Taking risks doesn’t mean shirking responsibility, but embracing possibilities. – Vick Hope

High beta names often get people excited because of price action, but the reality is that studies show low beta, steady stocks tend to have far better risk-adjusted return relative to their beta over time. Sure, you can certainly try to time higher beta names, but why bother when conditions suggest we are closer to an accident for the stock market in some time?

The Invesco S&P 500® High Beta ETF (NYSEARCA:SPHB) is an equity exchange-traded fund primarily focused on the high beta stocks in the S&P 500 Index. To put it simply, beta is a measure of a stock’s volatility in relation to the overall market. The higher the beta, the higher the volatility exhibited by a specific stock.

SPHB is constructed based on the S&P 500® High Beta Index. It commits to investing at least 90% of its total assets in the securities that form this Index. The Index itself is a product of S&P Dow Jones Indices LLC, which identifies the 100 stocks from the S&P 500® Index that have demonstrated the highest market sensitivity or beta over the past 12 months.

The fund and the Index are rebalanced and reconstituted four times a year in February, May, August, and November.

High Beta and Market Cycles

High beta stocks can provide a leverage-like effect on returns. When the market is making a sharp upward move, you might expect to gain a little extra return. Conversely, when markets drop, you may lose more than the market.

This does not mean that if the market has a long-term upwards bias, you will receive higher than market returns over the long term. The reason for this is that beta is a number calculated from trailing returns, and it can change over time. Just because a stock had a high or low beta does not mean it will maintain that status.

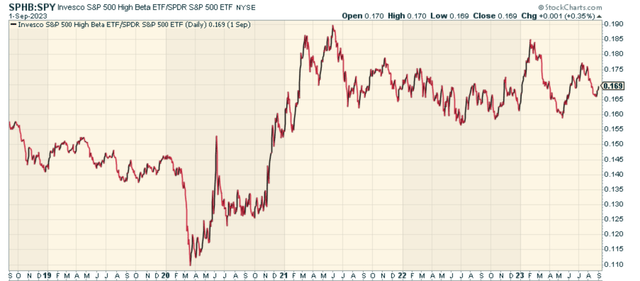

If we look at SPHB relative to the S&P 500 (SPY), we can see the relationship has been in a huge sideways trading range since 2021. More beta, more risk, same results as a beta of 1 with the index.

Stockcharts.com

SPHB: A Closer Look

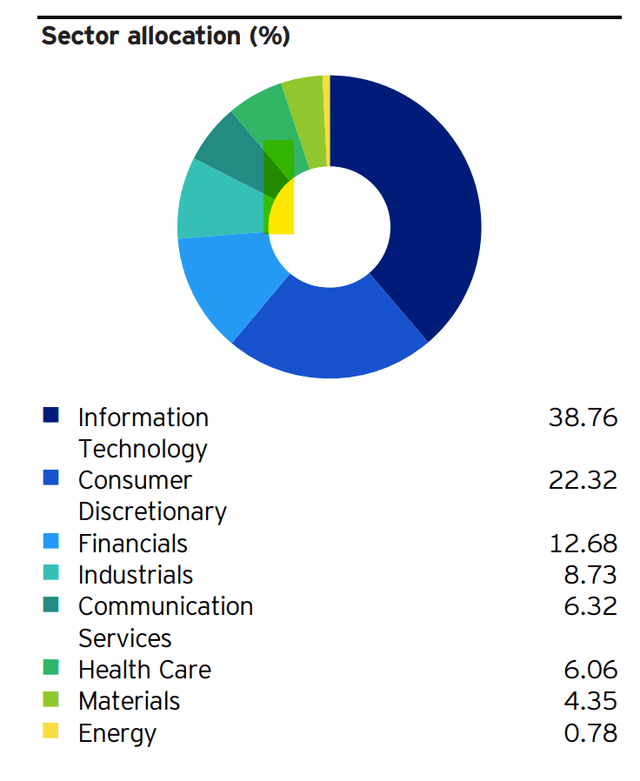

When we look at sector allocations, it should come as no surprise that Tech is the biggest part of the ETF, followed by Consumer Discretionary. Tech has been the clear winner in this year’s market performance, but the question ultimately is whether or not you want to chase it right now. I wouldn’t personally.

invesco.com

Conclusion

Investing in SPHB can be a rewarding yet risky endeavor. Its high beta nature makes it a potentially lucrative investment during bull markets and market rallies. However, it’s crucial to consider the high level of risk associated with investing in high beta ETFs, particularly in extended sectors like Technology at this stage of the cycle.

I would much rather consider its counterpart, the Invesco S&P 500 Low Volatility ETF (SPLV), where the top weighted sectors are defensive low beta areas in the Consumer Staples, Healthcare, and Utilities space with solid dividends now. Maybe you can make money in SPHB, but the investment case just isn’t there right now.

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here