Investment thesis

The first time I covered T-Mobile (NASDAQ:TMUS) stock, I called it “A Rock Star In A Stagnating Telecom Industry.” Indeed, the company demonstrates solid execution and stellar profitability, but it is almost impossible to sustain growth within a stagnating industry where penetration is close to 100%. Today, I would like to update my initial thesis because several important news were released since I covered the stock in early May. The most notable is the announcement that the company will start paying out dividends by the end of this year after it announced it will lay off five thousand employees within the short term. While the company expects dividend payouts to compound by 10% annually, even long-term forward yield looks unattractive compared to T-Mobile’s closest competitors. That said, I reiterate my “Hold” rating for the stock.

Recent developments

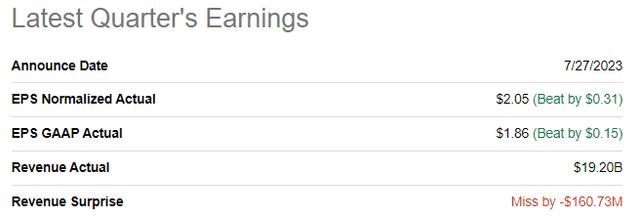

T-Mobile released its latest quarterly earnings on July 27, when the company missed consensus revenue estimates but delivered a beat from the bottom line perspective. YoY revenue decline aligned with the previous two quarters at approximately 2.5%. Despite revenue stagnation, the company demonstrated solid profitability metrics improvements. The operating margin expanded significantly YoY, from 14.5% to 21.3%. The good sign for investors is that this expansion was only partially the expense of R&D expenditures.

Seeking Alpha

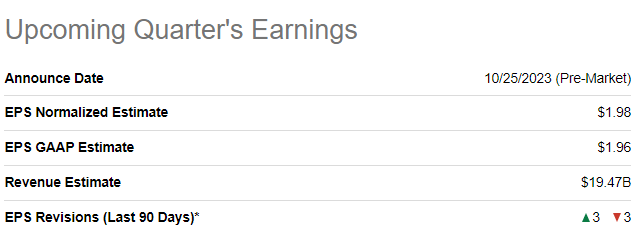

The upcoming quarter’s earnings are scheduled to be released on October 25. Quarterly revenue is projected by consensus at $19.5 billion, indicating there will be almost no YoY change.

Seeking Alpha

As I mentioned above, the company operates in a stagnating telecom industry. That said, driving revenue growth is very challenging, softly speaking. Telecom companies should now focus on the FCF margin expansion to deliver value to shareholders with attractive dividend yield and growth. Therefore, I was not surprised when it was announced in late August that the company would cut about 7% of its workforce or five thousand employees. TMUS estimates that it will incur a pre-tax charge of approximately $450 million in the third quarter of 2023 related to the workforce reduction.

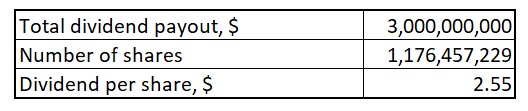

Let me estimate how much the company might get in savings due to the layoff. According to comparably.com, the average salary in T-Mobile is about $125 thousand annually. But this includes only salary and does not include other employee benefits apart from remuneration. Let me assume that additional benefits comprise about 30% of salary. That said, the company will save, on average, $160 thousand per employee due to layoffs. This gives us about $800 million in pre-tax savings per year. As a result of this massive saving initiative, on September 6, the company released an 8-K filing announcing that the company expects to pay approximately $750 million in dividends in Q4 of the current fiscal year and $3 billion in total dividends for the next fiscal year. As of the latest reportable date, the company had 1,176,457,229 outstanding shares. That said, I expect the FY 2024 annual dividend at $2.55, which represents a 1.9% forward dividend yield.

Author’s calculations

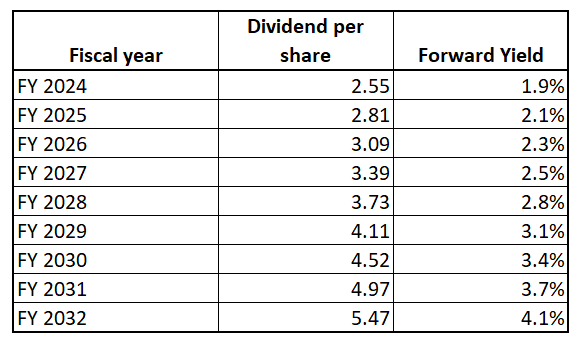

A 1.9% dividend yield might look low in the current high-interest rates environment, but in its latest 8-K filing, the company expects the dividend to grow 10% annually. That said, the forward dividend yield will look like this in the next decade if the company sustains its planned 10% dividend CAGR.

