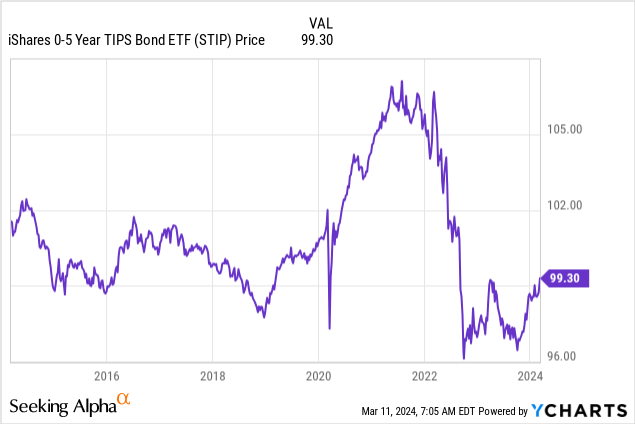

In this update from our pre-December Powell coverage, the iShares 0-5 Year TIPS Bond ETF (NYSEARCA:STIP) is a TIPS portfolio with the right duration to be able to speculate on medium-term developments in macroeconomic conditions. Long-term real rates are super hard to predict as there is so much uncertainty around the long-term factors that influence those rates, including longer-term inflationary factors. STIP has a shorter duration of around 2.43 years, which means the primary impact on this ETF will come from changes in short-term real yield expectations, which means rate policy and inflation dynamics, which are partially but not fully related as rate policy also refers to a growth mandate in the US, are going to be the focus for speculators with STIP. We think the decisive factor is maturity walls. If that has been the thing stopping Fed policy transmission so far into the real economy, when those walls come due, we may see the need to reduce rates to save growth. We think it’s possible that inflation is going to be stickier with respect to changes in underlying demand than before due to long-term inflationary factors. This combination would be good for STIP. It’s super efficient from an expense ratio perspective too at 0.03%.

Explaining The Logic

The 2.43-year duration means that what really concerns this ETF is the change in real yields within the 2-3 year horizon, since 2.43 years is when the effective maturity of the portfolio. Changes in the real yields before the effective maturity will influence the prices of these instruments and the ETF performance. Increases only in forward real yields beyond that mark will be good for the ETF, since it will roll over its funds into higher-value instruments. But we’ll focus on real yields over the next 2 years or so.

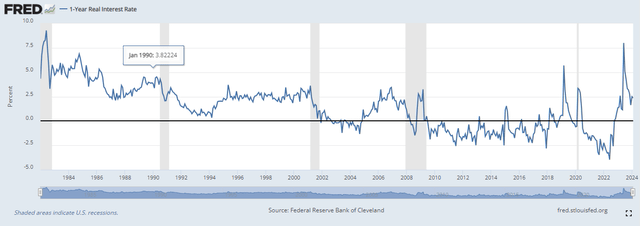

STIP really suffered in 2023 as that’s when real yields started getting rather than high, which we can approximate with the 1-year real yield chart.

1-Year Real Yields (FRED)

They did start to recover, but real yields are still generally quite high in the short term, around the levels after the onset of the GFC. Conditions are, of course, very different. Now we have inflationary not deflationary conditions, and rate policy was focused on accommodation, not on restriction.

Real yield falls when the gap between interest rates and inflation rates falls. We are in a situation where markets are likely expecting rates to fall with inflation coming down to policy levels. Interest rates are not close to former levels, while inflation in percentage terms is not that far away from policy limits, although it has been quite sticky, which is an important issue.

STIP will perform at this point if rates start to fall, and inflation actually doesn’t fall that much. We think the conditions for that situation relate very much to Powell’s change in tone at the meetings at the turn of the year, which we studied carefully. The Fed seems to believe that its growth mandate may come front and centre while hoping that the inflation battle is on the way to being over at above-average restriction. We know that this was their hope as they referenced inflation expectations for 2026 and further out, which, we thought, was ridiculous and wishful. We do not believe the inflation battle is over. The US economy has been resilient, so there was little evidence of that happening yet, although optimism has been renewed by the latest job reports which show unemployment ticking upward, but wage growth still being substantial. The substantial wage growth and consistently higher than policy rate expectations are two reasons why we think the inflation battle’s odds continue to be systematically underestimated. We think that inflation may even be stickier than expected in the face of greater recessionary pressures. That would be ideal for STIP: stickier inflation but still the need to cut rates to meet the growth mandate. We believe this is the likely outcome, that sticky inflation will need a recession in order to even hit the policy target at all due to inflation’s stickiness, but that rates may need to fall precipitously to respond to what could be substantial recessionary pressure from maturity walls.

So far, the only outstanding factor that could explain the seeming ineffectiveness of the Fed policy from transmitting into the levels of economic activity is the fact that a lot of household debt is fixed rate, like in mortgages. Same with corporate debt. However, we know for a fact that there are corporate debt maturity walls incoming. A huge proportion of debt needs to be refinanced in 2024 and 2025. As this gets refinanced, the effect of higher rates will hit home for corporates, which may affect employment and may finally cause a real recessionary pressure that does the job of finishing the inflation battle, but also creating concerns over commercial real estate and real estate in general which is super sensitive to employment data, as the mortgage industry is super sensitive to employment data. Powell has referenced the real estate market repeatedly.

Bottom Line

We think inflation is quite sticky because of union wage increases which are long-term contracts, but to a greater extent because of year-out and two-year-out inflation expectations still being high, which will factor into any long-term contracting. The recession will not be dramatically disinflationary. However, a recession will require the Fed to lower interest rates, and we think a recession could hinge on the maturity walls. This year will be decisive. If our speculation over the sequence of events is right, STIP is a good pick because real rates will fall, and you don’t have to make too many judgements about long-term real rates. While deglobalisation is a long-term inflationary pressure, the rate policy will depend on so many other factors that the outcome of real rates is hard to predict. STIP isn’t going to be influenced by the long-term outlook, and we feel that it is quite a narrow bet on the maturity wall factor, which we’ve explained. We reckon there’s potential here, and that real rates may have to get lower than normal to deal with a recession due to the possible shock of the maturity walls given the current rates by the Fed.

Read the full article here