Korean auto manufacturer Hyundai Motor Company (OTCPK:HYMTF) has rallied since I last covered the stock. Recent months have been more sobering, however, as another monthly sales shortfall put the company behind its annual sales growth target for 2023. The market’s indifference to the release indicates the impact of a China-driven slowdown, along with a broader economic slowdown globally, has already been priced in here. That said, labor troubles in the US could save the day – for context, production at the Detroit-3 (Ford (F), General Motors (GM), and Stellantis (STLA)) is currently being hamstrung by ~40% wage hike demands from the United Auto Workers (UAW) union. By comparison, Hyundai has managed its labor inflation without suffering any disruptions, most recently settling for a ~12% pay hike with its labor union.

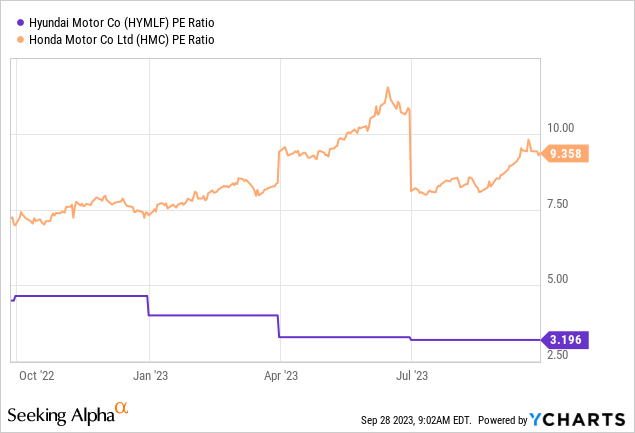

Beyond the near-term share gain opportunity from the UAW fallout, the rising production cost differential between the US and Asia should benefit Hyundai’s margins, given its diversified production facilities (higher weighting in lower-cost Asian countries like Korea, India, and China vs. the US). Higher for longer export margins also bode well for Hyundai’s ability to weather an auto downcycle in the coming months, as well as IRA-led hurdles (i.e., the US’ Inflation Reduction Act) on its planned EV transformation path. Yet, the current relative valuation discount (P/E of ~3x vs. ~9x for Japanese peer Honda (HMC)) seems to reflect none of these positives. Given the solid earnings base offered by the Hyundai Motor core business and attractive optionality from its ongoing EV transition, there’s clear re-rating potential here.

China Headwinds Weigh on August Sales Numbers

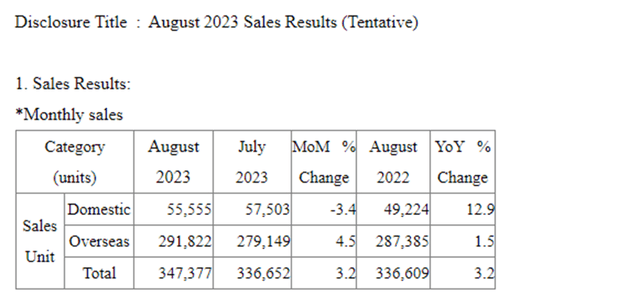

Hyundai reported some rather disappointing sales numbers to start the month. August was still up +3.2% YoY, and while it fell short of Kia Motor’s +5.3% YoY, the sequential monthly acceleration at Hyundai (vs a -2.0% decline for Kia (OTCPK:KIMTF)) was positive. In combination, the Hyundai/Kia duo (note Hyundai has a sizeable equity stake in Kia) saw sales growth of +4.1% YoY, also up from last month’s numbers. Yet, sales are tracking well below a full-year guidance bar that may be at risk of a downgrade – at +9% YoY on a year-to-date basis, Hyundai will need to pick up the pace significantly if it is to hit its combined +10% growth target for 2023.

