Shares of UMB Financial (NASDAQ:UMBF) traded about 4% lower on Monday after reporting strong earnings and its all-stock acquisition of Heartland Financial (HTLF) for $2 billion. Alongside this acquisition, UMBF is selling $200 million of stock at $75 to boost capital to support this deal. That is about a 10% discount to where shares traded on Friday and will boost the share count by nearly 5%–this sized discount is standard for an offering of this size. In my view, UMB offers attractive stand-alone financials, and there is a credible path to making this purchase accretive. I view shares as a buy.

Seeking Alpha

Before diving into the financials of this transaction, it makes sense to examine UMB’s quarterly results. In the company’s first quarter announced on April 29th, UMB earned $2.47, up from $1.91 last year, and the company’s standalone results remain impressive in my view, given the turmoil that has faced the sector. UMB has acquitted itself well in the fight for deposits, and net interest income has momentum. Additionally, its credit quality remains very strong, aided by the fact it does not have exposure to legacy, coastal commercial real estate markets.

In Q1, net interest income (“NII”) of $239 million rose by $9 million sequentially and was down by $2 million from last year. NII has been aided by asset growth, but margins may also have bottomed. Net interest margin (“NIM”) was 2.48% in Q1, and this rose 2bp from Q4, but was 28bp lower than last year. Nearly all banks have lower NIMs than a year ago, as deposit rates have risen dramatically given volatility sparked by Silicon Valley Bank and a higher fed funds rate. I view the sequential increase in NIM as a meaningfully positive sign. While the interest-bearing liabilities’ yield rose by 8bp to 4.03%, increases in loan yields offset this.

I have argued that stable deposits are a necessity when investing in a regional bank, and UMB meets this test Deposits rose 6.2% from last year, though noninterest-bearing (NIB) fell by 15.5%. NIBs have declined across the sector. With the ability to get 5+% in money market accounts, customers have an incentive to minimize NIB balances. These are largely transactional accounts, so there is a floor to how low balances can go, but when rates were low, customers allowed balances to stay above this floor. With 12 months passing since NIB outflows began, we should be nearing that floor. Indeed, NIB balances were only down by $52 million sequentially.

I do not expect dramatic increases, but the headwind of having to replace NIB balances with interest-bearing balances should be behind UMB, a positive for NIM. Its overall deposit performance was healthy, at $33.5 billion, up by nearly $900 million from Q4 and by $2 billion from last year. UMB is also paying 3.84% on interest-bearing deposits from 2.64% last year. This is a fairly high rate relative to peers, and with deposits rising strongly, it suggests UMB may be in a position to reduce rates without seeing deposit flows turn negative. I am not expecting an imminent large decline in deposit costs, but even holding them steady will enable NII to rise over time as it rolls maturing securities and originates higher yielding loans.

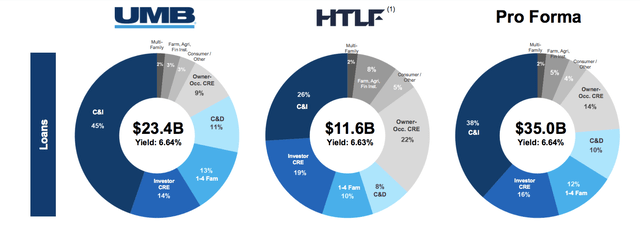

Loans grew by $250 million or 1.1% from Q4 and are up nearly 10% from last year. About half of the sequential growth was in each of C&I lending and in commercial real estate (CRE), which now total $9.9 and $9.0 billion respectively, and they are the primary components of its loan book. Because its loan book is largely floating rate, the average yield of 6.64% was up from 5.88% last year.

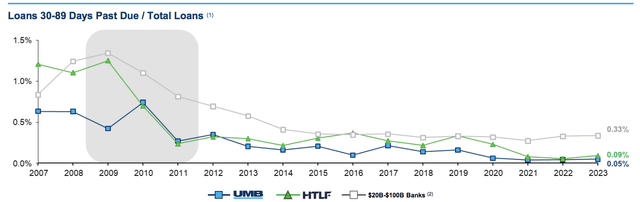

I will discuss its pro forma loan book in more detail below, but credit quality is quite strong. Net charge-offs were just 0.05%. There are only $3.1 million of loans 90+ days past due.

