IRM’s Growth Catalysts

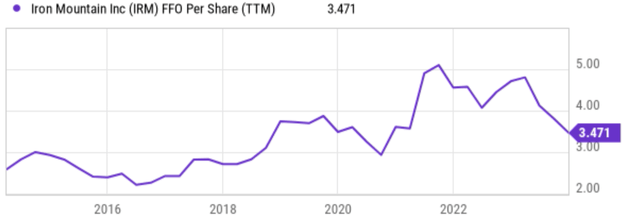

My last article gave Iron Mountain (NYSE:IRM) a sell rating, and the goal of this article is to upgrade the rating to hold. The key reason for the upgrade is the next growth catalysts that have developed since then. IRM has enjoyed robust earnings growth in recent years as seen in the chart below. This chart shows that its FFO per share has grown from an average of around $2.5 to during 2015~2017 a peak of more than $5 in 2021~2022. And the growth is driven by fundamental catalysts. The top one on my mind is the data center hosting business, a segment that is experiencing explosive growth. Over the past year, the unit has surged by an impressive 27%. This momentum is fueled by the recent opening of four new colocation centers, bringing the total to 24. Looking ahead, I anticipate this division to continue growing and contribute more to the companywide revenue streams. A good portion of the growth is also driven by bolt-on acquisitions. Management has been very effective at finding good fits that can accelerate IRM’s growth. However, it is my view that the balance sheet has become stretched now and the pace of these additions is likely to slow (more on this later).

Seeking Alpha

Outlook for the Next ~3 Years

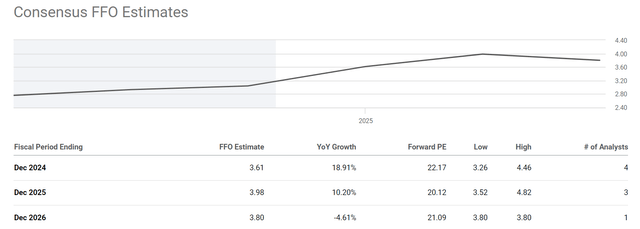

Looking ahead, consensus estimates project continued growth in the next 3~5 years, and I see good reasons to share such optimism. The chart below shows consensus estimates of IRM’s future earnings. As seen, they project an FFO of $3.61 for FY 2024, representing a large increase of 18.91% YOY. The growth is expected to continue at a double-digit pace of 10.2% into FY2025 and then begin to plateau in 2026.

There are certainties amply catalysts afoot that can materialize such projections. Besides the growth in data centers and bolt-on acquisitions, a more essential and sustainable driver in the long term is cross-sell opportunities the way I see things. More specifically, I expect that Iron Mountain should be able to continue to cross-sell into its large customer base in the years to come. I don’t expect too much growth in its core paper-document storage segment. I think its role would at best be stable as we gradually embrace the digital age. But bear in mind that it is through this “old” business that IRM has developed strong relationships with 95% of the Fortune 1000 corporations. The relationship has gained IRM a reputation for securely handling sensitive paper records, which can easily extend into other lines of its service. And the relationship is very stick, as reflected in its 98% retention rate.

As such, I see plenty of opportunities for IRM to leverage these existing customers by selling additional related products, such as shredding documents or converting them into digital form. With its reputation for security, the company has also been trusted to dispose of information technology equipment at the end of its usefulness, which creates a very renewable stream of income as IT equipment becomes obsolete and gets replaced every few years.

However, even if the projected growth indeed materializes, I am concerned that the stock is still fully valued, as detailed next.

