Overview

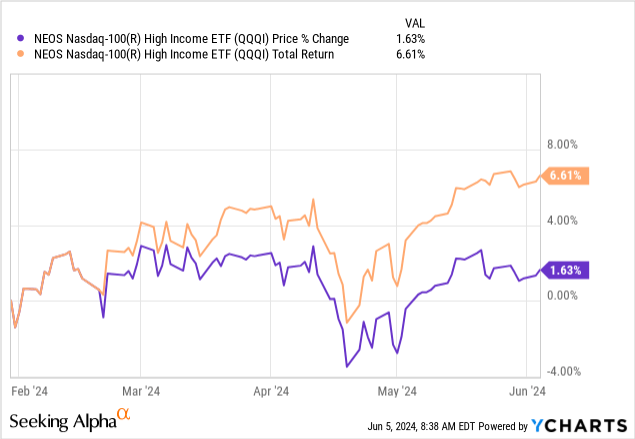

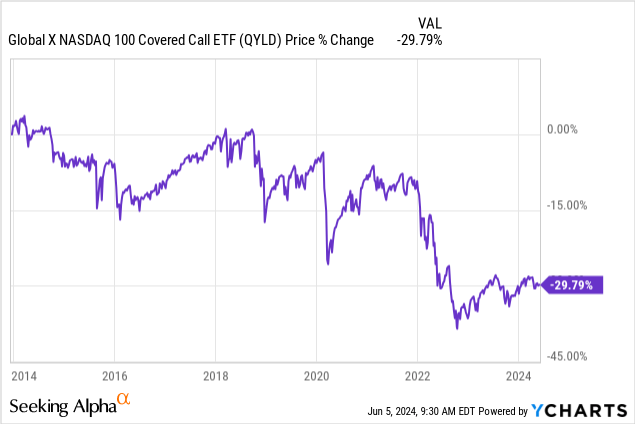

Covered call ETFs have been a great way to supplement any amount of income that may be produced from your portfolio of holdings. In my case, I have a basket of nearly 50 different traditional dividend stocks, REITs, Business Development Companies, and Closed End Funds and the high distribution yield collected from a covered call ETF would likely be snowballed into other areas of my portfolio. However, there are a ton of covered call ETFs out there that suffer from consistent deterioration of price. NEOS NASDAQ-100(R) High Income ETF (NASDAQ:QQQI) is a new ETF on the block with an inception dating back to January of 2024. Since it’s new, I wanted to take a fair look at QQQI to see if it’ll suffer the same price fate as similar covered call ETFs such as the Global X NASDAQ 100 Covered Call ETF (QYLD).

QQQI’s objective is to distribute high monthly income generated from its holdings that closely align with the Nasdaq-100 index. The fund generates this income with the data focused call option strategy. What makes QQQI different is that its option strategy may include both sold and bought Nasdaq-100 options that actually provide the possibility of upside price movement being captured from the underlying equities. This is because QQQI uses an out-the-money option strategy which allows for price upside to be captured, compared to an at-the-money strategy which does not. QQQI has a solid expense ratio, only totaling 0.68%.

The current distribution yield sits above 14.5%, making it a very appealing fund to investors looking to add high levels of income to their portfolio. Even better, the distributions are issued out on a monthly basis, which can be best utilized by investors nearing or at the retirement phase of their investing journey. This high level of income can be utilized in many ways but also comes with a few pitfalls, such as the upside capital appreciation being capped due to the option strategy.

Strategy & Vulnerabilities

The fund’s strategy is to align its holdings with the Nasdaq-100 index. This means that QQQI leans heavily towards the tech sector. The fund aims to invest at least 80% of its assets and collect the dividends and interest received to distribute them out to shareholders. However, the tech sector isn’t typically known for their sizeable dividend yields, so QQQI implements an ‘out-the-money’ option strategy to help generate the additional income needed.

The implementation of an out-the-money strategy is more efficient in my opinion because it helps capture more upside compared to an ‘at-the-money’ strategy. OTM strategies have strike prices that are above the current market price for the underlying equity or asset. This means that it has more room for the underlying asset to move up in value before the options are actually exercised. Conversely, an ATM strategy means that the strike price is close to the current market price and doesn’t have the same opportunity for upside appreciation.

