Investment Thesis

Philip Morris International (NYSE:PM) is redefining its identity from a traditional cigarette manufacturer to a leader in smoke-free products. The acquisition of Swedish Match, particularly its Zyn nicotine pouches, plays a pivotal role in this transformation, with U.S. volumes up by over 50% year-to-date as of Q2, marking a substantial increase in category share. Zyn, with a strong market presence and rapid growth, is central to PMI’s strategy in navigating the evolving landscape of nicotine products. With Zyn’s US adoption and growth looking compelling, investors should reassess the stock. The forward PE multiple and dividend yield makes the company compelling.

Background on Philip Morris “Smokeless Transformation”

In a landmark move, Philip Morris acquired Swedish Match for $16 billion in late 2022, a strategy aligning with the industry’s shift towards alternative nicotine products. This acquisition is not just a financial investment but a step towards diversifying beyond traditional cigarettes, as evidenced by PMI’s development of products like the IQOS heated-tobacco system and acquisitions like Vectura Group and Fertin Pharma.

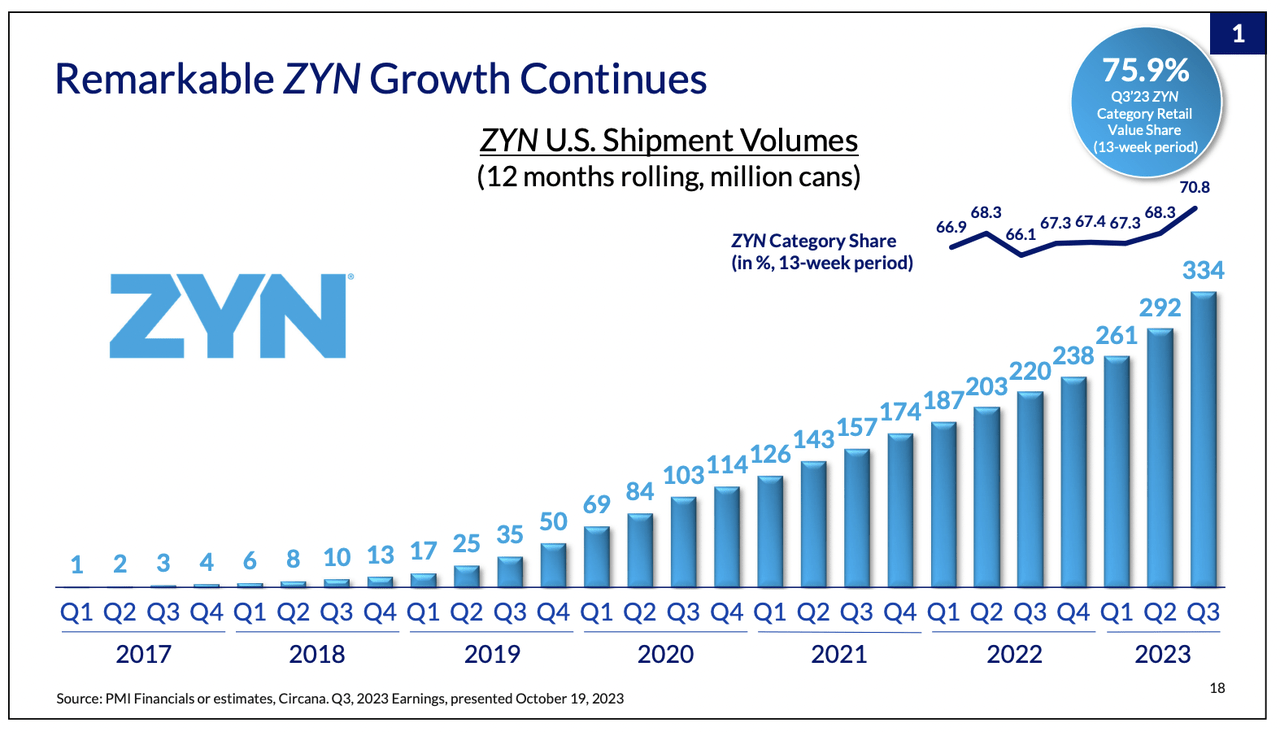

Large cigarette companies (such as Altria and Philip Morris) are embarking on a multi-year transformation plan to help smokers quit cigarettes and transition to smoke free nicotine products. While they still have the goal of their customers forming habits around nicotine products, these new products are being sold as less harmful alternatives allowing the firm to limit future liability from consumers hurting themselves through consumption. Currently Zyn has been experiencing exponential growth, reaching over $800 million in sales in Q3 alone (Q3 Earnings Call).

