Let’s face it – the last two years made it difficult to position U.S. small-cap stocks in portfolios based on relative performance versus the largest stocks.

Then, July 2024 happened. Sure, it’s only a short time frame, but shifts from one trend to another always have to start somewhere. And the technical picture here reveals a market set up with past signs of continuation.

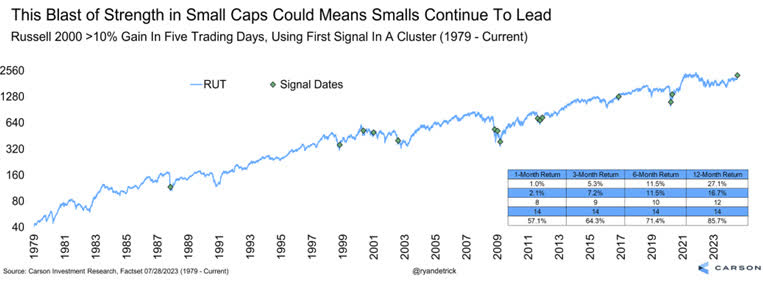

Our friend Ryan Detrick from Carson Group recently evaluated times when the Russell 2000 Index (referenced as Russell 2000 or RUT in figure 1 below) returned more than 10% in a period of five trading days, going back to 1979:

- Over the forward 1, 3, 6 or 12 months, the average cumulative returns have been higher, by 1.0%, 5.3%, 11.5% and 27.1%, respectively.

- Averages, of course, represent distributions of data, so it’s important to also note the Russell 2000 has been higher by 57.1%, 64.3%, 71.4% and 85.7% over the same time periods observed.

Figure 1: A Powerful Technical Signal with a Long History

Sources: Carson Investment Research, FactSet, as referenced by @RyanDetrick on X. Data is from 1/1/1979–7/28/2024). Average is the average of the returns within the respective time periods after the signal. Median is the median of these returns. Higher refers to the number of times the Russell 2000 Index was higher after the signal. Count is the total number of observed signals, in this case, 14. % positive is calculated as (Higher /Count), expressed as a percentage. You cannot invest directly in an index. Past performance is not indicative of future results.

Zooming in on July 2024

WisdomTree has managed equity strategies, including U.S. small caps for nearly 20 years. This year will go down as an interesting year both for world geopolitical events and the markets.

For the first six months of the year, small caps lagged significantly and by historically wide margins. But in just a few short weeks following a cool inflation report, the leadership shifted, and small caps outperformed dramatically.

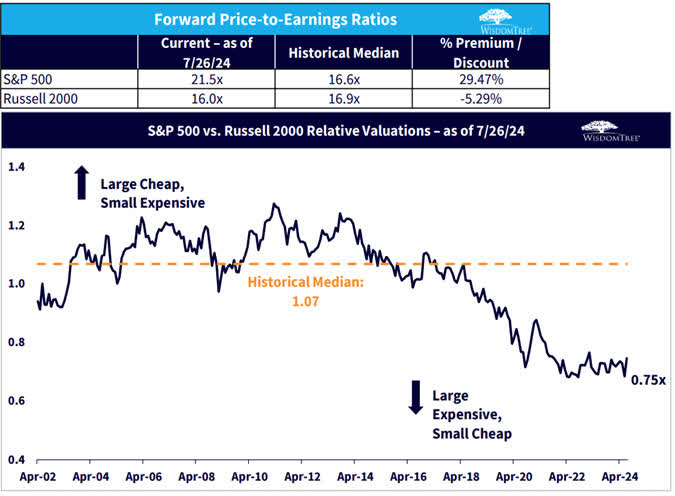

Over the last 20 years, small caps traded at a slight premium multiple to the S&P 500 Index (1.07x) but today stand at a 25% discount. The closing of this gap could represent a relative opportunity for small caps. But even more, there are pockets of the small-cap market that are still even more reasonably priced and discounted.

Figure 2: Historical Valuation Relationship between U.S. Large Caps and U.S. Small Caps

Sources: WisdomTree, FactSet, Russell. Data is 4/30/02–7/26/24. You cannot invest directly in an index. Charts taken from the WisdomTree Daily Market Snapshot.

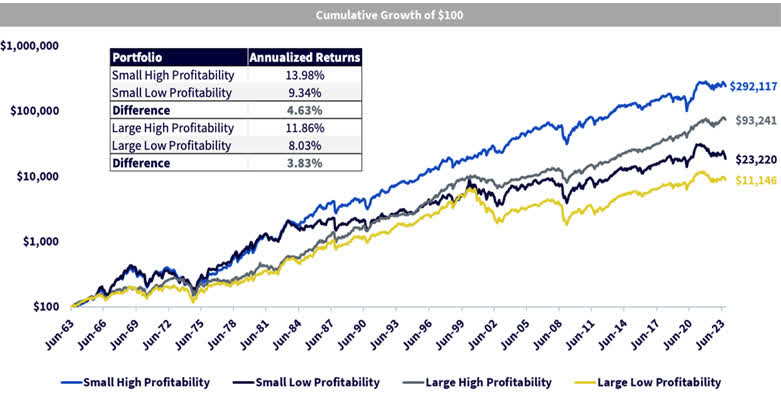

WisdomTree believes quality is an important factor in equity markets broadly and the U.S. equity and small-cap markets in particular.

