My Thesis

The semiconductor industry is undeniably complex. However, it’s an industry that houses high-quality companies, some of which come with significant risks. Many, including myself, believe that semiconductors are the future’s equivalent to oil-resource nations will vie for. This belief underscores the massive opportunities present in this field, albeit accompanied by substantial risks.

I believe that TSMC (NYSE:TSM), the manufacturer of world-leading chips, and ASML (NASDAQ:ASML), the company producing the machines used by TSMC to manufacture these high-end chips, possess some of the widest competitive moats in the world. Yet, they also come with a considerable level of risk.

The Connection

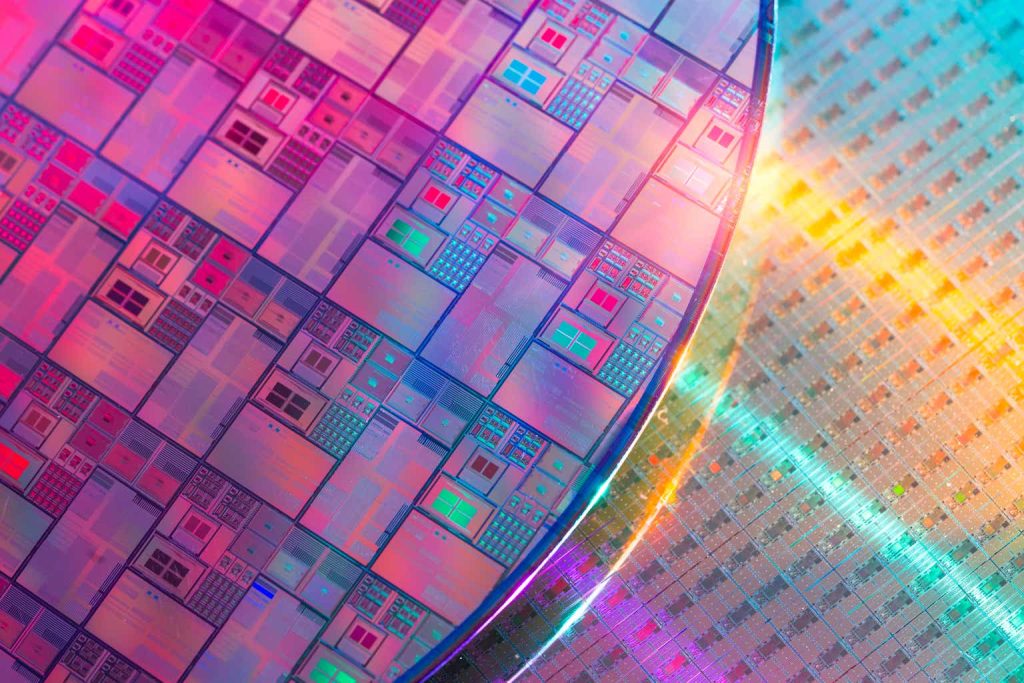

TSMC stands as an integral part of the global semiconductor supply chain. In essence, this Taiwanese giant manufactures the majority of the world’s leading chips-those used in AI, supercomputers, phones, and more. TSMC serves as the primary manufacturer for the world’s leading tech companies, including Apple (AAPL), AMD (AMD), Nvidia (NVDA), Tesla (TSLA), and numerous others.

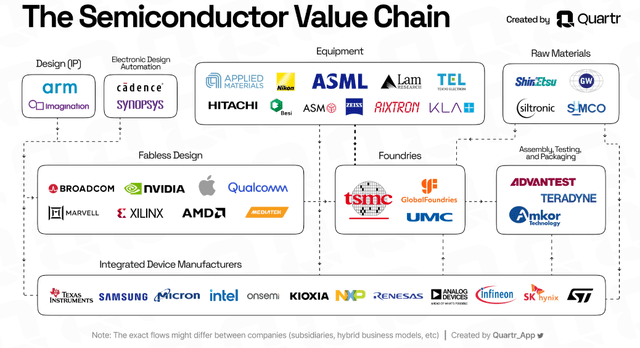

These chips have a ubiquitous presence, and their prevalence is only set to increase in the future. The industry itself operates in cycles, experiencing heightened demand during prosperous times and the reverse during downturns. High-end technology plays a pivotal role in semiconductor production. Companies like Applied Materials (AMAT), Lam Research (LRCX), and KLA (KLAC) provide the necessary equipment for chip manufacturing. Above them all looms a singular monopoly-the provider of the most crucial machines: the EUV machine.

