Introduction

Since my last look in April, Vanda Pharmaceuticals’ (NASDAQ:VNDA) stock is up 1.8%, compared to a return of 7% for the S&P 500 during the same period of time. My most recent evaluation, which resulted in a “hold” recommendation, raised concerns about their new FDA-approved drug for bipolar 1 disorder, Fanapt. I stated that, while bipolar disorder is a significant indication, Fanapt’s lack of differentiation from widely available and generic antipsychotics makes it unlikely to “contribute much to Vanda’s bottom line.” The following article will revisit Fanapt’s prospects in a competitive bipolar disorder market, as well as the upcoming catalysts for the company.

| Expected Date | Catalyst | Details |

|---|---|---|

| September 18, 2024 | FDA Decision on Tradipitant (Gastroparesis) | The FDA is expected to make a decision on tradipitant for the treatment of gastroparesis. Approval could be significant as no new treatments have been approved in over 40 years. |

| Q4 2024 | NDA Submission for Tradipitant (Motion Sickness) | Vanda plans to submit an NDA for tradipitant in motion sickness. This condition affects about 30% of the U.S. population, representing a large potential market. |

| Late 2024 | Phase I Study Initiation (CFTR Inhibitor—Cholera) | Vanda expects to begin a Phase I study for a CFTR inhibitor to treat cholera in Bangladesh, a region with significant unmet needs. |

Vanda Pharmaceuticals: Cash Strong, But Product Pipeline Weak

Looking at the treatment recommendations for bipolar disorder in the months following Fanapt’s (iloperidone) FDA approval, Fanapt is listed among five other second-generation antipsychotics. Fanapt is not favored, and the choice of agent depends on patient/provider preference. Abilify, like many second-generation antipsychotics, is available as a generic and costs as low as $5 a month. Importantly, physicians have years of experience with agents like Abilify and may prefer them over undifferentiated, newer-to-market second-generation antipsychotics like Fanapt. Subsequently, it’s difficult to envision Fanapt breaking even in this market after accounting for its cost of clinical development and ongoing SG&A expenses related to its launch and commercialization.

Nevertheless, Vanda launched Fanapt for bipolar 1 in Q3 2024. Recall that Fanapt was approved for schizophrenia in 2009. Fanapt net product sales were $23.2 million in Q2, decreasing 4% compared to the same period last year as “the result of continued generic competition in the U.S.”

In December, Vanda acquired Ponvory from Janssen (JNJ) for $100 million. Ponvory (siponimod) is one of four oral S1PR modulators utilized for multiple sclerosis [MS]. Ponvory does not appear differentiated from the other S1PR modulators. Novartis’ (NVS) Gilenya (fingolimod) revenues reached $3.3 billion in 2018, but have since waned due to generic competition. Q2 2024 revenue for Gilenya was just $138 million, down nearly 50% year-over-year. So there’s a reason Janssen was willing to part ways with Ponvory for just $100 million. Subsequently, I don’t anticipate Ponvory will impact Vanda’s bottom line.

Vanda’s internally developed Hetlioz is also succumbing to generic competition. Its revenue fell to $38.761 million in 1H 2024 compared to $61.595 million in 1H 2023.

Despite a variety of clinical and regulatory setbacks for tradipitant over the past few years, Vanda continues to vie for FDA approval in gastroparesis and motion sickness. In May, Vanda reported results from its second Phase 3 study in motion sickness. The study was “conducted in real-world conditions on boats in the coastal waters of the United States.” Tradipitant, unsurprisingly, as it is predominantly an antiemetic, reduced vomiting relative to a placebo (p

If the FDA approves tradipitant, it will face numerous obstacles. Although tradipitant works through a different pathway than existing medications’ anticholinergic and antihistaminic actions, which are associated with side effects such as drowsiness and dry mouth, current treatments, such as scopolamine, have been widely used for decades and are generally effective for many patients. Furthermore, these agents are available as generics, making them affordable and easily accessible. It is also worth noting that tradipitant’s primary endpoint was vomiting, whereas motion sickness includes other symptoms such as nausea and dizziness. Subsequently, I don’t think that tradipitant will see frequent usage for this indication.

The regulatory and market prospects in gastroparesis don’t appear any better. Phase 3 results were recently published in an article from the Clinical Gastroenterology and Hepatology journal and highlighted that the drug “did not meet the prespecified primary endpoint at week 12 (difference in nausea severity change drug vs placebo; P = .741) or prespecified secondary endpoints” in the intention-to-treat (ITT) population. The authors did point out that tradipitant may have potential “as a treatment for the symptom of nausea in gastroparesis.” But, again, this is just one symptom. Gastroparesis is a culmination of other symptoms like abdominal pain, bloating, and vomiting. Gastroparesis is also a chronic condition, and these results only spanned 12 weeks. As Vanda points out, “The FDA has imposed a partial clinical hold on tradipitant clinical protocols of longer than 12 weeks duration.” As a result, it is difficult to envision tradipitant being approved in gastroparesis. Even if it does, it is difficult to see how it fits in given that antiemetics like Zofran are already widely available as generics for gastroparesis-related nausea.

