From my experience, value investing is the best way to make money over the long haul. This is especially true when it has a contrarian bent to it. But it’s not for the faint of heart. The fact of the matter is that value opportunities exist because the market is pessimistic about the prospects they offer. To some extent, these concerns are usually warranted. But the hope is that they are overhyped by those who are bearish. Regardless, this can mean that you can be wrong for a long time before you become right. And that requires patience and a willingness to remain open that you might be wrong.

Over the past few months now, one company that the market has significantly disagreed with me on is JELD-WEN Holding, Inc. (NYSE:JELD). For those not familiar with the business, it is a building products company. The focus is on the production and sale of interior and exterior windows, doors, and more. Since I wrote a bullish article about the business, rating it a ‘buy’ back in February of this year, shares are down 23.9% while the S&P 500 is up 12.8%. This is because of a significant decline in revenue, profits, and cash flows. Considering what’s going on in the housing market, this performance does not surprise me in the least. However, the reason I remain bullish is that, even with management’s guidance taken into consideration, the stock looks attractively priced. This is true both on an absolute basis and relative to similar firms. Because of this, not only am I going to keep a bullish stance on the firm, but I am, in fact, going to upgrade it to a ‘strong buy’.

A great opportunity

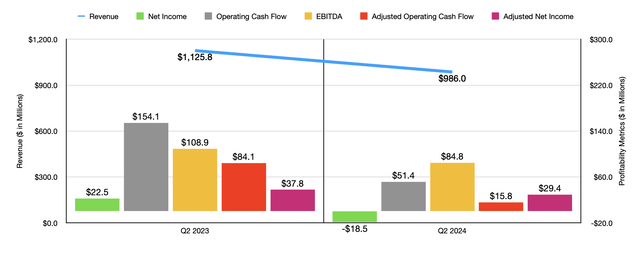

When I wrote about JELD-WEN Holding earlier this year, we only had data covering through the end of the 2023 fiscal year. Results now extend through the second quarter of the 2024 fiscal year. By pretty much every measure, things could be going better than they are. Take the most recent quarter as an example. Revenue for that time came in at $986 million. That’s down 12.4% compared to the $1.13 billion generated at the same time last year. According to management, this drop was driven mostly by a decline in core revenue of about 12% because of a drop in volume and changes in product mix.

Author – SEC EDGAR Data

Management blames this decline on the low-double digit volume drop in both North America and Europe. In North America, new single family housing construction is up by the low single digits. However, the repair and remodeling space has dropped at a mid-to-high single-digit rate. In Europe, residential construction suffered even more, with a high-single digit decline. Meanwhile, commercial projects have seen a low double-digit drop. Inflationary pressures are certainly playing a role in all of this. I would say that this is especially true when it comes to the repair and remodeling market. Having said that, high interest rates aimed at combating inflation have cooled property markets.

On the bottom line, the picture for the business has also suffered as a result. The firm went from generating a net profit of $22.5 million in the second quarter of 2023 to generating a net loss of $18.5 million this year. If we adjust for certain one-time things, profits declined from $37.8 million to $29.4 million. Other profitability metrics followed suit. Operating cash flow was cut by roughly two-thirds from $154.1 million to $51.4 million. If we adjust for changes in working capital, the drop was even more substantial from $84.1 million to $15.8 million. And lastly, EBITDA for the business declined from $108.9 million to $84.8 million.

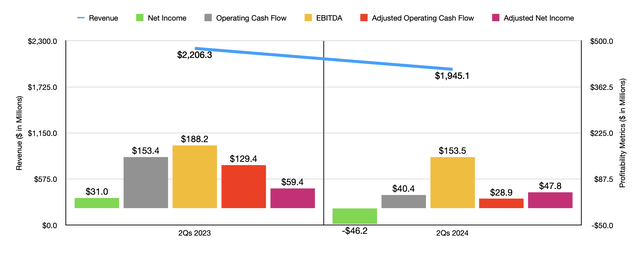

Author – SEC EDGAR Data

In the chart above, you can see results for the first half of 2024 compared to the same time last year. As was the case in just the second quarter on its own, revenue, profits, and cash flows, are all down. Most of these are substantially down. This weakness in the first half of the year has impacted with the year as a whole will probably look like. Management anticipates revenue of between $3.9 billion and $4.1 billion. Even at the high end, that would be below the $4.3 billion reported one year earlier. At the midpoint, this drop should be roughly 7.1%. Core sales could be down as little as 5%, though management did say that they might drop as much as 9%.