Complex Industry (Quarter)

A few months back, I wrote my initial article about ASML and its exceptionally wide competitive advantage. I encourage you to delve deeper into this subject to gain a better understanding of the business. In brief, ASML stands as the sole provider of these high-end machines globally, and TSMC stands out as one of its most significant clients. Their deep connection is crucial to each other’s success.

The Industry

Numerous studies have delved into the chip industry, but one particular read I recommend is “Chip War” by Chris Miller. This book dives into the history of the industry, shedding light on the economic battles surrounding high-end chips.

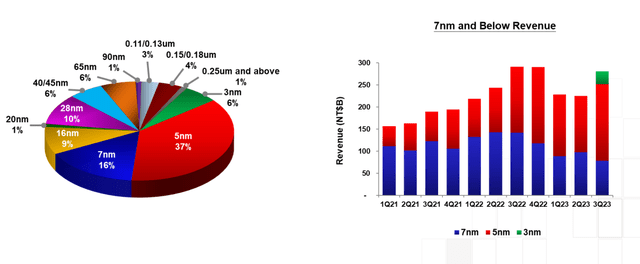

Miller describes the significance of these chips-why are they so crucial? The future’s economic growth and potentially even military advantage hinge on computing power. This power is fundamental in advancing AI systems and more. ASML’s mission perfectly aligns with this necessity-to produce the primary machine, one of the most complex technologies globally, facilitating the increase in the number of transistors in a chip. Progress in this realm has been remarkable in the past and is projected to persist in the future. Notably, in Q3, TSMC began generating revenue from their most advanced chip, the 3nm chip.

3nm is generating revenue (TSMC ir)

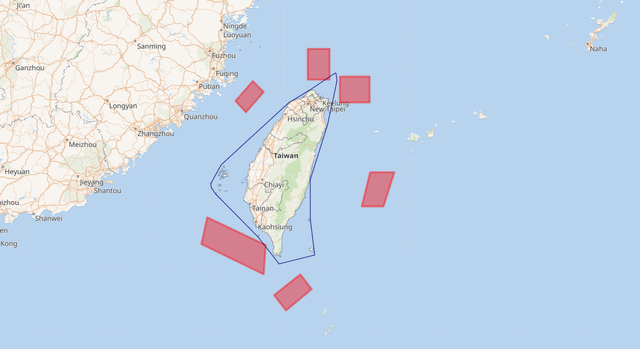

The United States has recently realized its vulnerability in this industry: the lack of onshore manufacturing. Most of the world’s leading chips are produced on a threatened island-Taiwan-where the US’s primary rival, China, aims to gain control. In response, Biden signed the Chip Act, allocating $52 billion in subsidies to construct fabs in the US. TSMC is already on the path to establishing fabs in Arizona. Similarly, the Netherlands-based ASML faces restrictions on exporting its most advanced chips to China by the US government. This move aims to impede China’s access to high-end chips and, consequently, high-end technology and potential military strength.

Due to the critical importance of this factor in the near future of technology, the growth potential is substantial, not only for these two entities but across the entire industry. However, this promise of growth comes with substantial risks.

The Main Risk, And More

I’m no geopolitical expert, but keeping up with the news often reveals headlines about potential threats or military exercises conducted by the Chinese army near Taiwanese territory. This poses the primary threat to this incredibly robust business. A business of such high quality and profitable growth typically wouldn’t trade at a mere 13 PE multiple (22′ net income). Its current trading position reflects the significant risk investors perceive. They seek low prices to offset the immense risk.

While I can’t predict the outcome if China were to invade Taiwan, I’m certain it wouldn’t bode well for TSMC, and likely, it wouldn’t be good for the world either, given the U.S. support for Taiwan. In such an event, there’s no doubt that TSMC would suffer. Importantly, TSMC is one of the three primary customers for the EUV machines manufactured by ASML. Therefore, ASML also faces near-term risks of lost revenue. However, this risk isn’t evident in its stock price, currently at a multiple of 31. This is the primary reason why, despite TSMC trading at a favorable price, my investment in ASML is double the size of my investment in TSMC.

2022 Chinese drill around Taiwan (Wikipedia)

The lure of substantial growth potential arising from future technological advancements and the consequent excessive demand for high-end chips has fostered intense competition for TSMC. I wager that China will spare no effort to develop its own EUV machine, despite the immense barriers to entry, as I elaborated on in my previous article.

Even with these substantial risks, I still view these two companies as promising investments for the future.

Quality Growth Is The Reason

As an investor, my priority is quality, but I’m keenly aware that investing revolves around risk and reward. Mitigating risk significantly involves buying quality companies at reasonable prices. The quantitative avenues I focus on are high returns on capital achieved without excessive leverage. Alongside revenue growth, these, in my opinion, are the primary drivers for stock price appreciation.

