Stock markets smile when job markets frown.

Except for workers, almost everyone is happy about today’s jobs report. Wealthy owners of equities see stock values rise when workers are hurting; for investors, the soft labor market means workers won’t have power to drive up wages and the Fed will slow down interest rate hikes.

Just a year ago, the talk was that the tables had turned in the labor vs. capital fight and workers had the upper hand. “Quiet quitting” — meaning “working to the rule;” “not giving your all;” doing just enough to not get fired; not taking the initiative; slow-walking the job — was actually a thing, though it was a fear for only a few months (according to Google term search, these terms peaked in August 2022 and dropped off by Thanksgiving 2022). Still, actual productivity trends never validated that particular employers’ fear and workers’ fantasy.

The Wall Street Journal coined “quiet cutting,” a term for a new employer strategy to engage in subtle layoffs. Quiet cutting involves changing employees’ jobs — often in unpleasant ways — in hopes that employees quit (saves on severance costs!).

Sluggish Real Earnings Indicate Employers Have The Upper Hand

Only one industry, the lowest-paid leisure and hospitality sector — which pays its workers an average of $560 per week — did not suffer a real wage loss. Workers in high-paid financial services and information technology sectors, on the other hand, experienced severe real wage losses, far exceeding the average 6.2 % loss in real earnings since the first quarter of 2021.

In an email, Jack Janasiewicz, portfolio manager and lead portfolio strategist at Natixis, sums up the asymmetry between the fate of workers and the stock market. He is honest, indicating workers may be unhappy. He writes that the stock market may be rising and will rise because, “wages have been adjusting accordingly albeit at a slower pace than many market participants might like.”

Worker Confidence is Down

Today’s Labor Department report confirms recent data from the U.S. Job Openings Survey (JOLTS) that the labor market is softer, weakening for workers, and becoming more favorable to employers. The most recent JOLTS survey showed U.S. job openings falling to the lowest levels in over two years.

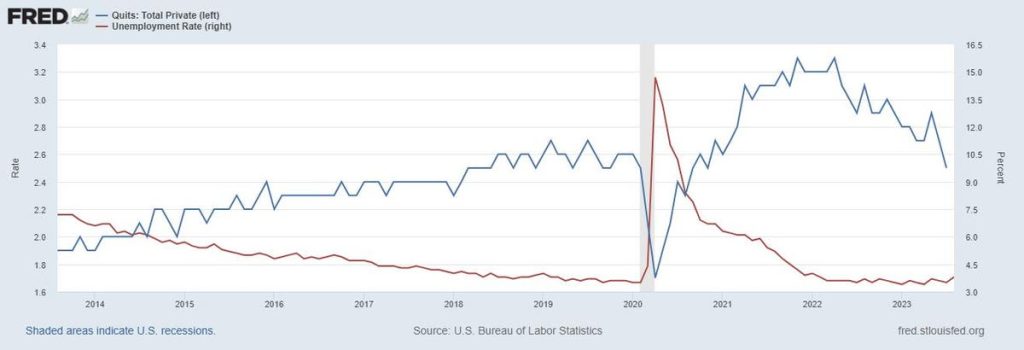

Indicators of workers’ fears and low confidence show up in the quits rate – which dropped to its lowest level since the start of 2021. The biggest drops in quits is in leisure and hospitality, but quits are also lower in the financial activities sector.

The “job leaver rates” are also down to 12.8%. Last month, 14.6% of the unemployed were jobless because they quit — they may have walked off the job singing that famous Johnny Paycheck line, “You Can Take this Job and Shove It.” Fewer were humming that tune in August.

Worker Confidence Show Signs Of Secular Decline

In 1983 a national survey asked workers, “About how easy would it be for you to find a job with another employer with approximately the same income and fringe benefits you now have? Would you say Very Easy, Somewhat Easy, or Not Easy At All?” In 1983, at the end of a deep recession, 19% said it would be easy. In the last 40 years that question has been asked from time to time and the answer is loosely correlated with unemployment in the way you would expect (when unemployment increases, worker confidence falls). But something has happened that indicates more worker fear. In 2022, with unemployment at a super-low 3.8%, only 11% of workers said it would be easy to find a comparable job. In 1983, even with 9.6% unemployment, more workers were confident that they could find a job as good as the one they had.

What is my forecast for the next year? Quiet smugness. We will see continued signs of labor market softening, weaker wage pressures, slowing inflation, and pleased employers and stock owners.

*****

Quits Rates Once, Understandably, Moved In The Opposite Direction With The Unemployment Rate Until Recently Indicating Lower Worker Power

Read the full article here