Last summer I published a sell rating on Joby Aviation (JOBY). Since then, the stock has fallen ~45% because expectations for commercialization have been delayed, competition has increased, and the regulatory environment has become more strict. In this article, I provide my updates on the industry, Joby’s progress, and my updated thesis on both.

Joby’s Progress Since Last Summer

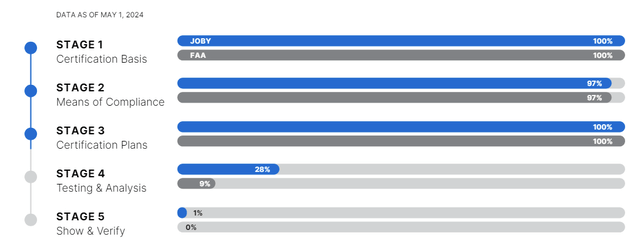

Joby’s G-1 certification basis was published in March in the federal register. This follows initial signing in 2020, re-signing in 2022, and a final review and public comment process. The final G-1 is mostly consistent with the initial document, with no indications of needing aircraft design changes.

Joby 1Q24 Shareholder Letter

Finalizing the G-1 locks in Joby’s G-2 (means of compliance) with the FAA. Although progress with the FAA has been positive, there could be delays during the final testing process that are beyond Joby’s control. This might allow other markets, such as Dubai, to commercialize first in 2025.

Joby discussed initial pricing between Uber Black and helicopter prices (~$10/seat-mile), aiming to reduce to ~5/seat-mile over time with increased volume efficiencies. These prices are higher than those suggested by peers, likely due to Joby’s higher initial operating cost assumptions. Also, Joby estimates needing ~10-20 landing spots to service all three NYC airports, which could be scaled through various agreements (public, public-private, strategic/exclusive vertiport). They plan to expand the ecosystem beyond the city center to airport routes. Partners are exploring dedicated lanes and air traffic controllers for eVTOLs.

In Q1, Joby reported an adj EBITDA loss of $110mm, higher than expected due to timing and continued investments in development. The company also reported modest revenue of $25k from DOD deliverables, which is expected to remain modest in 2024. Cash spend guidance for 2024 is ~$440-470mm, reflecting steady investment in key areas.

Overall, Joby is progressing well with its certification, manufacturing, and commercialization efforts. However, I anticipate delays in the US market ramp-up due to limited bandwidth and regulatory uncertainty with the FAA.

My Thesis On Joby and The eVTOL Industry

Joby Aviation is in a race to receive regulatory approval to commercialize their eVTOLs, which are essentially electric helicopters designed to serve as flying taxis in major cities. Joby aims to sell their eVTOLs to companies like Delta Air Lines (DAL), which will then charge passengers for rides. The industry, projected to reach $58bn in revenue by 2035, includes both manufacturers and service providers. This burgeoning sector envisions a future where flying to work in NYC becomes commonplace within the next decade.

With the FAA’s bandwidth for new programs in question and the potential political risks associated with an upcoming presidential election, I see a heightened risk for delays in the entry into service timing for eVTOLs. Even established players like Gulfstream have faced significant certification delays over the past year, with little clarity on the FAA’s expected resolution timeline. Companies are guiding toward initial aircraft capacities in the low tens and discussing parallel pathways to commercialization in the UAE, leading me to believe that current expectations for 2025-2028 production and delivery volumes are overly optimistic. Until I have more clarity on certification processes, I remain cautious on the broader eVTOL space.

Investor sentiment remains cautious, with many institutional investors in a wait-and-see mode due to the lack of immediate catalysts. Retail investors, who comprise over 75% of investments in these companies, often focus on cash reserves and the visual appeal of eVTOLs. Meanwhile, institutional investors rely on projections like the $58bn industry revenue estimate for 2035 to value these companies based on market share.

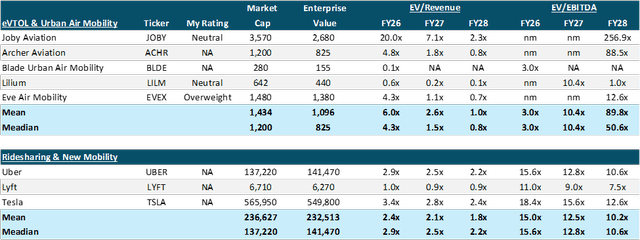

Joby Aviation is often spotlighted as the industry leader with a market cap of $3.6bn, followed by Archer Aviation ($1.2 bn), Eve Air Mobility ($1.5bn), Lilium ($640mm), and Blade ($280mm). Joby Aviation has already passed significant milestones and is now building up its inventory while awaiting regulatory updates from the FAA. This head start is why Joby trades higher than its peers; their eVTOLs are also larger and more expensive. However, the sky is crowded, and the ultimate determinant will be regulatory approval. The FAA’s Advanced Air Mobility Plan suggests a cautious timeline, with 2028 marked as a realistic year for eVTOL commercialization. Despite market expectations for a 2025 launch, I believe we are looking at the tail end of this decade for significant commercial use.