Before delving into the numbers, it’s crucial to recognize the cyclical nature of the semiconductor industry. Unlike the linear and consistent growth seen in other compounders, the semiconductor industry experiences cycles. Therefore, taking a long-term perspective is crucial, looking beyond the current earnings volatility. The industry reached its peak in 2021 during the chip shortage, and now we find ourselves in a semiconductor dip, evident in TSM’s Q3 report with a 10% decrease in topline revenue.

Considering the long-term outlook is pivotal. ASML has indicated that 2024 will be a transition year, preceding continued growth. This foresight is critical in navigating through the present volatility in earnings.

According to various research sources, the semiconductor industry is anticipated to achieve a CAGR within the range of 9-12% in the upcoming years. However, this projection is contingent upon factors like the potential AI boom or a lack of innovation, which could either propel growth or impede it.

Both companies have demonstrated impressive top-line growth over the last five years and are expected to continue this trend. ASML has recorded a 20% CAGR in its top line and is projected by analysts to achieve around 11% over the next five years. Notably, ASML has consistently outperformed analysts’ top-line estimates by 1-4% annually over the last decade, except in 2021. This lower projected growth in contrast to previous performance aligns with shifts in monetary policy.

TSMC has maintained an 18% CAGR in its top line over the last five years but is anticipated to reach 11% for the next three years. Unlike ASML, TSMC has often missed analysts’ top-line projections.

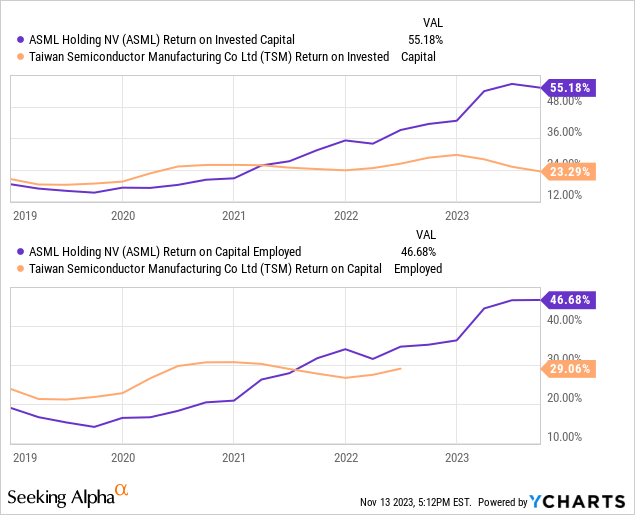

Crucially, this growth is driven by a high and stable Return on Invested Capital, despite industry volatility. Recent research by Morgan Stanley highlights the significance of a growing spread between a company’s WACC and its ROIC as a substantial contributor to outperformance.

The high returns on capital stem directly from the impressive margins both companies boast. In theory, ASML could significantly raise prices given its lack of direct competition. However, maintaining a positive relationship with its customers is paramount for ASML’s management. They’re cautious not to provide incentives for their customers, such as TSMC, Samsung, and Intel, to seek alternative solutions. Despite this, ASML’s margins, standing at 51% gross and 32% EBIT, are sufficient to establish a highly profitable company. Furthermore, these margins are gradually expanding.

Similar dynamics are observed at TSMC, although not identical. Samsung (OTCPK:SSNLF) possesses comparable capabilities to TSMC, especially in the production of advanced chips like the 3nm and 5nm, albeit at a different capacity. Recent reports suggest that Samsung’s 3nm chips may be more efficient than TSMC’s. TSMC presented impressive margins of 60% gross and 50% EBIT last year, but this year, they’ve dipped due to cyclicality. These high margins are particularly noteworthy for a capital-intensive company, surpassing those of many software companies.

Looking ahead, TSMC anticipates increasing competition, with Samsung and even Intel (INTC) aggressively vying for market share. The potential for a pricing war looms, posing a threat to erode margins in the future.