Zyn Sales Growth (Philip Morris Q3 Earnings Presentation)

Why Zyn Sells to Gen Z (and why this matters)

Zyn’s market strategy aligns well with the values and habits of Generation Z, a demographic that holds growing purchasing power and influence. Zyn is popular on social media, with media personalities talking about how Nicotine can be for you (Andrew Huberman Podcast). Some members of Gen Z are viewing Zyn as a relatively harmless product as traditional smoking declines.

As someone who is Gen Z, I see the presence of Zyn among people I went to college with, and loosely in friend groups (so far). People see Zyn as a gum-like product & the case it comes in does not have the social stigma like tobacco products. It’s also not a smoking product meaning there are far more social scenes where it could be permissible to consume Zyn.

Gen Z has been a hard market for traditional tobacco companies to go after. Zyn offers one the most compelling ways to sell to this age group. With a price point of just $3.99 for the smallest container, there does not appear to be a large price barrier for younger consumers to buy the product. This compares to the price of a box of cigarettes which goes for $7.19 and vape products, which go for ~$15 up front for a Vape Pen.

Zyn Flavors (Northerner)

How to Value Zyn (as Part of Philip Morris)

Zyn’s value to PMI can be assessed through its market share and sales growth. Zyn holds a 64.9% share of the U.S. nicotine pouch market, with significant growth observed in shipment volumes and sales. This dominance in a rapidly growing market segment is a key asset for PMI.

Phillip Morris’s valuation is comparable to its peers but has a division that is unique in its level of growth (ZYN). This part of the business is growing volumes at 66% YoY in the US in the third quarter and is already at a $3.2 billion revenue run rate (~800 million Q3 X 4).

In a comparative valuation, Juul had a valuation of $38 billion in 2018 on $1.3 billion in revenue, equating to a price to sales ratio of 29.23x sales. If we apply a more conservative 20x sales multiple to annualized Zyn/the Swedish Match division sales we can reach a division valuation of $64 billion. Keep in mind as well that Zyn has not faced the scrutiny (yet) that Juul eventually faced for marketing their product to kids. The health effects are also less pronounced meaning the probability of swift public frustration is lower. Both of these factors mean the division (especially given the growth rate) could be worth a higher price to sales multiple. I will keep it at a more conservative 20x annual sales multiple.

On its own, if we add this marginal valuation of Zyn to Philip Morris’ market cap ($141 billion) this would equal a new market cap of $64 billion. This represents a ~45% upside from the current market prices.

Why I Do Not Think This Is Priced In

Despite Zyn’s potential and market performance, PMI’s stock has shown volatility, possibly indicating an underestimation of Zyn’s value in the market.

The company trades at 14.94 times forward earnings (non-GAAP). This compares to a sector median of 17.21 times earnings. Zyn is one of the hottest, fastest growing products in the tobacco/nicotine industry. For the owner of the company to be trading at a lower forward PE than the industry does not make sense to me. This makes me believe the street is not pricing in the effects of Zyn.

Risks

While I think Zyn is likely to add serious upward pressure to Philip Morris stock, the road may be rocky. This last quarter, sales of smokeless products as a whole did not live up to expectations. I think this is a temporary blip and ignores the diamond in the rough: Zyn (on its own) has the power to be a game changer for Philip Morris. It continues to beat management expectations (Q3 Earnings Call).

Ethical Note

The transition towards products like Zyn, though potentially reducing certain health risks, poses ethical questions. Zyn has been shown to deliver a much more potent dose of nicotine into the bloodstream. This can cause younger adults (whose brains are not fully developed yet) to become highly dependent on Zyn. While this is beneficial for sales, this is concerning for a long run reputation.

Big Takeaway

PMI’s strategic move to incorporate Zyn into its portfolio is a significant step towards a smoke-free future. It diversifies PMI’s offerings and positions the company well in a changing market, and the ethical implications of Zyn appear to be lower than other smoking alternatives that have been popular (Juul). The increasing consumer adoption and velocity of Zyn, reinforce PMI’s position as a leader in the smoke-free market, aligning with its goal of becoming substantially smoke-free by 2030. I think the stock is a buy, but ethical concerns need to be weighed before a purchase.

Read the full article here