Author’s calculations

The management’s commitment to costs and capex efficiency, reiterated during the latest earnings call, gives me high confidence that dividend safety and growth will be sustainable. At the same time, I don’t understand why investors would be keen on investing in a 1.9% forward yield if T-Mobile’s competitors, Verizon (VZ) and AT&T (T), currently offer much higher yields, both at approximately 7.8%. Of course, both giants do not offer a 10% dividend growth, but why would it matter if, even with a 10% CAGR, T-Mobile’s FY 2032 forward yield is still substantially lower at 4.1%? That said, at this point in time, T-Mobile’s dividend plans look controversial to me. At the same time, returning money to shareholders looks like the only reasonable option if the company does not expect to deliver greater value via reinvesting in the business.

Valuation update

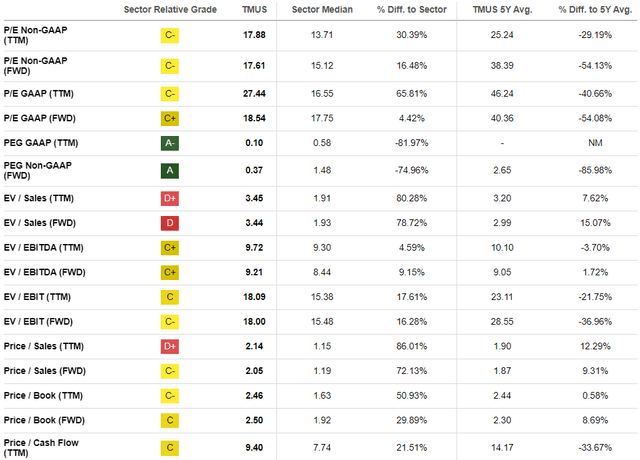

The stock declined in price by 3.5% year-to-date, significantly underperforming the broader U.S. market. Seeking Alpha Quant assigns the stock with an attractive “B” valuation grade, which indicates s moderate undervaluation. Indeed, current valuation multiples are mostly substantially lower than historical averages.

Seeking Alpha

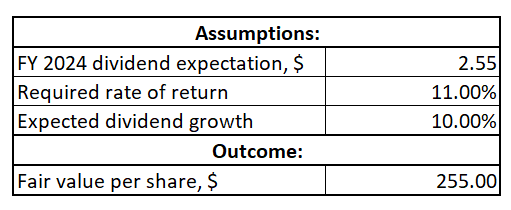

Since T-Mobile is now transforming from growth to value by paying out dividends amid the stagnated top line, I want to proceed with my valuation analysis with the dividend discount model. Since there is no history of paying out dividends, the level of uncertainty is high, and I use an elevated 11% WACC. I use a 10% revenue growth declared by the company in its latest 8-K filing. For the current dividend, I use the FY 2024 estimate I have figured out above.

Author’s calculations

The stock is massively undervalued from the DDM perspective, with about 90% upside potential. However, TMUS has a substantial net debt of almost $110 billion, or $94 of net debt per share outstanding. That said, my fair price for TMUS stock is $255, less $94, which equals $161. This indicates a 20% upside potential for the stock.

Risks update

T-Mobile targets more price-sensitive customers, who are more vulnerable to suffering in periods of economic downturns. While the U.S. economy demonstrates unexpected resilience amid the harsh global situation, there are also opinions that the U.S. economy will not avoid recession. For example, one of the famous U.S. economists, David Rosenberg, expects the recession to hit within six months. That said, T-Mobile’s customers might temporarily cut their telecom spending, which will hurt the company’s financial performance.

The company operates in a capital-intensive industry, where it is impossible to expand operations without debt financing. As a result, T-Mobile is in a substantial, above $100 billion net debt position. While I have little doubt that the company is able to meet its liabilities, substantial indebtedness makes it much harder to raise more debt financing to fuel new projects. If unexpected attractive expansion opportunities arise, the company might miss them due to the inability to expand its loan portfolio at acceptable terms.

Bottom line

To conclude, TMUS is still a “Hold” for me. The shift from growth to value looks like the only option for the company, given almost no notable growth prospects for the telecom industry. I appreciate the management’s focus on cost efficiency due to its commitment to improving profitability metrics and returning spare money to shareholders. Still, the move does not make the stock more attractive. The company expects dividends to grow by 10% annually, but T-Mobile’s forward dividend yield ten years from now still looks unattractive compared to the ones offered by Verizon and AT&T.

Read the full article here