So, as I’ve pointed out in the past, tradipitant is having a difficult time differentiating itself outside of antiemetic activity.

Interestingly, Vanda received multiple takeover bids in June for generous premiums, with at least one bid exceeding 50% of Vanda’s stock price. Vanda rejected both, stating the prices “substantially undervalue Vanda and are not in the best interests of the company and its shareholders.” Given the challenges described above for their lead prospects and the high premium of the bids, I found the rejection to be quite perplexing. Per my assessment, the only good thing Vanda has going for it is its cash position, and I believe their stock’s future performance will predominantly depend on how they choose to utilize it. Continuing to pursue regulatory approval for tradipitant, despite failed clinical trials, is an example of poor cash management, in my opinion. As another Seeking Alpha author recently pointed out in a bullish article,

Retail shareholders can buy Vanda for less than the company’s cash value, getting the potential benefit from the actions of activist shareholders for free.

While this may be true and an acquisition may still occur, this is not something I’m personally interested in and/or hoping for within the biotechnology sector. Remember that, in being human, management’s intentions are, at times, even more unpredictable than drug development itself.

Financial Health

In Q2, Vanda reported revenues of $50.5 million (up 10% year-over-year) and an EPS of -$0.08. The recent acquisition of Ponvory covered up revenue declines from their two lead products, Hetlioz and Fanapt. R&D and SG&A expenses totaled $16.661 million and $39.474 million, respectively. Vanda’s net loss for Q2 was $4.518 million.

Turning to their balance sheet, as of June 30, Vanda had $102.953 million in cash and cash equivalents and $284.723 million in marketable securities. Total current assets were $439.18 million, while total current liabilities were just $93.791 million. Vanda does not have any significant long-term debts.

Moving on to cash flows, Vanda generated $641,000 in net cash from operating activities in the first half of the year, despite a total net loss of $8.664 million. As a result, there is no need to provide an estimate for cash runway. However, given the expected acceleration of revenue declines from assets such as Hetlioz and Fanapt as a result of generic competition, Vanda’s cash hoard may soon be impacted. So this is something to keep an eye on in the near future.

VNDA Stock: Risk/Reward Analysis and Investment Recommendation

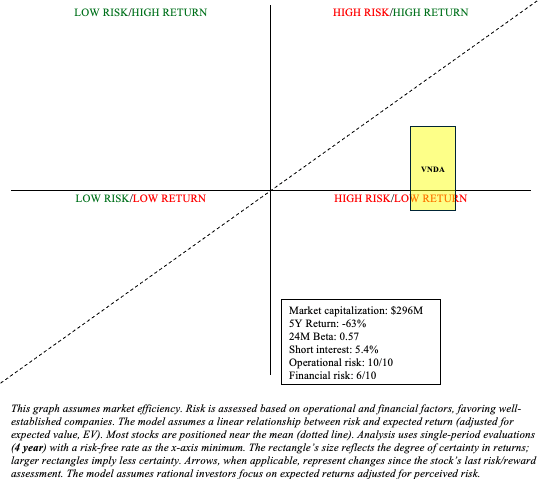

Finally, investing in VNDA is heavily dependent on management’s strategic cash management. Of course, this is a general rule, but I believe it is especially relevant in Vanda’s case. Assets such as Hetlioz, Fanapt, Ponvory, and tradipitant are unlikely to generate significant returns. It is unlikely that newer-to-market assets like Ponvory will offset Hetlioz’s revenue declines. As a result, it is reasonable to believe that the company will begin burning cash soon. Given VNDA’s past performance (-63% in 5 years, -59% in 10 years), it is difficult to justify investing in VNDA solely on the prospect of an acquisition large enough to satisfy management.

Author

VNDA remains a cautious “hold,” but I could see how it would work within a barbell portfolio. As for me, I am interested in drug development, and Vanda’s opportunities in this area remain limited and scattered.

Please also note that VNDA is a microcap stock, and investors should be aware of the risks that come with investing in companies with low market capitalizations. Risks include high volatility, which can result in significant capital losses over a short period of time; low liquidity, which makes it difficult to buy and sell stock at favorable prices; and a lack of information available to market participants, making decision-making more difficult. As always, investors should keep a diversified portfolio to mitigate idiosyncratic risks.

Read the full article here