Dear subscribers,

In this article, I mean to update my thesis on Kering, a French luxury giant. I’ve been an investor in French luxury for years. This has included purchases of LVMH (OTCPK:LVMUY), Pernod (OTCPK:PRNDY), Remy Cointreau, and others. Some of these companies, like LVMH, have been a part of my conservative investment portfolio for years. Others, like Pernod, are relatively new, taken in only because the valuation has finally become compelling, and I now believe the company to offer significant value for what is being priced here.

But this article is an update on Kering after about 3 months since I staked out my first position. I remain convinced that the best investment approach that you can have. A few weeks ago, when the company “cratered”, during mid-June or thereabouts and was close to below €300/share, I bought more. Unfortunately, this undervaluation did not last – and now we’re back to €330/share. However, this is still what I would consider cheap for the long term for Kering.

Why is this, and what makes Kering such a great investment now, despite the fact that it has declined from around €800/share back in 2020-2021?

That’s what we’ll find out here.

But to put it simply, I believe this company is worth around 40-50% more than we’re currently seeing – even at this share price, and that Kering has a quite significant upside.

You’re also, I believe, being paid quite handsomely in order to wait here, because unlike some luxury businesses, Kering has a 3.5%+ dividend – which is a real kicker (in a good way).

So let’s see 1Q and calculate some upsides.

Kering – A company worth your money, if you’re in it for the long haul

To be clear, I don’t see Kering as being “as good” as LVMH. LVMH is the market leader in French luxury. So when LVMH is cheap, I buy that, not Kering. Kering is a French-based multinational business, much like LVMH, that specializes in Luxury goods. Again, much like LVMH. But Kering is far more focused than LVMH, which for Luxury brands, in my view, is not necessarily a good thing. The risk of concentration when you’re not only “sector-“focused, but also brand-focused, is elevated.

Kering remains focused on the following brands.

-

Gucci

-

Balenciaga

-

Bottega Veneta

-

Yves Saint Laurent

-

Creed

-

Alexander McQueen

Naturally, these are very high-quality brands. Unfortunately, even though some of them are noteworthy in their own right, Kering remains mainly a Gucci company. Also, there’s some anecdotal difference here, because I use quite a few LVMH products, but really only one “type” of Kering products – the Creed Maison perfumes. But that’s pretty much where it begins and ends. I do not use any other brands the company owns, and it does not seem much like “Me”.

Kering is also significantly smaller than LVMH. With less than €20B in revenues, it doesn’t even crack “close” to LVMH here, and it also cannot match LVMH for margins – not even close, in fact.

However – with that out of the way, Kering is a very solid company, with almost 25% EBIT margins and over €2B in annual generated free cash flow, employing nearly 50,000 people.

Since my last article, we have 1Q, so let’s focus on that.

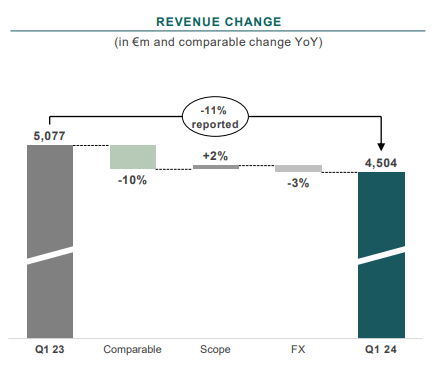

Revenues for 1Q were not as good, not even as little a drop, as I expected. The company, in fact, dropped more than I expected, with an 11% reported and 10% comparable revenue drop.

Kering IR (Kering IR)

What was the reason for this?

Weak macro, for one. The company is still in a situation where wholesale is down, weak traffic numbers are weighing on retail, and as you can see, FX is negative as well. The only positive was, ironically enough given that’s the one brand I use, Creed.