Over the long run, profitability has helped boost small-cap returns even more than large-cap returns and small-cap high profitability stocks performed even better than large caps.

Figure 3: How a Focus on Profitable Companies Has Impacted U.S. Equities in Both Large and Small Companies

Source: Kenneth French Data Library. Data is 6/30/1963–5/31/24. Data does not represent any specific index and simply reflects a sorting of U.S. equities within the CRSP database on the basis of operating profitability as of June of each year. Past performance is not indicative of future results.

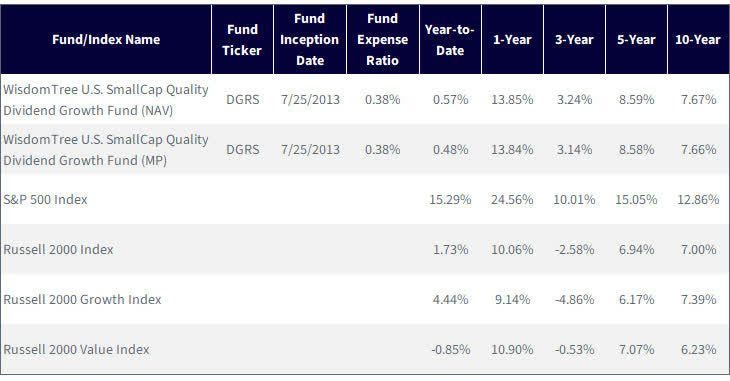

The WisdomTree U.S. SmallCap Quality Dividend Growth Fund (DGRS) is designed to track, before fees and expenses, the total return performance of the WisdomTree U.S. SmallCap Quality Dividend Growth Index. This strategy effectively addresses two important aspects of small-cap investing, even if neither of these can be used to “guarantee” what might happen in the future:

- Valuation Control: DGRS is not a strategy weighted by market capitalization—it is weighted by cash dividends, which brings some valuation sensibility to the approach.

- Profitability Focus: There can be a lot of speculative stocks within small-cap allocations, as in some cases these businesses are closest to the entrepreneurial fire that we always hear is burning in the U.S. By focusing on return on assets (ROA) and return on equity (ROE), as well as earnings growth, DGRS goes a long way toward screening these more speculative, unprofitable companies out of the exposure.

Figure 4: Performance

Source: WisdomTree, specifically data from the Fund Comparison Tool in the PATH suite of tools, as of 7/28/24. NAV denotes total return performance at net asset value. MP denotes market price performance. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

As we set up our analysis, we can look at:

- S&P 500 Index (500), which for our purposes here will be broad, diversified large-cap equities.

- Russell 2000 Index (RU2000), which will represent broad, diversified small caps.

- Russell 2000 Growth Index (RU2000G), which will represent more speculative, growth-oriented small caps.

- Russell 2000 Value Index (RU2000V), which will represent value-oriented small caps.

Figure 5 presents how these different strategies have performed in 2024 through July 26, 2024.

- The S&P 500 Index had a sharp downward move in the second half of July 2024.

- The small-cap indexes, as well as DGRS, had a strong upward move in the second half of July 2024.

- To be fair, for the full year-to-date period, the S&P 500 Index is still ahead of all the small-cap indexes and DGRS—but the gap just got a lot tighter.

Figure 5: Year-to-Date Picture Has Gotten a Lot Closer of Late

Source: WisdomTree, specifically data from the Fund Comparison Tool in the PATH suite of tools, for the period 1/1/24–7/26/24. NAV denotes total return performance at net asset value. MP denotes market price performance. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Within figure 6, we look at the same indexes and DGRS, just for the month of July 2024 instead of the full year-to-date period.

It clearly shows that within small caps, the Russell 2000 Value Index led, but DGRS was close behind. The Russell 2000 Growth Index, representing the performance of some of the more speculative small-cap companies like those in biotech and technology, was not leading—even though it did exhibit a positive overall response.

Figure 6: The Value Style Led Small U.S. Small Caps Higher in July 2024

Source: WisdomTree, specifically data from the Fund Comparison Tool in the PATH suite of tools, for the period 1/1/24–7/26/24. NAV denotes total return performance at net asset value. MP denotes market price performance. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Performance Is One Thing, but Fundamental Characteristics Solidify the Story

The improving performance of small caps in July reflects improved sentiment for a better earnings environment looking ahead as the Fed starts to cut rates. A factor that can further support gains is the relatively low valuation in these stocks.