Hyundai Motor

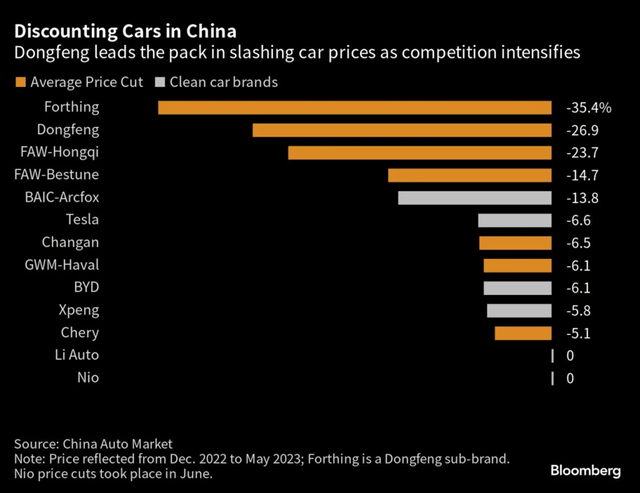

From here, there’s a risk that sales growth will continue its post-June deceleration. Volumes have been a key challenge amid the broader macro headwinds, particularly in China, where a property-led slowdown is taking shape. Margins are also under pressure as competitors step up their incentives to gain/retain share vs. maximizing profits. The Chinese EV market has been a key pain point in this regard, as price competition is fierce and foreign producers (ex-Tesla (TSLA)) have struggled to stay afloat. The silver lining is that Chinese sales go through equity-method joint ventures, partly shielding the negative P&L impact. In the meantime, resilient sales in other geographies, especially in the US, have provided some timely offset.

Bloomberg

UAW Strike Tips the Scales

On the whole, the US economy is in great shape, with Q2 growth running in the ~2% region and Q3 is expected to accelerate as high as +5.9% (albeit also due to a favorable base). By extension, the US auto market should also remain resilient through the coming months – even if we see one more round of interest rate hikes from the Fed. For foreign manufacturers like Hyundai, though, there’s a clear near-term opportunity to grab incremental share from the Detroit-3, as ongoing UAW strikes threaten to disrupt production for some time yet. Managing labor inflation will, thus, be a key competitive advantage going forward. Hyundai has a clear advantage here, given it has settled its contract negotiations on far better terms (+12% pay hike vs. the most recently rejected +21% offer from STLA) than the US manufacturers could hope for.

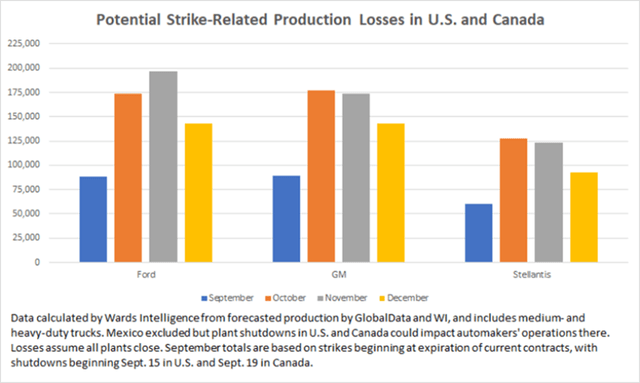

In the near term, both the UAW and the Detroit-3 are too far apart for a swift close, so expect tough, drawn-out negotiations and more escalation ahead. In a likely scenario where the Detroit-3 suffers production shortfalls, Hyundai should be able to make market share gains at their expense. The second-order impact from tighter supply and inventory balances also bodes well for the pricing environment. Alongside the Korean won’s continued depreciation vs. the USD, I see a path to near-term earnings upside for Hyundai.

Wards

The mid-term implication of UAW pressures is perhaps even more material for Hyundai’s earnings potential. Given the superior bargaining power of US labor unions, the wage gap between the Detroit-3 and Asian manufacturers like Hyundai looks set to widen significantly, boosting Hyundai’s relative competitiveness. So despite being at a disadvantage in terms of US IRA subsidies on the EV side (note Hyundai/Kia are ineligible for the $7.5k IRA tax credit), widening labor cost advantages should help offset some of the advantages for US-based manufacturers. Any upside to the Hyundai/Kia duo’s current high-single-digit market share, as well as an improved EV pricing backdrop, should help its transformation efforts, in turn supporting the case for multiple expansion.

Profit from UAW Disruptions with Hyundai Motor

Hyundai stock has sold off in recent months on concerns about peak earnings, and rightfully so, given August sales data leaves the company on track to miss its full-year guidance (+10% for Hyundai/Kia combined). But recent labor strikes in the US give Asian manufacturers a window of opportunity, and Hyundai is well-positioned to benefit. If recent news flow on labor negotiations with the UAW is anything to go by, the Detroit-3 could be set for prolonged disruptions across its US-based facilities.

To be fair, Hyundai hasn’t been immune from labor inflation pressures either, but its +12% pay hike settlement is a far better outcome than US manufacturers will probably land on. This bodes well for the company’s earnings power as long-term US production costs rise (vs. Hyundai’s Asia-focused production footprint) and erode the competitiveness of US-based manufacturers for the years to come. In turn, it also blunts some of the IRA subsidy challenges Hyundai has faced as it looks to make the EV leap ahead of its peers. The market has likely priced in most of the macro negatives at the current low-single-digit earnings multiple, leaving ample room for a narrowing relative discount vs. its Japanese peers.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here