In April, I maintained my strong buy rating on AerSale stock (NASDAQ:ASLE) despite the lack of tangible progress on its AerAware rollout to customers. AerSale is a business that has lumpy elements such as asset sales, and the only reason why I like the stock is the prospect of AerAware, and as I discuss in this report, the progress on that product rollout has been lackluster. However, I keep following the stock, and in this report, I will analyze the most recent earnings, discuss some elements of the business, and review my stock price target and rating.

AerSale Results Improve, But We See Margins Contract

AerSale

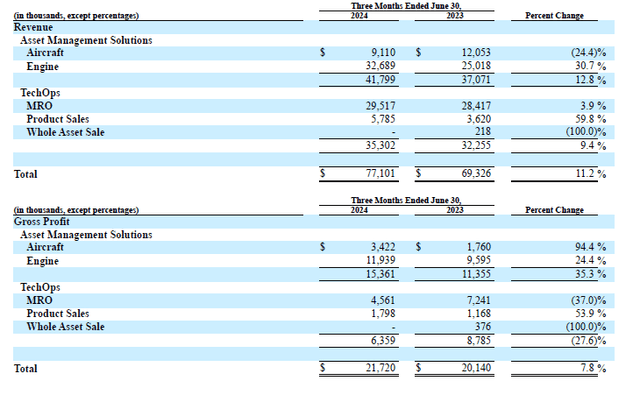

In the first quarter, we saw revenues and profits tank. Luckily, the second quarter saw a return to year-on-year growth. Asset management solutions were up 12.8%, or $3 million. The increase was driven by the Engine part of the business, with higher flight equipment sales of $3.2 million, $1 million higher lease revenues and $3.4 million higher used serviceable parts revenues. This was partially offset by lower flight equipment sales of $3.2 million and lower aircraft related USM sales.

TechOps saw revenue growth of 9.4% with modest growth in the MRO segment, which saw positive contributions from the landing gear MRO business but lower heavy MRO demand. Product sales increased 60% while there was no asset sale during the quarter.

Gross profit increased by 7.8% falling short of the revenue growth rate and I would mostly assign that margin contraction, due to the lower heavy MRO services demand.

One thing I don’t like about AerSale is simply its business, excluding AerAware. Sales declined 18.1% driven by lower flight equipment sales in 2023. Excluding these sales, sales were up 5.6%. Asset Management Solution sales were down 22.5%, driven by lower flight equipment sales and a smaller lease portfolio. TechOps revenues declined by 8.9%, but last year’s revenue was driven by the sale of its 737 AerAware demonstrator aircraft. Excluding this sale, sales would be up 10%. Year-on-year gross profit declined 39%.

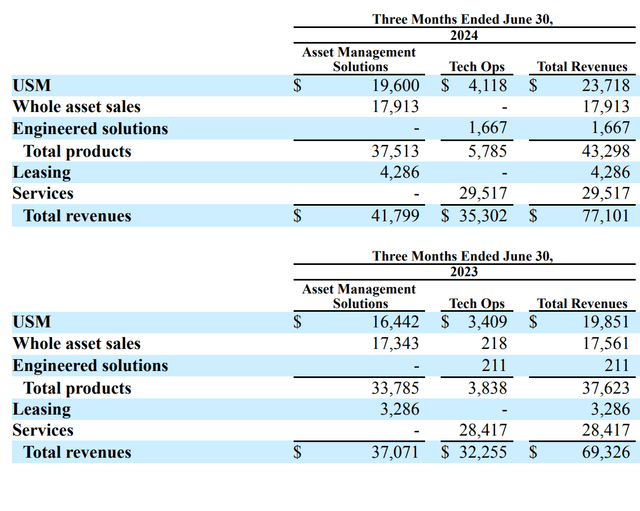

From the segment sales above, it’s hard to see what the main moving items are. That’s why we also have to look at a different table:

AerSale

This table shows that USM or part sales were up 19.5% year-on-year, while whole asset sales were more or less stable. Engineering solutions sales from $211,000 to $1.7 million, driven by AerSafe kit deliveries increasing. Leasing revenues decreased 23% as the lease portfolio is getting small. Product revenues grew 15.1%, while Services revenues increased 3.9%.

The Risks And Opportunities For AerSale

What caught me somewhat by surprise is the fact that MRO revenues didn’t grow significantly. For a very long time we have heard that MRO facilities are operating at full capacity, to the extent that freighter conversion work was being outsourced to free up MRO capacity. To see that MRO shops are not operating at full capacity and there being a slight decrease in heavy MRO demand now, is somewhat unexpected. At the same time, we do see that AerSale is increasing its MRO footprint and that should provide a boost to the streamlined revenues coming from the MRO business.

AerSale still has some Boeing 757 airplanes that have been converted, but have been hard to sell or lease to customers as demand for air freight has been less robust. The good news is that the market is somewhat improving, so AerSale could eventually sell those airplanes, but there is no clear timeline for it.

AerAware is truly the biggest disappointment. We have been hearing about it for years now and in December 2023, the augmented vision system finally received certification. However, eight months into the year, there still is no clear sight on when the first kits will be shipped to customers. AerAware in my view, should be the next big thing, but it’s veiled in uncertainty. Even now, there’s no clear timeline other than AerSale management thinking it could be six months or longer for deliveries to start, but it wouldn’t take years. To me, that’s not enough, the certification of AerAware already took a long time and in that time AerAware should have been able to work on a rollout plan with a launch customer and what we are now seeing is that there is no clear rollout plan. There’s positive feedback from potential customers, but that’s worth nothing to the top and bottom line.

AerSale Stock Has Upside But Is High Risk

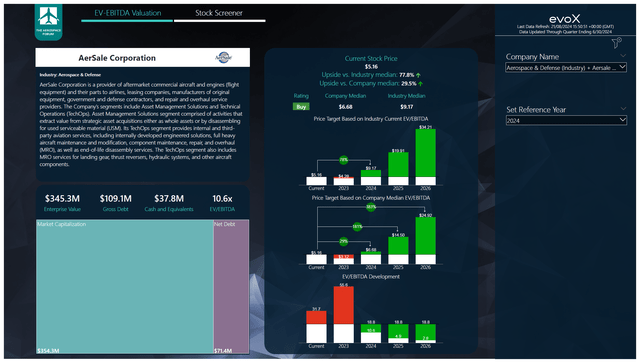

The Aerospace Forum

My price target has come down significantly. It used to be $18.70 and in my previous forecast I already reduced it to $10, and I am now reducing it to $6.70. It still provides some upside, but the current share price projections for 2024 really show what AerSale stock is worth without AerSale and that is honestly not a lot. EBITDA estimates for 2024 have been trimmed by 15% while this year is now expected to be a year of burning cash. In the years thereafter, there’s significantly more upside, but that’s driven by a combination of a higher MRO footprint and AerAware actually being rolled out to customers. If either of those two does not happen, there remains downside risk. All in all, with AerAware in mind, the stock remains a buy, but I foresee possible selling pressure until there’s more clarity on AerAware shipments.

Conclusion: AerSale Disappoints With AerAware Progress

AerSale saw its quarterly results improve year-on-year, and in some way, going from a decline in year-on-year earnings in Q1 to growth in Q2 shows the lumpiness of the business. Results could get better with the expansion of the MRO capacity providing more streamlined revenues from the MRO part of the business, but the big driver of growth should be AerAware, and we see that timeline slipping and becoming more and more uncertain, which is disappointing. I believe that AerSale stock remains a buy, but it really hinges on AerAware. Without AerAware this is not a stock that I’m even remotely impressed with.

Read the full article here