After five years in development, the U.S. Federal Reserve launched FedNow in July, the first government real-time payment system in the U.S. The service allows banks and credit unions to transfer money for their customers instantly.

Working alongside existing systems like Fedwire and FedACH, FedNow aims to improve the U.S.’s inter-bank and retail transaction infrastructure. Speeding up tasks like tax returns is another purported benefit of this framework. Eliminating processing delays for a better user experience is FedNow’s main focus.

Fintech firms like PayPal, peer-to-peer (P2P) platforms like Venmo and Cash App, and private entities like the Real-Time Payments (RTP) network by The Clearing House, filled the instant payment gap in the U.S. for several years now, however, more support was required in the backend infrastructure to make it happen.

Consumers could make instant wallet-to-wallet transactions using apps like Venmo but they couldn’t immediately withdraw the money to their bank accounts in real time. This limitation is solved now as banks adopt FedNow, and while there are valid concerns about the Fed’s payment rail competing with private-sector entities, there’s much scope for positive synergies.

FedNow And Blockchain’s Common Goals

Though FedNow doesn’t use blockchain technology, its goal is similar to ongoing innovations in the blockchain space – enabling instant peer to peer transfers and low-cost payments. Reports of the FedNow laying the groundwork for a potential central bank digital currency (CBDC) in the U.S. have been denied, but it may be too early to conclude as there’s merit to a possible FedNow and “Digital Dollar” overlap, in the future.

Blockchain technologies could deploy FedNow as the infrastructure for fiat on-ramps or off-ramps now. The FedNow Service Provider Showcase, an online resource connecting financial institutions and instant payment service providers, recently featured Dropp, a Hedera-based micropayments platform. Earlier Tassat blockchain announced its plan to build an API that’ll help clients access FedNow for real-time crypto-to-fiat settlements and vice-versa.

While partnerships between blockchain projects and FedNow can benefit financial services, FedNow is a centralized closed system, a “walled garden”, and is not aligned or the open-source development principals of (public) blockchain technology, or technologically interoperable with blockchain infrastructure.

FedNow’s early adopters didn’t include any blockchain projects like Tassat, Metal Blockchain, or Dropp, which are listed in the Service Provider Showcase. This emphasizes how the concerned central banks and agencies are about blockchain technology. It is important for the blockchain community to approach these recent developments critically and objectively, not blindly.

Tackling Centralized Payment Risks

FedNow promises great things and like all central bank payment systems, industry and consumers have little say in the development of policy, though the consultation process is improving with the developments of U.S. CBDC with the Digital Dollar Project, and the new and many pilots and consultations.

As the world becomes more politically volatile, civil rights specialists are concerned about personal and private data protection and that the government can (mis)use the banking system at its discretion to selectively block access to suit its interests.

The Canadian Government froze hundreds of protesters’ bank accounts last year as a means of stopping a truckers’ protest, an unpopular move that garnered support from across the U.S. A recent Moody’s report suggested that FedNow could aggravate bank runs, increase operational costs, and hamper fees-based revenue models.

Innovators in the private sector are taking the lead in offering instant payment services without FedNow. Fintech firms like PayPal or Venmo have served users to this end for a long time. A recent survey by Plaid indicated that over 60 percent of respondents tackled economic challenges during the pandemic using fintech solutions, however, Web2 financial products and services also have (similar) centralization problems.

Decentralized Web3 platforms like Ripple, Stellar, and Zebec are positioning to transform the payments space by addressing the limitations of traditional payments systems to combine technology and finance seamlessly, paving the way for a new era of frictionless global payments.

Web3 marks an ongoing systemic transformation enabled through digital finance. An estimated 80 percent of global financial leaders are aiming to use crypto for their businesses over the next three years or so and delivering speed to sluggish payment markets’ is one of the key factors driving adoption in this space.

While FedNow’s goal is similar to blockchain, decentralized blockchain technology is accessible globally, and is set to drive greater financial inclusion.

Making User-First The Standard

Web3 payment systems are developed with a user-first approach, one of their biggest competitive strengths over highly centralized offerings. Proponents of centralization will argue a range of issues will need to be demonstrably overcome with Web3 solutions from identity, cyber, and hacking risks to liquidity and settlement assurance, before broader acceptance is garnered across agencies.

Blockchain firms are leading by example with uses cases that put the users of the technology first to set the (industry) standard. Ripple enables real-time global payments for improved remittances or disbursements without tying up funds in destination markets, while Stellar’s open framework enables the world’s financial systems on a single network.

Sam Thapaliya, founder of Zebec Foundation says of the recently launched Nautilus Chain, “Zebec is helping to create a future where money is able to move more freely, giving individuals, businesses, investors, and teams faster and easier access to funds and tokens, the launch of Nautilus on mainnet is another breakthrough on the path towards this vision.”

The frontier of digital finance is set to deliver diverse use cases beyond real-time payments such as automated Web3 subscriptions, get-paid-as-you-work schemes, interest income on pledged assets for lending, wholesale cash management, asset swaps, custody and asset servicing, atomic settlements, and a host of new “user driven” applications, many improving liquidity and releasing trapped capital.

Following the launch of FedNow, some industry pundits commented “better late than never”, while some in the blockchain industry think the Fed is a bit late to the party. While it is clear that a government-backed service will attract many counterparties over time, both institutional and user adoption is growing for industry-led state of the art compliant blockchain solutions.

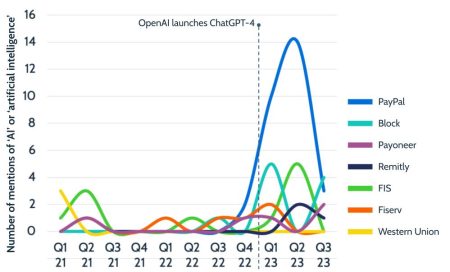

For now, the payment industry is the hot space to watch. With payment giants Visa and PayPal focused on stablecoins, industry solutions and consumer behaviors are likely to move at much faster pace than central banks. This has the attention of Congress with Representative Maxine Waters (D-California) deeply concerned about stablecoins without a federal framework for regulation, as the U.S. rushes to implement a framework.

The world is already moving to Web3 and the next generation of digital remittances and payments. The tools for building this new digital financial market infrastructure are available, now. The standards are different and so are the demands – the biggest challenge for central banks and agencies is to keep up with industry and consumers, in both.

Read the full article here