MasterCraft Boat Holdings, Inc., (NASDAQ:MCFT) was started 55 years ago, and it has become the world’s best-selling towboat maker. These towboats are used primarily for waterskiing and other watersports.

This company has about 153 dealers domestically and internationally that sell its boats. It has won numerous awards, and it holds 45 U.S. patents, which help make MasterCraft Boats what they are today. In addition to the MasterCraft (ski and wake boat) brand, it also sells under these brand names: Crest (which makes pontoon boats), Aviara (offering luxury day boats) and Balise (pontoon boats).

I think this company did well when consumers were getting stimulus money during Covid and also had extra free time on their hands. However, the free money era is over (for now) and people have less free time as most are back to work. So like many companies, I believe this company was a beneficiary of Covid and that has made for some tough comparisons in recent quarters. But, in time, the year-over-year comps will get easier.

The other reason this company is seeing a cyclical slowdown is because of the significant increase in interest rates. The much higher rates are impacting financing for high ticket items like boats. But there is a good chance that rates will be lowered this year and be significantly lower by 2026. All of this has led the stock to trade close to new 52-week lows, but this could be a chance to buy this stock at or near the trough of cyclical lows. Let’s take a closer look:

The Chart

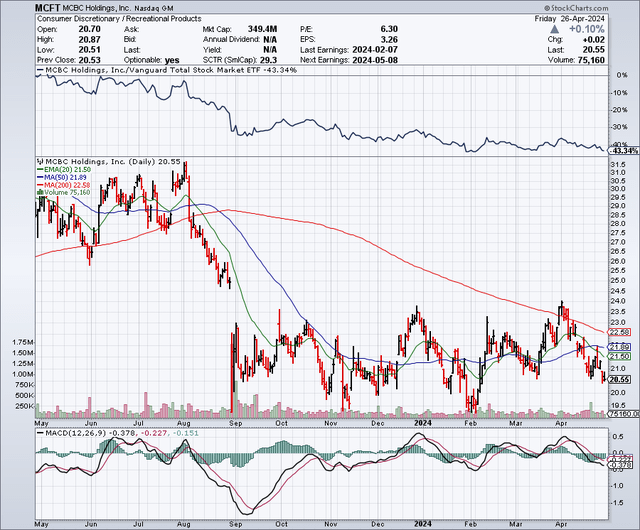

As the chart below shows, this stock was trading for around $30 per share in the third quarter of 2023, but then dropped on disappointing quarterly results. Since then, this stock has been bouncing up and down around the $19 to $24 level. The 50-day moving average is $21.89 and the 200-day moving average is $22.58. Since the 50-day moving average is less than $1 away from the 200-day moving average, it would not take a very big rally in order to create a “Golden Cross” formation on this chart. That would be a bullish indicator and a buy signal for many investors.

Stockcharts.com

Earnings Estimates And The Balance Sheet

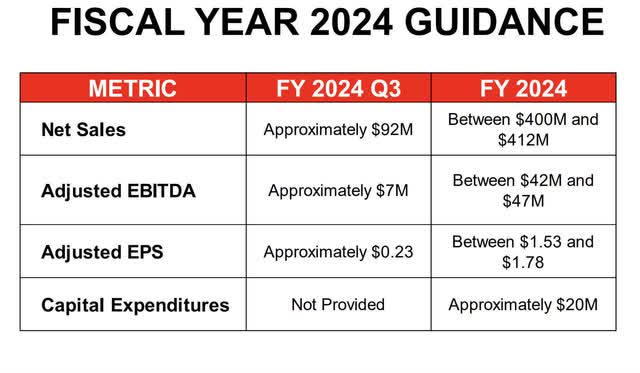

Even during a significant cyclical slowdown, this company is still making money. As shown below, MasterCraft is guiding for adjusted earnings per share to come in between a range of $1.53 and $1.78.

Analysts expect MasterCraft earnings to rise to $2.33 per share in 2025. That implies a price to earnings multiple of just around 8, which is significantly below the current price to earnings multiple of around 21.

MasterCraft Boat Holdings, Inc.

