Moderna (NASDAQ:MRNA) has an exciting cancer vaccine, mRNA-4157, that I wrote about last month, when I rated MRNA stock a hold, noting I didn’t have a strong thesis on the company’s infectious disease vaccines. MRNA is now approaching a launch of its recently approved respiratory syncytial virus (RSV) vaccine. That launch, if successful, could reduce reliance on COVID vaccine revenues, and boost an ailing top-line, between now and the launch of any cancer vaccines.

RSV vaccine approved, competition is fierce

On May 31, MRNA announced its respiratory syncytial virus (RSV) vaccine, mRESVIA, has been approved by the US FDA for adults 60 years and older. However, GSK plc (GSK) and Pfizer (PFE) launched their own RSV vaccines last year, and thus MRNA is a later entrant to the market. Those competitor vaccines would be more familiar to prescribers. That being said, MRNA isn’t a low profile company following its efforts during COVID, it is going to be able to market its vaccine, which, unlike competitors’ products, is available as a pre-filled syringe.

There is a problem though, on June 7, 2024, GSK announced the US FDA had expanded the label of its RSV vaccine to cover adults 50-59 years of age who are at increased risk from RSV (the prior approval was for ages 60 and up). At that time, GSK confirmed an H2’24 readout from trials developing its RSV vaccine in adults 18-49 years of age.

Trials evaluating the immunogenicity and safety of the vaccine in adults aged 18-49 at increased risk and immunocompromised adults aged 18 and over are expected to read out in H2 2024.

GSK comments on its RSV vaccine, Arexvy, June 7, 2024.

As for PFE, the company announced positive data in April 2024, from the MONeT trial, a phase 3 study of its RSV vaccine in adults 18-59 at risk from developing severe RSV-associated lower respiratory tract disease. That study looked at immunogenicity data (for example antibody titers) and safety, rather than producing a number on vaccine efficacy, but PFE notes this is a viable strategy to expand the usage of a vaccine.

Pfizer intends to submit these data to regulatory agencies and request expansion of the age group from the current indication to 18 years of age and older. The use of immunobridging studies to extrapolate efficacy from older to younger adults is an established regulatory pathway.4

PFE comments on results from MONeT, April 9, 2024, press release.

MRNA believes its vaccine will get a parity recommendation (with PFE’s vaccine and GSK’s vaccine), by the US CDC’s Advisory Committee on Immunization Practices (ACIP), when it meets this month (June 26-28). An agenda for that ACIP meeting notes presentations from PFE, GSK, MRNA on RSV vaccines on June 26, and a vote on RSV on the same day.

Still, even with a parity recommendation, the fact that the other two vaccines launched a season earlier, and now have or are closer to broader labels (i.e., use in those below 60 years of age), it is hard not to see that as providing confidence in those vaccines.

Beyond that, a follow-up analysis of MRNA’s phase 3 RSV vaccine trial resulted in a numerical decrease vaccine efficacy, albeit with overlapping confidence intervals, when including cases that had not initially been confirmed at the time of an initial analysis.

The primary analysis with 3.7 months of median follow-up found a vaccine efficacy against RSV lower respiratory tract disease (LRTD) of 83.7% (95.88% CI 66.0%, 92.2%)… A follow-up analysis of the primary endpoint was performed during FDA review, including cases that started before the primary analysis cut-off date but were not confirmed until afterward. The results were consistent with the primary analysis [VE 78.7% (CI 62.9%, 87.8%)] and were included in the U.S. package insert.

MRNA comments, May 31, 2024, press release.

Even though that follow is consistent with the initially reported data, there was some concern it could impact competition with GSK’s Arexvy. Of course, MRNA can respond to the competition by producing data in younger individuals and stressing the value of the pre-filled syringe, but I do think the competition is fierce.

There is also some discussion of differences on safety, but I think rare safety events might have been seen with GSK and PFE’s vaccines simply because they have now been used in many patients. Briefly, some cases of Guillain-Barre syndrome have been seen with GSK and PFE’s RSV vaccines. Time will tell on safety, but it could be a differentiator of note, if such events don’t pop up with mRESVIA, or if they seemed to occur less frequently.