Seeking Alpha

But Full Valuation is Reached

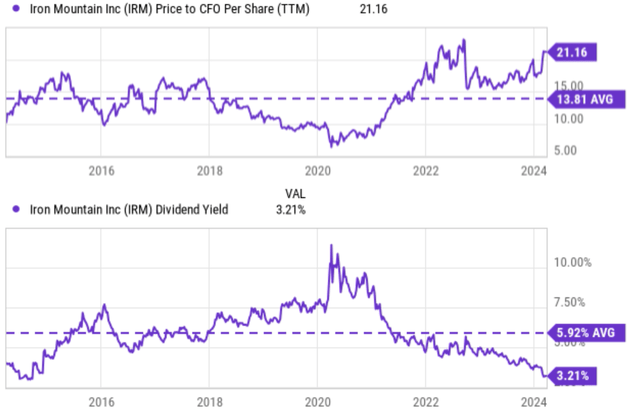

My view is that all the above catalysts and growth prospects have already been reflected in the current stock price. If you recall from the chart above, the stock currently trades at 22.2x P/FFO ratio and the ratio would remain about 20x for the next few years even if all the projected growths are materialized. To better contextualize things, the chart shows IRM’s P/ FFO ratio compared to its historical average in the past 10 years (top panel). As seen, a P/FFO ratio of 20+ is not only far above the historical average of 13.8x but also close to the peak levels in at least 10 years.

Seeking Alpha

To provide another alternative assessment, the chart below shows its dividend yield compared to its historical average (bottom panel). REITs pay out most of the income as dividends and therefore dividends are a good (better in my view) approximation to their true owners’ earnings in the long term. As of this writing, IRM’s dividend yield is 3.21%. It is at a level that again is not only far below its historical average (5.92% in the past decade) but also near the lowest level, providing another indication of heightened valuation risks.

Other Risks and Final Thoughts

Besides the valuation risks, there are a few key risks worth mentioning. Some of them are common to both IRM and its peers (such as macroeconomic risks and competition risks), but some of them are more particular to IRM. Here, I will focus on the latter category.

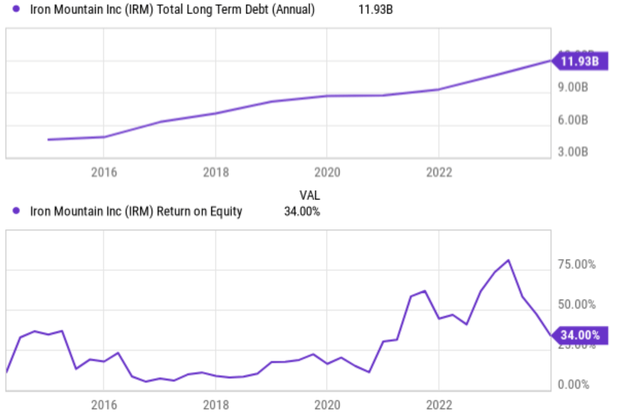

First, the long-term (say 5~10 years) growth of its digital segment remains uncertain as changes in technology evolve rapidly. The increasing use of cloud storage and digital record management tools not only threatens the demand for physical document storage but also IRM’s digital initiatives in my view. In the near term, its balance sheet has become a bit too stretched for me (see the top panel of the chart below). As aforementioned, IRM has relied on bolt-on acquisitions in the past to fuel its growth and I expect the pace on this front to slow because of the stretched balance sheet. To wit, IRM’s total long-term debt has been trending upwards. Its total long-term debt currently sits at $11.93 billion, compared to about ~$5 billion only 5 years ago. Combined with the rising interest rates, such a high debt level can increase its borrowing costs, eat into its profits (see the ROE decline in recent quarters in the bottom panel), and limit its future capital allocation flexibility.

To conclude, I rate IRM as a hold under current conditions weighing the factors discussed above (good catalysts, high valuation risks, leverage, etc.). To recap, its data center division offers attractive opportunities in a burgeoning industry and there are plenty of cross-sell synergistic opportunities. However, these positive catalysts are opposed by some concerns. At the top of my list is the valuation risk. Both its P/FFO ratio and dividend yield suggest IRM might be near the most richly valued level in at least a decade. Additionally, IRM’s rising debt levels could limit its financial flexibility and hinder its ability to make future acquisitions or CAPEX investments.

Seeking Alpha

Read the full article here