| ASML Holding | Netherlands | ASML NA | (ASML) | 2.6% | 260.01 | F | A+ | 3.0% | 0.9% | 17.9% | 68.4% | 15.5% |

Created using data from Seeking Alpha and the fund

The sector mix is dominated by the consumer discretionary players (20.7%), with Paris-quoted LVMH Moet Hennessy Louis Vuitton, a luxury market bellwether, being the key representative (5.7%). At the same time, there is only a trace amount of real estate (1.09%), energy (1.04%), and telecommunication services companies (16 bps).

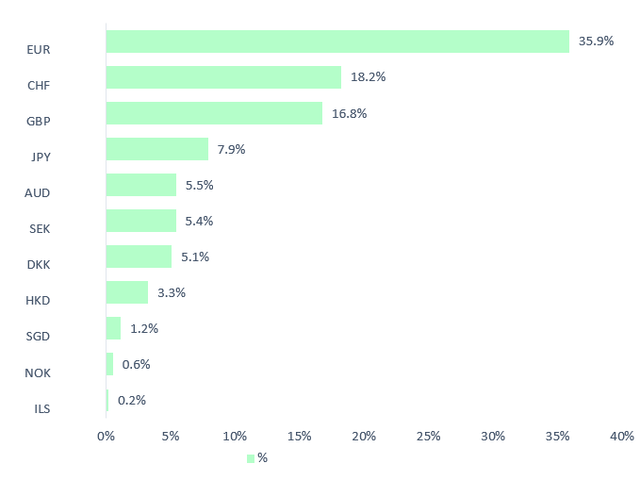

Among currency exposures, the euro and the Swiss franc are the essential ones.

Created using country allocation data from the fund

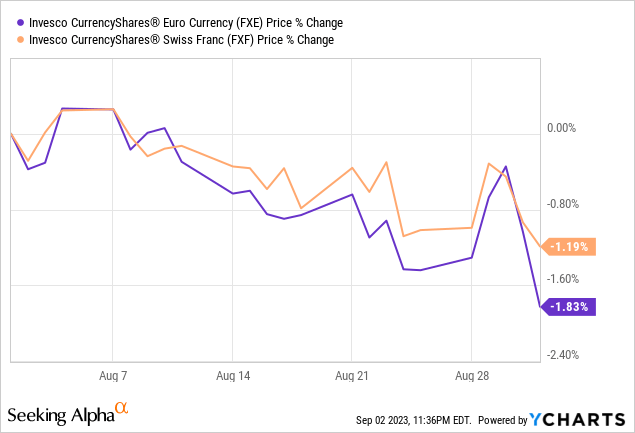

Both the EUR and CHF were drifting lower in August as shown by the performance of the Invesco CurrencyShares Euro Currency Trust (FXE) and the Invesco CurrencyShares Swiss Franc Trust (FXF).

USD pessimists might point out here that with the Fed theoretically pausing rate hikes soon and the European central bank continuing pushing financing costs higher amid surprisingly sticky inflation, the ETF with almost 36% exposure to the EUR (and plus around 5% hidden exposure as the Danish krone is pegged to the euro) is poised for strong gains. I doubt that. The EU interest rate question is far from certain as there is a sizable risk that further tightening will significantly restrain growth. For the CHF, the catalyst that has been bolstering it earlier this year was the Swiss National Bank buying the currency in an effort to immunize the economy from imported inflation. This worked excellently, but the question is whether the support will continue; as the chart above illustrates, traders are not that confident. For context, the August CPI rose by only 0.2% (1.6% YoY).

Next, regarding valuation. We see top-notch quality stories, as all ten companies shown above have the A (also A+) Quant Profitability ratings. However, a quality premium is something investors searching for stocks with sector-leading profitability have to tolerate. So in the group, just one stock scores nicely against the Quant Valuation indicators. Moreover, from an earnings yield perspective, IQDG is not attractive either. The data on its website show a P/E of 18.73x, which translates into an EY of just 5.3%, which is only 90 bps higher compared to IVV’s 4.4%. For better context, the iShares MSCI EAFE ETF (EFA) comes with a 6.9% earnings yield.

More On Performance

As shown by the table below, which compiles the data over the May 2016 – August 2023 period, IQDG did succeed in competing with EFA. But outmaneuvering IVV was a task close to impossible for it, even despite its exposure to top-quality ex-U.S. dividend stocks with robust earnings growth.

| Portfolio | IQDG | IHDG | EFA | IVV |

| Initial Balance | $10,000 | $10,000 | $10,000 | $10,000 |

| Final Balance | $15,778 | $19,928 | $15,281 | $24,903 |

| CAGR | 6.42% | 9.86% | 5.95% | 13.25% |

| Stdev | 16.83% | 13.35% | 15.69% | 15.96% |

| Best Year | 30.63% | 33.42% | 25.10% | 31.25% |

| Worst Year | -20.02% | -12.03% | -14.35% | -18.16% |

| Max. Drawdown | -32.48% | -18.77% | -27.58% | -23.93% |

| Sharpe Ratio | 0.37 | 0.66 | 0.35 | 0.77 |

| Sortino Ratio | 0.54 | 1.01 | 0.52 | 1.17 |

| Market Correlation | 0.86 | 0.88 | 0.87 | 1 |

Created using data from Portfolio Visualizer

And the culprit was its FX exposures, as illustrated by the better performance of the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), which uses currency contracts to mitigate the effects of exchange-rate gyrations.

Investor Takeaway

IQDG is a 2.36% yielding investment vehicle with a 42 bps expense ratio. The fund offers exposure to developed-world companies that 1) pay a dividend, 2) have adequate dividend sustainability, with earnings covering DPS sufficiently, 3) passed the quality screen comprising the ROA and ROE, and 4) score nicely against the earnings growth indicators.

USD pessimists on the lookout for steady, durable, and consistent dividend income from overseas issuers would probably find IQDG’s equity mix alluring. The problem here is that its outperformance is far from certain. The fund had systematically underperformed the U.S. market in the past, partly because of FX headwinds. At this point, even though there is a hypothesis that an interest rate cut is in the cards while the ECB should continue hiking, I do not have sufficient arguments for a USD bear thesis. Next, there is a notable CHF depreciation risk. Also, owing to both quality and growth ingredients that are supportive of richer valuations, IQDG has a smaller earnings yield compared to EFA. A more generous valuation amplifies risks. In sum, the ETF earns a Hold rating.

Read the full article here