Investment thesis

Leggett & Platt’s (NYSE:LEG) stock currently offers a very tempting above 7% forward dividend yield to investors. This, together with the company’s half-a-century history of consistent dividend hikes, might make some investors think that LEG is a compelling investment opportunity. But in fact, it is not. The company’s profitability metrics are in secular decline and the current harsh macro environment has accelerated the rate of margins shrink. The balance sheet is weak and the payout ratio is above 100%, which gives me high conviction that the end of the company’s stellar track record of dividend growth is very close. All in all, I assign the stock a “Hold” rating.

Company information

Leggett & Platt has a vibrant history tracing back to 1883. It is a diversified manufacturer that conceives, designs, and produces various engineered components and products found in homes, offices, and automobiles.

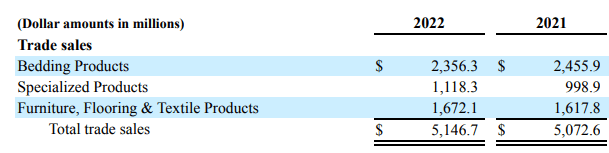

The company’s fiscal year ends on December 31. LEG’s operations are organized into 15 business units, divided into seven groups under the company’s three segments: Bedding Products, Specialized Products, and Furniture, Flooring & Textile Products. Bedding Products is the company’s largest segment, contributing almost half of LEG’s total sales.

LEG’s latest 10-K report

Financials

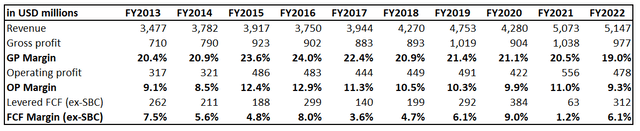

The company’s financial performance over the past decade did not impress me. Despite LEG’s revenue compounded at a decent 4.5% CAGR, its profitability metrics have deteriorated notably. It means that the company’s costs are increasing faster than its sales. That said, the company does not have much pricing power to pass on the inflationary effect to its customers.

Author’s calculations

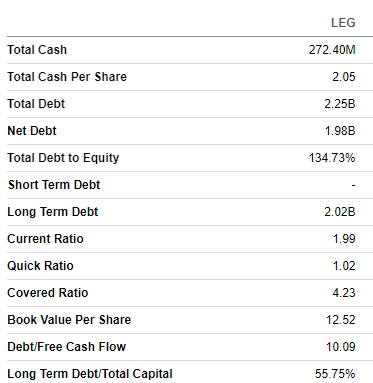

The free cash flow [FCF] margin ex-stock-based compensation [ex-SBC] is still positive at mid-single digits. This allows the company to maintain its status as a dividend aristocrat with a rich history of dividend payouts. LEG also conducts consistent stock buybacks. Stellar dividend history and buybacks are usually a good sign for investors, but I would like to emphasize at which cost the company sustains its shareholder-friendly capital allocation approach. The company’s balance sheet is highly leveraged with a $2 billion net debt position. Despite the current liquidity metrics looking solid, I am not comfortable with above 100% leverage ratio, especially given the secular trend of shrinking profitability metrics. LEG’s dividend payout ratio is at almost 106%, which looks unsustainable to me.

Seeking Alpha

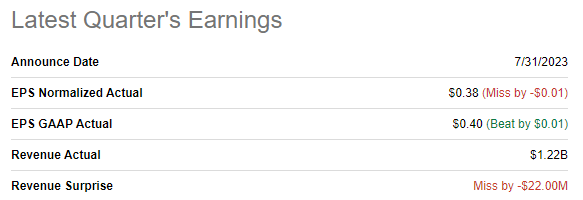

The latest quarterly earnings were released on July 31, when LEG missed consensus estimates. Amid the current soft demand in the end markets, the company’s revenue decreased by 8.5% YoY. The bottom line followed revenue decline as the non-GAAP EPS almost halved, from $0.70 to $0.38.

Seeking Alpha

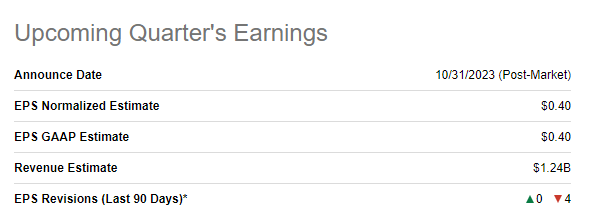

Near-term prospects look cloudy and consensus estimates project further YoY revenue decline. The upcoming quarter’s earnings are scheduled for release on October 31. Consensus estimates forecast quarterly revenue at $1.24 billion, which means a 3.8% YoY decline. The adjusted EPS is expected by consensus to shrink YoY from $0.52 to $0.40.

