As we bring September and the second quarter to a close, it looks like investors are in a sell-everything mood. Stocks and bonds fell yesterday for no specific reason other than that all news is being interpreted as bad news. JPMorgan Chase CEO Jamie Dimon warned that the U.S. is “not prepared” for 7% interest rates. Fed President Neel Kashkari asserted that there is a 40% chance that interest rates will need to rise “meaningfully higher” to defeat inflation. The juvenile gamesmanship in a scandal-ridden Washington is running the risk of another government shutdown, which could further damage the country’s credit rating. The list goes on…

Finviz

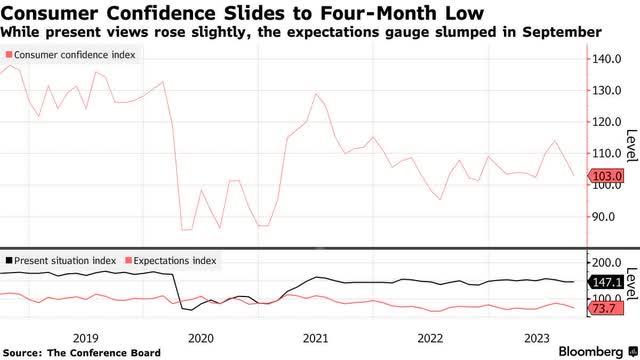

No wonder, confidence among consumers fell for a second month in a row, alongside the slide in stock prices. Scrolling through the headlines has been downright depressing in recent days. Yet the deterioration in confidence is concentrated on the outlook and not the present situation, which has been getting better. According to the Conference Board, the Present Situation Index, which is based on what is happening to current business and labor market conditions, improved! The Expectations Index fell back below a level that has historically been consistent with the onset of a recession. Imagine that?

Bloomberg

The warnings about an impending recession over the past year have been constant, and they have intensified the longer we go without one. Consumers have been inundated with these warnings, which despite being inconsistent with current conditions, make them understandably leery about the outlook. Still, survey results show that plans to buy autos remain at an elevated level and plans to buy appliances are trending up. This sounds like the start of the shift from services to goods spending that I have been expecting this fall.

As the next election approaches and the toxic political divide in this country intensifies, I suspect that consumer sentiment may deteriorate further. That said, I am going to stay focused on what consumers are doing rather than what they are saying, which is what dictates the state of the economy.

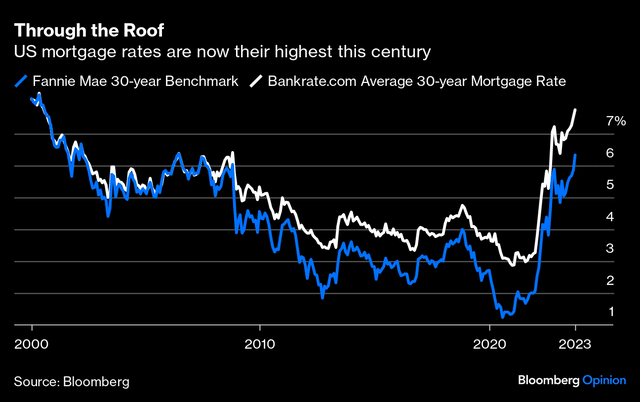

Yesterday’s new home sales number, which fell sharply below estimates, also raised concerns about the health of the housing market. With mortgage rates surpassing 7%, this should not have been a surprise. Shelter costs have been the stickiest component of the inflation gauge that everyone is complaining about, and higher borrowing costs are the solution. Current mortgage rates are killing demand, which should stall price increases and eventually lead to decreases, which will then result in lower mortgage rates as lenders compete for borrowers again. This is a cycle. The solution to high and rising prices is high and rising prices.

Bloomberg

The positive aspect of all this bad news is that its lessening should start to support risk asset prices as we begin the fourth quarter, setting the stage for a year-end rally. The major market averages are at or approaching oversold levels. If we have a government shutdown, it is not likely to last long. I expect softer economic data to start to reverse the rise in 2- and 10-year yields, weaken the dollar, and end the rally in crude oil prices.

When it feels like investors are selling everything, that is usually the best time to start buying, and as I’ve mentioned before there are $5.6 trillion reasons to do so. As investors recognize that the Fed’s rate-hike cycle concluded in July and that short-term interest rates have peaked, I expect investors will start to reposition money market fund assets that are earning a variable rate of more than 5% into stocks and bonds that are more likely to exceed that fleeting rate or return over the longer term.

Read the full article here