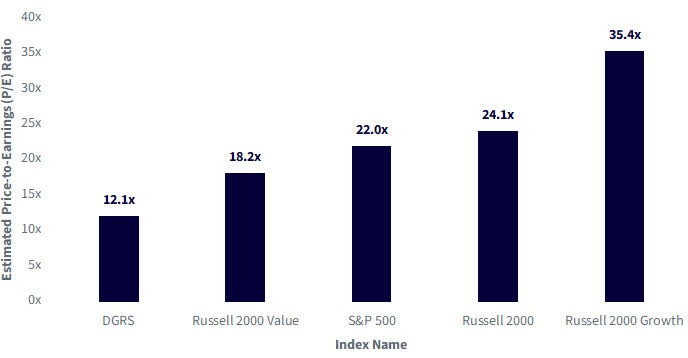

Figure 7 shows the estimated price-to-earnings (P/E) ratio based on earnings per share expected over the coming 12-month period.

- DGRS has a weighting process focused on valuations and dividends. This leads to a value sensitivity, and we see that here with a much lower estimated P/E ratio. Even the Russell 2000 Value Index estimated P/E ratio was about 50% higher.

- The speculative nature of the Russell 2000 Growth Index is even more stark here, as part of what accounts for an estimated P/E ratio of roughly 35x is that there are many companies with negative earnings in this exposure. Negative earnings within a strategy can tend to push the observed estimated P/E ratio higher.

- The S&P 500 Index is an important benchmark for U.S. equities, so many will view that estimated P/E ratio of 22.0x as an important fundamental characteristic of the U.S. market broadly.

Figure 7: Estimated P/E Ratios

Sources: WisdomTree, FactSet, with data accessed in WisdomTree’s PATH Fund Comparison tool as of 7/29/24.

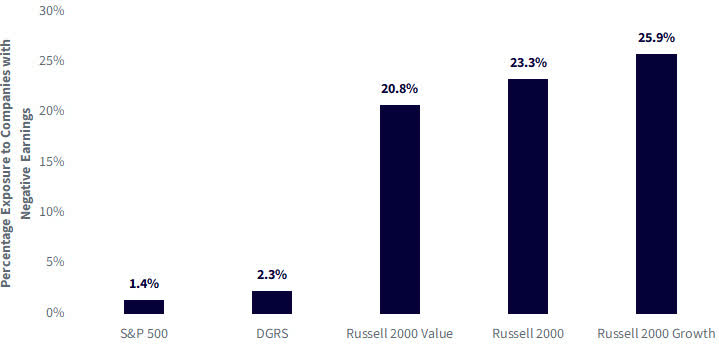

One of the starkest ways to look at what DGRS brings to a U.S. small-cap equity exposure is to review the exposure to speculative, unprofitable companies. We do this in figure 8.

- DGRS had exposure of only 2.3% to companies with negative earnings. This would also help to lower the observed valuation statistics that put a measure of earnings in the denominator of the ratio—a lack of negative earnings leads to a higher overall measure of earnings and a lower overall ratio.

- The Russell 2000, 2000 Value and 2000 Growth indexes all had exposure to companies with negative earnings above 20%.

- The S&P 500 Index had exposure to companies with negative earnings of 1.4%. DGRS was closer to the S&P 500 Index on this metric than it was to the other small cap-focused exposures.

Figure 8: Exposure to Unprofitable Companies

Sources: WisdomTree, FactSet, with data accessed in WisdomTree’s PATH Fund Comparison tool as of 7/29/24.

Sources: WisdomTree, FactSet, with data accessed in WisdomTree’s PATH Fund Comparison tool as of 7/29/24.

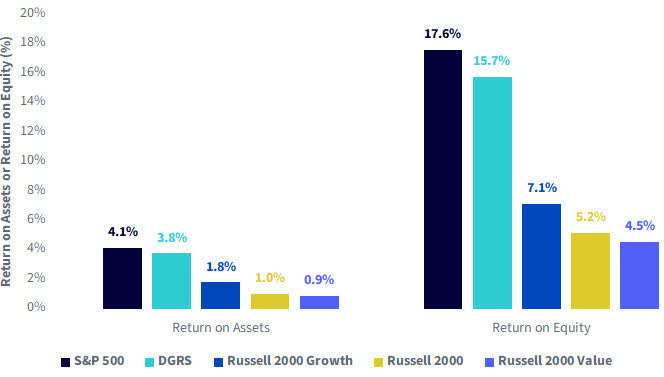

Finally, there is the quality aspect of DGRS. Figure 9 notes the ROA and ROE metrics and we can see that here as well the data is more similar to that of the large-cap companies of the S&P 500 Index than the other Russell indexes that focus on small caps.

Figure 9: Return on Assets and Return on Equity Measures, as of June 30, 2024

Source: WisdomTree, FactSet, with data accessed in WisdomTree’s PATH Fund Comparison tool as of 7/29/24.

Conclusion

Ryan Detrick made a compelling technical case for continued returns coming from the small-cap space on a technical basis. These strong market technicals are supported by relatively low valuations. And if we get interest rate cuts from the Fed starting in September, that will help alleviate the higher borrowing costs small caps have to face and clear another headwind for a longer-term performance shift.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti, CFA, Global Head of Research

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.

Original Post

Read the full article here