iShares Russell 2000 Growth ETF (NYSEARCA:IWO) is a passively managed investment vehicle that amalgamates small-size and growth factors. This is a precarious proposition, and the factor story inside its portfolio is not the one I like.

As we have seen earlier this year, the zeitgeist is fickle, and we certainly cannot say confidently that the growth-style era has finally returned, though some investors might have suggested it actually did when the S&P 500 bounced back from bear market territory amid abating inflation and premature hopes for interest rate cuts. And when conditions are fluid and there is no clear winner in the bull/bear battle but investors do not want to exit equities completely, I believe the most optimal factor combination they should consider is value plus quality.

And, as I will illustrate below in the note, IWO scores poorly against both value and quality indicators, as almost nothing has changed since my previous mostly neutral yet nonetheless skeptical coverage that was published more than two years ago. It is important to note that over that period, the fund performed dismally, declining much more than the S&P 500.

Seeking Alpha

IWO strategy

The keystone of the iShares Russell 2000 Growth ETF’s investment strategy is the Russell 2000 Growth Index, which it has been tracking since its inception in July 2000. IWO’s expense ratio of 24 bps is adequate.

As described in the prospectus:

The Underlying Index measures the performance of equity securities of Russell 2000 Index issuers with higher price-to-book ratios, higher sales-per-share historical growth and higher forecasted growth relative to all issuers included in the Russell 2000 Index.

More details on the nuanced process can be found in the methodology document on the LSEG website.

As I have already clarified in the previous note, even though the index’s simplicity translates into lower turnover, the flipside is that 1) the P/B multiple it relies on is certainly not the best one, to say the least, and 2) industries do have sizable valuation differences, which are ignored by it.

Under the hood: A complicated factor story

Regarding factors, there are a lot of disproportions in this portfolio. But first, I should remark that what is worth understanding about IWO is that it is not a small-cap portfolio at all.

On the IWO website, it is said that the index is:

composed of small-capitalization U.S. equities that exhibit growth characteristics.

But my analysis (based on 994 holdings out of the total of 1,070, with a 99.5% weight) showed that the fund has both micro- and small-cap echelons represented (1.46% and 25.4% of the net assets, respectively), but the weighting schema of its underlying index resulted in a pronounced tilt toward mid-caps (market value above $2 billion). So the weighted average market cap of $3.4 billion clearly illustrates this issue.

Second, it is not a straightforward task to assess IWO’s exposure to the value and quality factors. Let me provide some context with the following table:

| Metric (weighted-average) | 15-Nov |

| Market Cap | $3.4 billion |

| EY | 0.81% |

| P/S | 131.1 |

| EPS Fwd | 14.37% |

| Revenue Fwd | 18.13% |

| ROE | -0.85% |

| ROA | 0.05% |

Calculated by the author using data from Seeking Alpha and the fund; financial data as of November 17

I see three key problems here: A meager earnings yield, a completely nonsensical Price/Sales above 100x, and a surprisingly negative Return on Equity. Obviously, we need either a different methodology or a few adjustments to the data we have, or both to arrive at more reliable metrics.

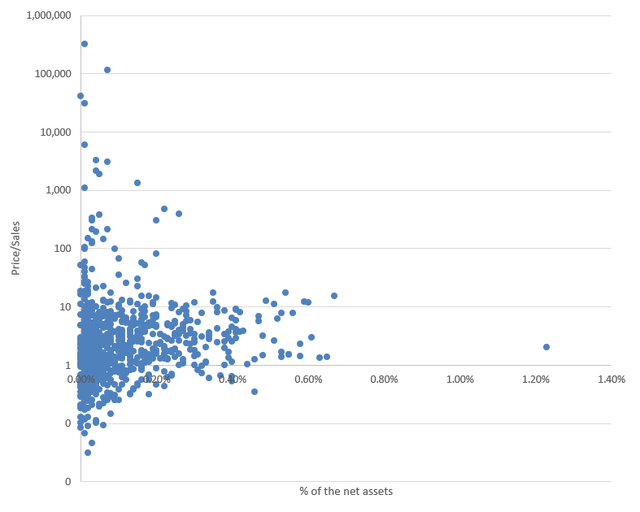

Let me elaborate on the P/S. The issues here are that IWO has exposure to 1) companies without revenues, predominantly from the biotechnology industry, like RAPT Therapeutics (RAPT), 2) a few outliers with microscopic revenues and six-figure P/S, like Keros Therapeutics (KROS) with its P/S of ~108,920x. Owing to these issues, I used the log scale for the chart below; importantly, the chart excludes companies without a P/S ratio (2.36% of the net assets).

Calculated by the author using data from Seeking Alpha and the fund

So a possible, and perhaps the simplest, solution is to apply the median ratios. The median P/S of this portfolio is about 1.93x, while the median EY is 1.4%. These figures are much more realistic, but hardly appealing nonetheless. Also, assuming over 28% of the holdings have failed to eke out even a meager net income in the last twelve months, I suppose we should replace the negative EYs with zero; in this case, it will go up to 3.7%. Still, a quality-light ETF offering an even more stretched P/E than the S&P 500 (26.9x vs. 22.7x) is definitely unappealing.