OTM option strategies may have less of a distribution since these tend to have lower premium amounts that can be collected. However, I personally feel that this is a good tradeoff to make if it means a better risk profile and less price deterioration over long periods of time. ATM option strategies may generally have higher and more consistent yields, but those price charts look scary to me. Take a look at the chart of QYLD, which implements an ATM option strategy. I covered the risks of ATM ETFs in my last coverage of QYLD.

Despite the more preferable use of OTM call options, the strategy still has some price vulnerability. The price upside is essentially capped with this strategy, and QQQI will likely not capture any additional upside. This is because once the price reaches the strike price, the option is exercised and no additional upside is seen. However, you may still get all of the downside risk associated with the price movements of the underlying assets. Therefore, if the tech sector were to experience a large sell-off, QQQI would likely see a lot of this downside as well.

Therefore, if you are looking for a high-yielding asset class that can also provide a higher sense of capital appreciation, I do not think that QQQI may be the right fit for you. You have to be okay with the fact that you are trading off future capital appreciation potential for a higher income now. With this in mind, let’s take a look at the holdings within QQQI.

Holdings

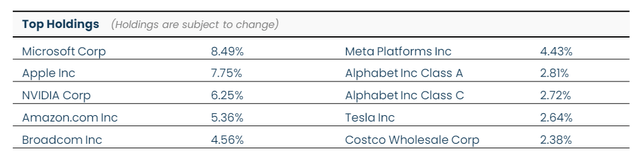

QQQI remains diverse with exposure man different industries. However, the technology sector accounts for about 51% of the exposure, which makes sense since the ETF aims to replicate the Nasdaq 100-Index (NDX). This is followed by the second-largest sector weighting being communication, accounting for 16%. Consumer cyclicals is the only remaining sector that accounts for a large slice of the exposure, sitting at about a 12% weighting.

Additionally, we see lots of top tier holdings as part of the top ten positions by weight percentage. We can see that Microsoft (MSFT) is the largest holding, which makes up about 8.5% of the total assets. This is followed by Apple (AAPL), accounting for 7.75% and NVIDIA (NVDA) making up 6.25%. This majority weight towards the tech sector actually helps create a higher distribution income, despite these holdings having little to no dividend yields themselves. This is because the option strategy benefits from higher levels of volatility, which is typically seen in tech stocks.

QQQI Factsheet

When volatility increases, so does the possibility of larger price swings in these individual holdings. For example, Nvidia has been one of the most volatile companies so far in 2024 and has experienced significant price growth. Higher volatility like this creates the opportunity for higher premiums to be collected from the options, since buyers are willing to pay more for the price protection that options provide. Additionally, covered call ETFs like QQQI are a great way to offset the risk of these highly volatile assets by providing a large stream of distribution income.

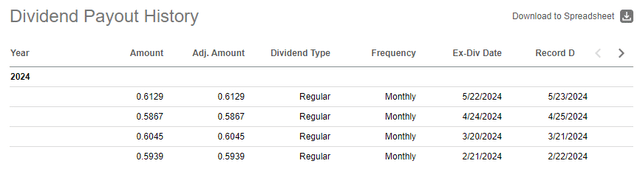

Dividends

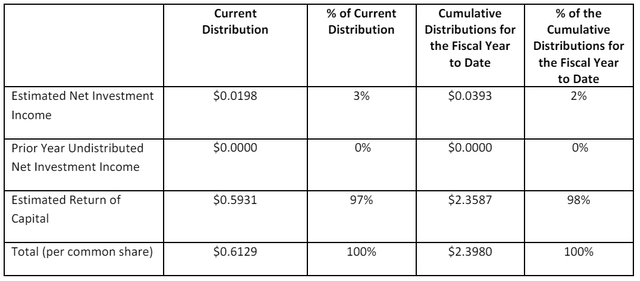

As of the latest declared monthly dividend of $0.6129 per share, the current dividend yield sits at about 14.5%. Since the history of QQQI is quite short, we don’t have much historical data yet to base any outlook on. However, it is safe to assume that the distributions may change month to month since they are fueled directly from the fund’s performance. Taking a look at the history, the distribution has stayed within a pretty consistent range so far, sitting between $0.58 and $0.6129 per share.

Seeking Alpha

Something noteworthy about the distribution received here is that it is mostly comprised of return of capital. Usually, return of capital is seen as a negative thing when it comes to closed end fund distributions because it means that the fund is funding the distributions with investors’ own capital. However, with a covered call fund like QQQI, this is simply a tax classification as a result of the income generated from the options within.

