Global luxury company LVMH (OTCPK:LVMHF) (OTCPK:LVMUY) offers a good way to check the pulse of the luxury market. And if it just reported its sales figures for the first quarter of the year (Q1 2024) are anything to go by, this pulse is weak.

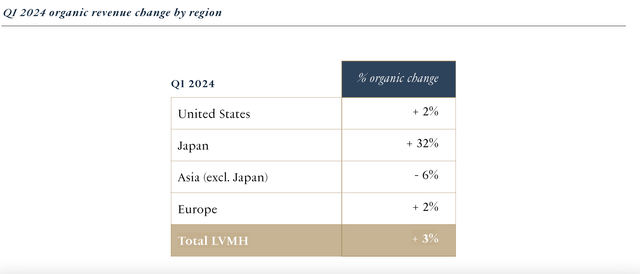

LVMH’s organic revenue growth slowed down to just 3% in the quarter and actually contracted by 2% in reported terms. The reason isn’t hard to find. Demand is slowing down across markets. But while the US and Europe have been expected to soften for some time now, the shocker is China. While the economy’s growth might not have seen the much hoped for post-pandemic upsurge, it wasn’t seen to be weak either. The company’s Asia ex-Japan sales, though, suggest otherwise.

China’s demand weakens

Asia revenues saw a 6% contraction in Q1 2024 (see table below), making it the only market to see declining sales. This is particularly glaring considering that there was no indication of this much softening last year. The market grew by 18% in 2023. Growth in 2023 can be attributed to a low base effect of COVID-19 restrictions in 2022. However, the sharp latest contraction indicates the recovery hasn’t been sustained.

LVMH ascribes the market’s weakness to overseas purchases by Chinese consumers. But this isn’t a convincing enough explanation. In Q1 2019, the last comparable period before COVID-19 and its effects, the Asia market grew by 17%. At the same time, the US and Europe also grew by 8% and 7%, respectively. In other words, there’s no reason why Asia can’t grow along with international markets.

The comparison with 2019 shows the extent of demand weakness across markets for LVMH. Specifically, it points to the fact that if it weren’t for Chinese consumers holding up American and European demand, they would show even smaller growth than already visible.

Source: LVMH

Wine & Spirits worst offender

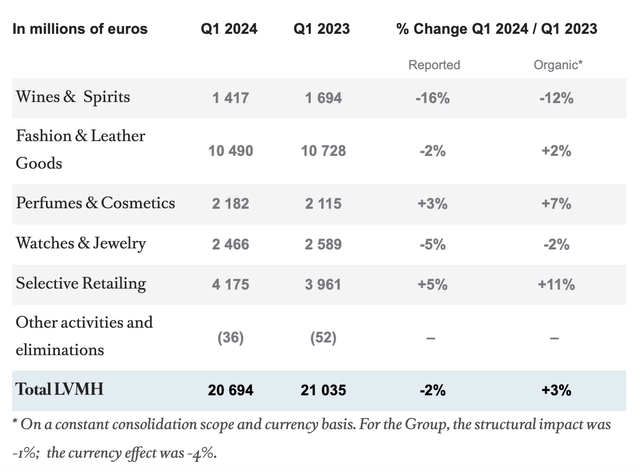

From a segment-wise perspective, Wine & Spirits is the worst offender. It’s the only segment besides Watches & Jewellery to see an organic decline. Normally, it wouldn’t merit focus, considering that it contributed to less than 7% of LVMH’s revenues in Q1 2024. For context, this is the smallest contribution by any segment (see table below).

But its 16% reported and 12% organic decline in the quarter had a disproportionate impact on the overall revenue numbers. If the segment’s sales had stayed flat from Q1 2023 in the latest quarter, the total reported revenue contraction would have been just 0.3% compared to the actual 3% decline. By extension, if it continues to deteriorate rapidly, the segment can affect LVMH’s total revenues significantly going forward as well.

LVMH’s insight into the market trends for Wine & Spirits is worth focusing on too since it can also provide a sense of the larger trends at play. The segment has seen an all-around demand softening. LVMH mentions reduced European demand due to large inventory and also “cautious restocking” by US retailers. The company also talks about “soft local demand during Chinese New Year” as a big impact, which ties back with the weak post-COVID-19 demand trends in the market.

Going forward, it’s hard to be optimistic about the segment either. The European Union is forecast to stay sluggish through the year. While there are varied forecasts for the US, which would ideally offer hope, I’d like to draw attention to my recent article on the beer and wine manufacturer Constellation Brands (STZ). Constellation’s wine segment contracted in 2023 and is expected to stay flat, at best, in 2024. This can be bad news for LVMH too, in so far, as it’s a reflection of the larger trends at play.

Growth by Segment (Source: LVMH)

Big segments soften too

Besides Wine & Spirits, the Fashion & Leather Goods segment, which brings in more than half of LVMH’s revenues, signals caution too. Its growth slowed down dramatically to just 2% in Q1 2024, from 14% in 2023. It’s also far lower than the already softening 9% in Q4 2023.

The reported numbers for the segment contracted by 2%. It’s possible a more favorable currency environment can improve reported growth but there’s no still denying the weakness in organic growth.

Price performance and market multiples

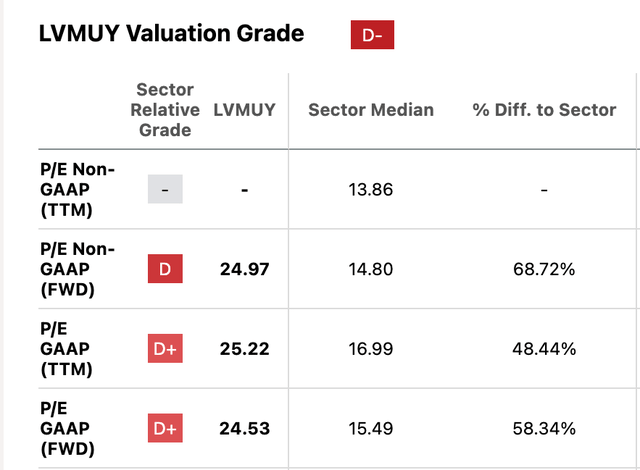

The latest update can impact LVMH’s price, which has actually held up rather well since I last wrote about it in August 2023. Despite a 22% drop by October 2023 and a sharp rise of 36% from these lows by March this year, the result is only a 3.25% decline since last August. But these past trends may well remain in the past if the fundamentals continue to weaken while the market multiples look elevated.

When I last checked, the stock’s trailing twelve months [TTM] GAAP price-to-earnings (P/E) ratio was 24.3x. It’s now slightly higher at 24.8x. It’s still slightly lower than the past 10 years’ average of 25.8x, but that doesn’t indicate any significant upside for the stock, not when it’s seeing a slowdown. The stock’s forward P/Es aren’t low either (see table below), confirming the lack of upside.

Source: Seeking Alpha

What next?

For investors looking at passive returns, now is as good a time as any to buy LVMH for its dividends over the long term. The company has paid dividends consecutively for the past 20 years, which have substantially added to returns from the stock.

However, it’s not one for capital gains right now. If anything, I expect its price to decline looking at the latest revenue update and the forecast weakness in key markets like the US and Europe. With China’s luxury market weakening, the hope for buoyancy from Asia has also waned.

At the same time, the stock’s P/Es look elevated too. With its interim results due only in July, which could shed more light on the latest trends, the information available so far is only disappointing. I’m downgrading LVMH to Sell, though if the company’s numbers look better than expected in July, this can be subject to change.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here