Another solution, and obviously a superior one, is to use Seeking Alpha Quant Valuation and Profitability grades; the latter is a solid measure of quality, as in IWO’s case, we cannot rely on its ROE distorted by debt-heavy and loss-making names.

| Parameter | 17-Nov |

| Quant Valuation B- or better | 14.1% |

| Quant Valuation D+ or lower | 58.97% |

| Quant Profitability B- or better | 61.74% |

| Quant Profitability D+ or lower | 12.1% |

And I am hardly impressed again. A mid-cap portfolio with just around 14% of the holdings having an attractive Valuation grade is a pass. Quality here looks not that bleak, with almost 62% of the companies having robust margins and capital efficiency. Nevertheless, there are other facts not to miss:

- 28.1% are unprofitable,

- 17.7% of companies (outside the financial sector) burn cash over the last twelve months,

- 17.8% are EBITDA-negative.

The silver lining: IWO delivers on the growth front

Though IWO’s median forward revenue growth rate looks relatively low (by growth style standards) at just 10%, it would be myopic to focus only on it. In fact, there are a lot of solid growth stories beneath the surface. For example:

- a weighted-average forward revenue growth rate of 18.1% looks robust, mostly thanks to the quarter of the net assets allocated to the companies with at least 20% growth rate,

- pundits expect no less than a 20% forward EBITDA growth rate from approximately 25.4% of the holdings, while EBITDA contraction is forecast for only ~4.6%,

- 24.6% should deliver an EPS growth rate in excess of 20%.

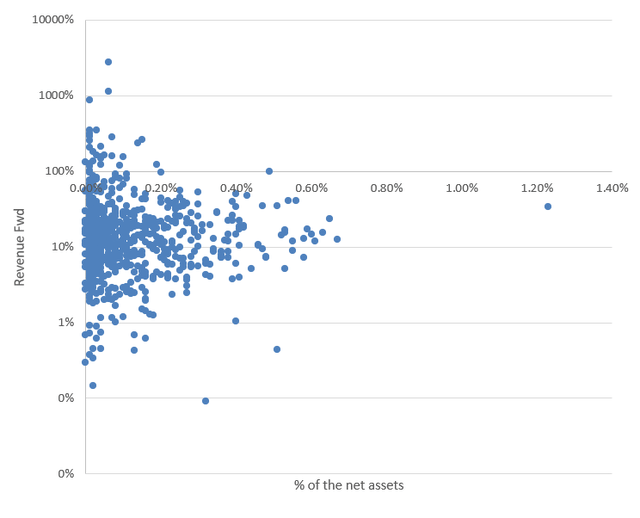

The following chart should give a bit more color on portfolio-wise revenue growth rates; an essential remark here is that negative figures (10.3% of the net assets) were removed.

Calculated by the author using data from Seeking Alpha and the fund

Performance discussion

Today I would like to focus on annualized returns. Alas, IWO was incapable of outcompeting the iShares Core S&P 500 ETF (IVV), iShares Russell 2000 ETF (IWM), and Invesco QQQ Trust ETF (QQQ) delivering a notably lower CAGR over the August 2000 – October 2023 period.

| Portfolio | IWO | IVV | IWM | QQQ |

| Initial Balance | $10,000 | $10,000 | $10,000 | $10,000 |

| Final Balance | $31,561 | $45,357 | $44,553 | $45,830 |

| CAGR | 5.07% | 6.72% | 6.64% | 6.77% |

| Stdev | 21.71% | 15.32% | 20.08% | 22.91% |

| Best Year | 49.42% | 32.30% | 47.90% | 54.68% |

| Worst Year | -38.50% | -37.02% | -34.13% | -41.73% |

| Max. Drawdown | -55.73% | -50.78% | -52.46% | -79.61% |

| Sharpe Ratio | 0.27 | 0.4 | 0.34 | 0.33 |

| Sortino Ratio | 0.37 | 0.57 | 0.49 | 0.47 |

| Market Correlation | 0.91 | 0.99 | 0.92 | 0.88 |

Data from Portfolio Visualizer

For a better context, below is the data from the 10-year period. Here, IWO outperformed IWM slightly but lagged other funds dismally, while its max drawdown was the deepest.

| Portfolio | IWO | IVV | IWM | QQQ |

| Initial Balance | $10,000 | $10,000 | $10,000 | $10,000 |

| Final Balance | $17,405 | $28,712 | $17,241 | $46,258 |

| CAGR | 5.70% | 11.12% | 5.60% | 16.55% |

| Stdev | 20.22% | 14.94% | 19.76% | 18.19% |

| Best Year | 34.68% | 31.25% | 25.39% | 48.40% |

| Worst Year | -26.26% | -18.16% | -20.48% | -32.58% |

| Max. Drawdown | -33.55% | -23.93% | -32.29% | -32.58% |

| Sharpe Ratio | 0.32 | 0.7 | 0.32 | 0.87 |

| Sortino Ratio | 0.46 | 1.08 | 0.46 | 1.44 |

| Market Correlation | 0.9 | 1 | 0.91 | 0.91 |

Data from Portfolio Visualizer; the period is November 2013-October 2023

Final thoughts

The iShares Russell 2000 Growth ETF might theoretically be a nice choice for growth maximalists who pay little to no attention to value, as if multiples can expand ad infinitum. However, even investors who are seemingly ready for frenetic price swings and painful drawdowns should understand that IWO is rife with loss-making biotechnology names (its overall allocation to the healthcare sector is ~20.7%) that are yet to deliver meaningful revenues, or revenues at all, with their performance being driven almost exclusively by catalysts that are hard or even impossible to quantify. Overall, I remain skeptical about the strategy; the Hold rating is maintained.

Read the full article here