Summit Therapeutics Inc. (NASDAQ:SMMT) is a project of biotech billionaire Bob Duggan, who made his money when he sold Pharmacyclics and its BTK inhibitor blockbuster Imbruvica to AbbVie (ABBV) for $21bn in 2015. Investors initially lined up to buy SMMT shares given the success of Pharmacyclics, which had Imbruvica to sell. I doubt whether the once antibiotic targeting and currently oncology developer Summit holds any asset equally worthwhile.

I covered the bases in my previous article, “Summit Therapeutics: Another Billionaire Project That Isn’t Going Anywhere.” It briefly goes thus:

For a number of years, Summit Therapeutics was a developer of antibiotics for the treatment of multidrug resistant infections. Before or during that, they were also developing a DMD treatment. All these programs failed, but the company didn’t go down with their programs. Although they were trading well below $1 for a major part of their existence, they managed to get themselves reborn – not once but twice. Their latest rebound happened after they abandoned the infectious disease program, purchased an oncology asset from Akeso, and turned into a developer of oncology therapeutics overnight. Not only that, this inexpensive company even managed to cough up nearly half a billion dollars for this asset that they purchased, Ivonescimab. And they ended up with a $1 billion+ market cap.

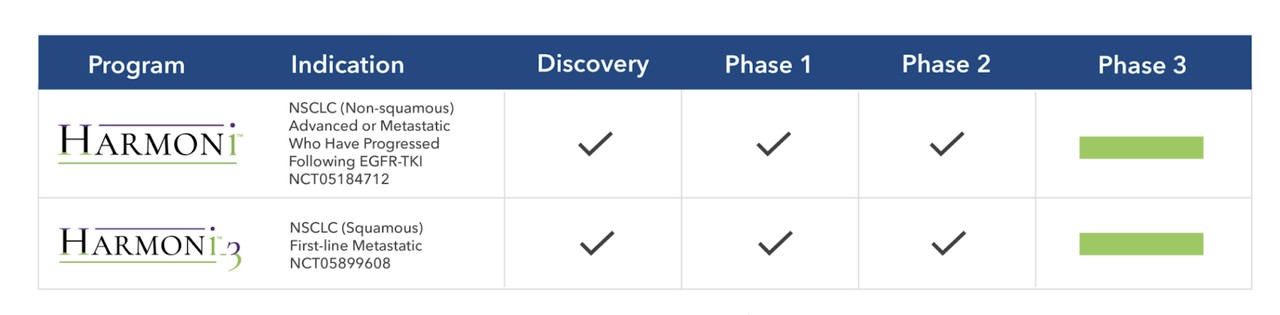

All this is possible because they have a billionaire in tow, however, no billionaire can save a company with sorry-looking data. Speaking of which, the current pipeline of the company looks like this:

SMMT PIPELINE (SMMT WEBSITE)

Ivonescimab is a PD-1/VEGF Bispecific Antibody that was being developed in China by Akeso, and completed phase 1 and 2 trials in that country. Summit plans to begin phase 3 trials with this molecule. Thus, whatever data I am going to find out now has come from trials in China. As everybody these days knows, Chinese clinical data isn’t of much value in the U.S. these days. So Summit has to start from scratch.

There are no PD-1 based bispecifics approved in the U.S. In phase 2 trial, this was what the molecule did:

As presented at ASCO 2022, ivonescimab treatment was associated with an overall response rate (ORR) in a Phase II study in patients with NSCLC who have failed EGFR-TKI’s of 68.4% and a median Progression-Free Survival (mPFS) time period of 8.2 months when combined with combination chemotherapy (pemetrexed and carboplatin) as compared to historical mPFS of 4.3 months in patients treated with combination chemotherapy (pemetrexed and platinum-based chemotherapy) alone, the current standard of care. In a separate cohort, ivonescimab combined with docetaxel in patients who have failed PD-(L)1 and chemo therapies demonstrated a mPFS of 6.6 months as compared to a historical mPFS of 4.5 months with docetaxel alone, a current standard of care regimen for these patients. The study which similarly had patients receiving ivonescimab plus chemotherapy as their first line therapy for metastatic disease, was considered to have demonstrated a tolerable safety profile and a low discontinuation rate for adverse events.

However that may be, the deal is huge – perhaps inordinately so. Akeso received US$500 million in upfront payment and could receive up to US$5 billion including regulatory and commercial milestone payments. This, from a $1.3bn biopharma for a yet-untested molecule is a bit of overspending. Compare that with some of the major biopharma deals of 2023 – here – and you can see what I mean. Entire companies have been bought for a fraction of that amount.

The company has been making efforts to add value to its new acquisition. As part of that, they have already begun two phase 3 registrational intent trials, one of which has already dosed its first patient. This is with Ivonescimab combined with chemotherapy in patients with epidermal growth factor receptor (EGFR)-mutated, locally advanced or metastatic non-squamous NSCLC who have progressed after treatment with a third-generation EGFR tyrosine kinase inhibitor (TKI) (“HARMONi” trial). The other one is Ivonescimab combined with chemotherapy in first-line metastatic squamous NSCLC patients (“HARMONi-3” trial), which will dose patients later this year.

I went through the company’s latest earnings call. Note that this call had no analyst participation, none at all. There was a lot of stuff about “Team Summit,” which is basically the people who developed Imbruvica over a decade ago. However, valuation-wise, there’s really nothing besides Ivonescimab’s Chinese trial history, which is competitive but not definitive.

Financials

Summit Therapeutics Inc. has a market cap of $1.3bn and a cash balance of $220mn. They spent $9mn in R&D and $6mn in G&A, which gives them a cash runway of over 14 quarters. Of course, that is going to change as they progress with their two phase 3 trials.

In my previous article, I discussed some of the weird finances of SMMT. Apparently, Bob Duggan funded $420mn out of the $500mn paid to Akeso upfront, and then he was given shares of the company in exchange. He owns nearly 80% of the company now, which is good in a way because with his huge stake, he will be extra cautious about the company’s future. On the other hand, this is not a “democratically run” company insofar as a single individual owns nearly all of the company.

Over 80% of the company is held by individual insiders, which basically means Bob Duggan. There’s very little retail presence, at around 11%.

Bottom Line

Nothing to like here. Summit Therapeutics Inc. isn’t a stock for retail investors. This is a molecule untested in the U.S., and if this was an ordinary company, they wouldn’t have paid that kind of money for such a molecule. The upfront part would have been less than this. But this is a pet project of a billionaire, so they can afford to overspend or take high risks. Retail investors cannot. I will stay firmly away unless there’s some very compelling U.S. data.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Read the full article here