In the first of my previous two articles on T-Mobile US, Inc. (NASDAQ:TMUS), I had called the stock a potential dividend player in the waiting, primarily based on its fundamental strengths and its history of imitating the industry veterans, AT&T, Inc. (T) and Verizon Communications Inc. (VZ). In my second and most recent article on T-Mobile, I had called the stock a value-play as well, making it a well-rounded investment with income and capital appreciation potential.

As part of the two analysis above, I had predicted that T-Mobile would be paying dividends within three years. Just like how the company has exceeded my expectations as a customer (as detailed in the second article linked above), the company has exceeded by expectations as a potential investor as well. A few days ago, T-Mobile CEO Mike Sievert disclosed the company’s buyback and dividend plans, as Seeking Alpha has covered here. I am presenting this follow-up article to readers to dissect the details of the buyback and dividend plan. Let us get into the details.

Buyback

- Let’s start by reminding ourselves that T-Mobile already had authorized $14 billion towards buyback in 2022, to be used by September 2023 (end of this month).

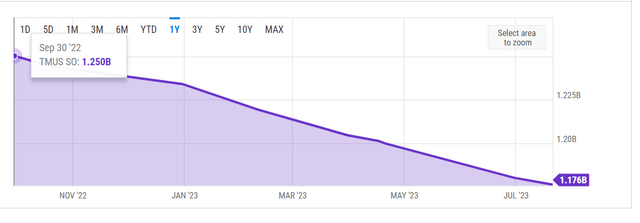

- The effect of the existing buyback is easy to see as the company’s total shares outstanding has gone down by nearly 6% since September 2022 as shown below. That is, a reduction of 117.60 million shares to bring the total shares outstanding to 1.176 billion from 1.250 billion.

- Let’s now turn our attention to the new buyback authorization of $19 billion, which is expected to be used by the end of 2024.

- Being pessimistic, let’s assume that T-Mobile spends an average of $160/share in the new buyback program, even though the current week high is $154 and the current price is nearly 17% below the $160 assumed.

- At $160, T-Mobile can retire 118.75 million shares, which would place the new total shares outstanding at 1.057 billion. What does that mean to the company’s earnings per share? Let’s find out below.

- Using the current expected 2024 forward EPS of $10.01 and shares outstanding of 1.176 billion, we get $11.77 billion as the expected FY 2024 net income. Now, using the potentially reduced number of shares through the buyback program at my assumed price of $160/share, we get a forward EPS of $11.13. That is, $11.77 billion in net income divided by 1.057 billion shares outstanding after the new buyback program expires. That’s a handy 11% jump in expected 2024 EPS from $10.01 to $11.13.

TMUS Shares Outstanding (YCharts.com)

Dividend

- T-Mobile currently does not pay a dividend but intends to spend $750 million in Q4 2023 and $3 billion in 2024 towards dividends. Using the current 1.176 billion shares outstanding, that’s 63.77 cents per share/quarter.

- Annualizing that, we get $2.55/share for a current yield of 1.84% using the current share price of $138.

- While this is obviously much lower than AT&T and Verizon’s yield, T-Mobile clearly has more room to grow its dividend. As an example, based on the projected dividend of $2.55/share and forward 2023 EPS of $7.77, T-Mobile’s payout ratio works out to just 32%. AT&T’s payout ratio is 46% and Verizon’s is 56% using the same metrics. Another example is the debt load carried by the three companies. T-Mobile has the lowest debt-to-equity at 1.1 compared to AT&T’s 1.4 and Verizon’s 1.6.

Can T-Mobile Afford Both

I believe T-Mobile can afford to reward investors through both buybacks and dividend for the following reasons.

- As mentioned above, T-Mobile’s EPS based payout ratio is fairly low and has enough room to grow the dividend annually. In addition, the company specifically mentioned higher cash flow as the reason to back its buyback program.

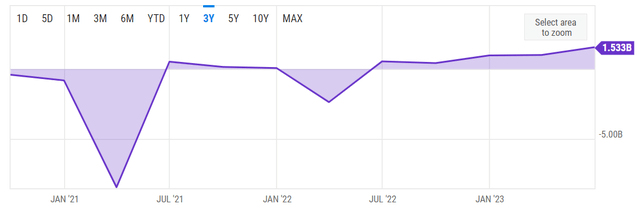

- Recent evidence backs the company’s confidence as T-Mobile’s Free Cash Flow [FCF] has been on an upward trajectory since the June 2022 quarter with FCF coming in at $521 million, $397 million, $941 million, $977 million, and the highest-ever (at least in the last 5 years) at $1.53 billion.

- Earnings are expected to grow at nearly 70%/yr for the next 5 years and even if T-Mobile manages 1/10th of that growth rate, its EPS will still reach about $11 in 5 years.

- Finally, T-Mobile’s buyback program will allow the company to save money over the long-term as retired shares do not have to be paid dividends. Using the numbers calculated above, T-Mobile can save at least $300 million/yr if it is able to retire 118.75 million shares while paying $2.55/share.

T-Mobile FCF (YCharts.com)

Conclusion

My intent is not to toot my horns, but it does feel good to when your prediction comes true, especially within such a short period of time. T-Mobile was showing all classic signs of a “to-be” dividend stock as it was generating more cash flow and reaping the benefits of the Sprint acquisition. In addition, as I mentioned earlier, T-Mobile made its reputation by first mocking, then following, and eventually overtaking the veterans in many aspects of its business. It was only a matter of time before the company followed suit when it comes to getting investors’ and funds’ attention by paying dividends. Not to forget, the buyback adds cherry on top.

I also expect T-Mobile to learn from the mistakes of the two industry veterans and to slowly work on reducing its debt load. This should allow the company to use more of its cash flow towards dividends and buyback, in addition to the synergy coming out from the Sprint integration. In short, I expect T-Mobile’s dividend to grow over time and suggest buying on weakness.

Read the full article here