Financial Overview

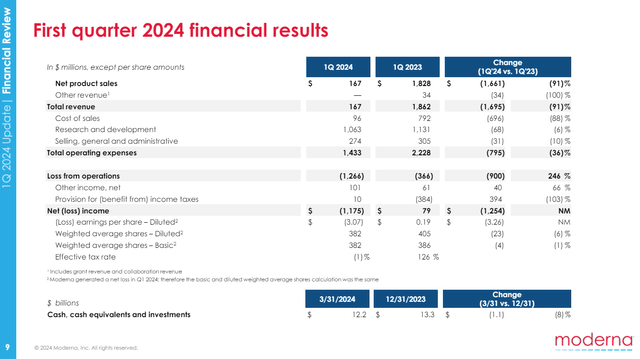

I reviewed MRNA’s Q1’24 quarter in my previous article. A few details are worth reiterating, to see where the RSV vaccine fits in and what it can offer.

MRNA brought in just $167M in net product sales in Q1’24, down from $1.8B in Q1’23, showing the decline of the COVID franchise. While total operating expenses are down from $2.2B in Q1’23 to $1.4B in Q1’24, a large part of that is from reduced cost of sales. The actual reductions in R&D and SG&A expenses are more modest. MRNA then could use a return to topline growth.

MRNA Presentation, May 2024.

COVID revenues are seasonal, however, and MRNA is still guiding for $4B in net sales for 2024, part of that will come from the RSV vaccine, but the vast majority looks set to come from COVID vaccine sales, both from advance purchase agreements (APA) and sales without an APA (such as in the US).

… So, round out the guidance, the last $1 billion in the $4 billion was both RSV and other countries that didn’t have an APA already signed for COVID. And we said that, that combined was about $1 billion. We never guided an RSV-specific revenue target…

Jamey Mock, MRNA CFO, Jefferies 2024 Global Healthcare Conference, June 6, 2024.

In the short term then, it looks like the contribution of the RSV vaccine is going to be minor. Nonetheless, the strength of the launch, noting the fact MRNA is sharing the market three ways with earlier entrants, will, of course, be monitored closely to gauge how competitive MRNA’s mRESVIA really is. If MRNA makes good inroads to getting a third of the market in its first RSV season, that that would bode well for the drug being a major revenue contributor going forward.

Conclusions, rating

MRNA’s RSV vaccine approval comes in time for the upcoming season (starting in fall and peaking in winter). A slight softening in the vaccine efficacy data isn’t to be dismissed, but the pre-filled syringe could help the drug compete with GSK and PFE’s offerings. While the initial launch might only see mRESVIA contribute a fraction to MRNA’s top line, the strength of the launch will be used to gauge what the drug can bring in going forward.

I still rate MRNA a hold, having now had a closer look at a key near-term launch from its infectious disease vaccine portfolio (mRESVIA). MRNA’s stock seems more responsive lately to speculation on avian influenza, as covered in a recent article by Edmund Ingham. I find it difficult to predict whether fears over avian influenza will grow, perhaps triggering a further rise in MRNA’s stock, or clear up, at which point MRNA could actually fall. In the latter scenario, MRNA still might receive a stockpiling order for an avian influenza vaccine one day.

Risks

Discussing some of the risks of holding MRNA brings up a few more points. The first is that the cancer vaccine continues to be a part of the big picture in MRNA’s future, and yet in H2’24, MRNA is exposed to a potential readout from BioNTech SE’s (BNTX) cancer vaccine, which could signal greater competition for MRNA in the cancer vaccine space. There are other competitors too in this space, but they are smaller players, for example Gritstone bio (GRTS) which disappointed the market with its initial update from its cancer vaccine in colorectal cancer, but should report more data in Q3’24.

A second risk is that MRNA sees delays in the development of some of its other vaccines. MRNA notes it plans to file for approval of mRNA-1010, the company’s flu vaccine, in 2024. Any delays in approval would see revenues move further into the future.

A final risk I see in 2024 is that an interim evaluation of vaccine efficacy, in the company’s phase 3 study of its cytomegalovirus (CMV) vaccine, disappoints the market. A successful CMV vaccine hasn’t been developed previously, and there is no guarantee that MRNA will produce strong data.

Read the full article here