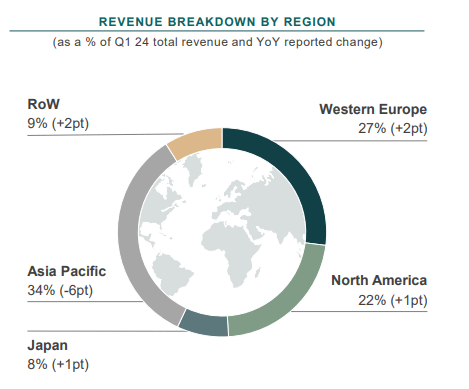

In regional trends, we’re seeing a similar development to LVMH. APAC/Asia is a problem, especially China, while Western Europe, NA, and Japan are…mostly in line with YoY, which isn’t exactly good, but it’s “decent enough” at this time.

Remember, out of the company’s brands and around €4.5B in quarterly sales revenues, over 45% of that is Gucci. If LVMH had even close to the same sort of concentration, I’d view this as risky as well. Also, Kering has a less favorable sales mix than LVMH in terms of geography.

Kering IR (Kering IR)

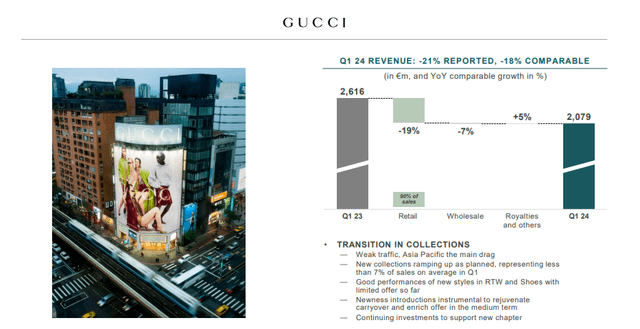

The perhaps biggest issue is that the company’s biggest segments, wholesale luxury, is down. It would be like LVMH Leather goods being down. The eyewear is working fine, and royalties/others are contributing well, but the core segment is not doing well – and retail is the reason why it’s not doing well.

Kering IR (Kering IR)

Taking the bull by the horns, we see that the company is attempting to course-correct with new collections ramping up and new investments to support better sales. Until we see that, however, and I believe we’re unlikely to see it this year, Kering definitely deserves a lower valuation than LVMH and other luxury brands seeing how low earnings are going here. Saint Laurent is unfortunately no better, except with slight sequential improvements in certain geographies.

Instead, the company’s smaller brands are holding up what can be held up (for the most part, Balenciaga is not exactly doing well).

Kering is, for the time being, between a rock and a hard place – at least for this year and possibly next. 1Q24 was not an improvement, which led to further decline. It means that we currently have a 1-year TSR of negative 32.5% (Paywalled TIKR.com Link).

The notion that the company should be worth €800 as it was trading a few years ago is laughable here, given sales and performance trends. The company also won’t comment on the consensus return to growth for 3Q, which is what many analysts, including me, were hoping for. The company did comment that it considered a return to growth realistic, but less in terms of phasing – and a margin that will trend between 24-25%. There’s currently an overall muted demand for Gucci and specifically core Gucci lines – and I’m far from the only analyst to see this.

We knew and we always knew it would be a slow buildup in terms of the proportion of the offer that comes through, which is new. But can you just talk about if there are any signs of improvement of traffic or interest coming back to the core Gucci lines? Or is it just too early?

(Source: Louise Singlehurst, 1Q24 earnings call)

There’s no real comment or answer as to when this can return – though I will admit, and point out, that much of this downtrend is in fact Asia, and it’s not unique for Kering – it’s only affecting Kering more in part of its Asian-heavy sales mix.

We don’t have more clarity in 1Q, which is why I maintain my previous valuation thesis for Kering, which was as follows.

Valuation for Kering – once Gucci recovers, and once Asia recovers, the upside will be there

The main difference to my last article about Kering is that Kering is now “cheap”. I’m also, due to the poor sales performance and lower-than-expected results, including now the company going “lower” than expected. My new PT for the company is now €480/share – though this still marks a clear upside.

The dividend has also risen – it’s now at 4.18%, and the company’s fundamentals are of course intact. None of the sales performance negatives have significantly impacted these – with the credit rating being A-, the long-term debt/cap being 44%, and the averages in terms of valuation still being at 21-22x for the 5-10 year average.

