Papa John’s International, Inc. (NASDAQ:PZZA) reported the company’s Q2 results on the 8th of August in pre-market hours, showing a mixed quarterly performance with weak sales but improving profitability. The market has so far reacted slightly positively to the reported results, as Papa John’s bottom row beat expectations.

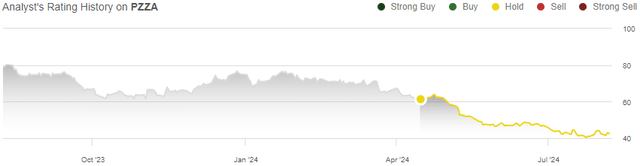

In my previous article on the stock, “Papa John’s: Back To Better 2.0 Plan’s Potential Is Likely Priced In,” I initiated the stock at a Hold rating as Papa John’s new commissary changes and other Back To Better 2.0 improvement initiatives’ potential success was already mainly priced in. Since the article was published on the 15th of April, as the restaurant market has been weak, Papa John’s stock has lost -29% of its value compared to S&P 500’s (SP500) return of 5% in the same period, making the stock more appetizing now.

My Rating History on PZZA (Seeking Alpha)

Q2 Report Shows Mixed Results

Papa John’s reported Q2 results showing revenues of $507.9 million at a -1.3% decrease year-on-year, related to weak comparable sales. The adjusted EPS came in at $0.61, beating the prior year’s $0.59 Q2 EPS despite considerably weaker comparable sales.

Revenues missed the Wall Street consensus estimate by $12.9 million, yet managed to grow the EPS year-on-year, beating Wall Street estimates by $0.08 in the adjusted EPS – good cost management ultimately made up for the weakness in sales.

In the quarter, Papa John’s closed 31 net units, led by 43 previously planned company-owned closures in the UK as part of the company’s international operational streamlining. At the end of the quarter, Papa John’s still had 5,883 system-wide restaurants, kept up by good growth in international franchised restaurants.

Papa John’s Comparable Sales Trail in Q2

As said, Papa John’s comparable sales were incredibly weak. North American Q2 comparable store sales came in at -3.6% leading to the revenue miss, with company-owned restaurants showing an even worse decline at -4.2% in the quarter; Papa John’s didn’t attract good traffic during the quarter, showing worrying signs of the brand’s health on the surface.

International comparable sales declined by -0.1%.

A part of the decline is clearly related to poor industry traffic. While food inflation in restaurants remained at an elevated level of around 4.1% in Q2 as per U.S. BLS data, the US consumer sentiment has worsened traffic considerably, leading to weak comparable sales growth across the industry.

Representative of industry growth, some competitors have also started to report their respective Q2 results, showing mixed results. Of notable pizza chains, Domino’s Pizza, Inc. (DPZ) also reported a small comparable sales miss in Q2, still growing 4.8% year-on-year amid the company’s fantastic growth history but down from 5.6% comparable growth in Q1. Yum! Brands, Inc.’s (YUM) Pizza Hut chain, on the other hand, reported a -3% comparable sales decline, more in line with Papa John’s.

Going into overall QSR comparisons, Papa John’s Q2 underperformed by a more notable margin. Yum Brands’ Taco Bell comparable sales grew 5%, KFC’s declined -3% and Restaurant Brands International Inc.’s (QSR) reported results showed a comparable sales growth of 1.9% across the company’s very notable QSR chain portfolio.

Considering the reported peers’ performances, Papa John’s sales weakness was predictable, but the severity of the decline is still considerable even accounting for the currently weak industry traffic. Papa John’s is focusing on streamlining marketing through increasing national marketing campaigns with the Back To Better 2.0 plan. Thus, improvements could start showing in the midterm future – I don’t consider the weak Q2 sales a catastrophe yet in the hope of future improvements with an industry recovery and the Back To Better 2.0 implementation.

Profitability Management Improves Earnings Despite Sales Weakness

While sales had a weak performance, Papa John’s managed to still increase adjusted operating income year-on-year by $1.5 million to $38.4 million. Ultimately, comparable sales growth determines the investment case as driving healthy traffic is a necessity for profitability in the industry, but improving profitability is a clear and significant positive sign in my opinion. The adjusted result understandably excludes around $10.1 million of costs related to international restructuring related to store closures, as well as non-cash impairment of domestic restaurant assets.