Now, I believe my previous Sell rating on Joby has now run its course, with the stock down over 40% since my last article. Currently, I anticipate the stock will remain stable until the certification process progresses further. Notably, Joby seems to be shifting its strategy towards selling aircraft in addition to operating them, driven by faster market developments overseas. This could prove beneficial in the early stages of consumer adoption of eVTOL ridesharing, as incorporating aircraft sales into the projections enhances overall profitability over the next 3-5 years. Also, if Joby formally enters the aircraft sales market, I expect the stock to gain favor with investors, thanks to the increased demand visibility and backlog growth. Joby’s robust balance sheet, the strongest amongst its peers, also provides a big degree of protection against potential certification delays.

Comparable Companies Analysis

Author’s Data

If we compare FY 2028 EV/Revenue multiples, Joby trades at 2.3x, significantly higher than the mean and median of 1.0x and 0.8x for peers like Archer (ACHR), Blade (BLDE), and Lilium (LILM). In contrast, Eve, my pick in the industry, trades below both the mean and median at 0.7x 2028 EV/Revenue. This indicates that Joby trades at a significant premium, while Eve, despite having the largest backlog, trades at a discount.

Including comparisons with tech-based vehicle companies like Uber (UBER), Lyft (LYFT), and Tesla (TSLA) reveal that Joby still trades at a premium. The mean and median for 2028 EV/Revenue among these companies are 1.8x and 2.2x, respectively, while Joby is at 2.3x.

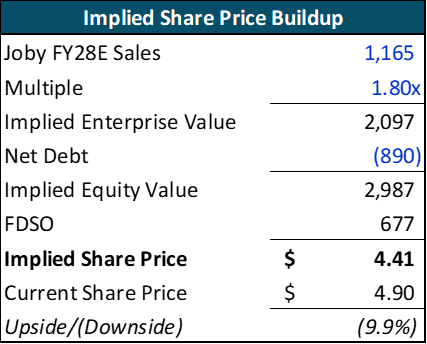

I believe Joby should trade at a premium to its eVTOL peers, but not higher than Lyft, Uber, and Tesla, given the higher risks and uncertainties it faces. Using an average EV/Revenue multiple of 1.8x for 2028 (based on Uber, Lyft, and Tesla), I arrive at a price target of $4.41 for Joby, ~10% lower than current prices as shown below:

Author’s Data

Upside and Downside Risks To Rating

- The growth rate of the eVTOL industry may differ from expectations, influenced by the pace of consumer and aircraft operator adoption

- Joby may receive FAA certification earlier or later than its current guidance.

- Joby’s business model, which emphasizes aerial ride-sharing as an owner/operator, might outperform or underperform compared to OEM or hybrid models.

- Joby’s network operations may prove to be more or less competitive than anticipated when compared to traditional transportation methods, other UAM competitors, and existing ride-sharing platforms.

Bottom Line

Joby Aviation is a leading force in the eVTOL space. They aim to manufacture, own, and operate eVTOLs for passenger flights. Joby has been developing eVTOLs longer than any other publicly traded eVTOL company, boasting a high level of vertical integration and benefiting from strategic manufacturing partnerships (i.e., Toyota). The eVTOL market is expected to outgrow the market size of the helicopter market, thanks to the eVTOL’s advantages in noise reduction and safety. Investing in Joby or other peers requires patience and high-risk tolerance due to the largely unproven business models, certification challenges, and potential lower-than-expected adoption rates, including competition-related risks. Despite these challenges, I believe Joby is well-positioned to execute its strategy and overcome challenges. Thus, I upgrade Joby to a Neutral rating, especially given the ~45% drop since my previous article, with an updated price target of $4.4.

Not mentioned in this article much is Eve Air Mobility, my top pick in the industry for multiple (I’ve published two articles on them thus far) and I will be publishing a new piece on them soon for those interested

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here