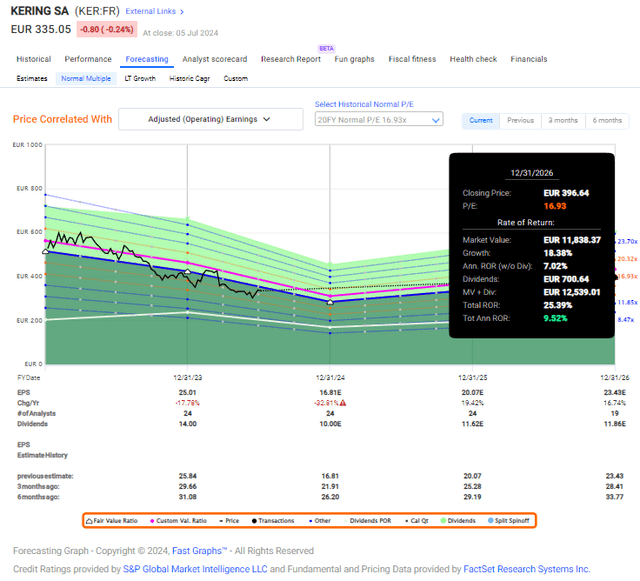

Of course, if Kering “wants” to be considered at that level, they can’t have negative earnings trends and poor growth – or it won’t be worth 22x. In 2023 and expected in 2024, we’re seeing a negative annualized EPS growth of 18% for 2023, and currently expecting 33% for 2024. The company is currently being traded at 16x P/E, which is one of the lowest-available valuations for a European/French luxury company.

At the same time, the discount is understandable because we want to see signs of a turnaround before I’d be willing to consider it a huge multiple.

However, it’s worth mentioning here that Kering typically outperforms market expectations by more than 25% both on a 1-year and 2-year basis (Paywalled F.AS.T Graphs link), and mostly otherwise hits its targets.

So if you believe that Gucci has a good potential for a turnaround, then I can tell you that anywhere from the 16-25x P/E range, you’re getting a positive annualized ROR, if we expect the brand to recover in 2025-2026 (which is the current expectations).

F.A.S.T Graphs Kering Upside (F.A.S.T Graphs Kering Upside)

What you see here is a good illustration of the upside for Kering on a forward basis, and the lowest potential P/E that I consider valid for the company. Again, this is the lowest – not something I consider realistic for the company; otherwise I wouldn’t be investing in it.

Instead, I would forecast Kering at 19-20x P/E, around the 10-year average, which implies an upside of 16.7% here. That, for any company of this sort, is attractive at the very least. Other analyst estimates are more conservative than mine – but still consider this company to be undervalued.

We can also look at other analysts overall. 24 S&P Global analysts follow the native Kering ticker of KER. They give the company a target of €300 low, which has been cut quite a bit since my last article, and a target of €575 high. The average is still around €375, with 8 analysts out of 24 at either a “BUY” or “Outperform”/similar rating.

I can understand the logic behind the cautious approach here, given that we’re in for a 2024E where further drop might be coming – and as things stand, I don’t even consider it all that certain that the turnaround will come in 2025. But my main question here is if Kering is worth more than €330/share – and to this, I say “yes”.

Kering, given all of the great brands that it owns, and the future potential of these brands, is worth at the very least €475/share, if not as much as €600/share or above €600. Until that time materializes, I’m happy to hold it at a YoC of 3.85%, which is where I currently am, and likely to invest more into the company.

My updated thesis for the business as of July of 2024 is as follows.

Thesis

-

Kering is a very sound luxury company, and the owners of one of the top-3 luxury brands on earth, Gucci. The company is A-rated, has a relatively low leverage, and a yield that is well above the average, at over 3.7% at this time.

-

Based on a look at primary company risks and upside, I consider the company to have an asymmetrical upside relative to its risk/downside. I see an upside of at least 15-20% per year, and at those rates, I’m allowing it a lower valuation than LVMH or other similar businesses.

-

Kering is a “BUY” and a good one. I give the company a PT of €480/share for the native, and I recently bought my first position in the company. I am, however, lowering my share price target due to the lackluster 1Q24, and the lack of any real visibility for a significant turnaround.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills every single one of my criteria. I consider Kering cheap at below €350/share for the native ticker.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here