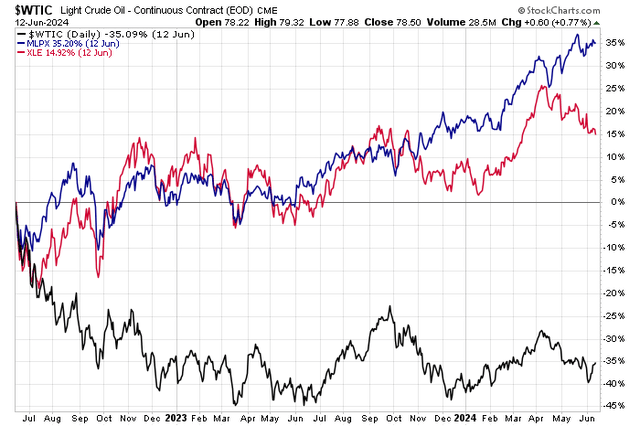

It was two years ago when WTI and Brent crude oil prices peaked. At the time, commodities seemed like the only strong hedge against an ongoing stock and bond bear market. Fast forward to June 2024, and oil is down sharply, but is still holding above the $70 mark on WTI and around $80 on Brent. Energy equities are down sharply from their Q1 peak amid a renewed bout of AI euphoria taking any kind of wind out of the sails of oil and gas names.

But units of MLPs have performed well. The Global X MLP & Energy Infrastructure ETF (NYSEARCA:MLPX) is very close to all-time highs and still sports a distribution rate near 5%. I have a buy rating on the ETF.

MLPX: Strong Outperformance Compared to XLE

Stockcharts.com

According to the issuer, MLPX invests in midstream infrastructure entities such as pipelines and storage facilities that have less sensitivity to energy prices. The ETF invests in MLPs and other energy infrastructure companies, which may result in above-average yields, and unlike traditional MLP funds, MLPX avoids fund-level taxes by limiting direct MLP exposure and investing in similar entities, such as the General Partners of MLPs and other energy infrastructure corporations.

MLPX is a moderate-sized portfolio with total assets under management of $1.53 billion as of June 12, 2024. Sporting an annual expense ratio of 0.45%, the fund is a popular play among investors seeking a high yield with some diversification benefit compared to the returns on the S&P 500.

Share-price momentum has been strong for much of the year while the ETF’s risk rating is solid at a B, though the allocation is somewhat concentrated which I will detail later. MPLX is highly liquid with 90-day average trading volume of more than 220,000 shares and a median 30-day bid/ask spread of just four basis points.

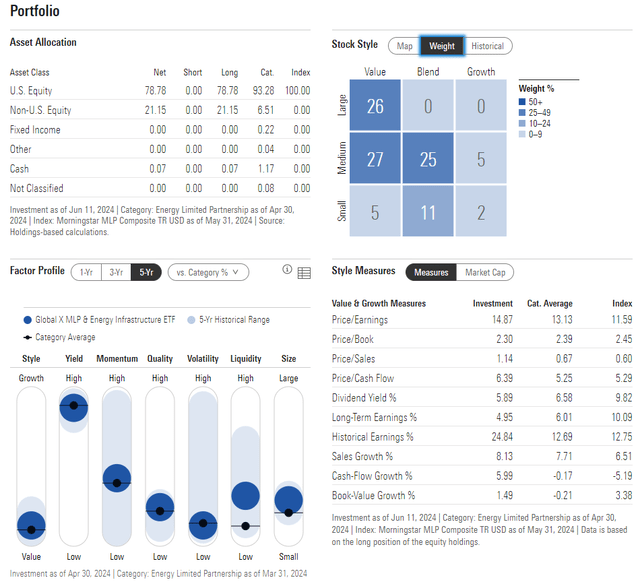

Looking closer at the fund’s internals, MLPX’s portfolio is spread across the style box. The 4-star, Bronze-rated ETF has a current price-to-earnings ratio of 14.9, about six turns cheaper compared with the SPX, but its long-term EPS growth rate is modest at under 5%. Its factor profile reveals that its earnings quality is weak while there’s ample small- and mid-cap size exposure. The style bent is decidedly to the value side.

