This article was coproduced with Leo Nelissen.

It’s time to talk about a company I haven’t covered in years: Walgreens Boots Alliance, Inc. (NASDAQ:WBA).

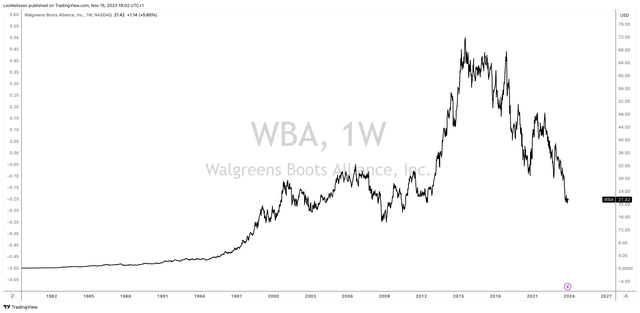

Even including dividends, the stock is back at 2012 levels after being in a downtrend that started more than eight years ago.

TradingView – WBA Total Returns

As such, the company, which is a holding of the Dow Jones Industrial Average (DJI), would have been a terrible stock to play the “Dogs of the Dow” strategy.

According to Investopedia:

“Dogs of the Dow” is an investment strategy that attempts to beat the Dow Jones Industrial Average (DJIA) each year by leaning portfolios toward high-yield investments. The general concept is to allocate money to the ten highest dividend-yielding, blue-chip stocks among the 30 components of the DJIA. This strategy requires rebalancing at the beginning of each calendar year.”

The Dogs of the Dow strategy is based on the assumption that established, reputable companies do not adjust their dividend payout to reflect market conditions.

As a result, the dividend can be used as an indicator of the company’s overall value. Conversely, the stock price of the company can fluctuate depending on the state of the business cycle.

Companies with a high dividend yield relative to their stock price are likely at the bottom of their business cycle. Hence, their stock price is expected to increase faster than companies with low dividend yields.

In such situations, investors who reinvest in high-dividend-yielding companies annually can hope to outperform the overall market.

None of this applied to Walgreens.

Although the company did not cut its dividend, it also didn’t catch a break, as investors have been selling with high conviction.

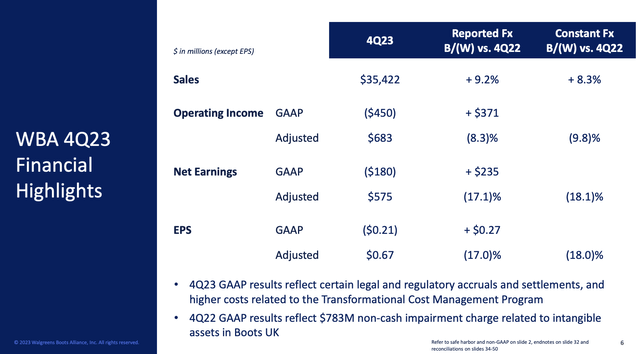

The most recent fourth quarter of fiscal 2023 confirmed many of its struggles, even though revenue growth wasn’t that bad.

The U.S. Retail Pharmacy business saw a growth of 3.6%, while the Boots U.K. business achieved an impressive 10.9% sales growth.

However, the adjusted EPS of $0.67 reflected an 18% decline on a constant currency basis, attributed to lower COVID-19 contributions, sale-leaseback gains, and a higher tax rate.

Walgreens Boots Alliance

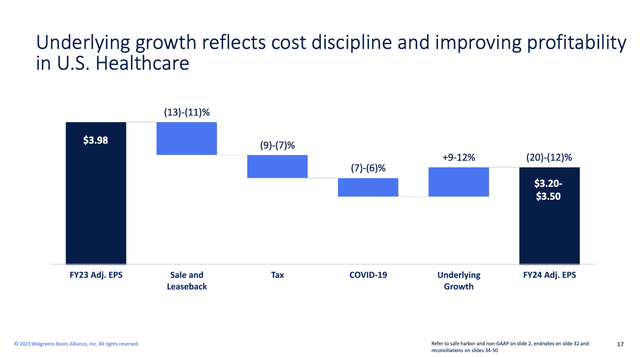

Even worse, guidance is bad as well.

The fiscal 2024 guidance indicates an adjusted EPS range of $3.20 to $3.50, down from $3.98 in fiscal 2023.

Key headwinds include the same factors that ruined the fourth quarter, including lower sale and leaseback contributions, a higher tax rate, and reduced COVID-19 contributions.

The company also anticipates macroeconomic pressure on consumers and a weaker respiratory season compared to the prior year.

