Above: Hawaii is the unassailable bedrock of the Park portfolio, contributing over 35% of the total annual revenue ~$1.6b.

Despite mixed 2023 results, most analysts retain positive outlooks for the shares of Park Hotels & Resorts Inc. (NYSE:PK). Management is guiding for full year 2024 results to be mostly flat. Park is a luxury hotel REIT (42 properties/total 26,000 rooms) encasing some of the legacy Hilton Hotels chain’s best properties. Analysts still like the company’s fundamental growth prospects in applying Capex investment to the best properties. Add in a demonstrated skill set in managing its finances, with a current ratio of 1.58. By most standards, that would be judged as adequate. But the caution flag is still out.

However, we get an entirely different picture from Alpha Spread’s DCF analysis:

Base case: $12.7

Worse case: $0.26

Best case: $45.3

The underlying value analysis of the portfolio tells another story. Strong assets and established locations always win the day. No matter how many times you read analysis of realty stocks, they always contain one undeniable factor that swallows every metric: Location, location, location.

And in that context, we note that Park’s top revenue contributors are as good, if not better, team than some, all in top US locations: NYC, DC, Chicago, LA, Boston, NOLA, Denver, Key West, Miami Beach, and in the “slugger spots”, Hawaii and Orlando. The big metro cities have a foundational strength in business and convention travelers, some feed from casinos, which is cost free marketing (Boston) for international travel. Even stronger are the Park properties in Hawaii, Orlando, Miami, and winter draw for the northeast, including Disney World, over many decades.

(Note: Park has stopped payments in June on two San Francisco hotels totaling $725m in non recourse loan secured by Hilton SF and the Parc 55 projects. The company’s statement blames the default on a deterioration in conditions in San Francisco, affecting many aspects of the local and travel economies. It has not impacted the current trading in the stock, according to bankers we know, because the market understands the conditions there. Park is looking for a buyer. At the moment, that appears to be a tough undertaking. Eventually, once a buyer signs, it’s a plus for the shares.)

Resort dominant hotels contribute 60% of the total Park revenue projected:

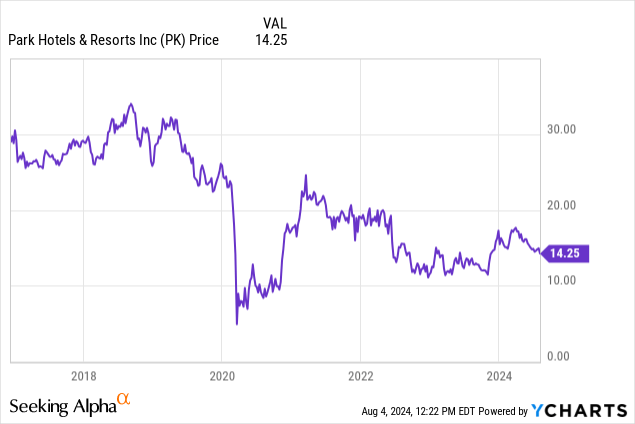

Price: $14.25 at writing

Consensus upside: $19-ish.

2024 Key Metric Annual Management Guidance

Yield: 6.5% as of the end of 2Q24

Est 2024 total revenue: $1.6b

Full year 2023 RevPar growth: 8.7%, projecting 2024 up from range of 3.5 to 5.5%.

Projecting RevPar for 2024 range: $194-$201. (We see that as an attainable goal.)

Adj FFO per share E: 2.10 to 2.26

Net income attributed to common holders: $144 to $174

Adj. EBITDA: $660m to $690m

Dividend based on history: Forward estimated at $1.00

Enterprise value: $$6.8b

EBITDA Multiple: 10.1X

Macro Outlook: Economic, Sector, Park exposure

The application of REIT analysis metrics can be complex, plunging analysts into deep dive explorations of established brand and location, debt ratios and carrying costs for debt, etc. But at this point in time, we believe the keys to decisions on this stock are far more dependent on the intermediate prospects for the sector as a whole.

They are, of course, Fed forward actions, looming recessions anywhere from a soft landing to out-and-out crash, or no recession at all. And for the leisure and lodging centric stocks, these tough questions continue: The post-Covid spending sprees fueled by consumer frustrations, has it now peaked and left us with historic cycles? We do know the workplace has changed. Once, most people actually went to work each day. Today, post-Covid, growing percentages of people telework at home. AI will attack payrolls in a high personal service sector like hotels.

And overall, the US Treasury has unloaded storms of free money which had a major hand in the sector labor shortages – still existing in major markets. So now hotels have had to raise wages as recruiting has been constrained. The quality of employees has gone down, the price up. But the introduction of tech solutions from the entire occupancy process, from checking in to departure is beginning to show. That’s among the reasons why the July jobs report shows such a small increase.

The July Jobs total added was bad enough at 114,000 overall. But leisure and lodging, which always starred in those record months, showed a tepid gain of 23,000 in the 16.3m leisure and hospitality worker total. So we now have a core baseline of ongoing sales growth ahead, which may impair prospects for the sector. And sales growth is the mother’s milk of EBITDA and FFO.

Add to that the general inflation, which has hit the hotel sector’s Capex costs in mandated utilities costs, plus supplies of food, and you have a perfect storm of escalating cost pressures on prices. And in hotels, the marketing decision is always that empty beds are worse than beds without heads, or even deep price slashes on room rates.

Until recently, there was enough unmet room demand to keep Park Hotel room rates within the YOLO demo (you only live once) psychology of hotel tripping. Now that is beginning to fade. And let’s not forget the rising threat of AI to the many job categories at the customer contact and service levels that may speed the adaptation of new ways to cut labor costs.

Park has wisely appraised the outlook of the industry ahead and by now converted 86% of its portfolio to luxury level hotel brands.

So if you take the sector as heavily exposed to macro challenges, most of which are guesswork, you know that by proxy, Park operators could be thrown at the mercy of its landlords seeking relief from triple net leases. And this is before we know for sure whether the just released jobs report is the canary in the coal mine for the economy or the sector.

Yet, we have looked at Park’s numbers. Despite a revenue mix and trace evidence of a recovery, we can and do see some shoots. So it comes down to valuation at $14.25 a share. So we must put in the mixture a possible recession factor based on history of recessions and recoveries that Park could endure of a worse case slide to $12.55. At the same time, a rate cut from the Fed plus the recession by 1Q25 assuming the current selling price could drive Park even lower into the realm of bottom fishers ~$8.35 to $7.00 then back up to $14.75.

It’s a timing issue: We cannot see a bull case forming a run yet, but we do think there is enough interest here to HOLD if you own, or open a small hedged position if the stock begins to show some fatigue after 3Q24.

Read the full article here