Seeking Alpha

I think that the business is in the late stages of its business cycle. I cannot say that it is the “decline” stage of the business lifecycle because long-term consensus estimates forecast modest revenue growth in the next five years. But this growth pace is expected to be lower than in the past decade. LEG’s past financial performance suggests that even with a decent revenue growth trajectory, the company is unable to convert this revenue growth into value for shareholders. It is also important to mention that the company does not demonstrate strong pricing power, and a 2-3% revenue growth in the upcoming years means that profitability metrics are highly likely to continue shrinking gradually in the future. The company’s weak balance sheet and the current harsh environment do not add any optimism to me.

Valuation

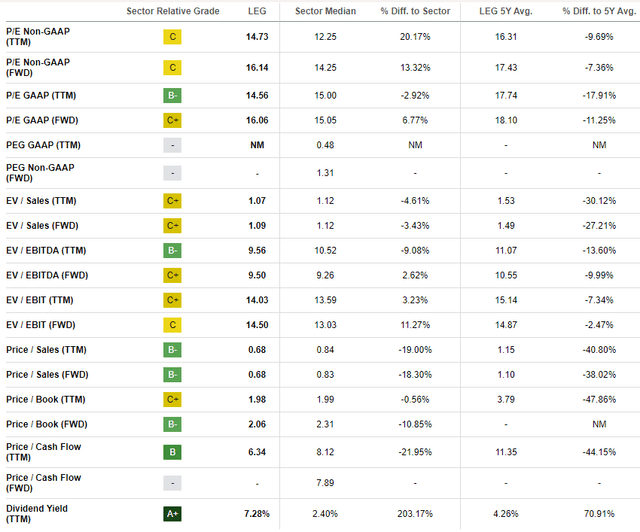

The stock’s price declined about 24% year-to-date, significantly underperforming the broader U.S. market. Seeking Alpha Quant assigns the stock a decent “B+” valuation grade since the current multiples are significantly lower than historical averages. On the other hand, comparisons with the sector median valuation ratios are mixed.

Seeking Alpha

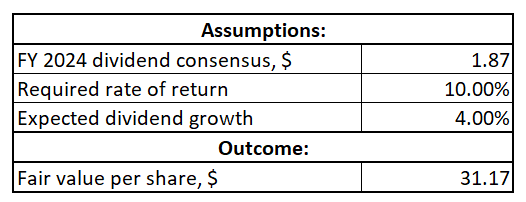

LEG has a very rich history of dividend payouts. Therefore, I prefer to use the dividend discount model [DDM] to evaluate the stock. I use a 10% WACC as a required rate of return. Consensus dividend estimates forecast FY 2024 payout at $1.87. For the dividend growth, I use the past ten years’ CAGR rounded down to 4%.

Author’s calculations

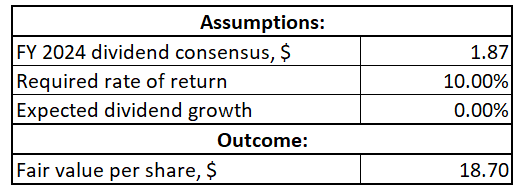

With the above assumptions, the stock’s fair price is about $31.2, which indicates a 25% upside potential. However, there is a very high level of uncertainty regarding the dividend growth rate. The DDM also ignores the massive net debt position of LEG and the fact that the company’s profitability metrics are shrinking. That said, dividend growth is not safe. And the DDM formula is very susceptible to changes in dividend growth rate. If I implement no growth, the stock’s fair price plunges to below $19 per share, meaning a 25% downside potential.

Author’s calculations

Risks to consider

The markets where the company operates are highly competitive and are sensitive to economic cycles. That said, an economic downturn is highly likely to lead to reduced consumer spending on homes, automobiles, and furniture, thereby adversely affecting LEG’s earnings. Moreover, fluctuations in raw material prices can have a significant upward pressure on production costs. This will ultimately lead to potentially shrinking margins if the company is unable to pass on the inflationary effect to its customers.

The company relies on a complex and globally diversified supply chain. Geopolitical tensions, trade restrictions, or other unfavorable global events can undermine the company’s ability to source materials, affecting revenues and reputation. The company also faces operational risks, including machinery breakdowns, labor disputes, or issues related to health and safety. Any of these risks could disrupt production schedules and add unexpected operational costs.

Operating in multiple jurisdictions exposes LEG to a complex network of regulations and legal requirements. Failure to comply with these regulations can result in financial penalties, legal proceedings, and reputational damage. Furthermore, changes in existing regulations or the introduction of new ones can force the company to significantly adjust its operations and strategy.

Bottom line

To conclude, LEG is a “Hold”. Don’t let the attractive forward dividend yield together with vibrant dividend increases history mislead you. Dividend growth does not look safe to me given the company’s weak balance sheet and deteriorating profitability metrics. There is little evidence that a strong turnaround is possible in the near future. Moreover, my valuation suggests that the stock is not attractively valued.

Read the full article here