As we can see below, the transition from fiscal ’23 to ’24 involves addressing several notable headwinds to adjusted EPS.

- Sale and leaseback are estimated to negatively impact year-on-year by 11% to 13%.

- Higher tax rates and lower COVID-19 contributions contribute to a ten percentage point increase and a 6% to 7% year-on-year impact, respectively.

Walgreens Boots Alliance

Excluding these impacts, underlying growth of 9% to 12% is expected, which is good news.

Total sales in fiscal ’24 are projected to increase by 1% to 4% on a constant currency basis. Adjusted operating income is expected to decrease by 5% to 12% on a constant currency basis.

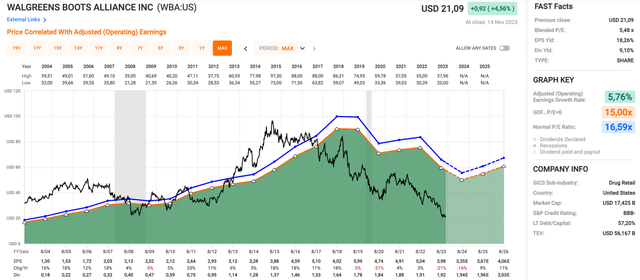

Looking at the chart below, we see that the company has suffered from falling earnings since pre-pandemic years.

- In the 2024 fiscal year, analysts expect the company to see a 16% EPS contraction.

- In the 2025 fiscal year, EPS is expected to bottom with 9% growth, followed by a potential increase to 11% growth in FY2026.

FAST Graphs

If this were indeed the case, the stock would be incredibly cheap.

It would be the cheapest stock on my radar, especially if it were to return to a 16.6x P/E multiple, which has been the normalized multiple going back two decades.

The problem is that investors aren’t trusting WBA.

The company is in a transition.

It takes time and comes with tremendous uncertainty.

It also doesn’t help that its dividend (currently yielding north of 9%) is in danger.

According to Adam Galas:

“In 2024, WBA is expected to pay a $1.95 dividend. Its free cash flow per share next year? $2.00.

That’s a 98% payout ratio in 2024.

708% payout ratio in 2023.

Next year, WBA’s dividend is expected to leave it with $43 billion in free cash flow.

And the extra interest cost could be almost 4X that much.

S&P already has WBA on a negative watch for a downgrade to BBB- and Walgreens isn’t likely to risk a downgrade to preserve its dividend streak.

How do we know? For 47 years, WBA always announced a Q3 dividend hike.

For the first time since 1976, WBA didn’t hike its dividend in the 3rd quarter.

How much would a token 1 penny per quarter hike have cost? About $36 million per year.

How about a 1/4th of a penny per quarter hike that would have kept the streak alive? $9 million yearly.

Walgreens seems worried about $36 million or even $9 million, and it’s potentially staring down the barrel of a possible $150 million interest rate hike.”

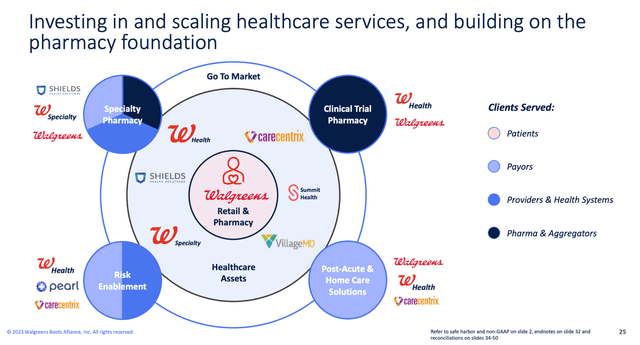

With an elevated risk of dividend cuts and a business that doesn’t have growth, the company is looking to boost growth and cut costs.

Currently, efforts are underway to unlock embedded profits, with a focus on expense discipline.

The company plans to exit non-strategic markets and clinics in fiscal 2024, aiming for increased density in regions with the greatest potential for future profitability growth.

Walgreens Boots Alliance

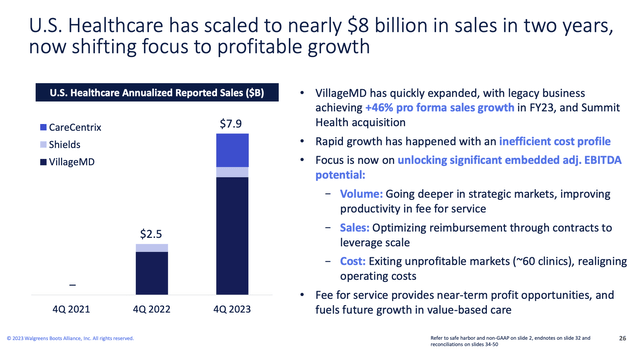

The company’s VillageMD primary care-led risk-bearing platform has shown consistent performance in reducing the total cost of care and improving outcomes.