The increase was related in part to local marketing savings, potentially being at least a small factor in the poor reported comparable sales as well.

Notably, while company-owned restaurants took the worst hit to comparable sales growth at -4.2%, Papa John’s communicated company-owned restaurants to post increasing profitability – Papa John’s domestic company-owned restaurants showed a $35.2 million restaurant-level income, up $3.1 million from Q2/2023.

With the good profitability shown, I believe that the report was overall positive despite weaker sales giving a mixed image. Lower local marketing could have a bad short-term effect on sales, but the streamlined national marketing fund could start to drive better traffic in the future as well.

Updated Valuation: PZZA Has Become Appetizing

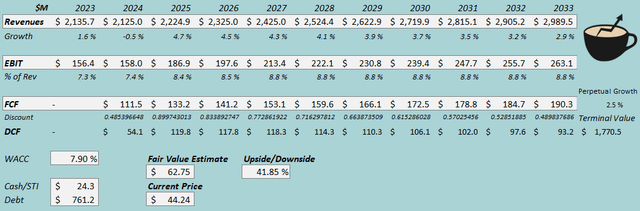

I updated my discounted cash flow [DCF] model in light of the reported Q2. I now estimate weaker revenue growth of -0.5% in 2024 due to Papa John’s weakness and industry weakness, but the revenue growth to be similar afterward.

For the EBIT margin, I remain at an 8.8% level estimate after the Back To Better 2.0 is fully implemented, but I have shifted margin improvements to happen sooner now after temporary 2024 restructuring costs. The report also raises confidence in the estimated margin improvements being achieved.

Papa John’s cash flow conversion should remain good with the estimated growth.

For more thorough explanations of the estimates, I refer to my initial article.

DCF Model (Author’s Calculation)

The estimates put Papa John’s fair value at $62.75, 42% above the stock price at the time of writing. After the stock has fallen considerably, the stock has started to come with potential upside as the Back To Better 2.0 plan is being implemented; the stock now seems attractive.

The fair value estimate is up from $52.26 previously due to a lower used WACC, as cash flow estimates have stayed nearly identical.

CAPM

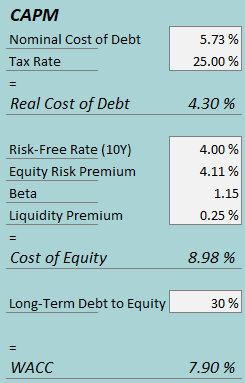

A weighted average cost of capital of 7.90% is used in the DCF model, down from 8.82% previously. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, Papa John’s had $10.9 million in interest expenses, making the company’s interest rate 5.73% with the current amount of interest-bearing debt. I again estimate a 30% long-term debt-to-equity ratio.

To estimate the cost of equity, I use the 10-year bond yield of 4.00% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I again use a beta estimate of 1.15. With a liquidity premium of 0.25%, the cost of equity stands at 8.98% and the WACC at 7.90%.

Risks

The stock does still come with notable risks. Most importantly, the comparable sales were incredibly poor in Q2, and a continuation of the trend could easily deteriorate Papa John’s margins and investment case as a whole. While franchised restaurants won’t have such a negative immediate effect on Papa John’s margins from poorer sales, weak traffic will ultimately impact franchisees’ will to open up new units.

Furthermore, the stock’s upside still relies on good Back To Better 2.0 implementation. While I believe the initiatives look good on the surface, the plan could still come with unknown risks as well.

Takeaway

Papa John’s reported incredibly weak Q2 sales, but impressively improving underlying profitability in the quarter. While sales underperformed the already weak QSR industry in the US, lower local marketing costs and other cost streamlining managed to improve the bottom line amid the Back To Better 2.0 plan implementation.

Papa John’s International, Inc. stock now seems undervalued, largely relying on the planned initiatives’ success in improving demand from centralized marketing and other improvements. As the valuation has become attractive, I now upgrade my rating to Buy on Papa John’s amid the mixed Q2 results.

Read the full article here