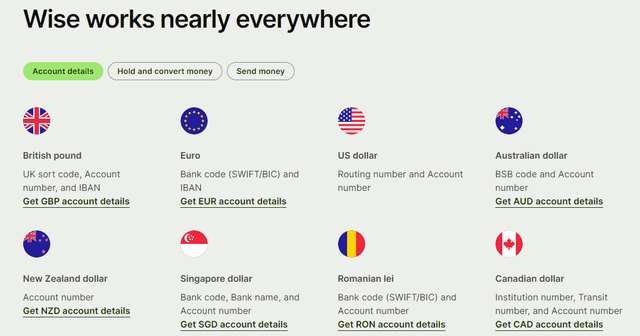

One of the more interesting public companies I’ve come across in fintech is Wise plc (OTCPK:WPLCF). Wise essentially offers consumers an international money account that can be used to swap between 40 currencies in 160 different countries. An addition to in-app currency conversion, Wise customers can also spend those currencies through the Wise debit card. The card can also be used to withdraw local currencies from ATMs.

Wise

It’s a product that is likely very attractive to consumers who frequently travel to various different countries or to business owners that have a global workforce and want access to multiple currencies for payroll purposes. The company’s growth over the last few years has been impressive.

Account and Revenue Growth

Since fiscal 2019, Wise has tripled active users from 3.3 million to 10 million at the end of fiscal 2023. Maybe more impressively, the company has been able to generate this growth mostly through word of mouth. Which is a general indication that the service being provided is highly rated by customers. Wise generates revenue through two mechanisms.

First, the company has a take rate on all of the currency conversions that are transacted through the platform. As of Q1 FY24, that take rate was 0.67% – flat sequentially but up 9 basis points year over year. Additionally, Wise earns yield on the treasuries that back customer deposits held through Wise accounts with program banks.

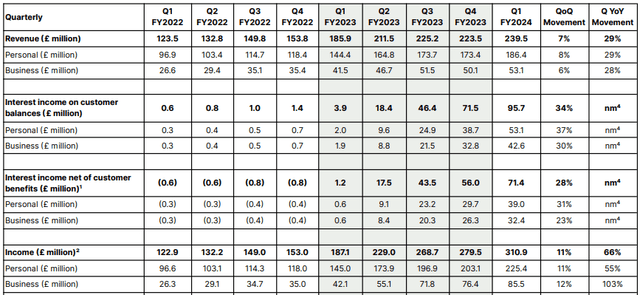

Performance trend (Wise)

For fiscal year 2023, Wise grew income by 73% year over year from £557 to £964 million. Of that total, £118 million was derived from interest after adjusting for customer benefits. Gross profit came in at £638 million with adjusted EBITDA of £238.6 million; growth of 73% and 97% respectively. For Q1 of fiscal 2024, Wise has continued its terrific growth story with a 29% year-over-year increase in revenue from £186 million to a little under £240 million.

Balance Sheet and Valuation

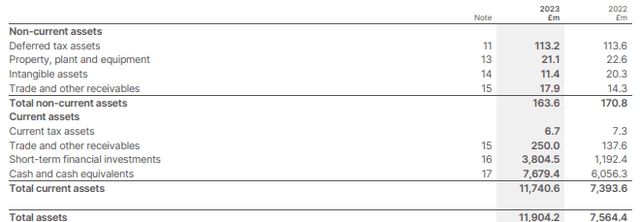

At the end of fiscal year 2023, Wise held just under £11.2 billion in total assets – the overwhelming majority of which were customer assets.

Assets As of June 27th 2023 (Wise plc)

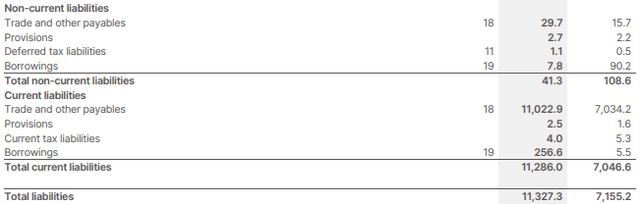

On the other side, the company had a little over £11.1 billion in total liabilities at the end of fiscal 2023.