The company is exploring digital partnerships, such as the pilot program with CityMD and Duane Reade, aiming to enhance customer access to healthcare services.

Walgreens Boots Alliance

Walgreens is also partnering with Pearl Health to expand its risk offering to community-based primary care providers. This partnership aims to provide a management services offering, including prescription fulfillment, medication adherence, immunizations, care gap closures, and diagnostic testing.

Cost cutting is also a major measure.

The company is aiming to lower capital expenditures by $600 million in its 2024 fiscal year and has taken actions to manage cash effectively, focusing on working capital improvements exceeding $500 million.

This brings me to inventory management, which involves reducing stock-keeping units, addressing slow-moving product categories, and leveraging the efficiency of eCommerce shipments fulfilled by stores, often delivering to customers within an hour.

And this brings me to real estate.

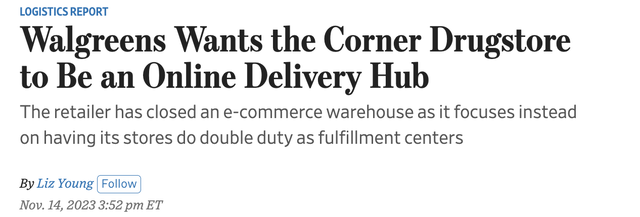

The other day, the Wall Street Journal reported that Walgreens is utilizing one of its biggest assets: its major footprint.

Wall Street Journal

According to the article, Walgreens is shifting its focus from dedicated fulfillment centers to utilizing its extensive network of 8,700 stores for e-commerce order fulfillment.

Walgreens plans to streamline online order processing by having store employees pick and pack items for same-day delivery through third-party apps like DoorDash and Uber Technologies’ Eats division.

This approach aims to eliminate the need for separate distribution networks for online and in-store sales, enhancing overall efficiency.

In light of the numbers we just discussed, with a 3.3% decline in comparable retail sales but a 14.2% increase in online orders for retail goods, Walgreens acknowledges the shift in consumer behavior.

Personally, I have so many people telling me they haven’t set foot in Walgreens (or any of its peers) in months. People prefer online commerce, and the ongoing crime wave doesn’t help either.

Because of its massive store count, the company encourages customers to opt for same-day delivery when items are in stock nearby. Orders selected for no-rush shipping can be expedited for same-day delivery through local store employees and third-party delivery services.

With all of this in mind, there’s a case to be made to buy Walgreens.

However, I am not eager to bet on turnaround stories.

Usually, I like a good comeback story, but not in this market.

- We’re dealing with elevated rates and sticky inflation.

- Some great companies with much stronger businesses than WBA have also sold off. While they may offer less potential upside, it means we can buy great companies at great prices.

That’s why I’m focusing on WBA’s real estate.

WBA is using its real estate to its advantage – even more than before.

Investors can do the same by directly investing in its buildings.

The best way to do it is by buying Realty Income Corporation (NYSE:O).

Buying Walgreens Real Estate Is The Way To Go

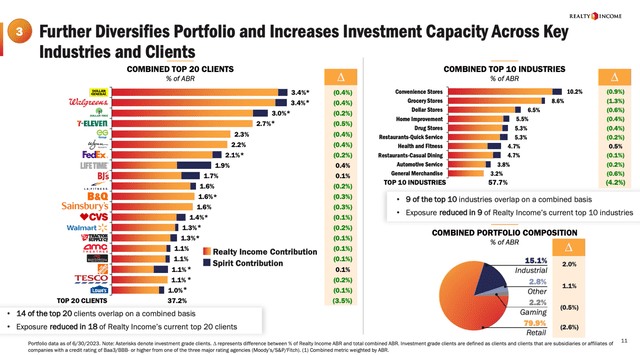

Realty Income is America’s largest net lease real estate investment trust or REIT. It is currently in the process of acquiring Spirit Realty (SRC), which would boost its holdings of buildings with top-tier tenants.

After the merger closes, the company has 3.4% exposure in Walgreens.

Realty Income

On top of that, investors get access to a portfolio that includes tenants like Dollar General (DG), 7-Eleven, CVS (CVS), and others.