From a profitability perspective, management anticipates an operating cash flow of between $200 million and $225 million. This compares to adjusted operating cash flow last year of $224.7 million. Meanwhile, EBITDA is expected to come in at between $340 million and $380 million. However, management did specify in their second quarter earnings release that it will probably be near the low end of this scale. For the purpose of valuing JELD-WEN Holding, I’ve decided to use the very low end of it. I did the same thing when it came to operating cash flow. We don’t have any estimates when it comes to adjusted earnings. But by annualizing the results seen so far for the year, I get an estimate of $110 million.

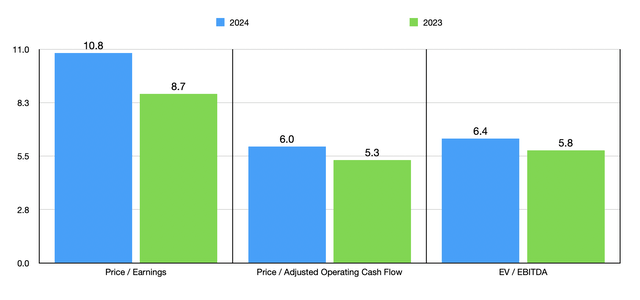

Author – SEC EDGAR Data

Taking the historical figures from 2023 and estimates for 2024, I was able to value the company as shown in the chart above. Even with the more expensive picture that 2024 looks to be, shares are very cheap on an absolute basis. This is especially the case from a cash flow perspective. As part of my analysis, I then compared the firm to five similar enterprises. This assessment can be looked at in the table below. On a price-to-earnings basis, a price-to-operating cash flow basis, and an EV-to-EBITDA basis, JELD-WEN Holding came in as the cheapest of the group. This is certainly encouraging in and of itself.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| JELD-WEN Holding Inc. | 10.8 | 6.0 | 6.4 |

| Janus International Group, Inc. (JBI) | 12.2 | 8.9 | 7.4 |

| Gibraltar Industries, Inc. (ROCK) | 17.3 | 10.3 | 10.2 |

| Griffon Corporation (GFF) | 17.0 | 7.5 | 10.4 |

| CSW Industrials, Inc. (CSWI) | 44.0 | 27.2 | 24.6 |

| American Woodmark Corporation (AMWD) | 13.2 | 6.6 | 7.3 |

During these difficult times, it’s also imperative that management make wise decisions aimed at protecting the business for the long haul. The company did do just that recently. However, not every decision is going to be perfect. As of the end of the most recent quarter, JELD-WEN Holding had $1 billion of net debt on its books. Some of this is expected to come due quite soon. This includes $200 million of senior notes that are coming due in December 2025. This number was originally $400 million, but management redeemed half of the amount last August. To address these without tapping into operating cash flow, the company decided to issue $350 million of senior unsecured notes. These will come due in 2032.

Unfortunately, these notes bear an annual interest rate of 7%. However, management is using the other $150 million in proceeds to pay down some debt under its term loan facility. This is a variable rate debt, so the picture will change from quarter to quarter. But in the most recent quarter, it carried an annualized interest rate of 7.44%. So we do get some savings on that front. Altogether, I calculated that this maneuver should increase annual interest expense by $4.1 million before factoring in any changes in the tax shield that the company might get. As discouraging as this is, it’s a small price to pay for being able to push a chunk of debt seven years further into the future.

Takeaway

Fundamentally speaking, things might not be going the best for JELD-WEN Holding at this point in time. The markets in which it operates are weak because of inflationary pressures and high interest rates. However, in the long run, I suspect that these markets will do fairly well. Once interest rates here at home in the US start to fall, that should prove bullish for the business. And that initial drop is expected to occur next month. And in Europe, interest rates are already starting to fall. The European Central Bank actually cut rates by 0.25% in June of this year. Add on top of this catalyst how cheap shares are and the recent move that management made that shows that they are forward-thinking, and I believe that a ‘strong buy’ rating is appropriate for this business at this point in time.

Read the full article here