Beyond being a strong underwriter, UMB is very conservatively reserved, and it took $10 million in reserves in Q1. That leaves the bank with $227 million in allowances for losses. UMB has had just $9 million of charge-offs over the past year. We like to see banks have 2–3 years of charge-off protection in reserves. Even if the pace of charge-offs tripled, UMB would have 8 years of reserves, and with delinquencies so low, such an increase in losses is unlikely in the near future. We can see credit conditions deteriorate significantly before UMB is forced to take significant losses.

One negative is that UMB has a $13 billion securities portfolio that yields just 2.87%. As such, there are $1.25 billion in unrealized losses. Over time, as these securities mature, they can be reinvested at higher yields. UMB has a very strong 11.1% common equity tier 1 (CET1) ratio, but this excludes unrealized losses. Because UMB has below $100 billion in assets (and will continue to after the Heartland deal closes), it does not need to include them in capital calculations. Still, it does speak to the true economic position of the bank, and when including losses that sit in accumulated other comprehensive income, UMBF has 9.2% CET1, and this ratio would be closer to 7.5% including losses on held-to-maturity securities.

UMB has significant liquidity and growing deposits, so it is unlikely to ever need to recognize losses. Additionally, with its equity issuance and a larger asset size post-Heartland, these losses are less impactful to adjusted CET1. Over time, as bonds mature, this AOCI impact will also shrink. I am comfortable with UMB’s capital position, but investors should recognize it carries such high headline capital, given these losses are excluded from calculations.

Aside from this, UMB also has a strong fee-based revenue stream. Non-interest income was aided in Q1 due to a 10% gain in trust and securities fees to $69.5 million. Higher market levels will continue to be a YoY tailwind to fee revenue. Additionally, bankcard fees also rose by 20% to $22 million; this was aided by lower rewards activity, and I would expect to see some sequential declines here as this expense normalizes. UMB also has managed expenses well, with salaries and benefits only up 0.3% to $143 million.

Overall, UMB reported strong results, and it is positioned to earn $9.00 this year, assuming 0-2 Fed rate cuts, and stable credit performance, leaving shares compelling at less than 9x earnings in my view. Importantly, I expect HTLF to increase UMB’s run-rate earnings.

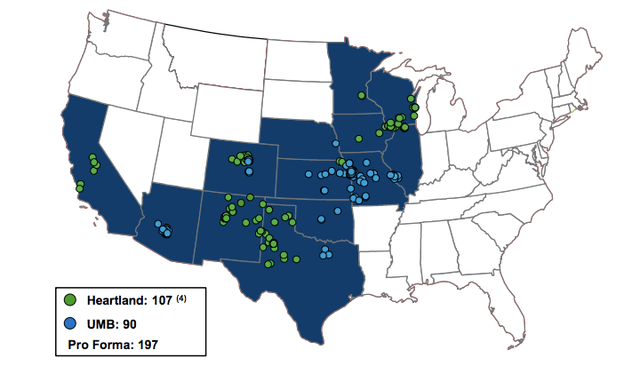

As you can see below, this acquisition fills out UMB’s footprint across the Central US, adding a meaningful presence in Texas, New Mexico, and Wisconsin. Together, the company will have $65 billion of assets. That gives it greater scale, but also still significant flexibility below the $100 billion asset level when regulations become more onerous.

UMB Financial

HTLF will add $15.3 billion of deposits at a total cost of 2.11% vs 2.6% for UMBF, which will lower the cost of funding for the combined entity. As part of the transaction, UMB aims to realize $94 million in run-rate cost savings, or about 27.5% of HTLF’s noninterest expense, with 40% realized in 2025. I view this as credible, as HTLF has a large fixed asset presence relative to its size. For instance, it has 107 branches vs 90 for UMB, but it has just half the deposits. There is meaningful room for UMB to rationalize the footprint here. Additionally using UMB’s practices, if it can improve branch productivity, meaning there is significant growth potential.