Realty Income

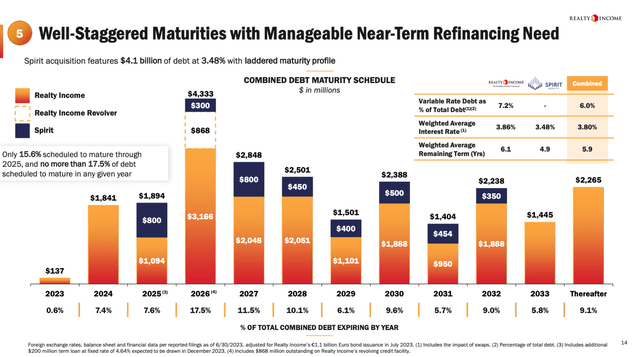

The best thing is that this portfolio comes with a healthy balance sheet as well.

After the merger closes, Realty Income is expected to have a net leverage ratio of 5.4x EBITDA, a fixed charge coverage ratio of 4.6x, and just 6% variable debt (95% fixed debt).

The company, which has a weighted interest rate of just 3.8%, has a 5.9-year weighted average remaining term on its debt and barely any maturing debt in 2023.

Realty Income

Even better, this balance sheet comes with an A- rating, making Realty Income one of the safest bets in the REIT industry.

The company is also a source of steadily rising dividends.

Realty Income has a track record of 29 consecutive annual dividend hikes. It currently has a 5.9% yield, protected by a 74% payout ratio.

Although its five-year dividend CAGR of 3.7% isn’t very high, it’s more than decent for a company as mature as Realty Income.

Even better:

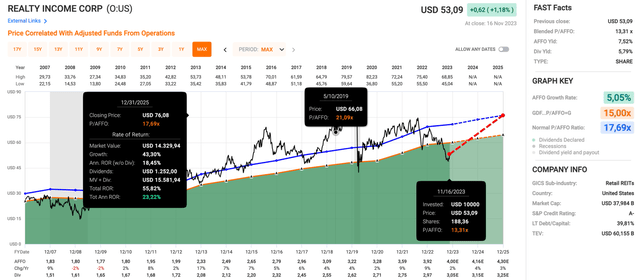

- Since its IPO in 1994, the company has returned 13.4% per year.

- It has a beta of 0.5 versus the S&P 500, indicating subdued volatility.

- 26 out of 27 years showed positive earnings per share growth.

Again, Realty Income is no potential ULTRA deep value idea like WBA. However, it also does not come with risks.

Odds are Realty Income can maintain juicy total returns.

The company is expected to maintain positive adjusted funds from operations growth this year, followed by 3-4% annual growth going forward.

FAST Graphs

When adding that the company has a yield close to 6%, we can expect annual returns in the high-single-digit range (3.5% AFFO per share growth + 6% yield).

However, the benefits are even better. O shares currently trade at 13.3x AFFO. While a subdued valuation makes sense in an environment of elevated rates, it trades well below its 20-year normalized AFFO multiple of 17.7x. A gradual return to that valuation could result in annual returns close to 20%.

Given the Walgreens valuation, if EVERYTHING goes right, the stock could triple in the years ahead. However, the odds of that are not in its favor. Realty Income may not triple, but it could double in the next ten years, including dividends.

When combining consistent dividend growth, a top-tier asset portfolio, and low financial risks, it’s clear which horse to bet on.

With all of this in mind, I don’t always prefer real estate over investing in tenants. For example, tenant The Home Depot (HD) had a better performance in the past ten years than its major landlords, including Realty Income.

Nonetheless, when dealing with an environment where retailers need to reinvent themselves, buying high-quality real estate trumps a lot of consumer stocks, including WBA and most of its peers.

Although this is in no way an attempt to keep people from buying WBA or get WBA investors to sell, I think it’s hard to make the case that WBA can deliver better (risk-adjusted) returns than Realty Income.

Takeaway

Walgreens’ numbers tell a story of struggle and uncertainty.

Despite efforts to address headwinds, including a transition in business strategy, the company faces challenges like a potential dividend cut and a business in need of growth.

The real estate angle presents an interesting alternative.

Realty Income, America’s largest net lease REIT, emerges as a potential investment avenue.

With a solid track record, low-risk profile, and steady dividend growth, Realty Income offers a compelling contrast to the uncertainties surrounding WBA.

While the latter’s stock could potentially triple if all goes well, the safer bet lies in Realty Income’s consistent performance and potential for steady returns, making it a preferable choice in the current market landscape.

Read the full article here