Venture Capitalists (VCs) are often regarded as the architects of innovation, providing the capital that fuels the growth of groundbreaking startups. Yet, the herd mentality in this high-stakes industry is becoming more and more pronounced, leading to potentially precarious situations. As AI dominates the current debate, is it time for a much-needed reevaluation?

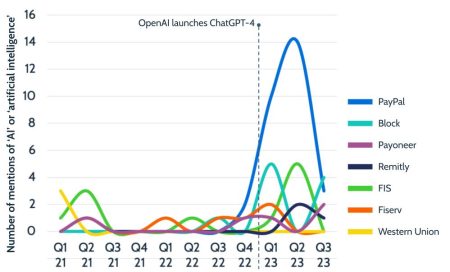

In recent years, the world of VCs is like a continuous race from one zeitgeist to the next – like micro mobility, last mile delivery, crypto, web3 or SPACs. If AI is the word on everyone’s lips today, the response is almost Pavlovian. Almost every startup morphes overnight into an AI enterprise to catch the attention of VCs, and meetings are becoming increasingly exclusive to AI pitches.

This scenario mirrors a familiar human behavior: the herd mentality. When one person starts clapping, soon the entire room joins in applause. Or, think about the school playground, where one kid picks up a new game, and suddenly everyone wants in. It’s seemingly natural but poses a distinct issue when applied to venture capital investments. We must be alive to the allure of the bandwagon.

Why, though, do sophisticated investors known for their discerning decisions fall into this pattern?

If a reputable VC is investing in an AI startup, others think, surely it’s a smart move. Thus, the dominoes begin to fall. Everyone dreams of being an early investor in the next Meta or Amazon

AMZN

Herein lies the fundamental problem: this herd mentality can obscure genuine innovation and create bubbles that blind us to other great investment opportunities. If, for example, all the attention is on AI, what about the brilliant HR, mobility, food, fintech or healthtech startup that doesn’t fit neatly into the AI box? They may struggle to secure investments, despite having massive potential.

When everyone is piling into the same sector, it’s easy to inflate valuations beyond reasonable levels. The result? When reality fails to meet these lofty expectations, the bubble bursts, leaving startups in ruin and investors nursing their wounds.

The message here isn’t that VCs should avoid trending sectors like AI. Instead, it’s a call for discernment and perspective.

Successful VCs have the vision to back trends before they become trends. They create value, not just follow it. After all, true investment prowess lies in spotting potential early, not in entering an existing trend. Investing once a trend is already a trend means you’re too late to realize significant returns.

There is a world in which micro mobility, last mile delivery, crypto, web3, SPACs, and other sectors can thrive and fulfill genuine needs in society. However, it’s crucial that we don’t inflate expectations to unsustainable levels where the reality, no matter how beneficial to society, will only disappoint. Hype has a place, but clarity and courage are required to set realistic valuations and expectations.

As we stand at the precipice of yet another potentially inflated hype cycle with AI, let’s heed the lessons of the past.

The path forward is a VC who embraces their role as more than just financiers. These are the stewards of responsible innovation, the guardians against unfounded hype and the champions of justified valuations. The VC who cultivates an environment where genuine ingenuity is as valuable, if not more so, than being part of the ‘in-crowd’ will successfully calibrate hype with valuation to ensure sustainable growth.

In the end, the future giants of the business world may well be those ventures that were nurtured in the clear light of rational expectation, not the shadow of hype.

The path forward should be one that balances excitement with prudence and innovation with sustainability.

Read the full article here