We remain buy-rated on Okta, Inc. (NASDAQ:OKTA). We expect the stock has priced in the macro weakness and now sees growth driven by a macro-related shift in focus to cross-selling products to its existing installed base amid a softer global IT spending environment pressuring new customer growth. OKTA’s gross retention rates remain strong, in our opinion, in the mid-90% percentage range; the dollar-based net retention rate for the TTM period is 115%, and we think the resilience of the net retention rate is driven by the upsell and cross-sell activity in spite of uncertain macro environment.

OKTA’s dollar-based net retention rate for the TTM period ticked down sequentially for the second quarter in a row from 117% last quarter, but we’re not too concerned about the QoQ decline as we’re seeing customers tighten budgets in the current macro backdrop and hence slow the expanding seat rate compared to previous quarters where net retention was in the +120% range. Consistent with management’s view, we expect QoQ net retention rate to fluctuate some more due to a mix of renewals, upsells, and new business, but we expect it’ll stay in the +110% range.

Additionally, we now think the macro weakness has been priced into the stock and the outlook for H2FY24. Management now guides for total revenue of $558M to $560M for 3Q24, representing a 16% Y/Y growth and non-GAAP operating income of $53M to $55M. We think the business outlook factors in current macro headwinds, which makes us more constructive on OKTA’s ability to beat estimates in the second half of FY24. OKTA also raised FY24 revenue guidance to $2.207B-$2.215B for a 19% Y/Y growth and guided higher for non-GAAP operating income by $50M. We think OKTA will be a safe investment even in the case that the Fed’s higher-for-longer narrative plays out.

OKTA is rebounding nicely from its 2022 lows, during which the stock dropped roughly 70%, underperforming the S&P 500 by around 52%. The stock has underperformed the broader peer group YTD, but we think OKTA is now hitting an inflection point. Our previous concerns regarding the integration of Auth0 and a slowdown in IT spending on cloud infrastructure are factored into the stock. We believe the company is now more resilient to the uncertain macro environment and expects growth driven by the shift in business mix to cross-selling and upselling. We see an increasingly favorable risk-reward profile for the stock into 2024.

The following chart outlines OKTA stock performance against the S&P 500.

YCharts

Two drivers for profitable growth

OKTA reported revenue up 23% this quarter to $556M, largely driven by an uptick in subscription revenue of 24% Y/Y, which accounts for the bulk of total sales. While we understand investor concern about the slower Y/Y growth rate of subscription revenue compared to 1Q24’s 27% Y/Y growth, we continue to expect subscription revenue growth to remain in the higher double-digit percentage in the back end of FY24. We see two main catalysts driving profitable growth for the identity management software provider into FY25.

1. Cross-selling Tailwind

Management is shifting its business mix to focus on cross-selling and upsells to its existing customer base; the effect of this will be expanding its footprint with its installed base by providing new products to its identity access management or IAM portfolio. We expect the cross-selling strategy will help ramp and scale visibility in spite of macro weakness. Simultaneous with the cross-selling, OKTA is still bringing in new customers, but at a slower rate than FY22 and FY23; this quarter, total customers came in at 18,400 compared to 18,050 last quarter.

Additionally, the cross-selling and upselling strategy should increase the threshold to transition out of OKTA’s IAM into a competitor’s offerings. Microsoft’s (MSFT) recent penetration into the SSE and IAM space has triggered some concern about OKTA’s market opportunity. We continue to expect the opportunity in identity to be big enough to fit multiple players.

2. Reducing expenses

We’re constructive on management’s efforts to reduce expenses in FY24 to match the macro backdrop; the company’s total operating expenses this quarter were lower than expected despite a slight increase in headcount. We’re seeing OKTA shrink GAAP operating loss both QoQ and Y/Y this quarter to $162M, or 29% of total revenue, from $160M, or 31% of total revenue in 1Q24 and $208M, or 46% of total revenue in a year ago quarter. Operating income also expanded this quarter; Non-GAAP operating income was $59M this quarter versus $37M last quarter, representing 11% of revenue compared to 7% in 1Q24. We think the lower expenses, coupled with the revenue outperformance, will drive profitability into FY25.

Valuation

The stock is undervalued, in our opinion, especially when compared to the cybersecurity peer group. On a P/E basis, the stock is trading at 55.0x C2024 EPS $1.46 compared to the peer group average of 78.7x. The stock is trading at 4.7x EV/C2024 sales versus the peer group average of 6.5x. We think OKTA is better positioned to leverage the growth opportunity in the identity market with the shift in focus to expanding its footprint with existing customers rather than onboarding new customers amid a weaker global IT spending environment. We think investors exploring entry points in 2H23 will be well rewarded in CY24.

The following chart outlines OKTA’s valuation against the peer group average.

TSP

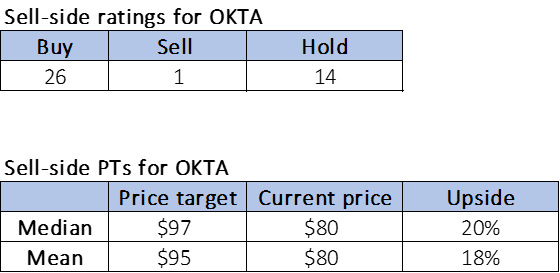

Word on Wall Street

Wall Street is a bit dispersed in its sentiment on OKTA, but the majority lean toward a buy rating. Of the 41 analysts covering the stock, 26 are buy-rated, 14 are hold-rated, and the remaining are sell-rated. The stock is currently priced at $80 per share. The median sell-side price target is $97, while the mean is $95, with a potential 18-20% upside.

The following charts outline OKTA’s sell-side ratings and price targets.

TSP

What to do with the stock

We continue to be buy-rated on Okta, Inc.; we think this is a stock that should definitely be on your radar in the cybersecurity space. While we understand investor concern over macro headwinds slowing new customer growth, we think management’s shift in business mix to cross-selling products and reduced expenses will drive profitable growth into FY25. The identity and access management market is estimated to expand at a CAGR of 12.6% between 2023 and 2030, and we expect OKTA will be a core benefactor of this growth, especially as the A.I. boom expands the cyberattack landscape. We see Okta, Inc. stock outperforming toward H2FY24 and recommend investors explore entry points at current levels.

Read the full article here