We can see that the distributions year to date were also slightly funded by the net investment income, which includes the dividends and interest earned through the holding of the underlying assets. The majority use of return of capital has its own benefit here, as this means that the income received is a bit more tax friendly.

QQQI 19a-Notice

This means that an ETF like QQQI can be utilized in both tax advantaged accounts as well as regular taxable brokerage accounts. However, you may still incur tax consequences caused by capital gains during the time of sale.

Outlook

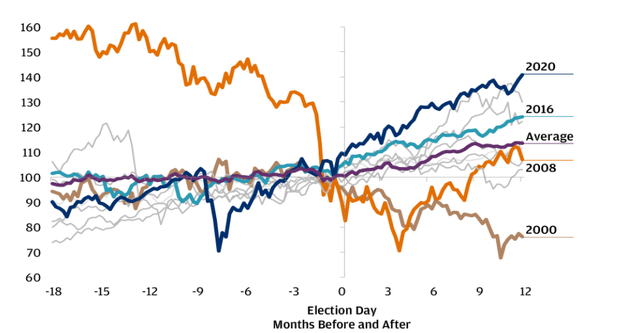

Since covered all ETFs tend to thrive in environments of higher volatility, I wanted to give some of my thoughts on how I believe the fund will perform going forward. With the US Presidential elections happening at the end of 2024, I think this will present high levels of uncertainty in the markets, which may translate to higher levels of volatility. While this volatility may be good for the income generation aspect of QQQI, data also backs the likeliness that the stock market generally moves up after elections are over. Therefore, we have the potential to benefit from increased income as well as some slight upside movement afterwards.

JPMorgan

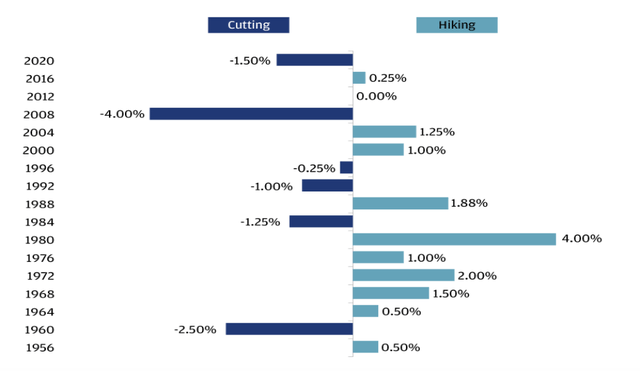

Additionally, we have ongoing talks about interest rate cuts. The Federal Funds rate still remains at its highest level ever over the last decade, and this is due to the hikes that rapidly took place at the mid-point of 2022. Inflation has started to show signs of cooling and unemployment remains low at the moment. I believe that we will likely see very light interest rate cuts by the end of the year and this aligns with many economist forecasts, who project there to be a cut as early as September of 2024.

I believe that interest rate cuts will propel valuation across the market higher. This is because as interest rates decrease, debt capital financing becomes more affordable to obtain through lower costs of debt maintenance. As a result, many companies across all sectors are able to pursue more growth initiatives that can fuel higher price movements. This includes higher amount of capital expenditure amounts, additional research and development, and acquisitions and expansion opportunities.

JPMorgan

Lastly, keep in mind that the Fed has either cut or hiked interest rates during most election years. While the past decisions have no pull on this year’s decision, it serves as a nice reference point that the Fed has historically made rate changes more frequently during election years than they have not. It’s worth mentioning because any talks of interest rates has historically caused higher levels of volatility in the markets, which are prime conditions for QQQI to generate higher income.

Takeaway

In conclusion, QQQI’s covered call option strategy presents the opportunity to collect a high 14% dividend yield. In addition, QQQI uses an out-the-money option strategy, which allows the ETF to capture some upside price movements during bull markets. This is a nice bonus when compared to the negative price deterioration that can be seen with covered call ETFs that use at-the-money option strategies. QQQI remains highly diverse but leans more towards the tech sector.

While this may present some concentration risk, it’s potentially offset by the fact that the tech sector typically experiences a higher level of volatility, which can benefit QQQI. With the US Presidential election on the horizon and ongoing talks around interest rates, I believe that market uncertainty will be high, causing the distribution rate of QQQI to sustain.

Read the full article here