Solvency And Return To Shareholders

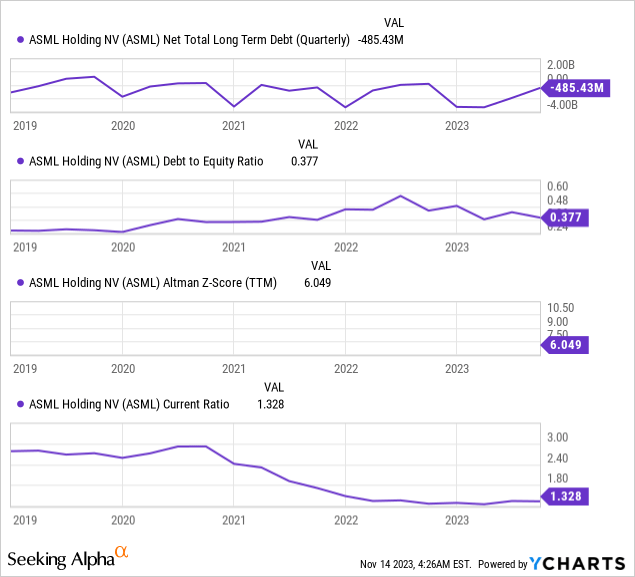

Both companies, in my assessment, exhibit strong solvency. The majority of ASML’s debt carries a low-cost interest rate, with $1 billion at 3.5% interest, and the remaining long-term debt-bearing interest rates under 2%. Additionally, their cash position surpasses their debt, demonstrating a robust financial position. They maintain a healthy current ratio, an Altman Z score well above 3, and a low debt-to-equity ratio.

TSMC boasts a cash position double its debt, with a substantial portion of the approximately $11 billion local debt carrying an interest rate below 2%. The recent U.S. debt undertaken by TSMC carries an interest rate higher than 3%, while the local debt remains at low-interest rates. TSMC’s financial metrics are impressive, featuring a current ratio above 2, an Altman Z score exceeding 5, and a debt-to-equity ratio of around 0.3.

In summary, both companies maintain robust balance sheets that I find appealing for potential investment.

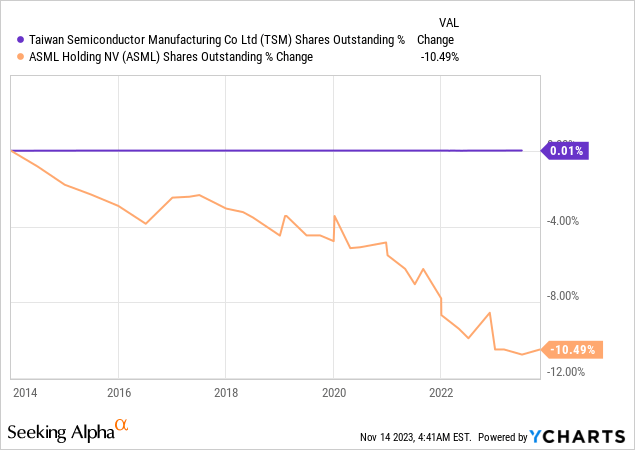

Both companies offer modest dividends, with TSMC paying out 1.8%, having grown at a 13% CAGR over the past decade. ASML provides a relatively lower yield of 1%, but its dividend has seen remarkable growth at a 25% CAGR over the last 10 years. Additionally, ASML engages in share buybacks, contributing approximately 1% annually to the EPS growth.

Valuation, Risk/Reward Game

I plan to conduct two separate valuations: one based on historical multiple averages and another using a Discounted Cash Flow approach.

TSMC presents a unique challenge due to its cyclical nature, necessitating a long-term perspective. Despite the Free Cash Flow drawdown, I believe the current price is reasonable. In my valuation, I’ll consider last year’s results, as they are likely indicative of the upcoming year, especially with the semiconductor industry poised to resume its upward trajectory. Calculating the price-to-earnings ratio using last year’s net income, the company stands at a 13 PE ratio. This is lower than the average earnings per share growth over the last 5 years, resulting in a PEG ratio below 1. I speculate that if TSMC were an American company, it might command a multiple similar to ASML’s. The current 13 PE ratio is 40% below the 22 mean of the last five years. While there is a valid reason for this lower valuation, considering the numerous articles that could be written about the China threats, it remains an essential factor.

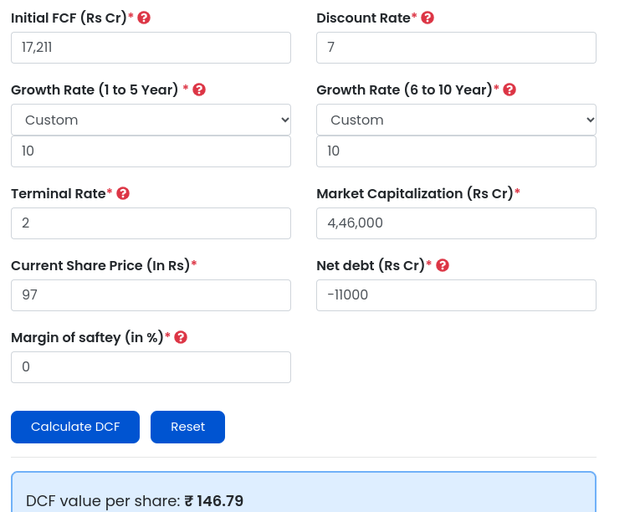

For the discounted cash flow analysis, I’m utilizing the 2022 Free Cash Flow to showcase the potential FCF post-down cycle. The terminal growth rate is set at 2%, and the WACC is calculated at 7% based on the alpha spread calculation. I’ve kept the FCF growth rate at 10%, aligning it with the revenue growth to adopt a conservative approach. The resulting valuation indicates a 33% undervaluation, with an intrinsic value of $146.