Conservatively, UMB has underwritten this deal assuming no revenue synergies, but I expect there to be opportunities. For instance, HTLF gets just 15% of revenue comes from fees vs 39% for UMB; improving productivity here can be a source of growth. The entity will have $21.2 billion combined wealth AUM, and greater scale should increase the competitiveness of the offering.

The new bank will have $52 billion in deposits and just $35 billion in loans, for a loan-to-deposit ratio of just 67%. This leaves the bank with substantial excess liquidity, as this ratio can safely run north of 80%. With new loans yielding over 7%, there is an opportunity to significantly boost lending and NII.

Importantly, both banks have a history of strong credit underwriting. While HTLF’s record is not quite as impressive as UMB, it is better than industry peers. At the closing of the transaction, UMB will take $159 million of credit marks to align reserves.

UMB Financial

The combined bank will have more CRE and less C&I exposure than UMB on a stand-alone basis. A substantial portion of this growth is due to increases in owner-occupied CRE, which has less vacancy risk and is functionally a hybrid between C&I and CRE lending. Still, there is also an uptick in non-owner occupied CRE.

UMB Financial

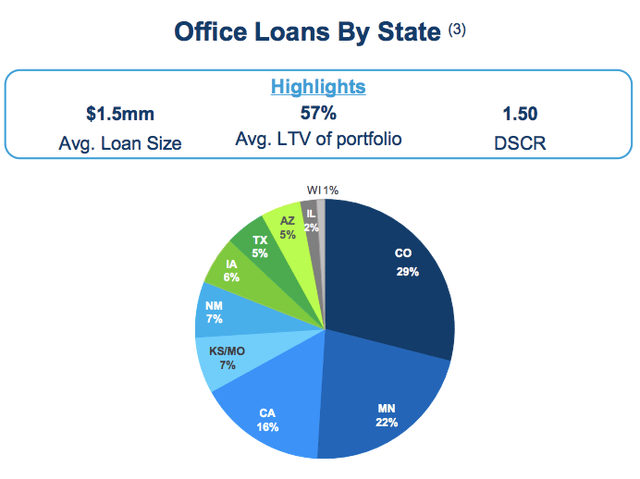

My primary concern here would be office, Importantly, HTLF has a well-diversified portfolio with just a $1.5 million average loan size. The loan to value is just 57%,meaning even if values fall significantly, the likelihood of loss is low. Colorado is the biggest exposure, but the Denver market has been growing meaningfully in recent years, which should support vacancies. Plus, as part of due diligence, UMB had the ability to look through loans to ensure it was comfortable with credit. Ultimately, these factors leave me comfortable with the incremental $159 million in reserves as part of this transaction.

UMB Financial

The combined bank will have a 10.1% CET1 with AOCI a less than 1% theoretical impact next year. There will be $215 million of M&A integration expenses, which will take about 3 years to recover via lower non-interest expense at HTLF. Revenue synergies could speed up the breakeven time. Based on these assumptions around reserves and expense synergies, with Heartland, UMBF expects $10.05 in 2025 EPS vs $7.70 its stand-alone analyst consensus on a run-rate basis. Given only 40% of synergies will be realized in 2025, the true EPS would be closer to $9. However, given the Fed is unlikely to be cutting rates dramatically and UMB’s potential NII growth, the 2025 analyst consensus of $7.70 may well prove low. Ultimately, this deal should add about $1.30 in earnings power in 2025 and over $2 thereafter.

While stocks often fall when acquiring a business, this appears to be a well-conceived, appropriately priced purchase by UMB. With it likely to be accretive, I see it as adding value over time. Shares have been stuck between $75 and $85 for several months, but with over $9 in stand-alone earnings power and a $1.30 benefit from HTLF next year, this company can likely achieve $10 EPS. With strong capital, deposit growth, and better scale, I see UMB moving towards the 10x earnings of peers and expect shares to migrate towards $100. I would be a buyer on this weakness.

Read the full article here