Liabilities as of June 27th 2023 (Wise plc)

Though it should be noted that on Wise’s Q1 FY24 Trading Update, management disclosed £1.5 billion in customer balances. That was up 8% sequentially and 49% year over year. Like seemingly any growth stock, WPLCF trades at some pretty rich multiples compared to industry peers.

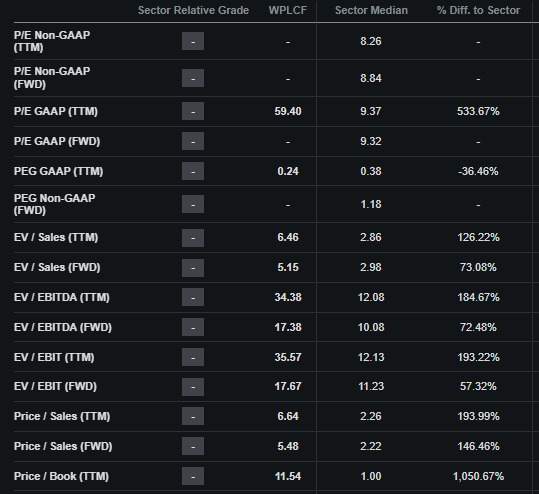

Wise Valuation Multiples (Seeking Alpha)

At over 5 times forward sales, 11 times book, and 59 times trailing twelve month GAAP PE, Wise plc trades at a considerable premium to the financial services sector medians. But again, this isn’t abnormal for a growth stage company. However, beyond just valuation, I see other risks that I think are worth considering.

Risk 1: Competition

There are already several credit card issuers that don’t charge foreign transaction fees for usage. This potentially disincentivizes a Wise account for average travelers who don’t generally have a purpose for exposure to multiple currencies at a time. Wise additionally offers the ability to withdraw cash in native currencies as well, but there are other companies that do as well. For instance, Revolut advertises a very similar service to Wise and claims to have 3 times the user base. Revolut also offers additional assets like stocks and crypto.

As an analyst who has spent a considerable amount of time covering cryptocurrencies and blockchain networks for Seeking Alpha, I’d be remiss if I didn’t mention the possibility that crypto networks could inevitably disrupt traditional banking and payment processing – including Wise. The existence of distributed blockchain ledgers with stablecoin smart contracts are a major headwind for financial institutions.

For example, it is already possible to swap stablecoin derivatives of dollars for euros on networks like Avalanche (AVAX-USD) or Polygon (MATIC-USD) for just a few pennies. There is currently over $100 billion and €300 million in liquidity available on public blockchains. We’re also seeing Visa (V) pilot the use of the Solana (SOL-USD) blockchain for settling transactions in Circle’s flagship product USD Coin (USDC-USD). As user interfaces built on top of public blockchain networks improve over time, the networks are designed to cut out middleman layers like Wise and allow merchants and customers to interact more directly.

Risk 2: The Fiat Experiment

Frankly, fiat currencies have a lot of problems. Beyond giving sovereign nation states the ability to dilute their debt by debasement at the expense of the currency holders, the necessity of so many different global fiat currencies existing simultaneously is very much up for debate. The fewer fiat currencies that are utilized globally, the less necessary a service like Wise’ may become. Of course, this is a risk that is likely less immediate, as fiat currencies being phased out likely won’t happen for many years down the line. Nation states are also unlikely to give up their control over monetary instruments without a fight. But it is nonetheless a concern that long term Wise investors should consider.

Summary

I actually really like Wise. Despite what might come off as a skew to the risks in this article, my concerns about Wise’s fiat-business sustainability won’t likely manifest until far into the future if they manifest at all. For an investor who wants to benefit from innovation in an industry that desperately needs disruption, Wise plc is possibly one of the better bets in the market. It’s a licensed money transmitter and is registered with FinCEN. Which almost certainly gives it a leg up over a cryptocurrency industry that is still suffering from regulatory ambiguity in the United States and abroad. I don’t personally hold WPLCF shares at this point in time. But as a profitable growth company, it’s one I’ll considering buying on any deeper broad market dips.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here