It’s important to note that the risk of a conflict in the Taiwanese region is not factored into the WACC calculation. Consequently, one should approach this assumption cautiously. In general, I wouldn’t consider making this company a significant part of my portfolio due to the elevated geopolitical risk.

DCF (finology)

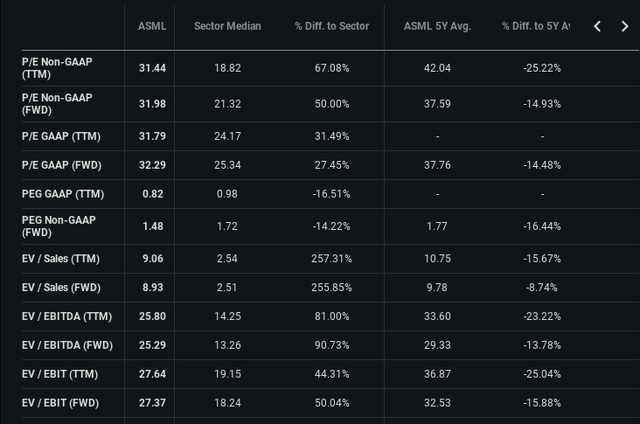

Regarding ASML, I previously assigned it a BUY rating in my last article. Since then, the market experienced a rally, and the stock has risen by 10%. Despite this, I still see an opportunity, considering my belief that ASML is worth a valuation of 30 times earnings. It stands as a unique monopoly globally. Although ASML is still significantly below its 5-year averages, it’s important to note that those averages were notably influenced by the zero-interest-rate policy (ZIRP) era. A historical mean comparison suggests the stock is a buy, but the DCF model raises questions, requiring a long-term perspective to justify such a multiple.

multiples (seeking alpha)

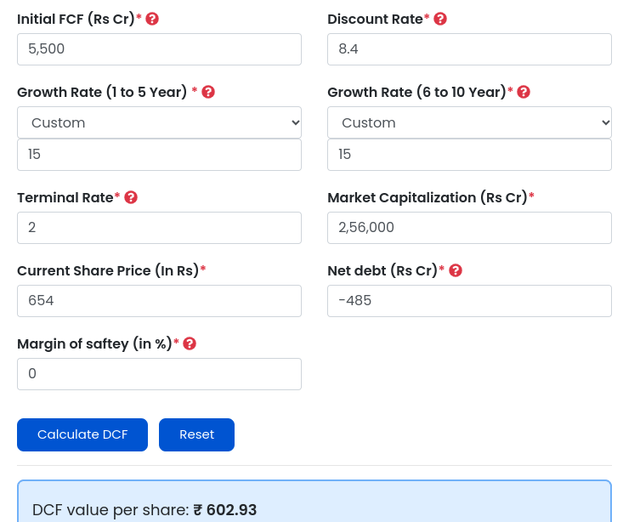

In my DCF analysis, I’m using this year’s projected revenue and the 5-year average Free Cash Flow margin for the input. The terminal growth is set at 2%, the WACC is 8.4%, and the FCF growth rate is 15%, which is lower than the 20% CAGR anticipated for earnings per share growth by analysts-this is a conservative approach. The derived result suggests a slightly undervalued company by 8%, with an intrinsic value of $602. I opted for different metrics this time to be more conservative after the recent price hike. However, using a 20% growth rate, for instance, could yield a 25% discount, resulting in an intrinsic value of $876 for this quality company.

DCF (finology)

Conclusions

Considering the nuanced risk/reward dynamics that high-quality compounders present, my current preference leans toward ASML over TSMC, despite the more appealing price of TSMC. While I anticipate ASML can recover from any lost revenue from TSMC, the risks associated with TSMC are notably high. In my perspective, ASML is a company suitable for buying and holding for the long term, even in a substantial position. On the other hand, TSMC is a BUY in my view, primarily due to its attractive price. However, I would allocate only a small portion of the overall portfolio to TSMC and consider trimming it if it experiences significant appreciation. All in all, at this juncture, I would opt for the supplier over the manufacturer.

What would be your choice?

Read the full article here