MLPX: Portfolio & Factor Profiles

Morningstar

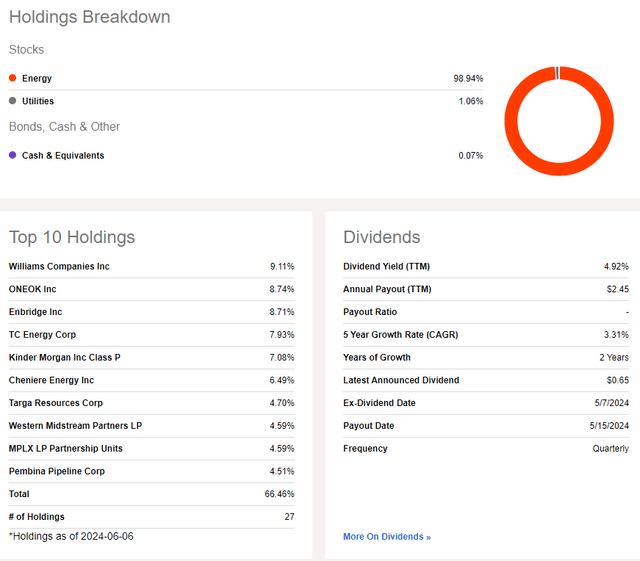

MLPX is almost entirely an Energy-sector portfolio. The concentration in the top 10 positions is about two-thirds of the fund, and since many of those names are tightly correlated, industry trends and even individual-company earnings reports can cause volatility throughout the allocation.

So, paying attention to both the fundamentals and momentum situation of major MLPs is critical. On dividends, the ETF paid out $2.33 last year, a modest increase from 2022 and the biggest total distribution going back to 2016.

MLPX: A Concentrated Portfolio, High Energy Exposure, Big Yield

Seeking Alpha

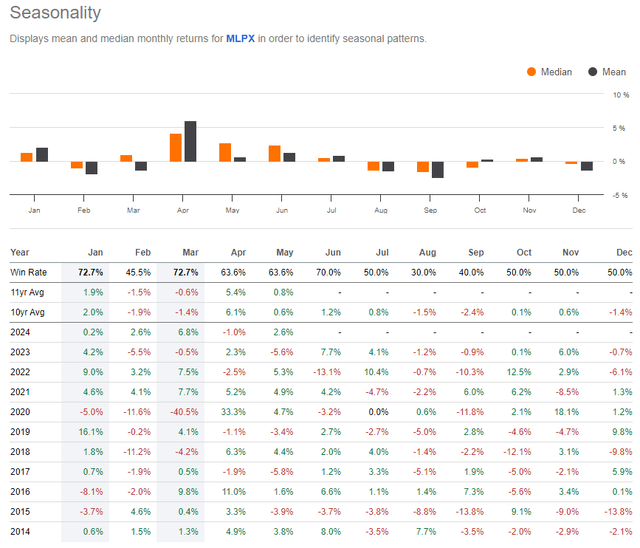

Seasonally, we are approaching a weak time of year for MLPX. Returns in June and July have been marginally positive when analyzing performance trends over the past 10 years, but August and September is the notable weak calendar stretch, so this is a significant consideration for prospective investors looking to time their entry effectively.

MLPX: Seasonality Turns Bearish Later in Q3

Seeking Alpha

The Technical Take

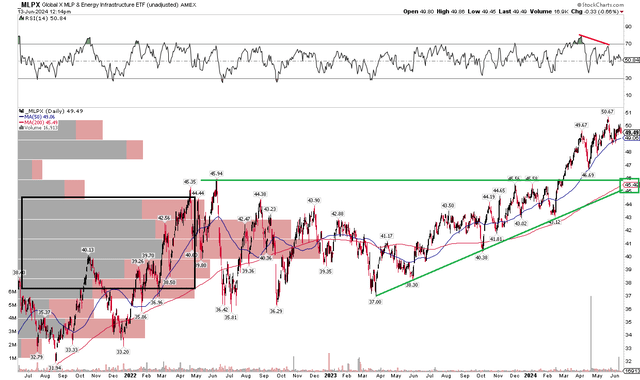

With a mid-teens earnings multiple, focused allocation, and dicey seasonals ahead, MLPX’s technical situation is healthy. Notice in the chart below that shares broke out above key resistance at the $46 mark back in the first quarter. That should now become support on pullbacks. Furthermore, there’s a confluence of potential support near that same mark. The long-term 200-day moving average currently comes into play between $45 and $46 while the uptrend support line from the March 2023 low is right there too.

But take a look at the RSI momentum oscillator at the top of the graph – it printed a lower high while price advanced to the best levels since 2015. That’s a negative divergence that bears watching as we head into the high-demand summer months in the energy markets. For now, MLPX remains above its flattening 50dma and it won’t take much buying activity to send the ETF to new multi-year highs.

Overall, the long-term trend is higher while some near-term caution is suggested by the RSI gauge. But with significant support likely in the mid-$40s, the risk/reward is favorable in my view.

MLPX: Bullish Uptrend, Above Support in the Mid-$40s

Stockcharts.com

The Bottom Line

I have a buy rating on MLPX. The fund of MLP equities sports an attractive P/E, a strong yield, and positive technicals.

Read the full article here