In May, we wrote that it wasn’t time to buy banks because the reasons behind the failure of three of the biggest banks in U.S. history earlier this year hadn’t yet been resolved. Is the banking industry finally turning a corner, making bank stocks or ETFs like the SPDR® S&P Regional Banking ETF (NYSEARCA:KRE) buys? Read on to learn why our latest research suggests the answer is no.

Banks continue to face stiff headwinds

It’s true that in the second quarter, big banks’ revenue and profit were solid. For example, JPMorgan Chase (JPM) reported revenue and earnings per share growth of 34% and 58%, respectively, and Bank of America’s (BAC) sales and profit climbed 11% and 21% respectively. Most big banks within our universe reported double-digit revenue growth. Even the much-maligned Wells Fargo (WFC) saw revenue and earnings per share increase 20% and 51%, respectively.

However, the key problems facing the industry have worsened since May, and results for smaller and mid-sized regional banks weren’t nearly as good. For example, PNC (PNC) reported sales increased by just 3% and earnings per share fell 2%. KeyCorp (KEY) revenue fell 11% while EPS fell 50%. The industry’s results were bifurcated in part because big banks are more insulated against deposit churn. Often, they boast more revenue streams and diversified assets on balance sheets, too.

Regardless, banks big and small continue to suffer from declining valuations for legacy bonds held on balance sheets. The recent surge in Treasury yields to last year’s peak levels likely mean losses on Treasuries in held-to maturity portfolios remain problematic.

Similarly, rising yields still mean short-term Treasuries are a compelling alternative to savings accounts, suggesting banks must pay more to retain deposits, pressuring net interest margins.

Banks are also still at risk of a looming commercial and consumer credit crisis. Treasury yields are often used to set commercial and consumer lending rates, so rising yields have made it even more expensive for borrowers to refinance maturing loans.

This is a problem in the commercial building space because hybrid and work-from-home policies have increased vacancy rates, depressing commercial property values. Consumers are similarly hamstrung. Inflation has slowed, but prices are still rising, and the jobs market isn’t as healthy as it was in early 2022.

The strain on banks is evident in their quarterly reports, which overwhelmingly show rising loan loss provisions in anticipation of growing defaults. Since loan loss provisions are recorded as expenses, these provisions are negatively impacting earnings. Consumers financial health will likely worsen when student loan repayments restart on October 1, further taxing budgets.

Attempts to reduce exposure to risk are also reducing loan growth. In the quarterly Senior Loan Officers Opinion Survey (SLOOS), banks reported requiring more collateral and higher credit scores and fees for loan approvals. They also said they’re shrinking loan amounts from levels previously allowed. Coupled with lower demand because of higher rates, the picture for future loan growth isn’t favorable.

In short, banks still face a one-two punch to profitability. Fewer loans issued slows revenue growth while higher costs to fund loans and more loan loss provisions squeeze earnings.

Banks still score poorly in our research

Eventually, bank stocks will turn higher. It’s likely that happens prior to the resolution of the various problems facing it. However, there’s little evidence in our research to suggest a turn is upon us.

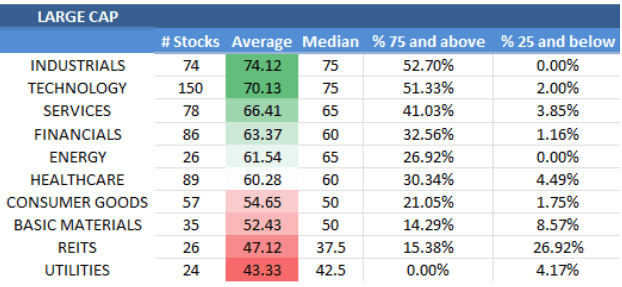

The financial sector scores above average, but banking industries rank below average in our weekly industry rankings.

Large cap financials score above average, but not because of banks. (Limelight Alpha)

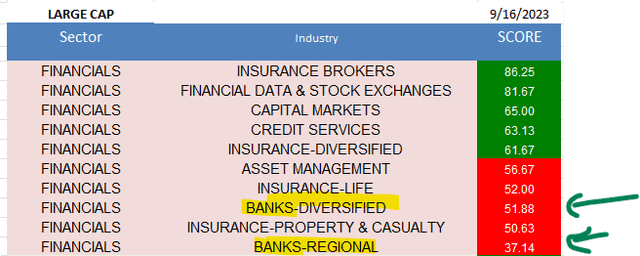

For example, large cap diversified banks rank below average, and regional banks are the worst-scoring industry in both the large and mid-cap financial sectors. They also score below average in our small cap universe.

Regional banks score below average. (Limelight Alpha)

Since industry scores are built by averaging scores across the individual stocks in our universe, very few individual bank stocks score well. For example, no large cap banks have scores in our research above 90 (strong buys) or above 80 (buy rated). The highest-scoring bank is UBS Group (UBS), with a relatively lackluster score of 75.

Scores are calculated using a 7-factor model that includes money flow, forward earnings estimates, earnings beats history, valuation relative to historical levels, insider buying, short interest, and seasonality.

Until more banking stocks begin to climb in our scoring system, lifting the industry above average, the risk to reward for bank stocks will remain unfavorable.

Read the full article here