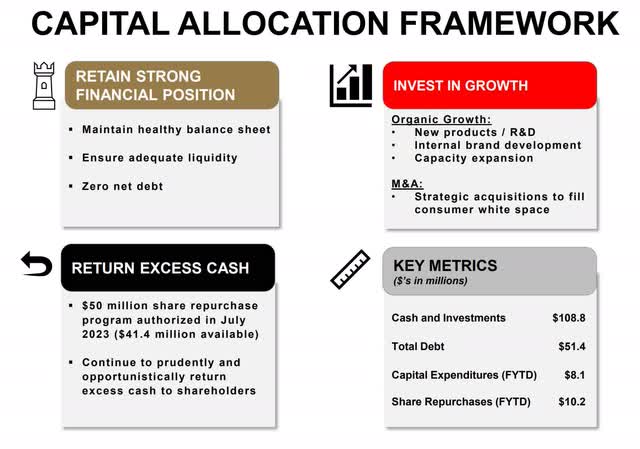

In addition to posting profits during a downturn, I am also impressed with MasterCraft’s balance sheet strength. This company has $108.8 million in cash and only $51.4 million in debt. In addition, MasterCraft has a $50 million share buyback authorized and there is about $41.4 remaining on this buyback, as shown below:

MasterCraft Boat Holdings, Inc.

A Shareholder Activist Is Involved And Has Amassed A Large Stake

Coliseum Capital Management recently bought more shares in MasterCraft (on April 18, and April 22, 2024), so it continues to accumulate, and it now owns over 2.3 million shares. This represents a stake of just over 13% in MasterCraft. Coliseum Capital Management is an activist investor with some of its holdings, so it will be interesting to see if they have any plans to get further involved in the company and buy even more stock in the future.

An activist investor could push for the sale of MasterCraft to a larger company or competitor. This company could be an ideal acquisition because it has a strong balance sheet. I think it would make sense for Brunswick (BC) to acquire Mastercraft, but there could be other potential suitors. In February, Bank of America (BAC) put out a list of small-cap stocks that could be ideal buyout targets, and MasterCraft made the list.

Brunswick also makes boats, and it is a much larger company with a market capitalization of about $5.5 billion versus a market capitalization of just around $350 million for MasterCraft. There could be significant cost synergies with a larger company acquiring MasterCraft, which, along with a well-known brand name and a strong balance sheet, make it attractive.

A Couple More Bullish Points To Consider

While we are talking about Brunswick, it is worth noting that on the balance sheet, it has about $2.83 billion in debt and around $549.2 million in cash. This shows it has nearly 6 times as much debt as it has in cash. I want to highlight this because it helps to show why MasterCraft is so impressive in terms of balance sheet strength—it has about twice as much cash on hand as it does in debt. When companies are in a net debt free position, like MasterCraft, it reduces balance sheet risks for shareholders. In many cases, it also means the company deserves to trade at a premium.

It’s worth noting that MasterCraft has a history of reporting much bigger profits during cyclical uptrends and peaks. For example, in 2021, it earned $3.08 per share. In 2022, it earned $4.72 per share, and in 2023, it earned $5.09 per share. With these types of earnings power, it makes sense to buy some shares now during what could be the trough in earnings. MasterCraft could go back towards these types of earnings power when interest rates decline, which could be a major driver of the next upcycle for boating. This could be what a major investor like Coliseum Capital Management sees as the basis for it to continue buying more shares. MasterCraft shares could be deeply undervalued at current levels, especially if it can return back towards peak earnings levels as shown above.

Potential Downside Risks

In cyclical downturns, some companies turn to discounting and that impacts profit margins. There are signs of promotions and discounts in the boating industry now, so this is a potential downside risk. If the Federal Reserve delays rate cuts, it could lead to an even bigger slowdown for the boating industry. An even worse situation would be if the Federal Reserve fails to achieve a soft landing and instead creates a recession. A recession would be one of the biggest potential downside risks for investors in boating stocks.

MasterCraft is set to release financial results for the third quarter of fiscal year 2024, on May 8, 2024. This could be a potential downside risk because there is always a chance that sales have declined further, and discounting could have also deepened since last quarter. If earnings or revenues miss, or if guidance is weak, this stock could take another leg down.

In Summary

I see a number of reasons to start accumulating (averaging into) this stock over time. It appears to be undervalued, and it has a strong balance sheet. The shareholder activist obviously sees upside, and that could be either a rebound in sales and profits in 2025 and beyond, or perhaps a buyout offer. I believe this stock could easily trade back to around $30 per share, if sales were to rebound in a lower rate environment, or if it received a buyout offer. A move back to $30 would represent a big gain of nearly 50%.

This stock could be at or near cyclical lows, and it could get a big lift when the Federal Reserve starts lowering rates. It is hard to say exactly when a stock will hit bottom, so I am only buying a partial position now and will consider buying more if there is further price weakness, especially after the next earnings report on May 8.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Read the full article here